Local Break Out In Metals

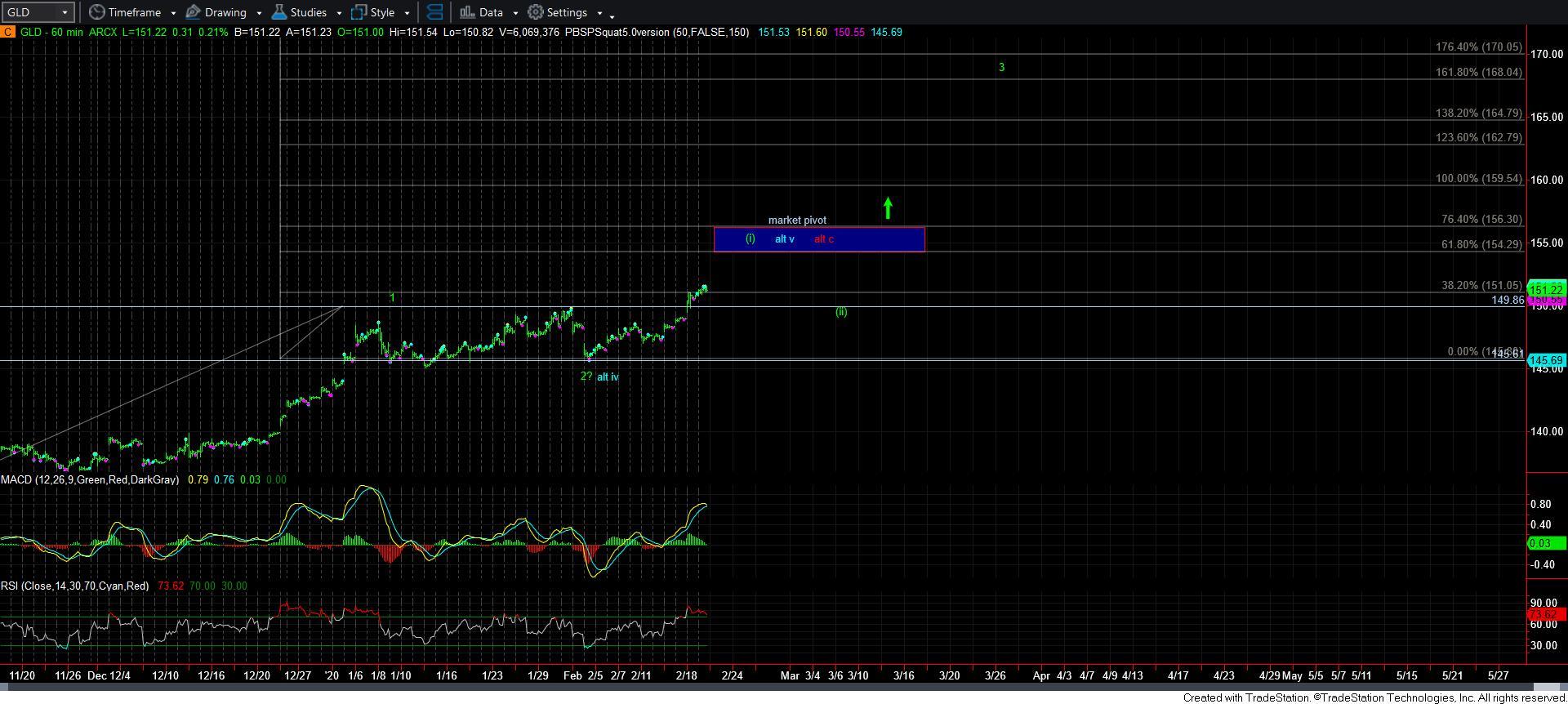

With the GLD breaking out over the 150 level, the market made it clear that the next segment of the rally phase is upon us.

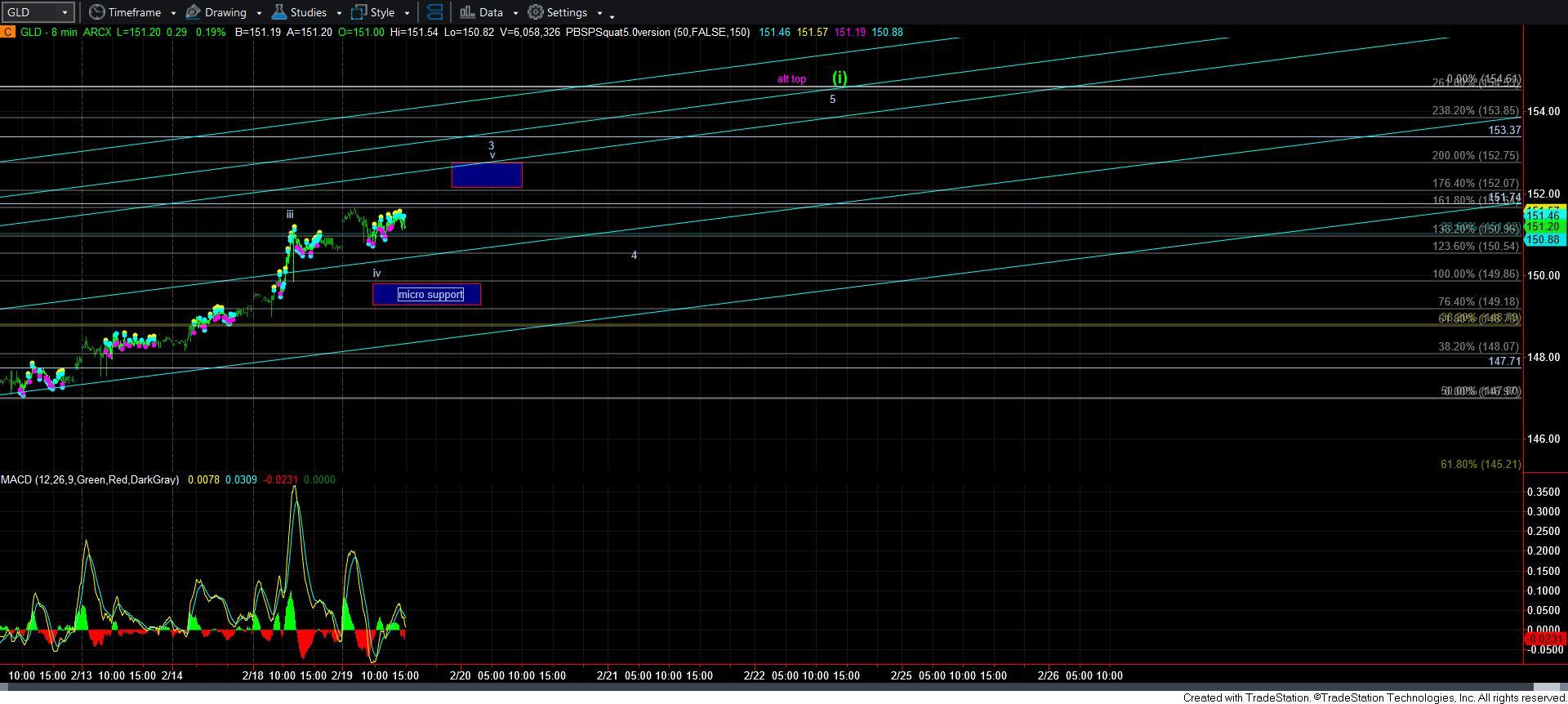

At this point in time, the metals market is rather easy. As long as the charts remain over their respective micro supports, then we can continue to look higher over the coming week or two.

Micro support in GLD is 149.75, but can be as deep as 149.20. Ideally, we hold over the 149.75 level, and move up towards the 152-152.75 region to complete wave 3 of what I am counting as wave [i], as you can see on the attached charts.

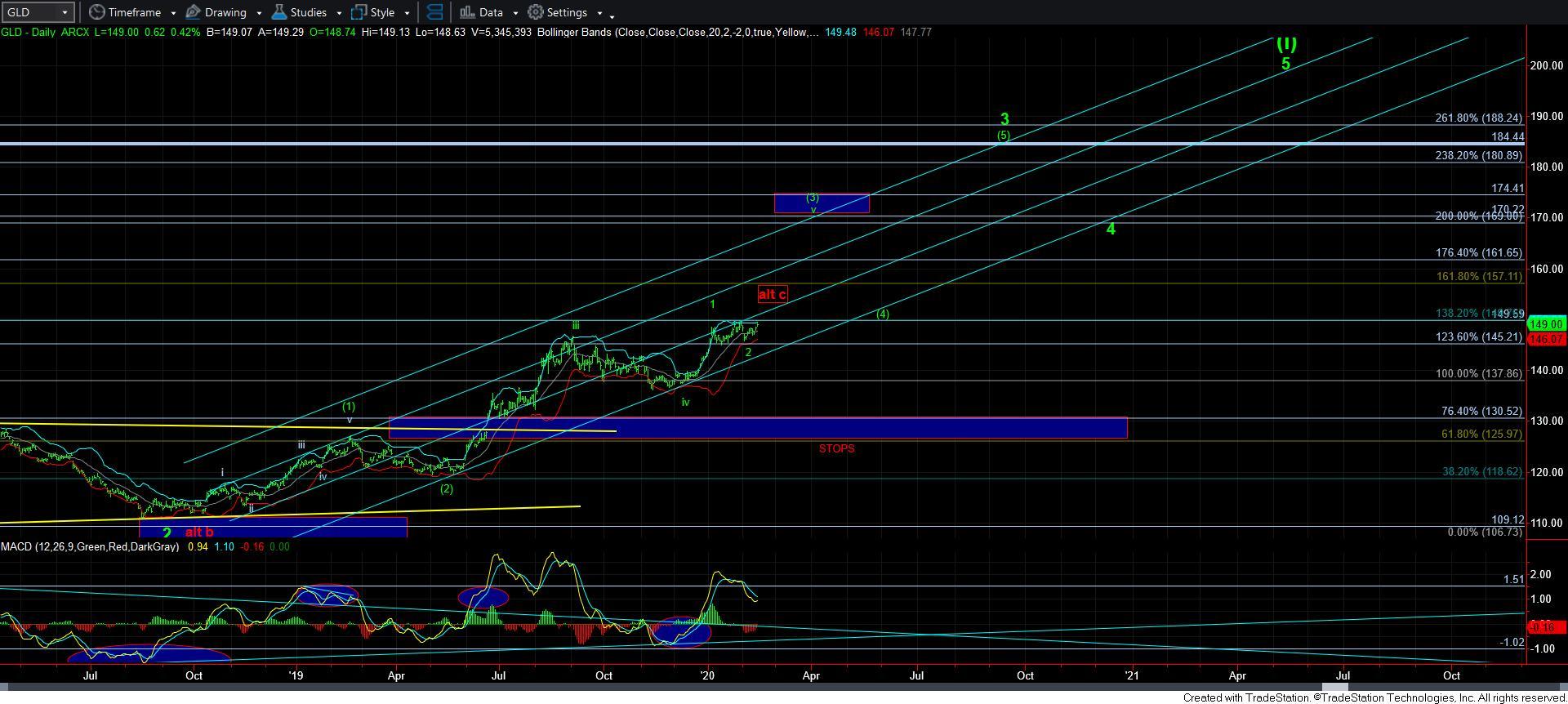

This is where I want to take a moment to discuss the significance of this 154/56 region again. This resistance can represent a top to the GLD which can send it back down in a bigger pullback towards the 140 region, or it can even represent the top to a c-wave in the most bearish potential on the chart. The manner in which we pullback from the 154/56 region will tell us if we can completely discount the most bearish potential at this time. But, based upon the structure in silver, I would say that it is already a lower probability.

That brings to me to silver. And, if you look at my silver chart, you can see that I slightly modified my count. Before, I had wave i of [3] at the .382 extension of waves [1] and [2]. But, it looks like it would make much more sense for this extension towards the .618-.764 extensions of waves [1] and [2] to be a more appropriate target for wave i of [3]. Hence, I have slightly adjusted the count.

I have even attached a 5-minute silver chart, which suggests that another push higher would only complete wave [iii] of this wave i. In the alternative, it would be all of wave i. Support is in the 17.88-18 region in silver right now, and as long as we remain over support, I think we will rally up towards the market pivot for wave i.

Now, admittedly, I would have to note that the GDX is the more sloppy of the counts I am tracking. I am guestimating that this rally can top out in the 30.50-31 region, and I will apply the same perspective to the GDX that I do to the GLD. Yet, please take note of the silver count as well when analyzing GDX, since silver is not really suggestive of having topped out in any major way once we complete this rally. Rather, silver seems to be suggesting that we are setting up a bigger rally phase for the spring of 2020, and it reinforces my primary expectation in GDX for the heart of a 3rd wave to take hold.

So, I think we can see higher over the coming week or two in the metals complex. And, then I am going to expect another period of weakness, but lesser than the one we just experienced off the September high. This one should take weeks rather than months, since it is of a smaller degree. But, if silver is truly leading the way, then we should be setting up for a sizeable move up in the metals complex in the spring.