Local Top In Bitcoin?

Many days ago, on April 29, I warned that the crypto market was at a point of increased risk. The first warning was a high reading Optix. While price continued higher in Bitcoin, it did so in an overlapping, corrective structure typical of B waves. Ether has yet to see a higher price since April 29. This simply highlights how topping is a process, whereas bottoms in cryptos tend to be sharp and sudden.

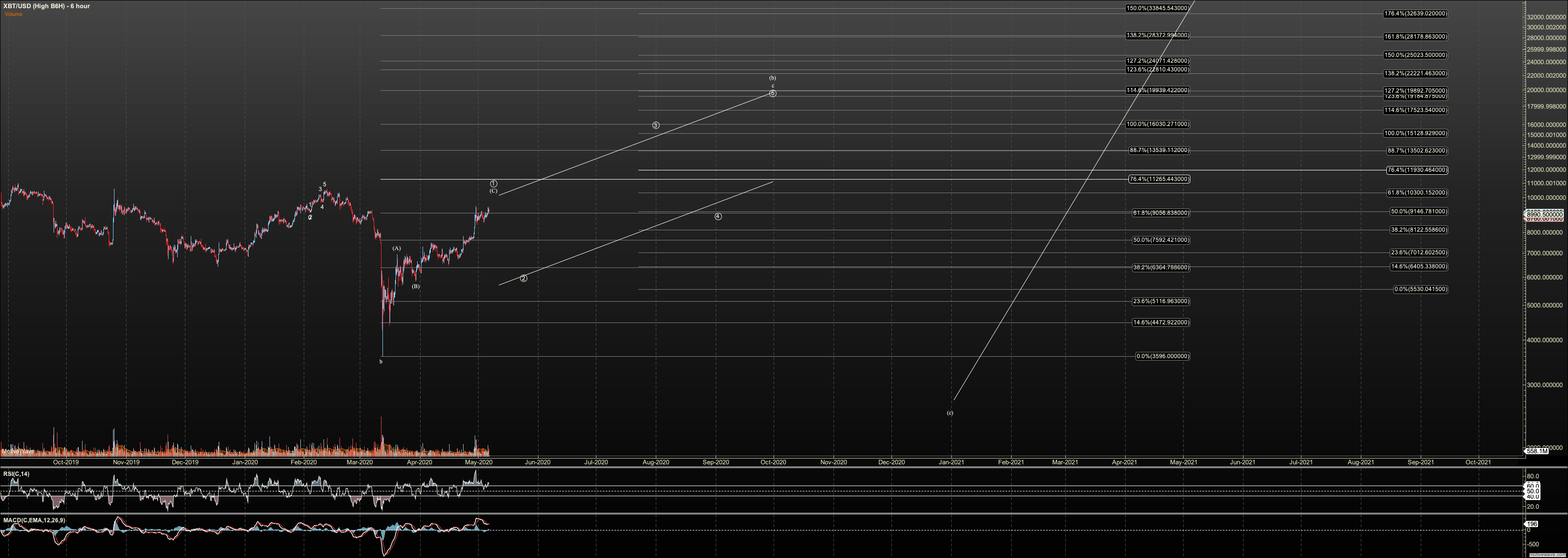

Last night we finally saw the action commensurate with a local top. The question on my mind is whether we see one more wave higher, or start to barrel lower for many weeks. If you did not plan for this moment, now is the time. We ideally see one more high but risk since the March 12th low has not been higher than it is now.

On both my Ether and BitcoIn charts, I am focused on my 'alternate 1'. I suggested since April 29, that they get my 'leaning'. But now I have jettisoned my primary micros for good. Tomorrow I'll flip the titles of these charts.

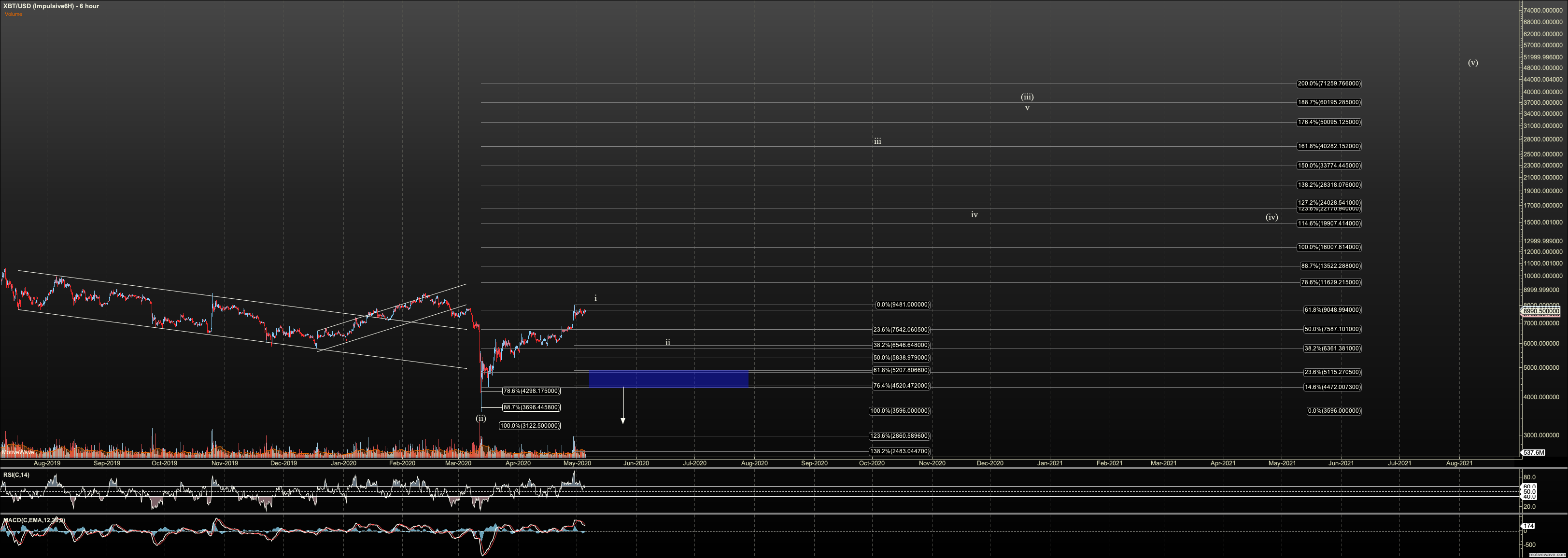

Bitcoin

Ideally we see one more high in Bitcoin toward $10,600. However, the low last night slightly pierced the channel governing the diagonal structure off the $4313 low on March 16th. So, I'll view the breach of that low at ~$8000 Bitmex, should it happen, as a warning or at least make our way towards support $4000. As long as above that low, I'll look for one more high. I have my hedge orders at that $7785. Even if we break that low with a spike and then reverse, which is possible, we have good confirmation of a multi-week correction being nigh. And, if by chance that correction results in a break of $4500, risk of seeing $2K in a new version of my most bearish scenario is likely in play.

Ethereum

Ether is much the same as Bitcoin in regard to the overnight action. We did not see my red C play out, and instead moved directly toward the large channel I've been following. For now this is a deep circle 4.But likewise, I'd like to see last night's low hold and still see that fifth wave. But since we tested that channel a great of last night's low can bring $102 in focus.

ETHBTC

We have a reversal, but we still need to see if we can form a more lasting bottom in circle 4.

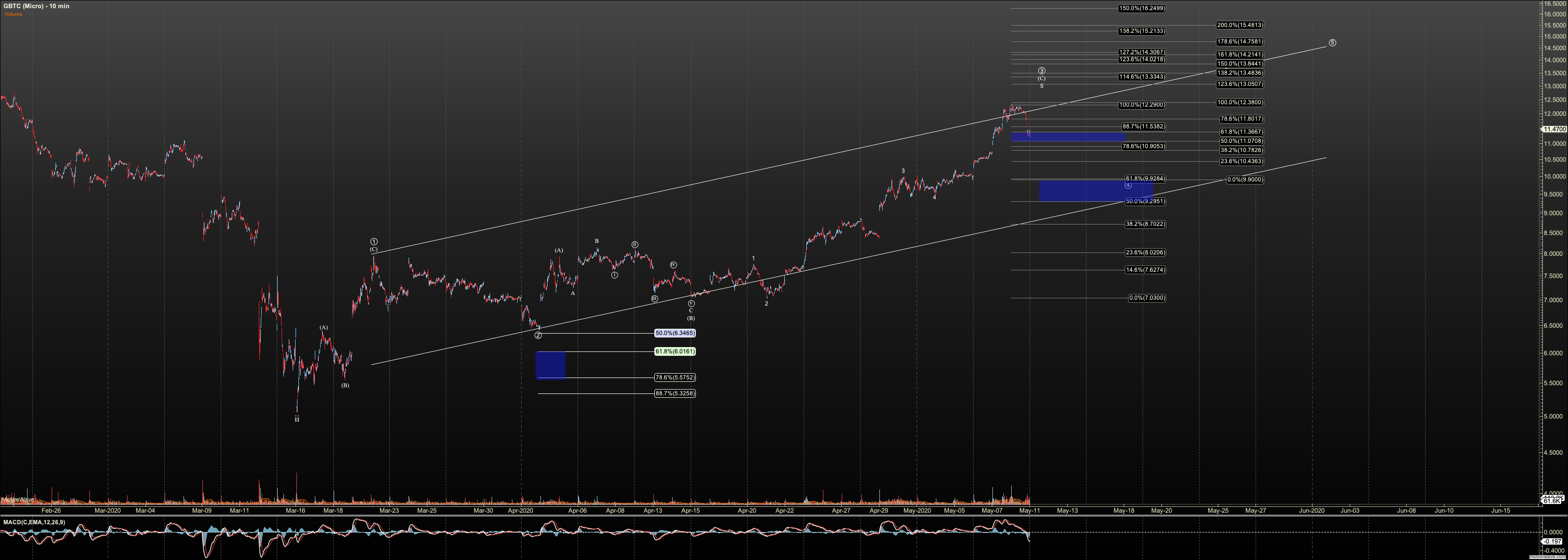

GBTC

GBTC was close to $11.07 support at close, and if breached, we'll watch $9.29. I presume we'll need to see a solid reversal continue in Bitcoin for $11.07 to hold. I find it more reasonable that we see a larger bounce off $9.29

ST Tactics:

Be broke below levels last week for adding and pushed against the channel. I want to see a strong indication of a reversal before adding. But per above I remain poised to hedge, and may start to take the short side in my scalping if $8K Bitcoin breaks.