Let It Run - Market Analysis for Apr 3rd, 2024

The metals market has been running quite nicely and we have been enjoying the fruits of our patience. But, I am going to admonish you to not get too cute in your positions. To that end, I will be opening this update with a quote from Jessee Livermore, and closing it with another quote of his as well.

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!”

When the metals run as they are now, we do not often see large corrective moves, or as some refer to them, ‘gentlemen’s entries.’ And, while I had wanted to see one more pullback before the melt-up began, the metals rarely offer guarantees for those expectations. Yet, I am going to give the market one more chance to provide us with a larger pullback in GDX and silver.

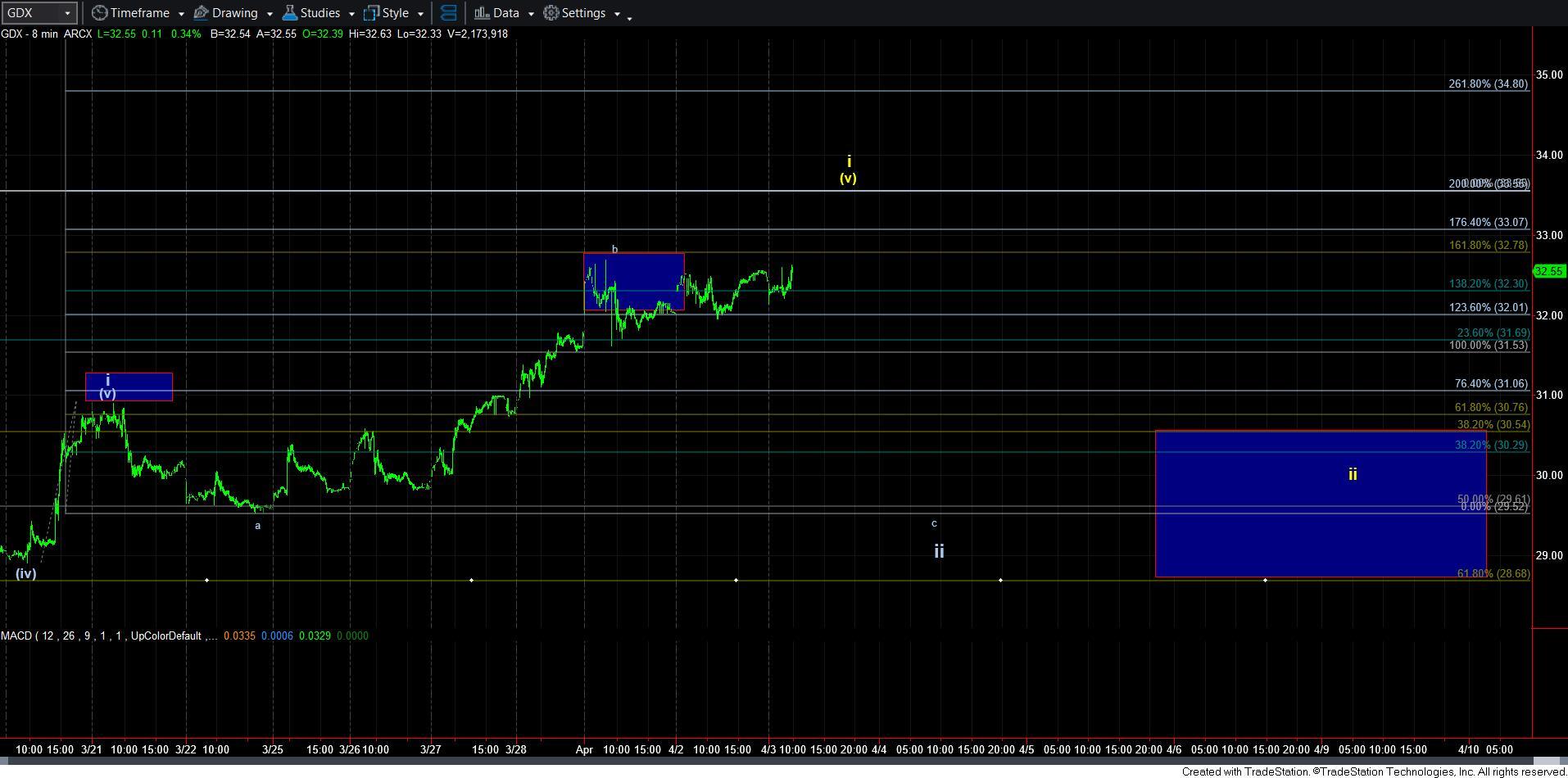

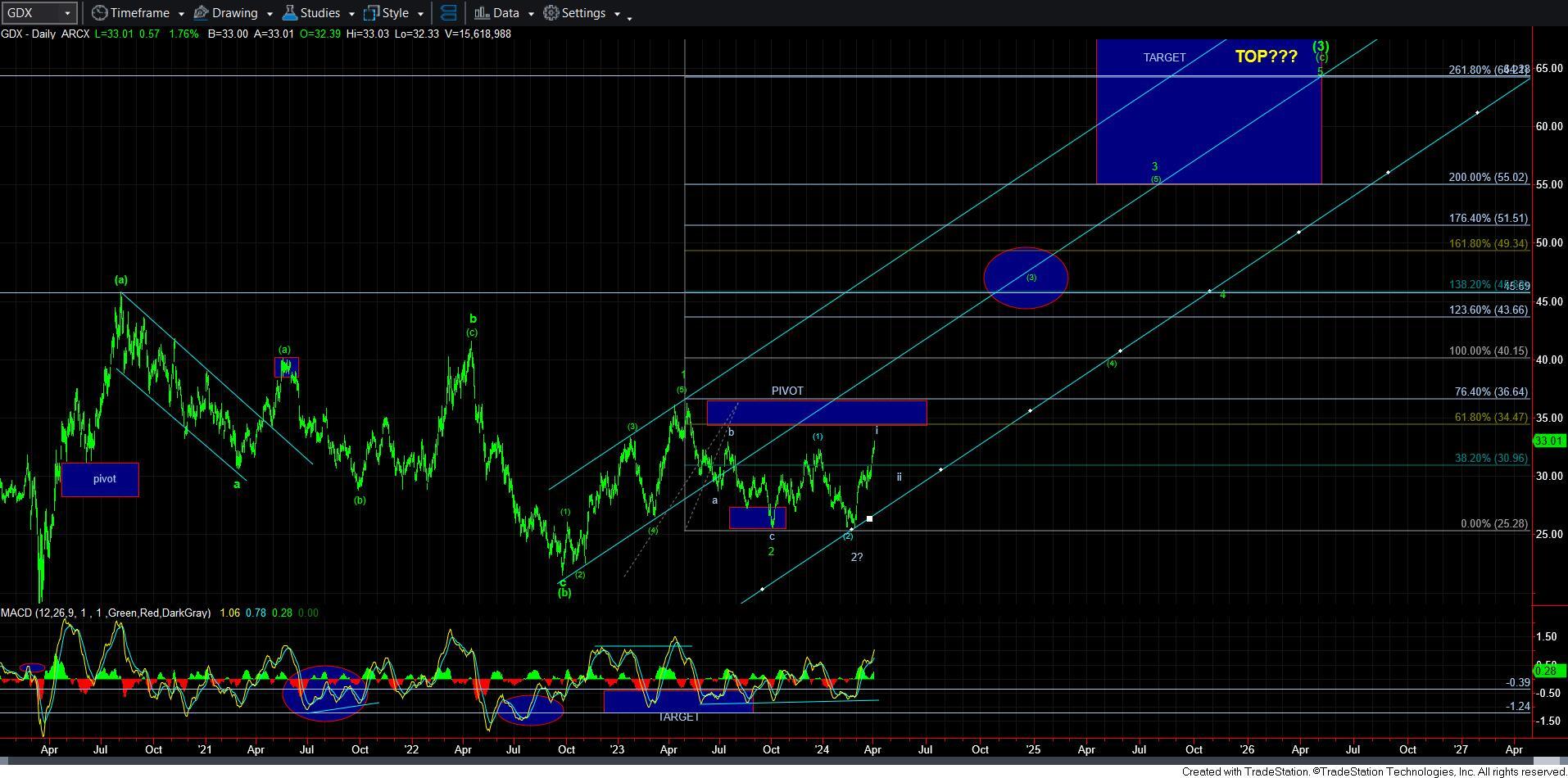

In GDX, it seems the market is trying to follow through on that more extended wave [v] of i I outlined over the weekend. So, if we are indeed just completing a larger, more extended wave i, then it should mean we can see just one more pullback/consolidation in a wave ii. And, that is going to be my primary count for GDX for now.

Now, if we begin to accelerate through the pivot noted on the daily GDX chart, then all bets are off, and it would mean we had an absolute tiny wave ii pullback already in place. But, for now, that has to be my alternative perspective.

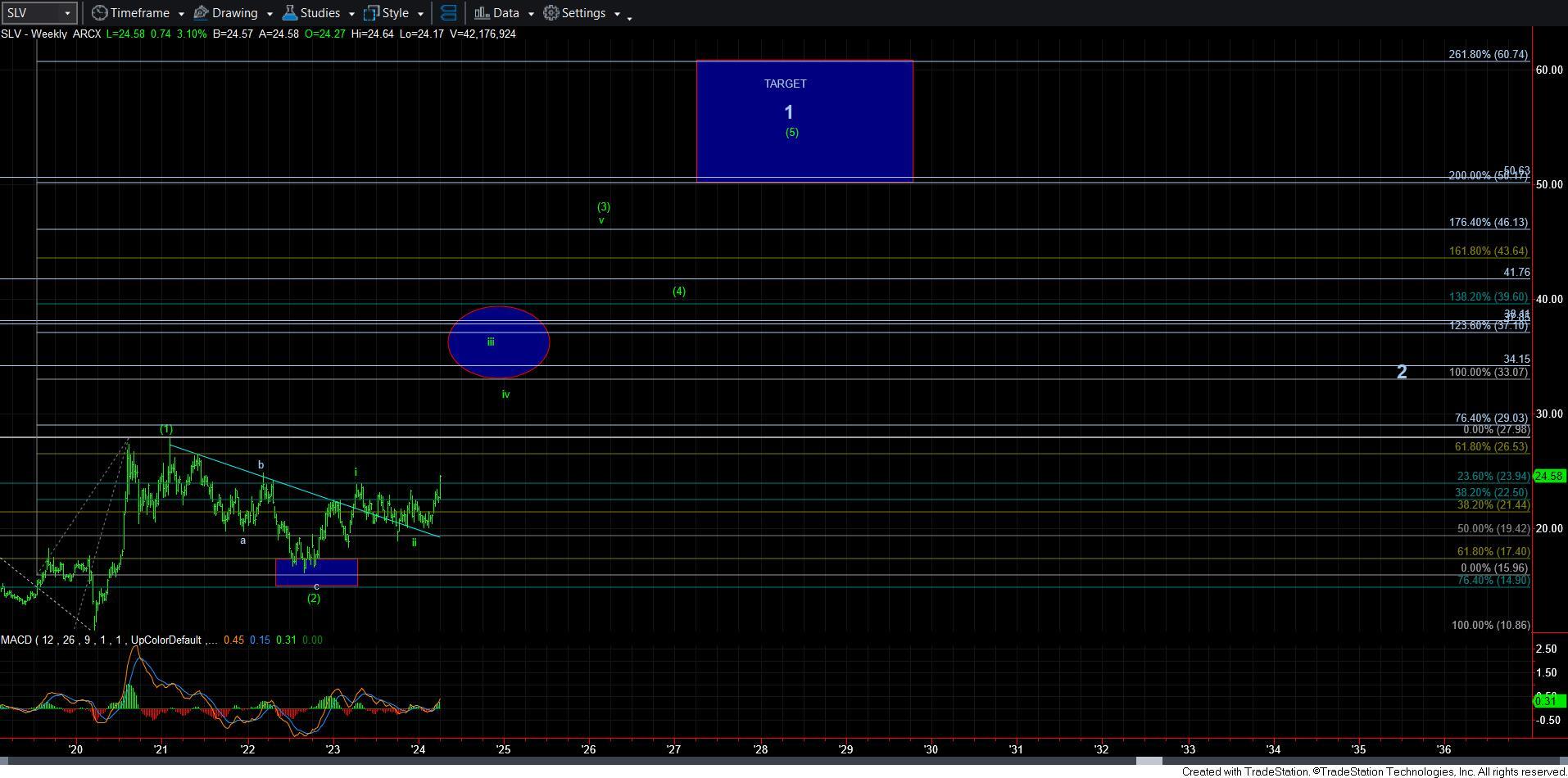

In silver, since we have now moved through the 26 region, I have to now consider that wave [ii] has already completed in VERY shortened and shallow fashion, and we are now trying to complete wave 1 of wave [iii]. That means I am attempting to maintain a reasonable expectation for a wave 2, which can coincide with the wave ii expectation I have in GDX. And, should that 1-2 play out as outlined, then what we have seen thus far is likely nothing compared what we will see once we break back out over the high of wave 1. It would not surprise me to see several days where we see 1.50-2.00 moves in silver. And, this would be within the heart of wave iii seen on the SLV weekly chart.

As I have outlined before, should this 1-2 set up develop and then begin to rally back over the high of wave 1, that would potentially trigger a move similar to the one seen at the end of 2010 into 2011. So, if you want to get VERY aggressive in silver long trades, that would be the ideal set up to allow to follow through before jumping in for those types of trades. During that type of rally, every 3-wave pullback, no matter how small, can be traded to the upside on even an intra-day basis. And, that is for what I am waiting before I begin to do day trades in silver.

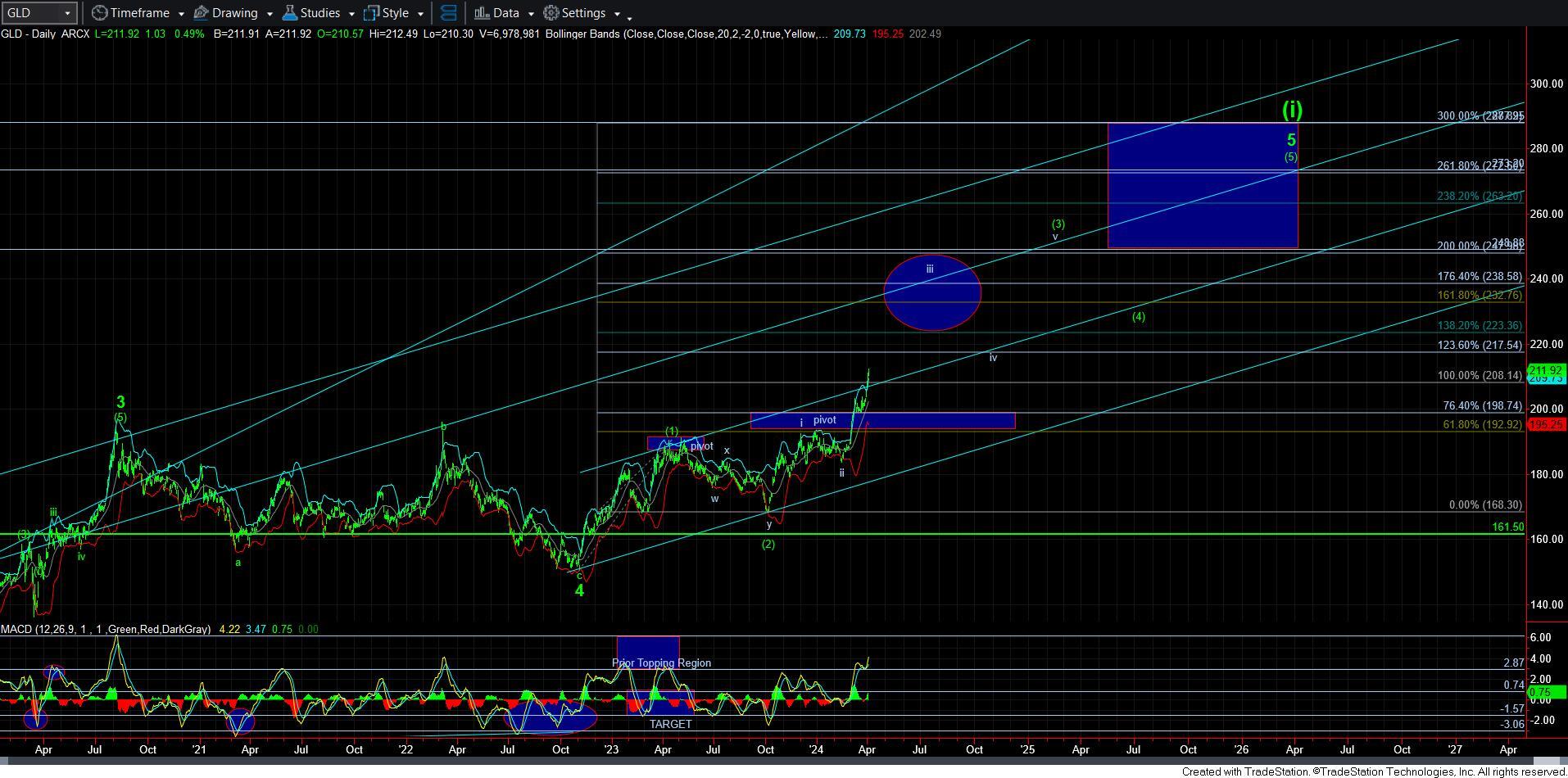

Now, as far as GLD, it has moved through resistance this week, so I think I can safely say that we are already in the heart of wave iii. And, the only question I have is how high can this extend. In fact, I see potential that just wave iii alone can easily take us to the 243-250 region over the coming weeks/months. And, should we reach that 250 region, then I will likely have to adjust waves v of [3], [4] and [5] to higher targets. So, the main point upon which you should focus is that 198 is now our support (the top of the pivot box), and I am looking much higher as long as we remain over it.

I also want to point out that one of the hallmarks of the price action during a heart of a 3rd wave is that the market moves out of its lower channel, and then moves into an upper, accelerated channel. This is exactly what we are seeing right now, which is another signal that we are likely into the heart of wave iii of [3] in GLD.

This now brings me to the main point I want to make at this stage in the rally. While I am going to attempt to track smaller degree counts, I want to clearly state that I may be hurting you more than helping you in trying to outline the micro-counts. It may cause some of you to consider selling your positions or even shorting. And, I think that is a big mistake when we move into this stage of the rally, especially in GLD.

I also know many of you are entertaining some bearish counts in the metals as well, because I have been asked questions long those lines quite a few times. However, I really cannot come up with a bearish count on that daily GLD chart which would exceed 20% in probability at this point in time. In fact, I would have to come up with a very convoluted wave count to even consider a bearish count at this time. However, if we see a break of 198, then I would re-consider. But, as long as we remain over that pivot on the daily chart, this is a BULL MARKET in GLD.

For many months, I have been trying to focus everyone on the strong potential being presented by the GLD chart, despite much of the moaning and groaning about the metals complex during that time. This chart has been leading the way for the complex, and I see no reason why it will not continue to fill in its wave count in the coming year or two. But, I also expect to see silver and GDX provide us with significant catch-up moves as well. And, based upon the percentage moves we are seeing of late in silver, I think we are only seeing the beginning phase of that move.

So, now I am going to close this update with another quote from Jessee Livermore:

“Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.”

Have a good afternoon.