MM Afternoon Notes - Market Analysis for Dec 7th, 2021

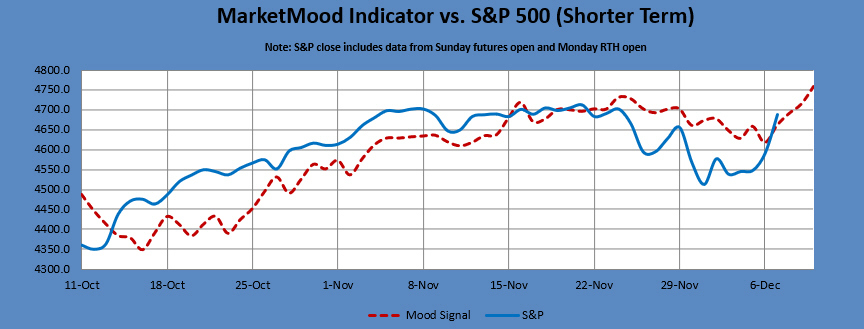

While Market Mood Indicator (MMI) has no daily call due to a continuation pattern in conjunction with yesterday's ambiguous close (up with last hour decline), the charts were and are pointing straight up. In fact, it's almost a celebration all around! The MM Trend Trader's main bullish signal is looking to be joined by the higher probability signal at end of day tomorrow if nothing changes. The longer term trend is likely to change to neutral from bearish today (i.e. S&P 500 closes above 4627).

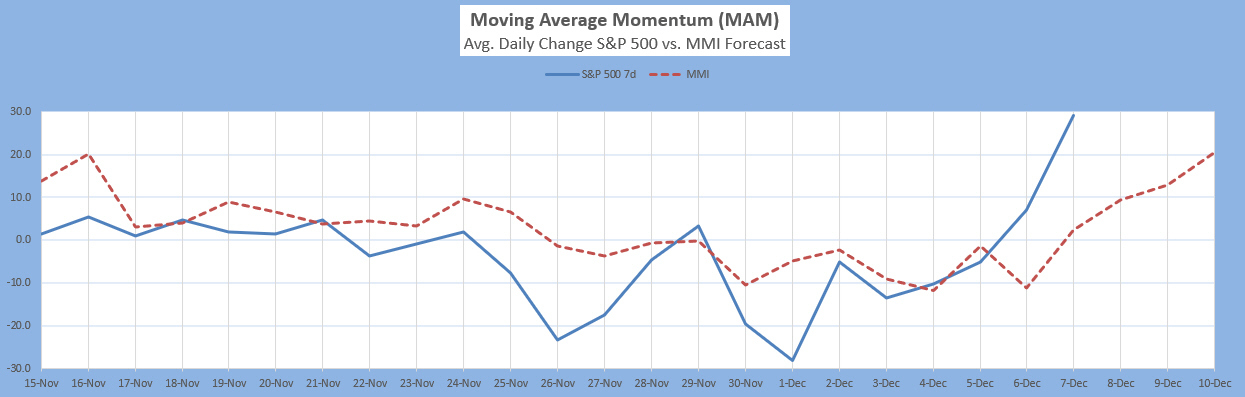

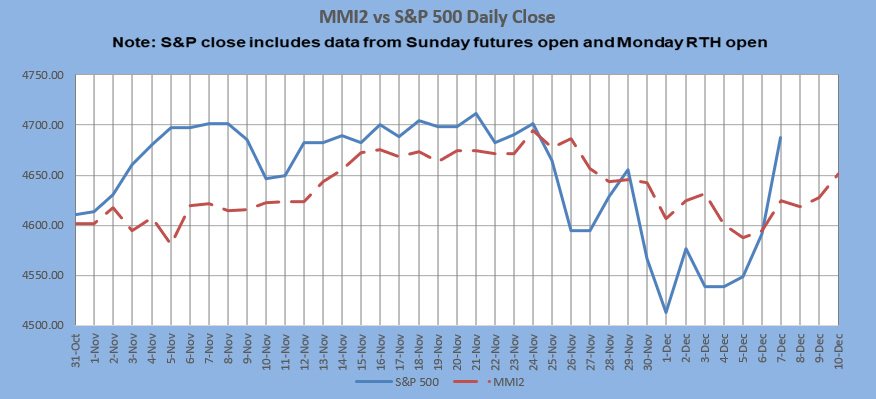

We'll see if the party keeps going as the MAM and MMI2 charts (below) do leave room for a pullback or consolidation later today or tomorrow as the market is a bit ahead of itself. There's a good chance for a MM MACD buy signal for tomorrow (trigger level TBD). CDMS even has preliminary strong buy signals for Thursday and Friday.

The MAM local low by Dec. 13 call was satisfied and now we're watching for a local high by Dec. 16.

Latest charts follow the summary table. For more detailed info see this evening's full report:

MM Indicators and Trading Parameters Summary:

| Indicator | Scope | Direction |

| LTTI | Longer Term Trend | Bearish => Neutral |

| MMTT (main) | Medium Term Trend | Bullish > 4571 |

| MMTT (HP) | Medium Term Trend | Neutral |

| MMTT (b/b) | Near Term bull/bear Trend Line | 4571 SPX (cash) |

| MM MACD | Swing Trade | Neutral => Buy (level TBD) |

| CDMS** | Today Close to Next Trade Day Close | No Trade |

Note: Medium term is roughly 1 week to 2 months. Longer term is roughly 1 month to a year or more.

**Composite Daily Mood Signal (CDMS) combines the MMI daily signal and the various MM trend and trading indicators into one overall daily trade signal. Possible signals are buy, strong buy, no trade, sell, and strong sell.