META: Profits Roar, Cash Flow Whispers — Which One Should You Trust?

Right now there is an interesting push/pull between profits and free cash flow. And this is not just in META — it’s present across the big five tech companies and more. Lyn Alden discussed this recently. What follows are excerpts from her post that highlight the financial tug-of-war between the two metrics. Then we will examine what the masses are telling us via the structure of price on the chart.

Lyn Alden Discusses Profits Versus Free Cash Flow

“These are the biggest companies in the United States that run datacenters, and are increasingly turning those datacenters toward hosting AI hardware as they partner with the pure-play AI companies. Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Oracle (ORCL) are the biggest hyperscalers.

The [big] question is how much will all of this capex pay off over, say, the next five years in terms of revenue and free cash flow? These five companies collectively issued $120 billion worth of bonds this year to fuel their AI capex, which is 4x their typical annual rate of bond issuance.

A bear would say that these hyperscalers won't get quite the ROI they are hoping for. Their prior software growth had much lower capital requirements, which allowed them to channel most of their profits toward share buybacks and juice their stock prices. Now all of this hardware capex will lead to lower share buybacks, a lot of new debt issuance, and mixed revenue and profit results to show for it after several years.

A bull would say that they will get the ROI they hope for. All of this capex, while indeed quite expensive, will greatly boost their revenue, profits, and free cash flow in the future. They'll have tremendous pricing power, and companies around the world will need to use their services to remain competitive.” — Lyn Alden

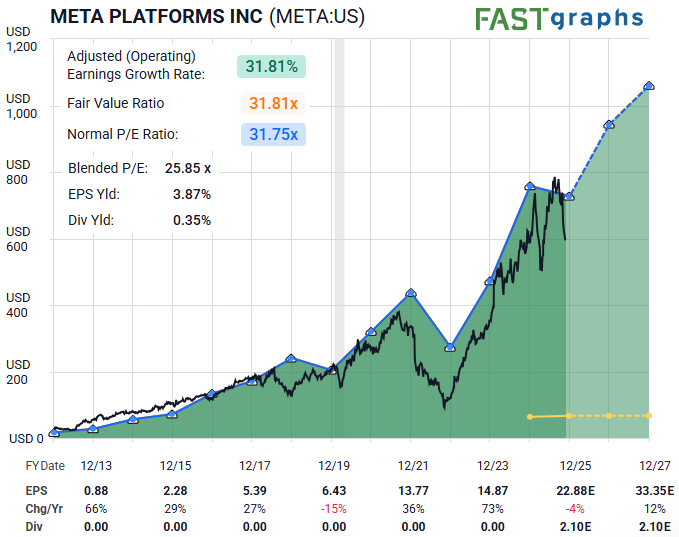

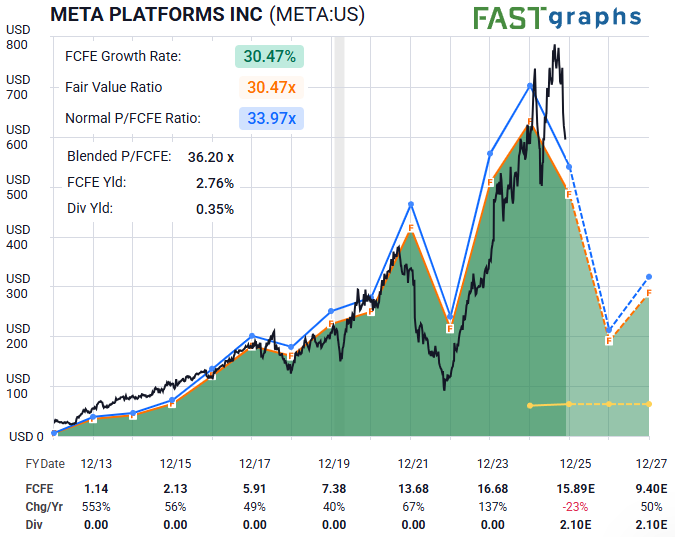

F.A.S.T. Graphs 101

- black line: the current and historical stock price

- blue line: stock price at its historical average P/E

- orange line: a conservative measure of valuation (18.62× P/E in this case)

- yellow line: dividends paid that year

- dark/light green: historical earnings transitioning into forward estimates

Meta’s Profit

Meta’s Free Cash Flow

————————————————————————————————————————————————————————————————————

There is a clear demarcation between the two graphs. Profits are inflating at the expense of free cash flow — not an unusual pattern, but the question remains: will the masses agree with the strategy and continue driving the stock higher?

Sentiment Speaks

This is a term that Avi Gilburt uses to describe how we can listen to what crowds are telling us via price action on the charts. These structures are variably self-similar at all degrees. They repeat from the small scale to the large scale. We can use this to project the probable path for META.

When you look at Zac’s chart above, what immediately jumps off the page is that this is a nested count. What does that mean? Price has formed the initial wave (1)–(2) rally structure. In addition, the next lesser-degree wave 1–2 appears to already be in place.

The nested count is shaping up because we have a rally off the wave 2 of wave (3). Parameters are clear: as long as price remains above the $575 area, we may be in the heart of a third-wave rally. The upside initially targets the recent high near $800 — and from there, we monitor and assess.

And this is where the push-pull between profits and free cash flow ultimately gives way to the only arbiter that matters: price. If META holds above that $575 line in the sand, the nested structure suggests the crowd is already choosing its side — and it’s leaning toward the roaring profits, not the whispering cash-flow concerns.

We must keep in mind that markets are not refereed by accountants — they are driven by crowds. And if price can defend the $575 support, the nested structure argues that the crowd has already begun to cast its vote. From there, META wouldn’t just retest $800 — it would be stepping onto the runway of a potential third-wave surge.

The capex debate will rage on, but price may resolve the argument long before the spreadsheets do.