Kinda Five Up - Market Analysis for Aug 4th, 2021

Well, we kinda have seen 5 waves up, but not really in all the charts. While the GDX and silver charts have provided us with a 5-wave rally off the recent lows, I wish I could say the same of the GLD. Of course, it could have a truncated 5th wave, but those are quite rare, especially in the gold charts.

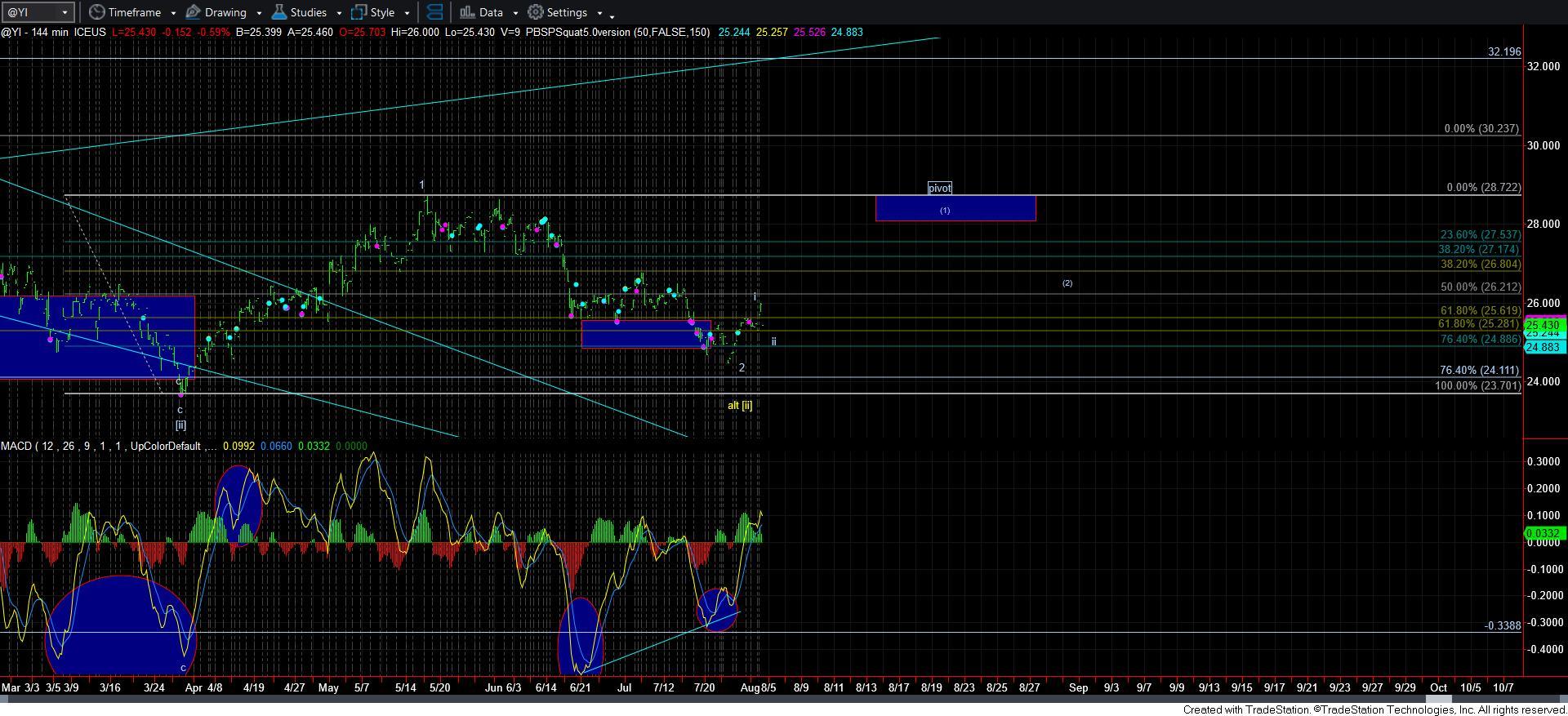

For now, I am going to leave the GLD chart aside, and see how it progresses in the coming days. As far as silver, it has support for a 2nd wave pullback in the 25-25.25 region. And, as you can see from the attached GDX chart, support is between 33.50-34.35.

As the current pullback takes shape, and we see a reasonable 5-wave c-wave taking us to support, I will then put out a Fibonacci Pinball structure for a break out set up in GDX, as it is the clearest chart I have right now. I will note the next higher micro pivot within this [i][ii] structure that is potentially developing, which will outline where aggressive long trades can be taken, and what levels to use as support.

As long as the market continues to develop in this structure for the GDX, I am going to maintain a bit more patience and allow the more aggressive long setup to develop over the coming week. Remember, we do not want to force an aggressive long trade, but, rather, we want the market to present us with a fat pitch, which gives us clear low risk parameters to attempt an aggressive long trade.