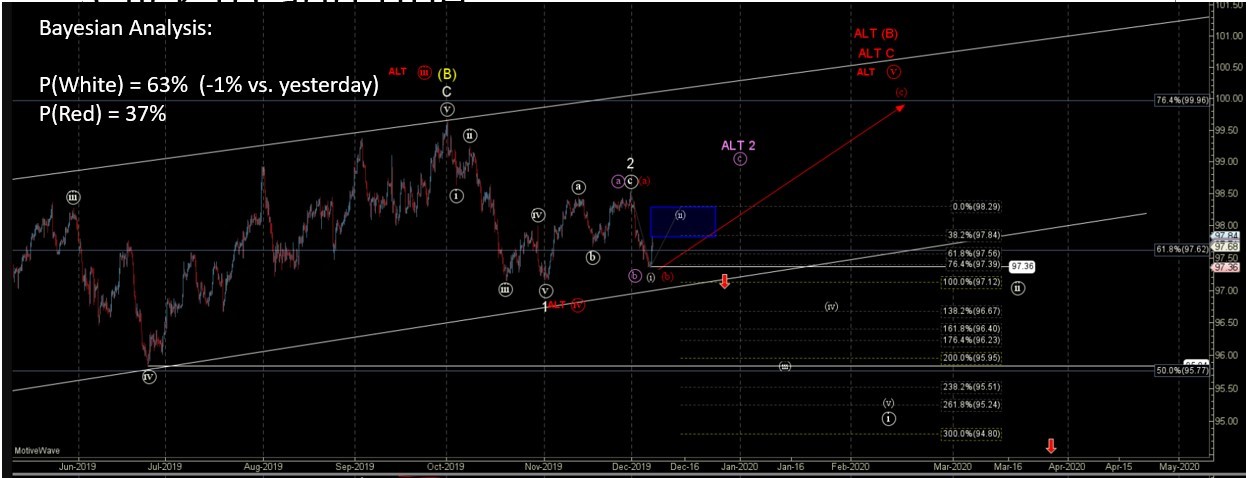

Leaning Bullish After Consolidation Completes

With the market barely moving, the Bayesian Timing Signal (BTS) is presently neutral after locking in profits last week, as the SPY dances between 308-314.

Bayesian analysis still leans bullish with SPY targets in the 330s after this consolidation completes. However, note the signal is neutral for a reason – as there is still uncertainty in the air and we aren’t immune from a rug pull (i.e. nothing is guaranteed even if things continue to lean bullish).

Here are the updated paths: (1) [Probability (P)=64%] SPY consolidates between 308-314 (and possibly getting as deep as 305) and then resumes its bullish ways to the 330s, and (2) [P=36%] SPY generally begins a more aggressive path lower that see the 290s or worse.

Further, at the micro level there are three general paths: (A) [P=39%] The bottom was seen on 12/3, SPY stays above 313ish and things generally push higher from here and then into the 330s, (B) [P=36%] SPY stays in a “wider” consolidation zone between 305-315 for another few weeks and then breaks higher to the 330s, (C) [P=25%] Things consolidate (whether A or B) and then break down to the 290s or worse.

In metals, there's very little to add, as we locked in bullish profits last week and were on the sidelines for the mini-waterfall on 12/6. GDX continues trading between 26-28 for over a month now; so, action has been muted for quite some time. The move higher over the last week definitely lacked conviction; so I do believe we are closer to a multi-week top vs starting something more bullish.

Could still get one more micro higher, but the BTS isn’t yet excited about a bullish position; and leans neutral to slightly bearish presently.

In oil, after locking in profits earlier last week, the BTS jumped back into USO at the LOD on 12/6. At the micro-level, sure did “nail” that one, as within one hour, USO went straight to 12.50 before pulling back into the EOD. Things continue to look bullish in energy and members are reminded of our energy ETF exposure in the BTS table.

Note: For members interested in real-time trade signals for a dozen or more ETFs across a range of commodities and industry sectors (QQQ, IWM, GLD, SLV, TLT, UNG, XLE, XLF, XBI, etc.), you are encouraged to check out the Bayesian Analysis Plus service. Plus, be sure to check out the BEWTS 1-2 day signals.