Let’s Get This Straight – THIS IS A 3rd WAVE!

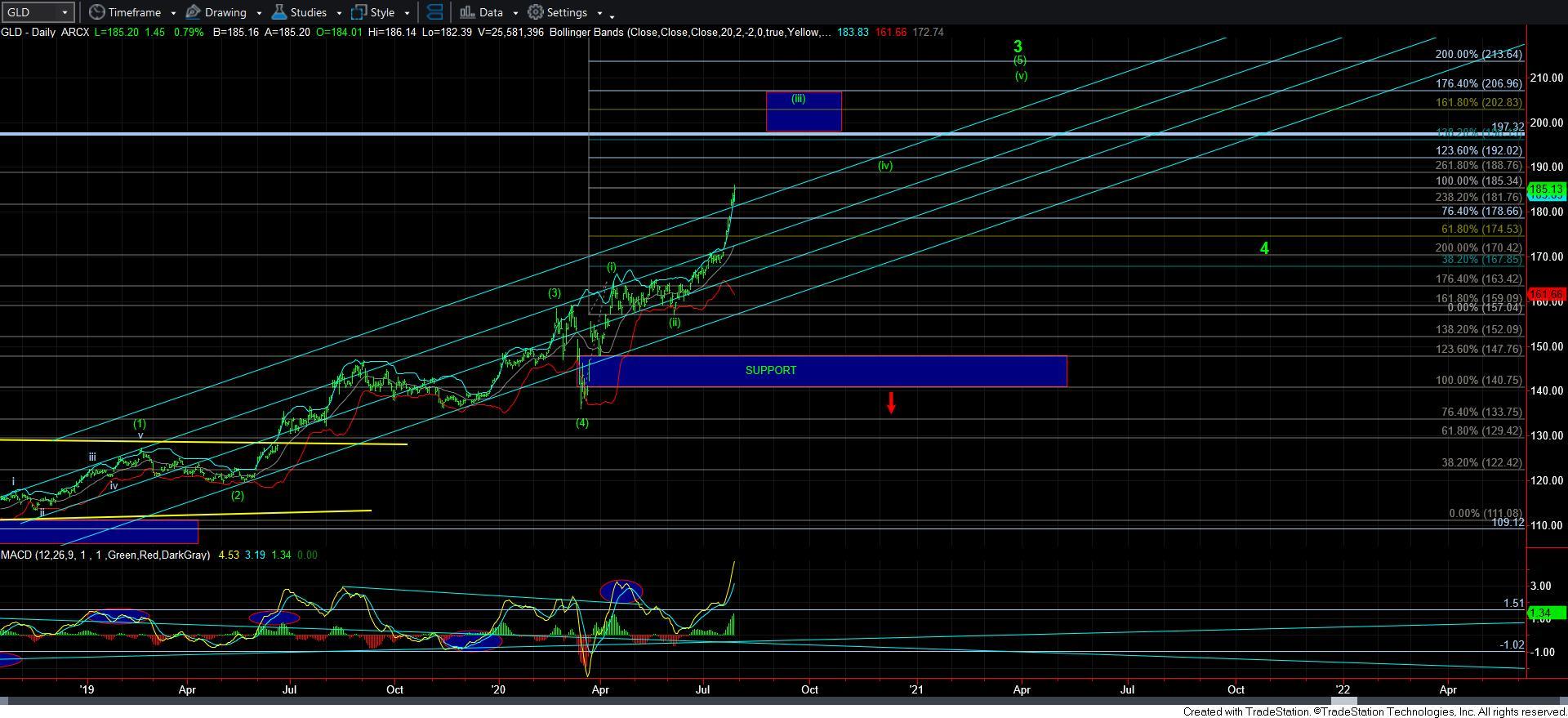

Folks, there is no way for me to reasonably count the GLD and the silver charts as anything other than a 3rd wave. And, based upon that perspective, I have to maintain expectations for higher levels to be struck in the coming months. The only question really centers around how much of a pullback can we see.

With regard to silver, I am viewing us as ideally “stuck” within wave iv of [3].

If you were following me over the last several days, you would know that I had to adjust my target for the wave iii of [3] to a Fib Pinball level higher than I had previously. And, as the market was approaching it the other night, I warned you that we will likely see a very strong reaction once we complete wave iii of 3, which is exactly what had happened. Moreover, yesterday, I presented a "general" path of how I think the wave iv may take shape. And, today, we dropped almost to the penny of where I expected to see the [b] wave of the b-wave within wave iv.

But, when we take a step back, and consider how far we have traveled off the March lows, the market really needs a rest before we head over 27 next to complete wave [3]. So, I have included a VERY micro structure for this wave iv on the 5-minute silver chart. But, I must warn you that there is no specific way a 4th wave must take shape. Yet, this is my best “guess” regarding the micro structure, as it stands now. Ultimately, I am simply looking at this as a consolidation over support before we are ready for our next rally over 27.

Over at the GLD station, my ideal target for wave iii is the 1.236 extension of waves [i] and [ii], which is the 192 region, and the top of our next target box. However, since metals LOVE to extend, I have raised my target for wave iii to target the 1.236-1.382 extension of waves [i] and [ii]. That provides us with a target for wave iii of [iii] in the 192-197 region.

In the very small degree, I am “assuming” that we are only now completing wave [3] of wave iii, but I am really not sure regarding that wave degree. I would need to see a wave [4] pullback begin soon to make me more confident of that micro degree. Until then, I am going to rely upon the higher wave degree, which clearly has us in wave iii of [iii], and, when it is completed, will likely provide us with a wave iv pullback in the coming weeks.

Ultimately, I am expecting we are heading to the 202-207 region to complete wave [iii] of wave [5] of 3 off the December 2015 lows. Once this structure completes for wave 3, I will be looking to lighten my load when it comes to long positions in this complex. But, in the near term, I think I will wait for wave iv to show itself before I consider a shorter term long-side trade for wave v of [iii]. However, depending upon how waves [3] and [4] and of wave iii of [iii] takes shape, I may consider a long trade for wave [v] of iii in the coming weeks.

Now, I am going to be brutally honest with you when it comes to GDX: I am genuinely unsure of how to count this smaller degree within this wave [5] of 3. There are so many charts of miners that really look like they need a bigger wave ii within wave [5] of 3, whereas others seem to just be starting their waves [5] of 3. So, for now, I am simply going to follow the bigger patten, and view a minimum target for GDX right now being the 47.50 region, but with strong potential to extend to the 55+ region in the coming months. As the market progresses, I will be able to develop the micro count in a more accurate manner. But, for now, I am simply gleaning what I am seeing in the metals charts, along with a general summation of what I am seeing in the individual miner counts.

Overall, much of what I am seeing suggests that much higher will be seen in the complex in the coming months, and potentially well into 2021. And, while silver and especially GLD are now providing us with a nice wave structure on the 60+ minute charts, I am still struggling with the smaller degree count on GDX. But, I certainly expect that to clear up in the coming weeks. Until then, I will stay long and strong, as I have throughout the last 5 years, and will look for opportunities for leveraged long trades over the coming weeks.