Leaning Bearish Since October 4 Short Signal

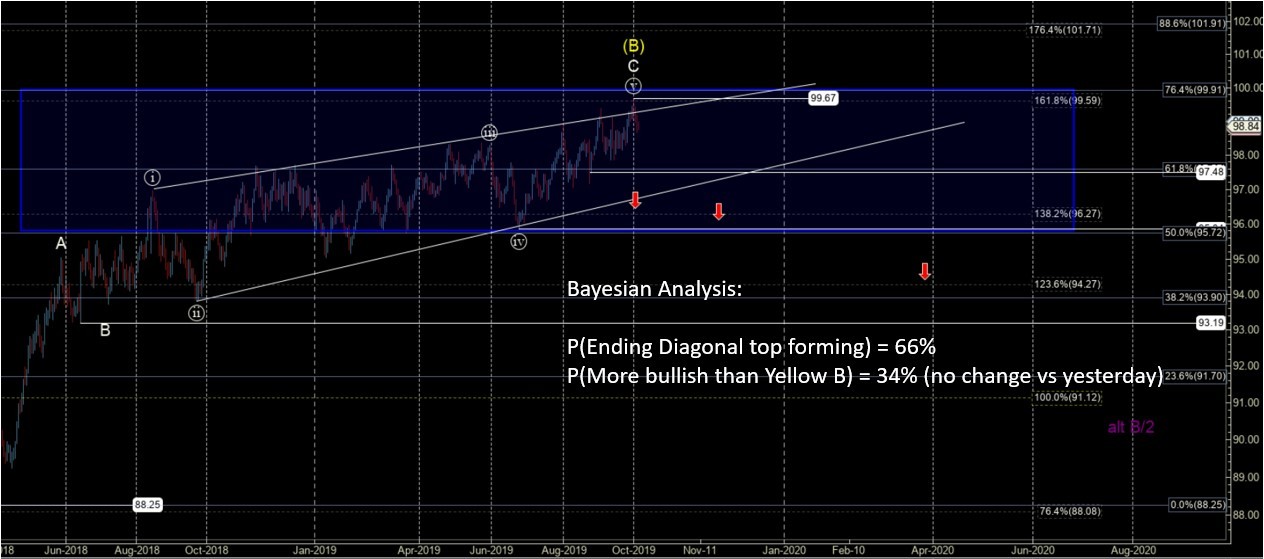

On October 4, our Bayesian Timing System (BTS) gave us signals to short the SPY, QQQ and IWM.

Today, the BTS indicates a 47% probability that the SPY bottoms above 282-ish and begins an aggressive path higher to ATHs. There's a 53% probability the SPY breaks 282 and sees as low as the 240s (and there doesn’t seem to be much support in the 270s and 260s).

Even though near a coin flip, the steep one-day rate of change in probabilities late last week tells of significant uncertainty under the surface. It appears to me that one side is about to throw in the towel and a large move is on the horizon.

Will it be the bears or bulls?

All we can do is continue to look at our clues. Getting above the important 291 on Oct 4 alleviated the immediate waterfall potential, but now we find ourselves in the precarious 291-296 zone. A sustained break higher out of this region does lend itself towards ATHs, while breaking back below 291 opens up a minimum test in the 282-285 region.

For now, the probabilities from this perspective lean bearish and thus the short signal. A vibration window thru October 10 needs to be kept an eye on, as well.

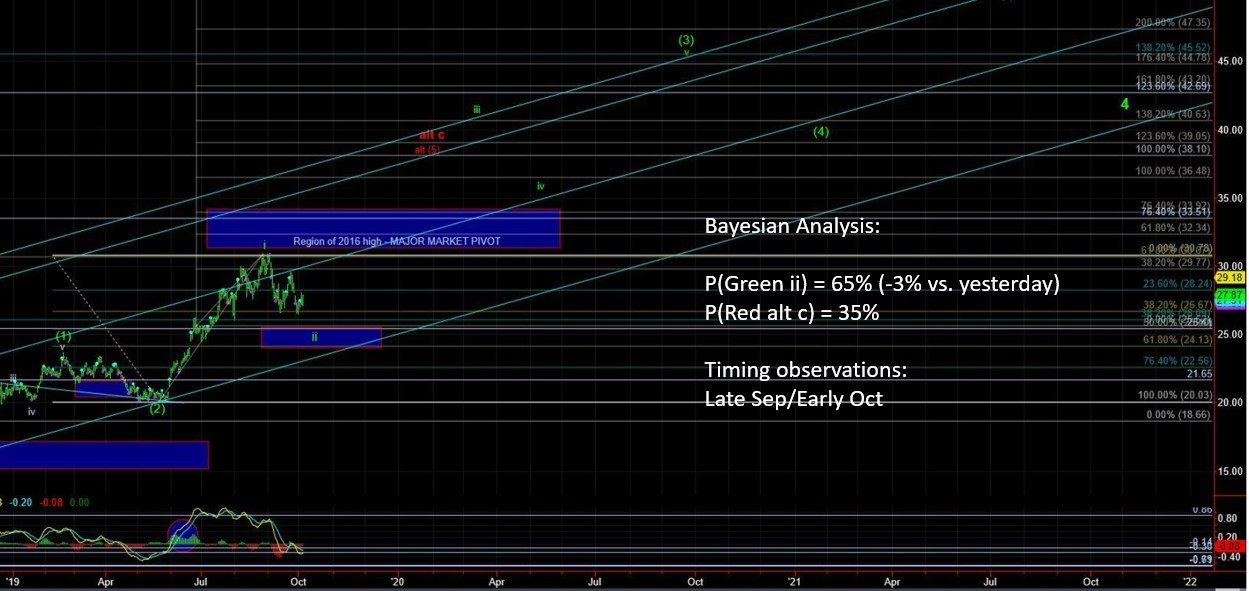

Login to also see our Bayesian analysis of the metals, energy, bonds, and USD -- in all more than a dozen ETFs across a range of commodities and industry sectors (QQQ, IWM, GLD, SLV, TLT, UNG, XLE, XLF, XBI, etc.).