Lazy River Grind Up

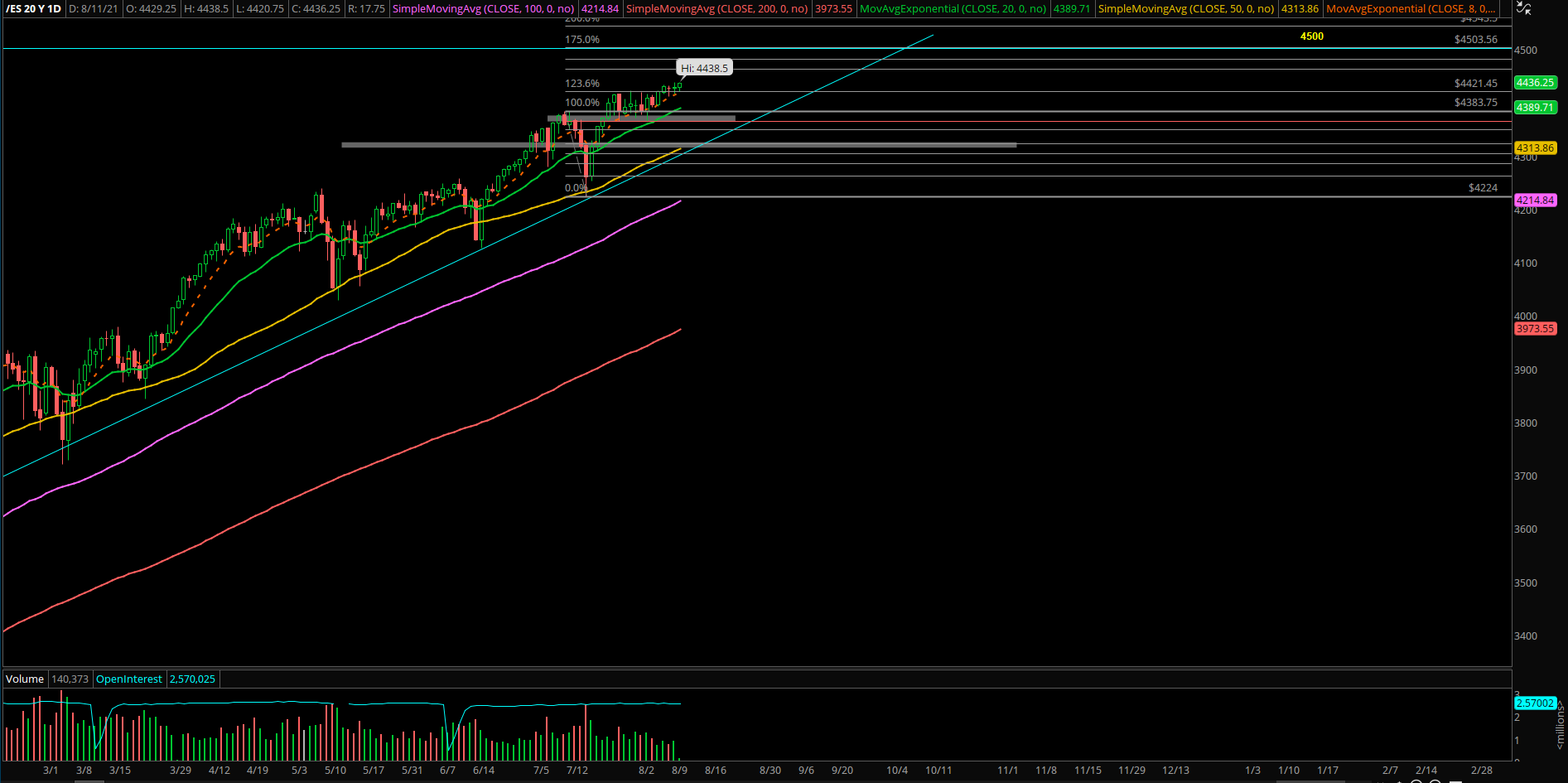

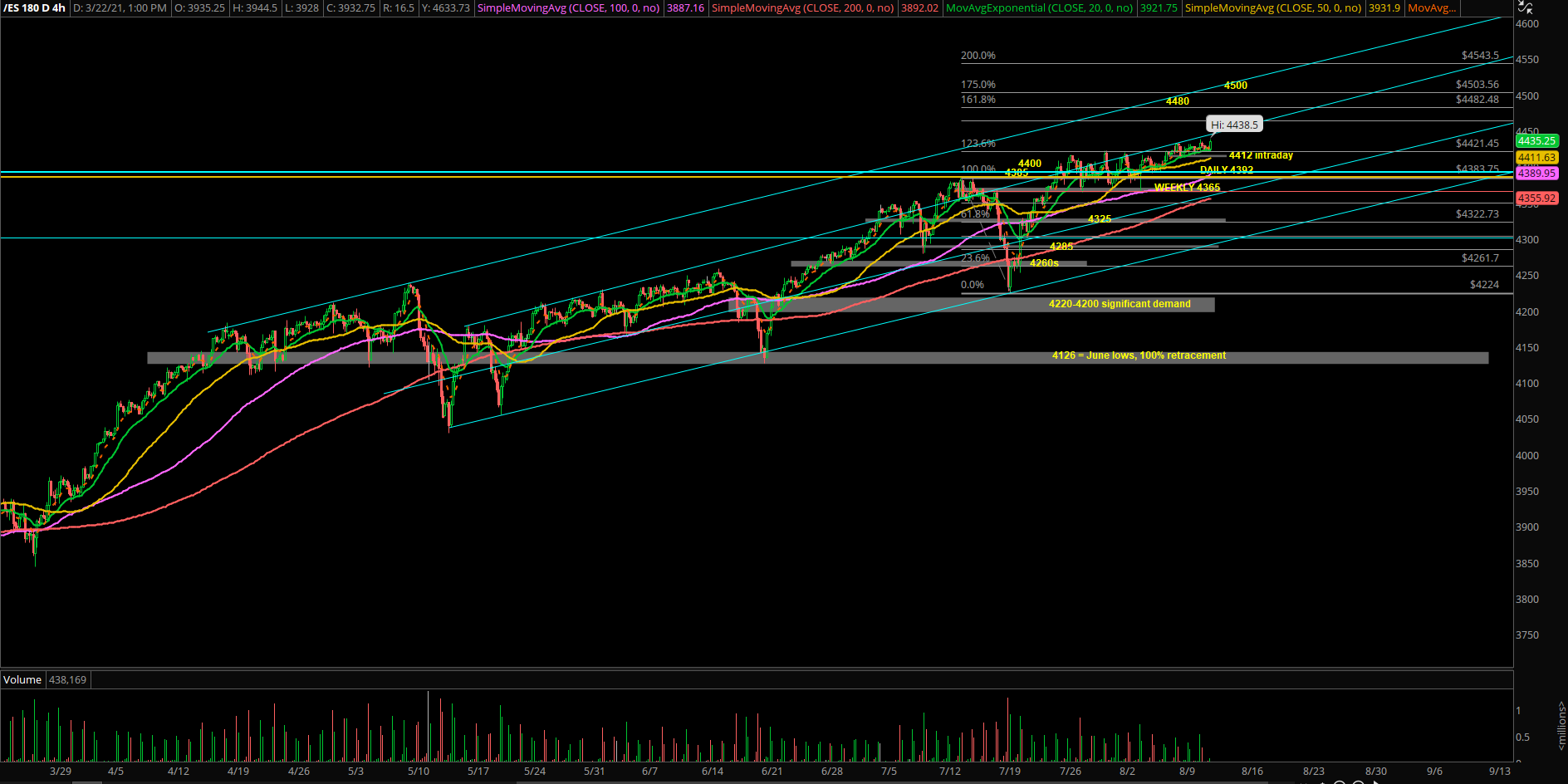

Yesterday was another consolidation day, where the Emini S&P 500 (ES) attempted the 4435 key level breakout, but could not sustain. This morning's CPI timing catalyst provide a decent spike up, and we'll see if it sustains.

Nothing has changed: All intraday dips remain buyable when trending above 4412 for a grind up into 4480/4500. Use 4392 as the daily timeframe must hold support (EOD pricing).

All weekly dips must remain above 4365 to be deemed as buyable; otherwise risk opens to 4325-4300 for a bigger pullback. Note that 4365 has been the past two week’s low, so there’s significant demand.

There are different timeframes here, so know which one you are participating into and reconfigure stops/risk.

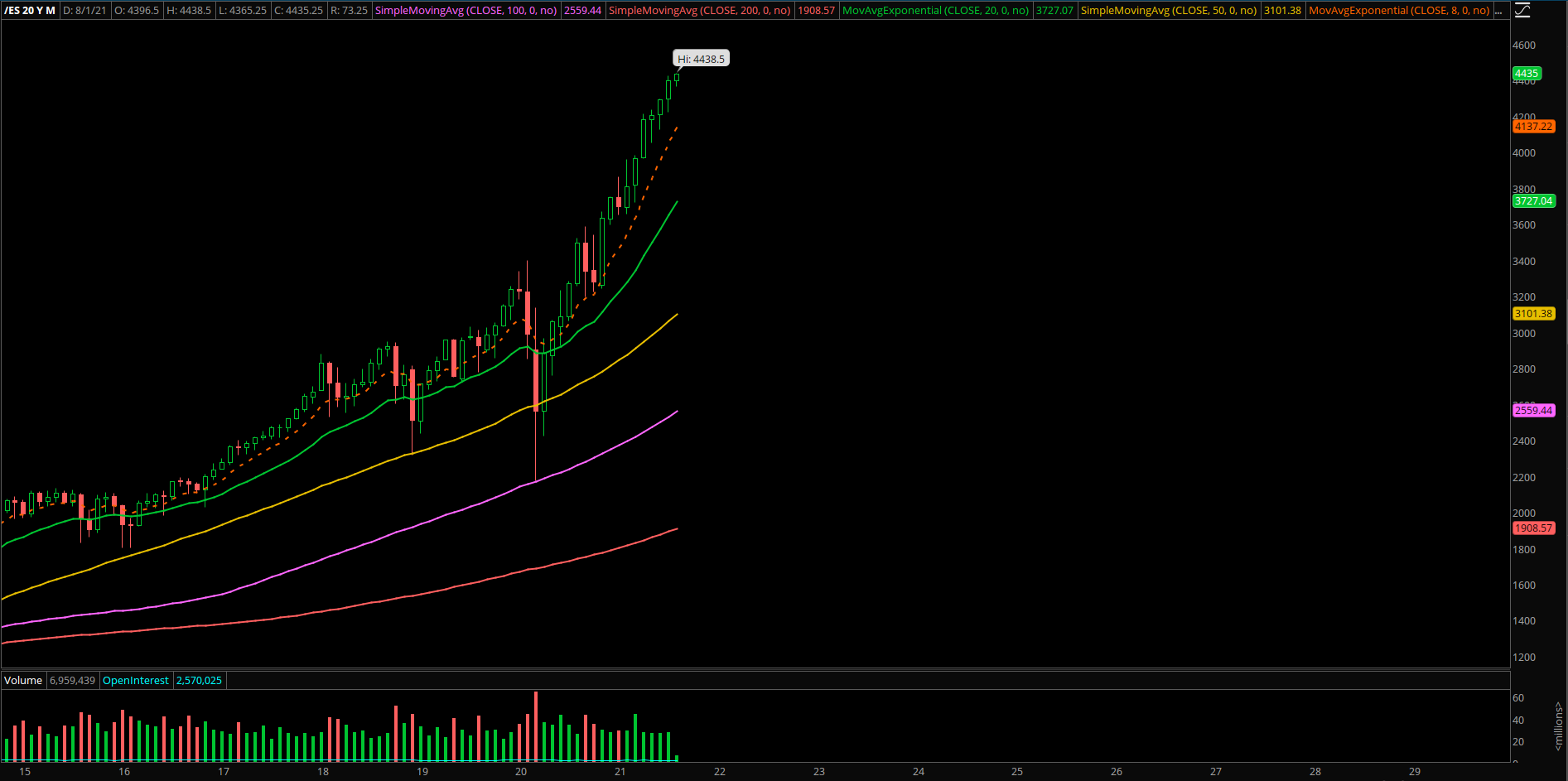

Overall, not much has changed because it’s August and the environment fits with historical stats alongside with trading volume drying up across the indices and a lot of the important stocks.

Regarding market sector rotations, big tech is likely going to lag/consolidate while financials, semiconductors and materials (XLF, SMH, XLB) go for a breakout rotation/potential outperformance in this stretch of the race.

In addition, many of our bonus stock setups in the past few months have significantly outperformed the market benchmark of S&P 500. Names such as AMD, AAPL, ADSK, ADBE, AMZN, DOCU, NVDA, REGN, SE, TSLA. The key is to pick and try and ride the ‘best in breed’ setups until they rotate/lag/invalidate and also cut losers aggressively in order to have your money compound in better setups. There are lots of decent setups providing quick +15-20% returns via common shares alone and the occasional +30% runners.

Know your timeframes here. It's been a fairly methodical lazy river grind up thus far as we expected given the past couple months of preparation for the summer trading environment. Racket up stops and try to hang on tight for the best performing train setups, cut laggards/underperformers, rinse and repeat.