MM Big Picture Update

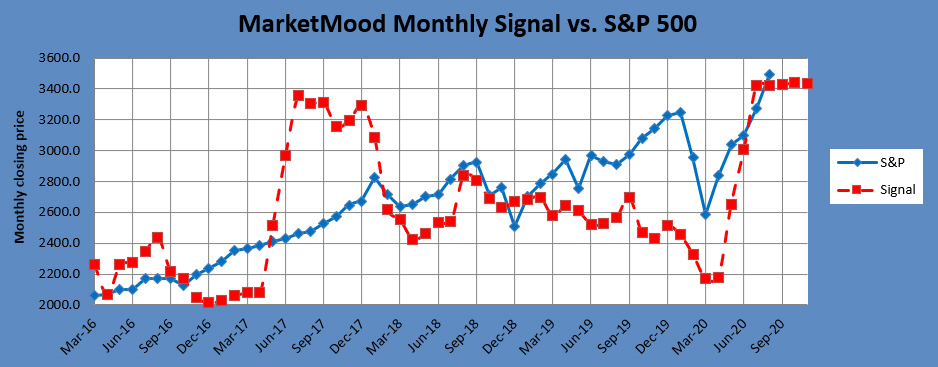

The overall picture remains nearly the same as the Big Picture Update from last week except for one thing. The monthly chart has been showing a market that really wanted to breakout above 3400 SPX. Now that's a done deal. As soon as this breakout moment has run its course, next up should be whipsaw and/or a reversal.

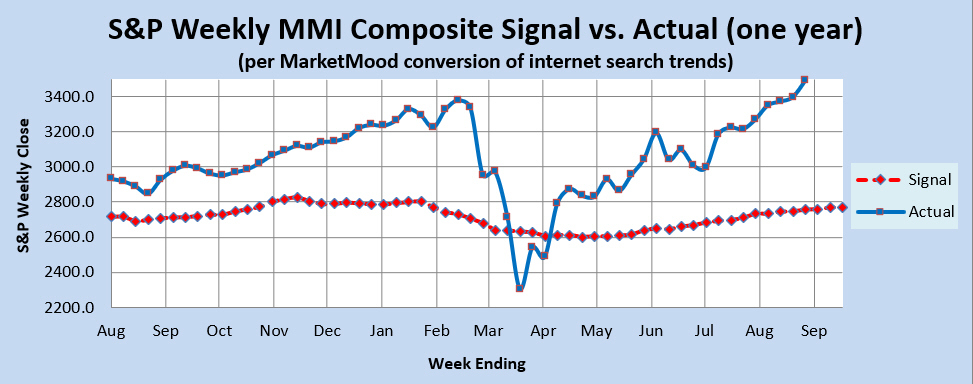

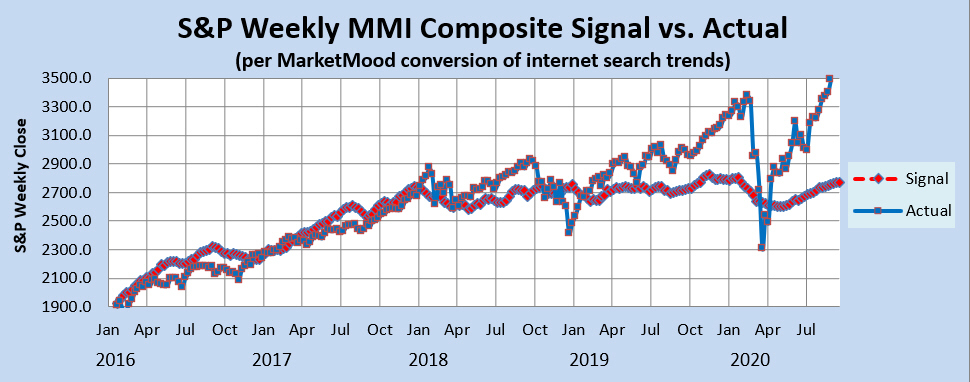

The weekly chart has a somewhat different picture. It's warning that the market is extremely and unsustainably overbought vs. sentiment and that it has no business being up this high. The usual resolution to this is a sharp drop which could occur at any time. However, it's also possible for sentiment to turn up and embrace a positive resolution. While the market is currently more overbought per sentiment than it was in February just before the big drop, a major difference is that sentiment trend continues to point in a generally upward direction while in February it was on its way down.

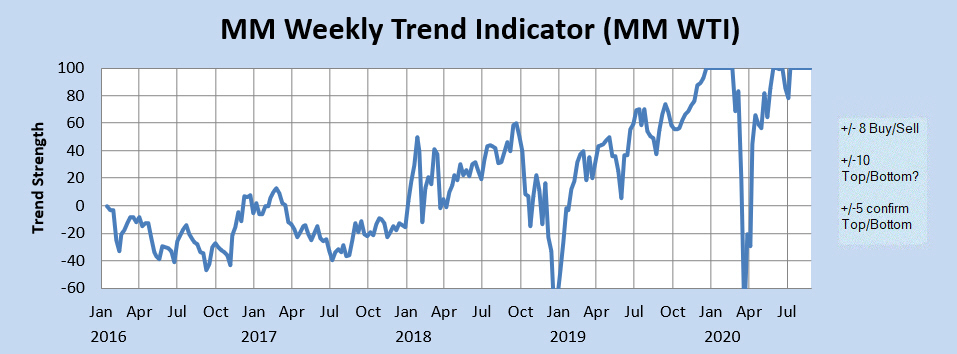

The weekly trend indicator shows an extremely strong, yet unsustainable bullish trend, only matched by the record extremity seen from December 2019 through mid February of this year. This was then followed by record extremity on the bearish side in March.

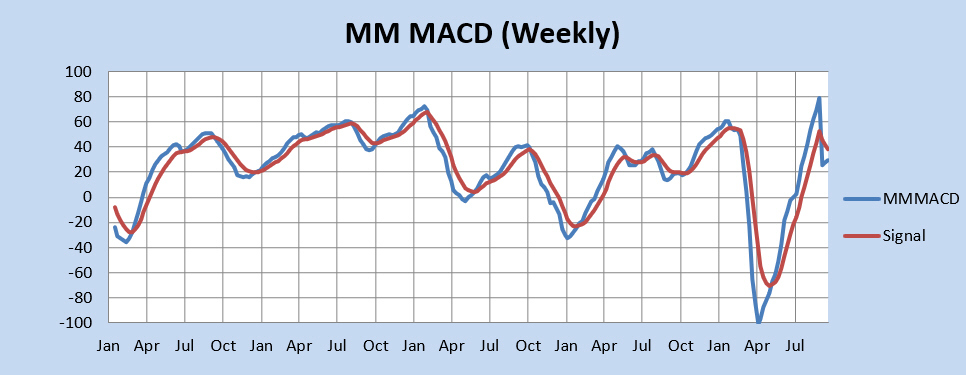

Finally, the weekly MM MACD is at a crossroads and giving mixed signals. It has been considering turning bearish, but the trend remains in bullish territory.

Taking all of this together, the market has gotten the breakout it wanted, but now the rubber band is stretching and a snap back effect will become more likely the further above 3400 SPX it gets. The weekly data implies that a correction is long overdue. The weekly charts show a market that has no business being up as high as it is right now, but sentiment is still pointing in a generally bullish direction overall. Either sentiment will need to start accelerating with further optimism to catch up with the market, or the market will soon enough give us the "snapped rubber-band" effect which can be quite alarming as was seen in February and March of this year. The trend is clearly bullish, yet the bulls have some long overdue bills that need to be paid and will be soon enough. There are no indicators that a pullback is imminent, yet when it comes (which could be at any time), it could be quite an upset.