Light at the end of the tunnel!

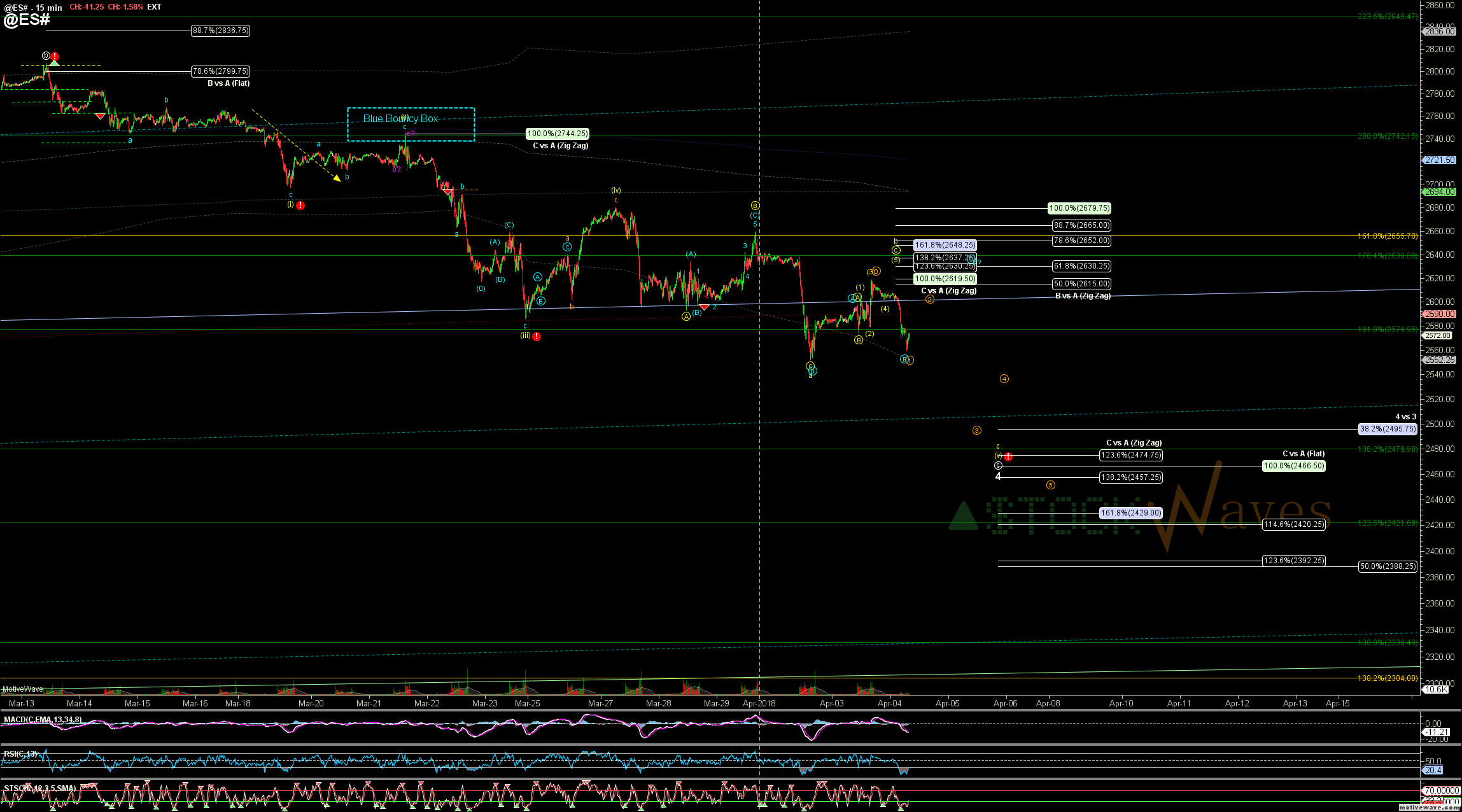

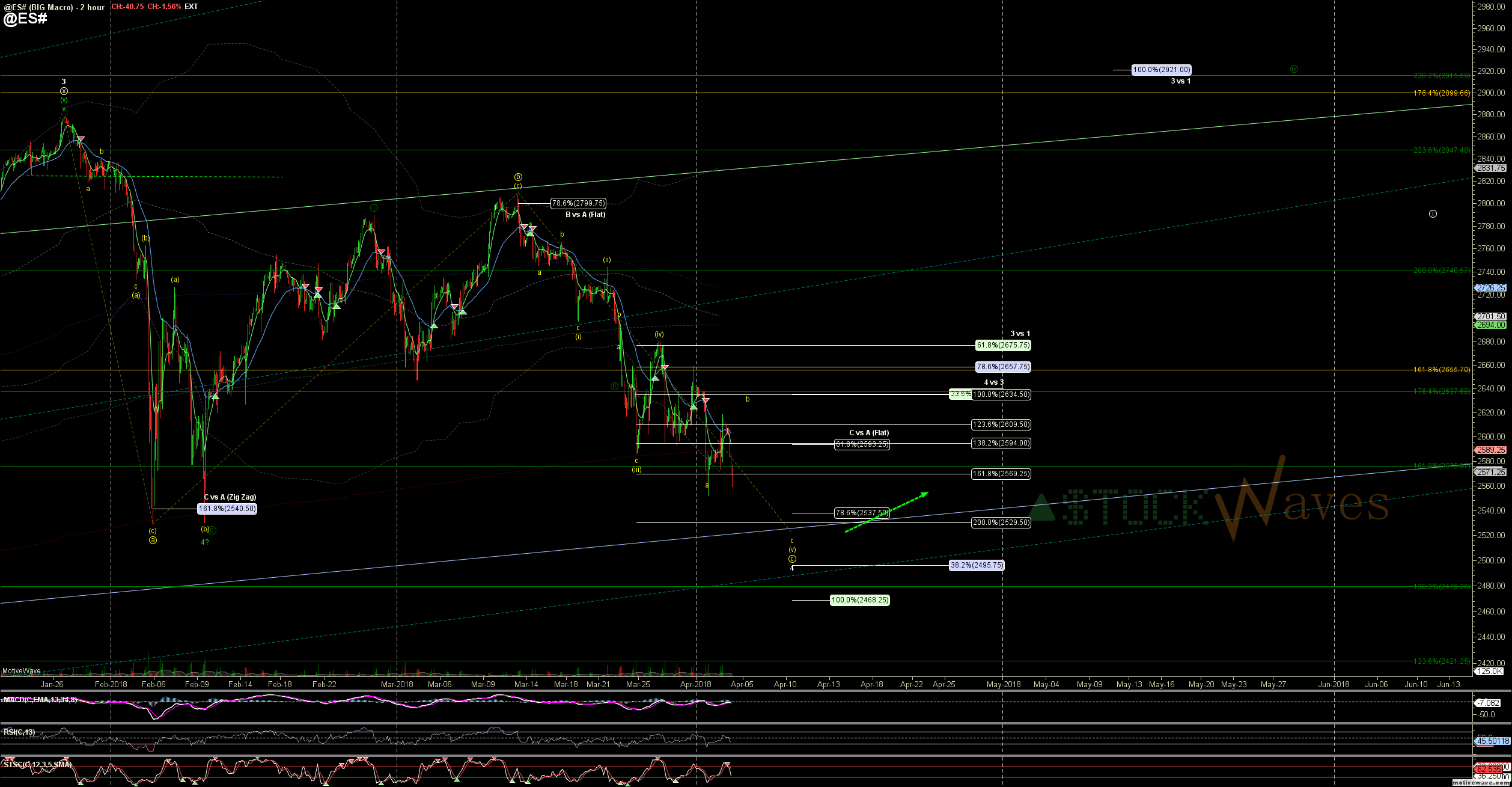

As we came into the 123.6% extension of a C wave Monday morning ~2550 $ES I started to warn about a ~2.5% bounce as a "b" wave inside the (v)th of our Ending Diagonal circle c down to complete wave 4 off the Jan top. We got 2.6%, but did not manage to get a sub-micro (5)th to 2630. This morning's drop looks more in line with the start of c down explained more below.

This is not TOO big for micro 1 of c of (v) down, however it does project a bit lower than 2490 (orange)... but since the 100% of circle c of 4 resides down at 2466 I have less concern that this would "need" to continue down harder to 2388.25 after dipping a little below the 38.2% retrace for 4.

There is an alt that I can see in the short term though. Without a clearly completed 5 waves for micro C of b last night this COULD count as an expanded flat for micro B and try again to head up in C of b (inside the (v)th down) to the 2630 region before turning down again.

IF orange micro 2 of c down we should ONLY get a corrective (A)(B)(C) bounce to the 2590-2600 region, beyond that or more impulsive and the blue micro C up to 2630+ becomes more likely.

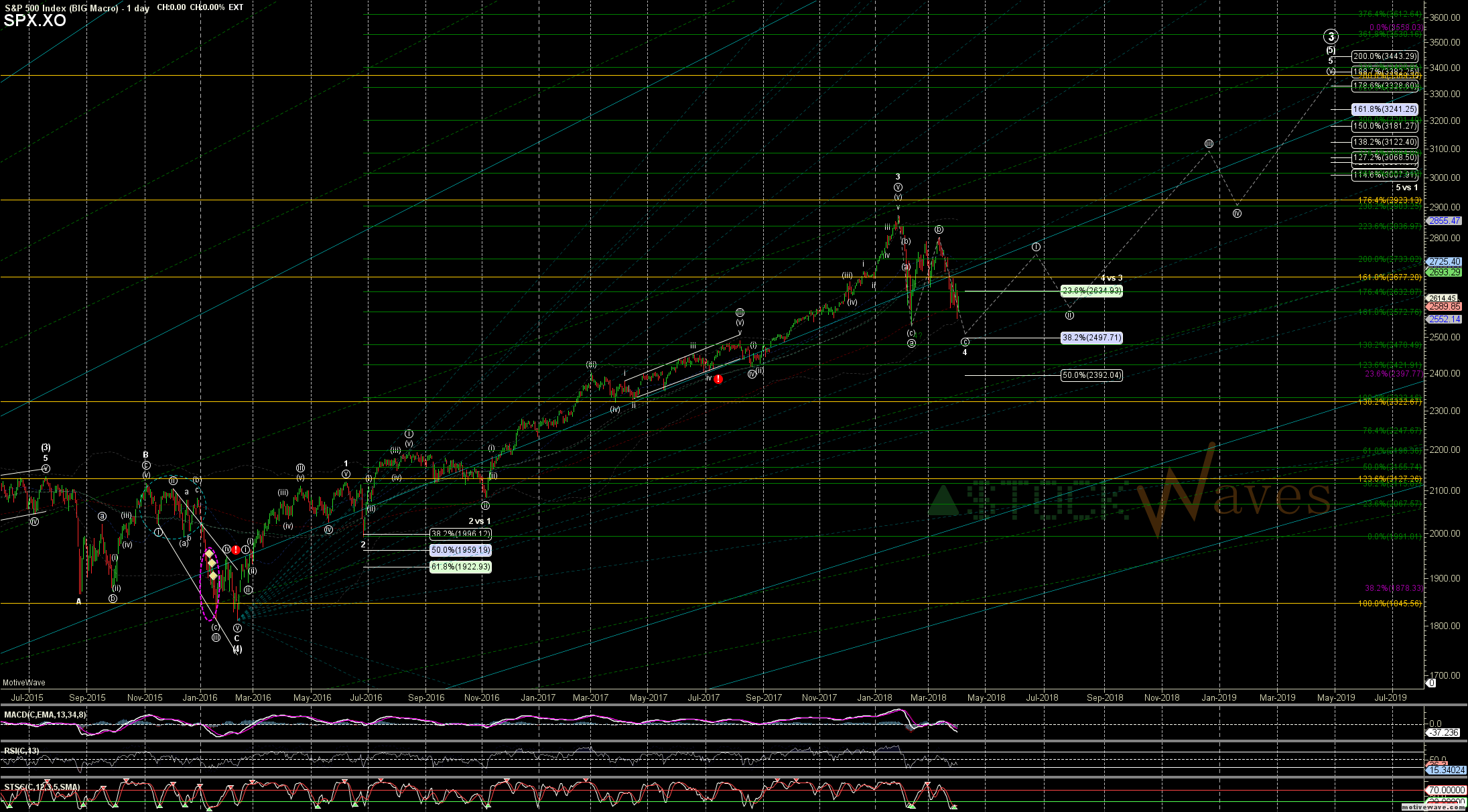

Both of these final patterns have us likely bottoming in this wave 4 later this week or next. I will be working on the write-up of the last Webinar Garrett & I did in StockWaves with many of our top picks for the coming wave 5 rally. Don't miss out!