Let It Ride - Market Analysis for Apr 21st, 2021

Well, folks, there really is nothing much to do at this point in time. I am going to allow the market to complete the first bigger degree 5-wave structure off the recent lows so that I can begin to turn aggressive on the metals complex.

As for now, I think the GDX provides us with the best picture of what the market needs to do to complete that initial 5 waves up. As you can see from the attached 8-minute chart, the chart is quite self-explanatory. Support is clearly outlined, and the GDX has yet to complete waves 3, 4 and 5 within wave [iii] off the low, followed by waves [iv] and [iv] in order to complete wave i of the next larger degree trend.

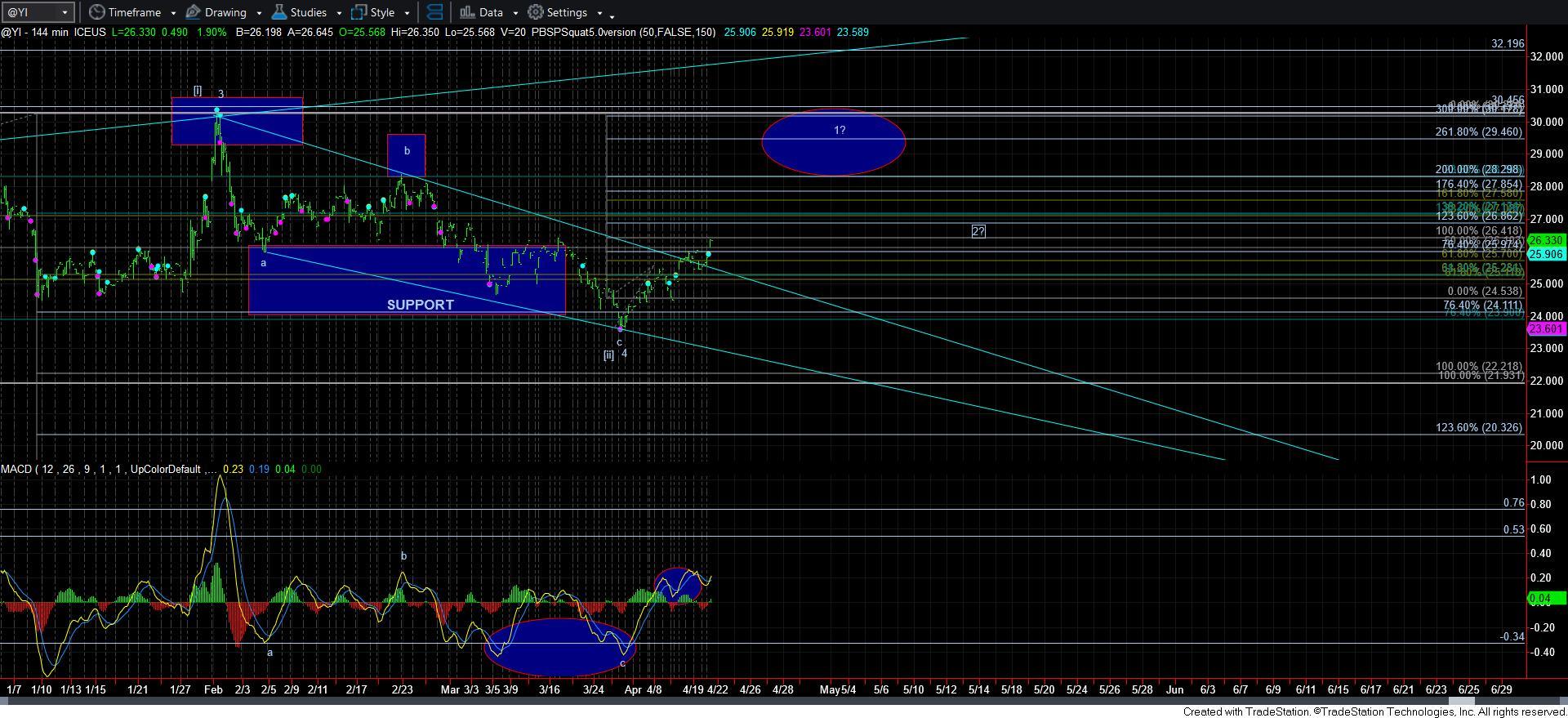

As far as silver is concerned, I want to re-post what I wrote earlier today, as it presents a slight change in perspective on silver for me:

So, as this silver rally maintains as an impulsive structure, and should we continue to the ellipse and complete 5 waves, then I will have to go back to the [i][ii] structure we were speaking of months ago. Remember that I was unsure if wave [i] had completed at the last highs, or whether that was wave 3 in a bigger leading diagonal for wave [i]. Well, if we complete a standard 5-waves up in an impulsive structure, then I am going back to the [i][ii] structure, with this being wave 1 of [iii].

Should silver complete a 5-wave structure into the ellipse, then I will adopt the more immediate bullish count noted above.

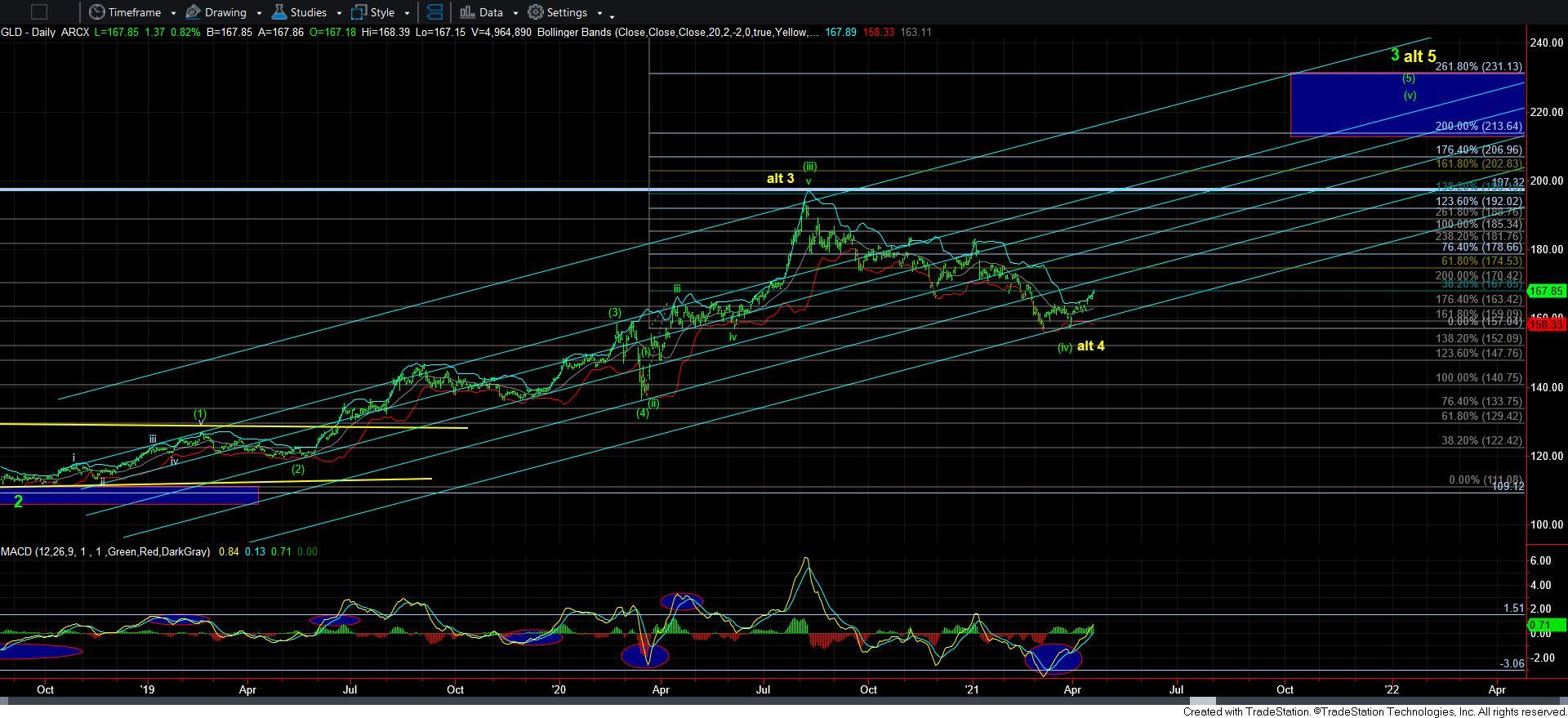

As far as GLD is concerned, I am still having an issue with the smaller degree structure due to the double bottom. But, based upon the micro structure as I am tracking it, a 5 wave structure would likely take us to the 176-180 region to complete the initial 1st wave in this potentially new trend.

I am trying to keep this simple, and let the market continue along its merry way to provide us with a solid 5-wave rally structure off the recent lows. Once that develops, then we can begin our plans as to how to handle the next phase of the bullish cycle in the metals complex later this year.