Knocking on Dec Highs

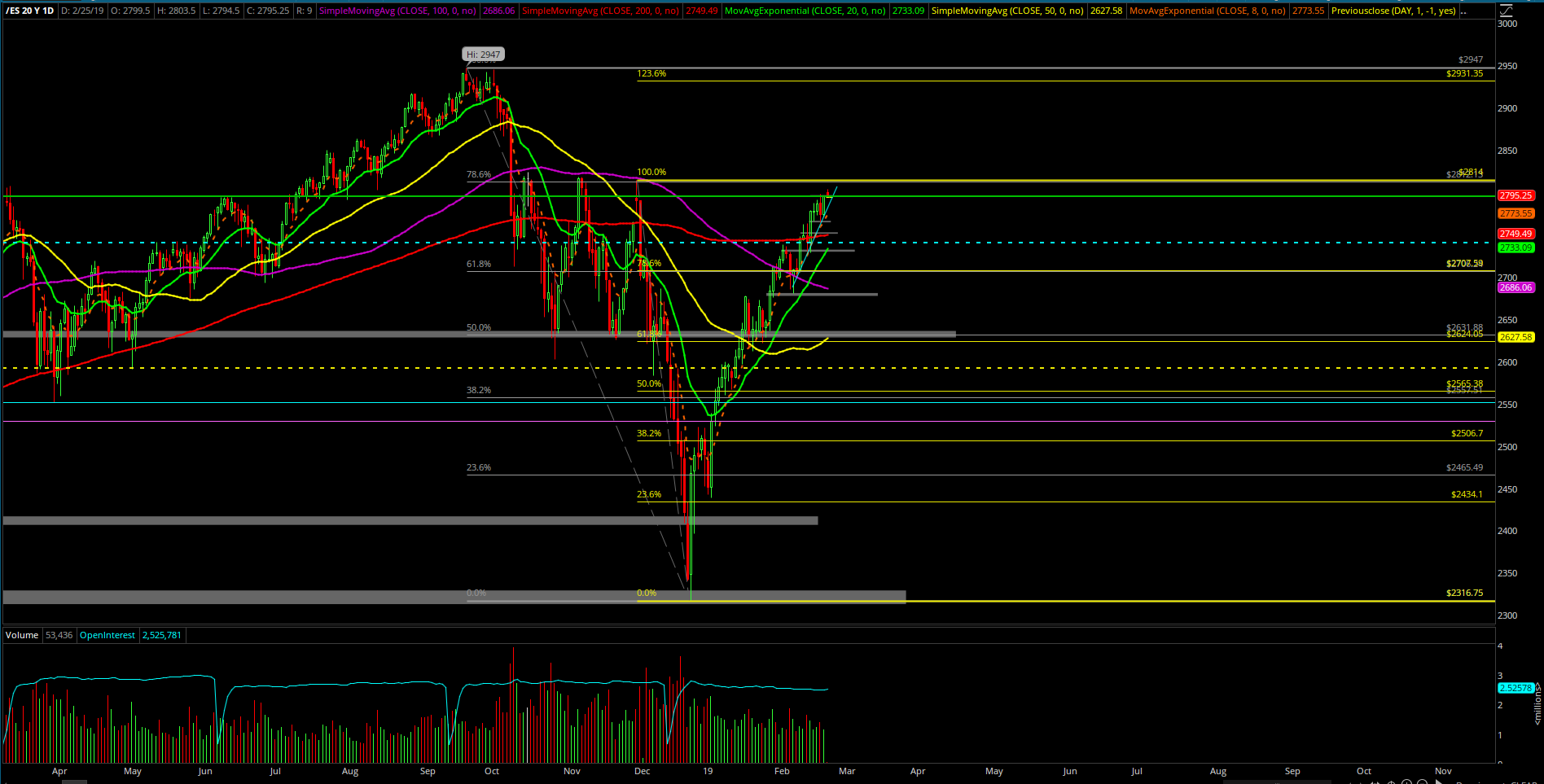

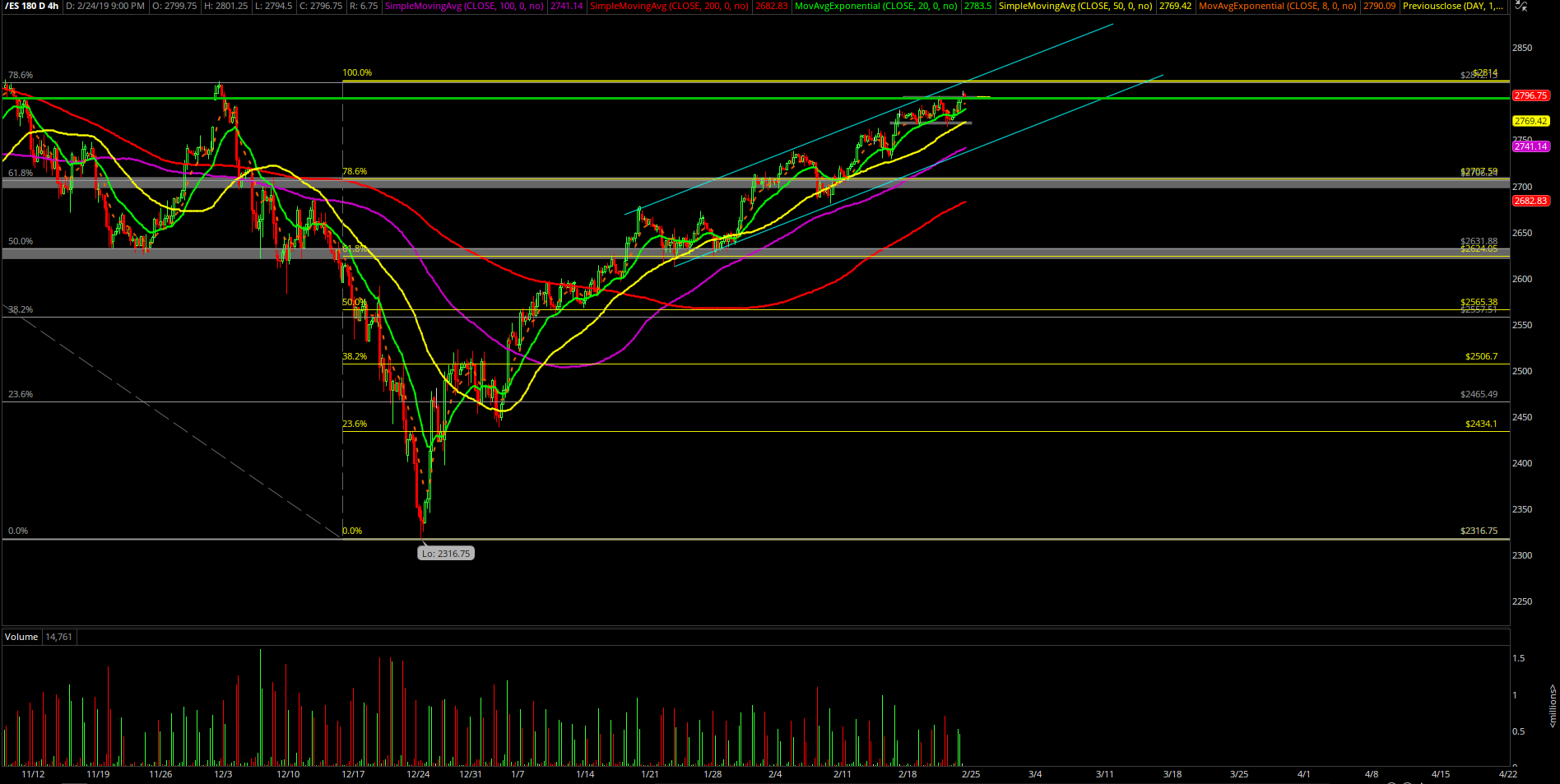

The 3rd week of February spent the majority of the time being stuck in 2760s-2780s bull flag range on the S&P 500 doing the good old consolidation before the eventual higher highs breakout. In simplest terms, the bull train was able to fulfill the 2795-2800 major target and opened up the next level at 2814 derived from the December highs.

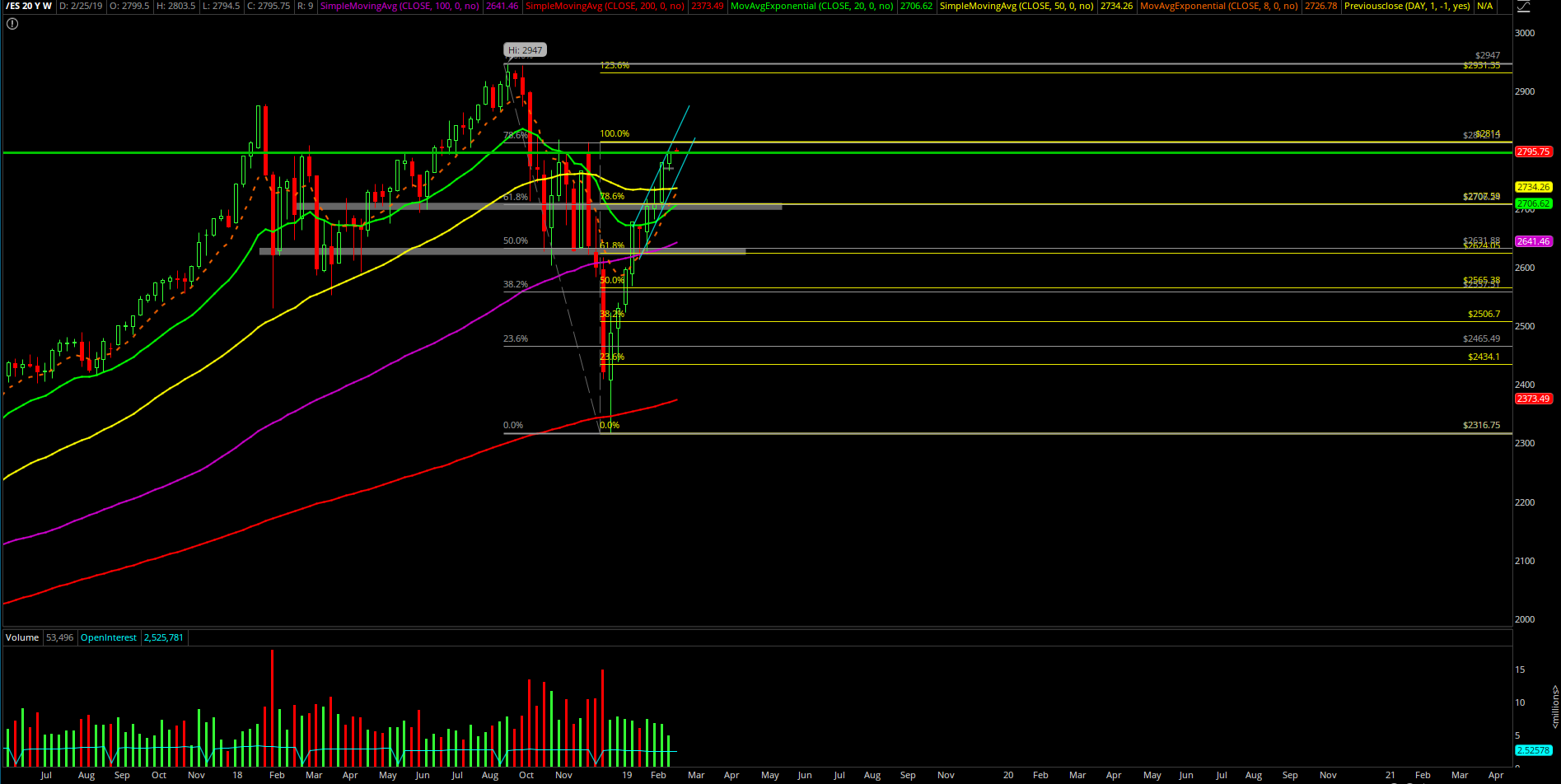

The main takeaway from the week was that it was the 7th week out of the past 9 weeks that closed at the highs for the weekly candle wrap up. Nothing has changed as the bulls remain in full control in terms of momentum being sustained as the week’s trending support kept getting stick-saved. The opposing bears remain endangered and irrelevant still and only have a chance again if December highs hold/reject hard.

What’s next?

Friday closed at 2795.25 around the highs of the week gaining 17.5 points or 0.63% vs. the prior Friday. The bull train is getting rather close to the Dec highs at 2814 so the inside month context is at risk due to the sustained momentum and velocity of the powerful train.

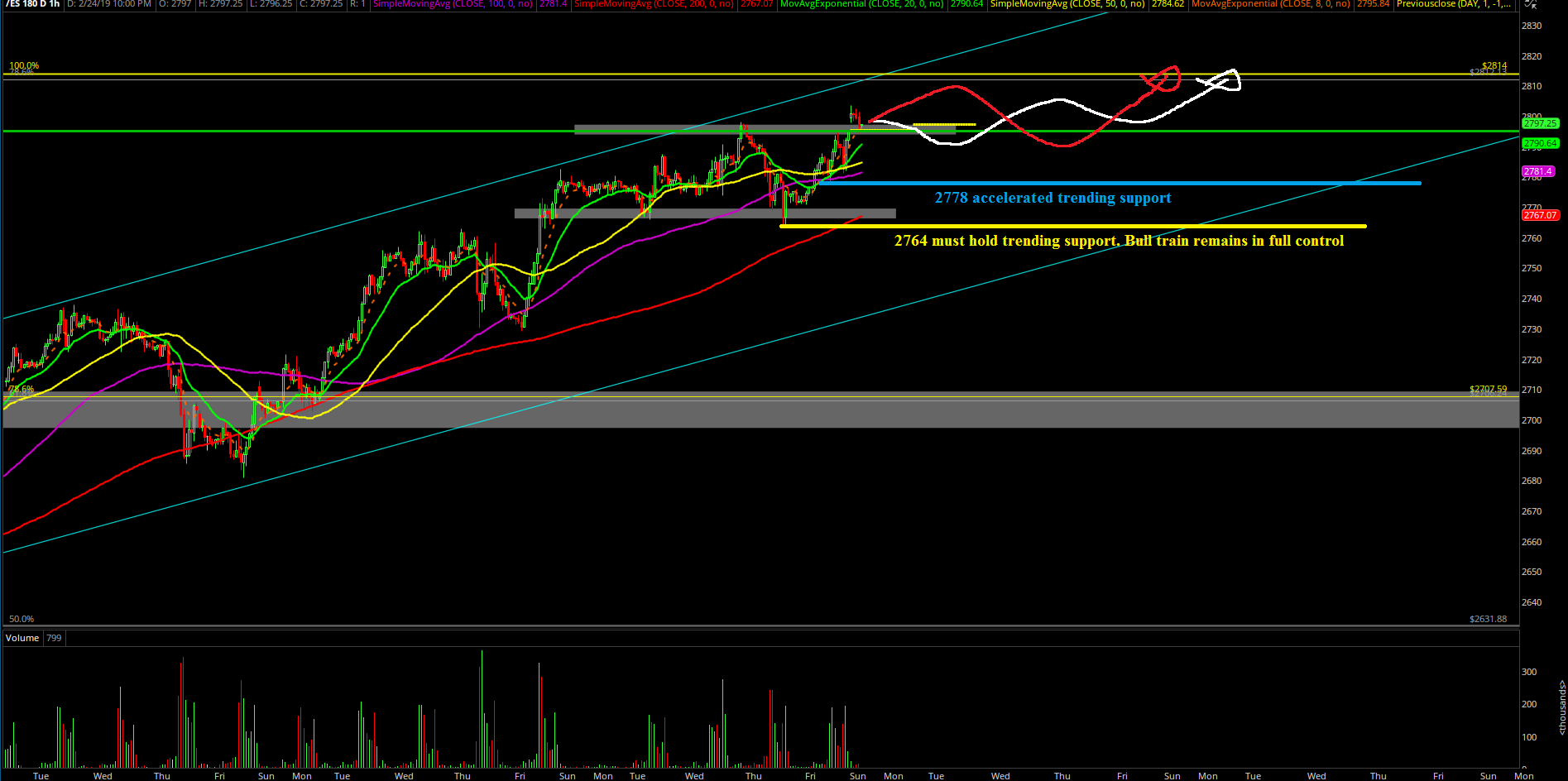

Heading into this week, we still remain bull-biased when price action hovers above 2764 for immediate trending purposes. The bull train remains in full control when 2764 holds based on the weekly low. We also have to be open-minded if this bull train surprises us with a clean breakout above December highs of 2814 and forces an outside month breakout that signifies further highs are likely coming due to continued strength. We need to see above 2814 in order to open up 2865, 2900 levels and new all time highs.

Zooming in, when above 2778, we are looking for 2814 as the next continuation target based on the accelerated trend. In simplest terms, the 1hr white line projection from Friday remains valid until we see changes on the price action and red line as the alternative permutation.

Please note: it is February month end this Thursday so the bulls will attempt to wrap it up at the dead highs again given the uptrend context since January. Please understand the ongoing battle here on all the different timeframes. Know your timeframes.

-----

For the short-term bears, the absolute earliest indication of a trend reversal possibility would be a break of 2764 in order to have a chance to do a range expansion to the downside (levels such as 2750/2730/2700/2680). Until this occurs, its déjà vu all over again… grind higher highs, bull flag/consolidate, breakout again.

Clear and concise context for this month:

In simplest terms, we are aware that February will likely be another inside month based on the current odds. (surprise surprise) We’re going to capture the range and pocket the points because it’s a freaking huge range. The current odds indicate that bulls are unlikely to break above 2814 (December high) and bears unable to break below 2438 for February so let’s play it smart given the huge range and in an efficient manner by focusing the morning spikes and setups.