Key Time, Price Hovering Within the STFR Zone

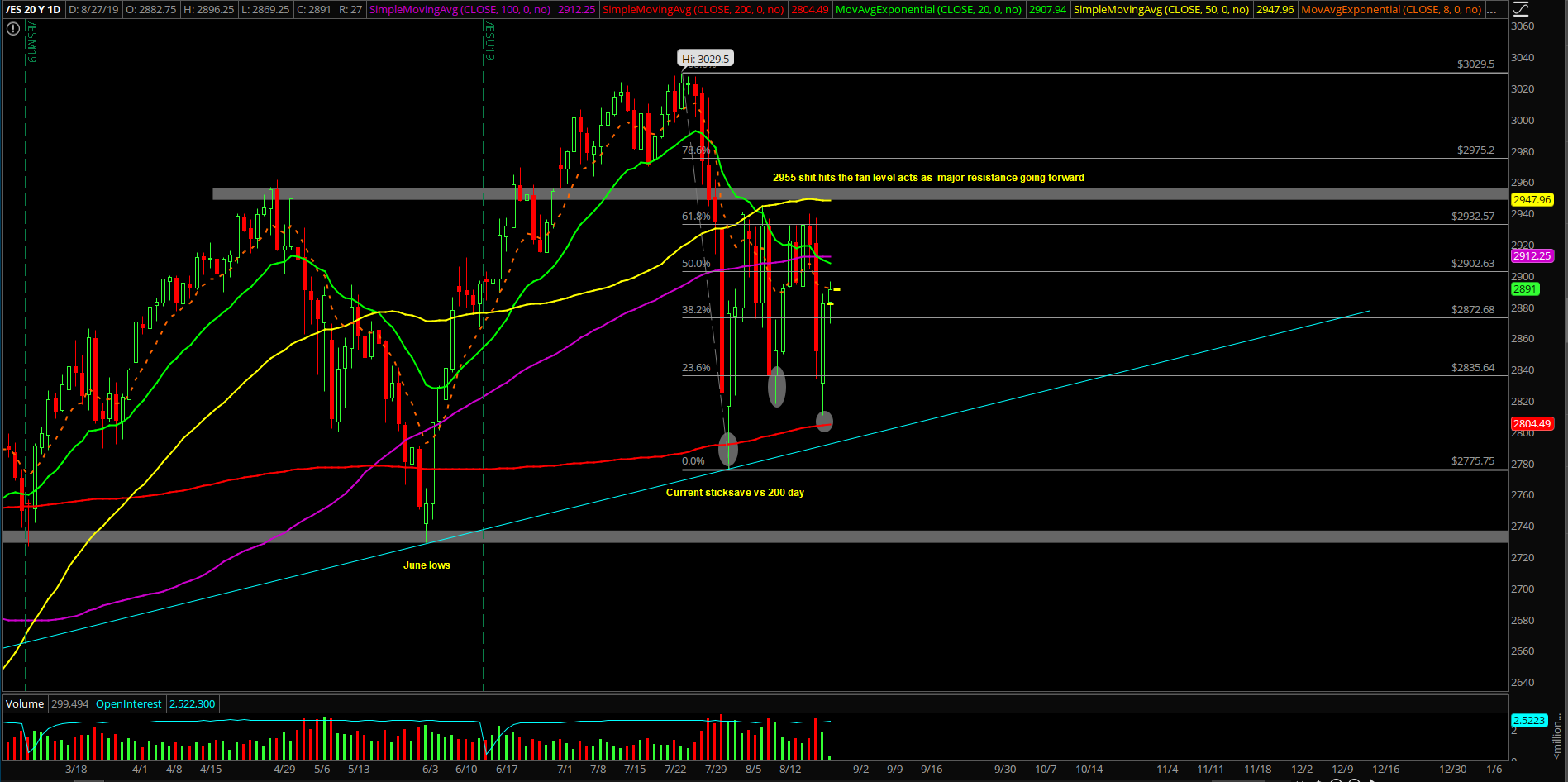

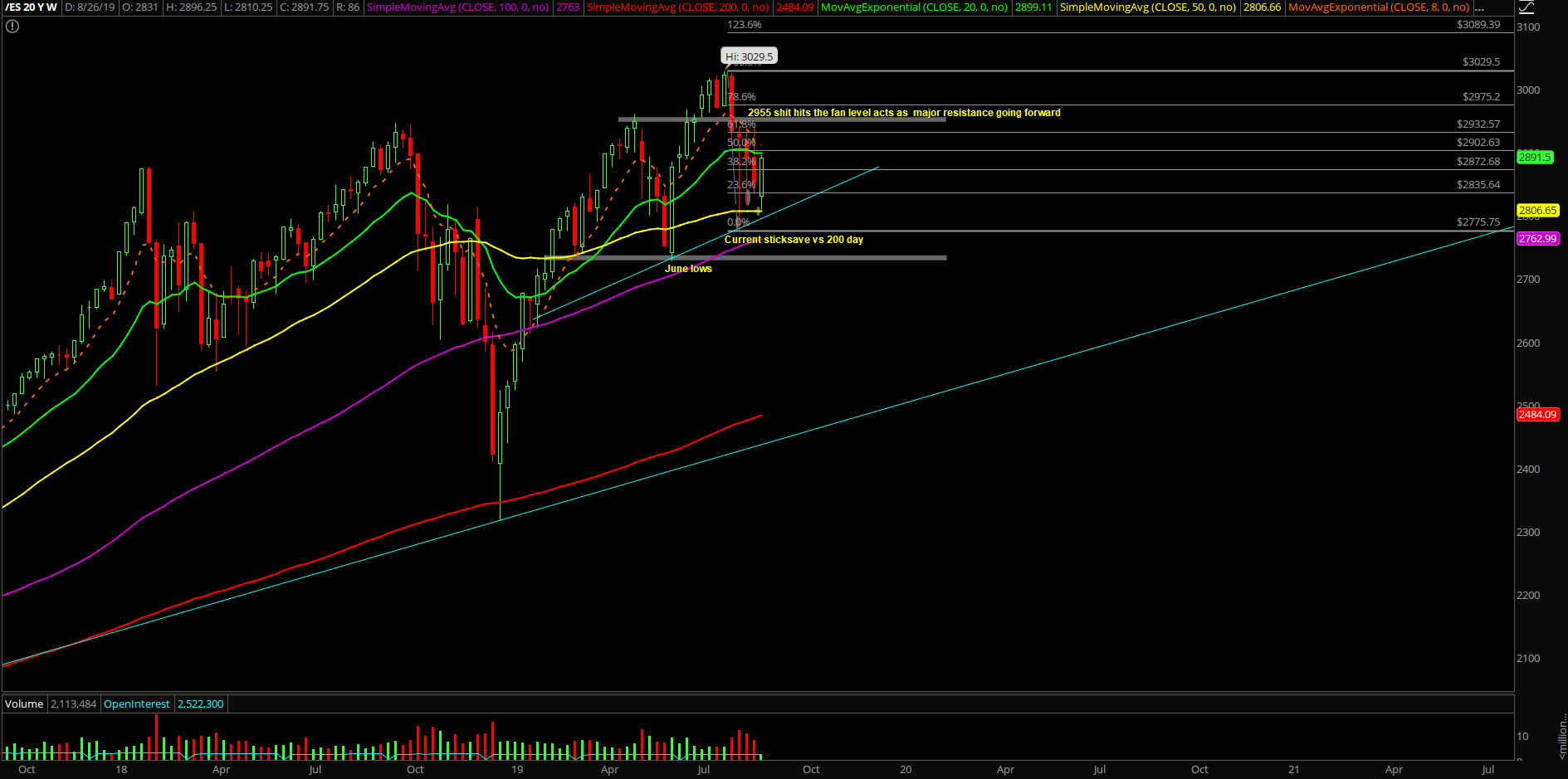

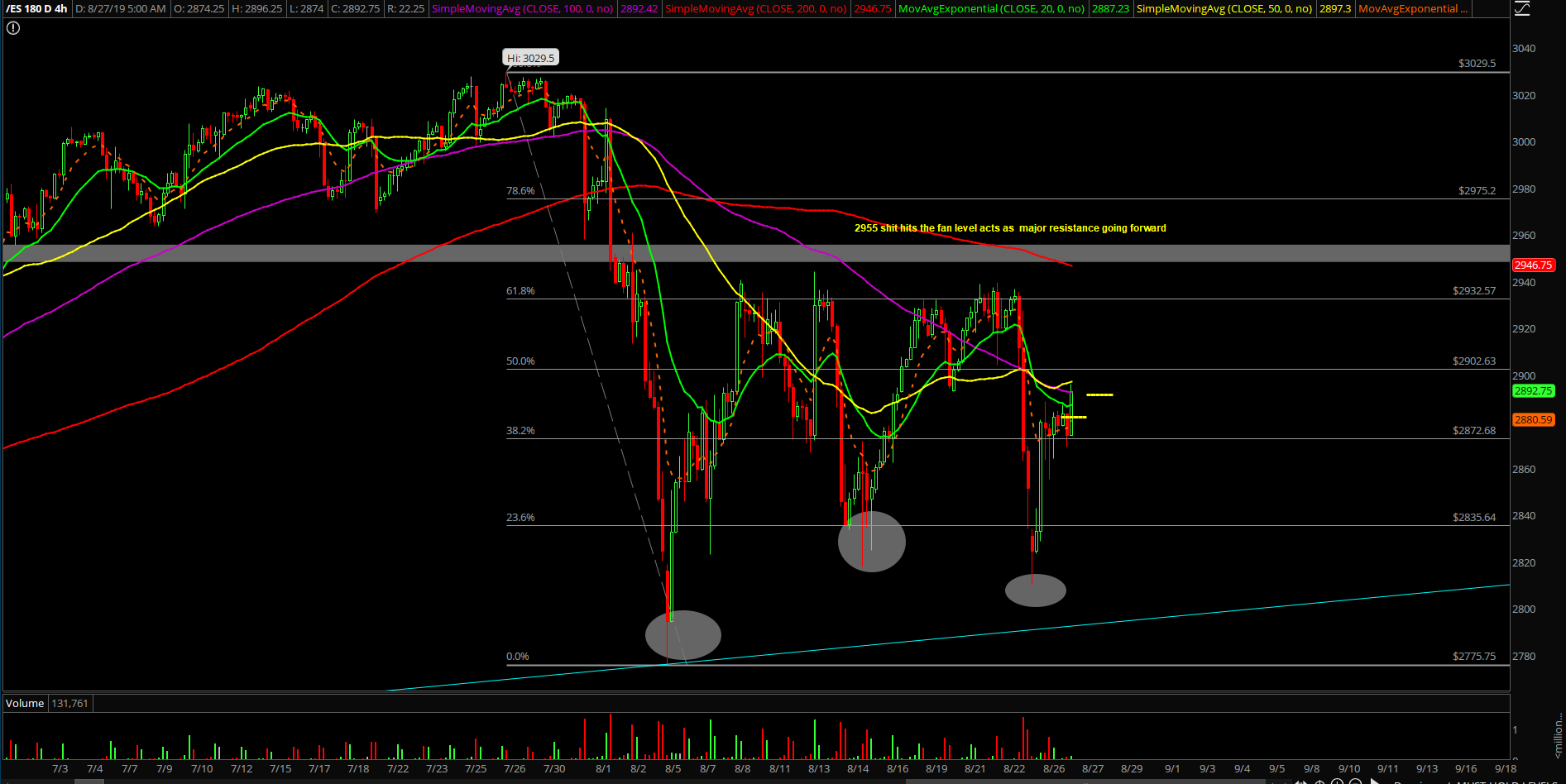

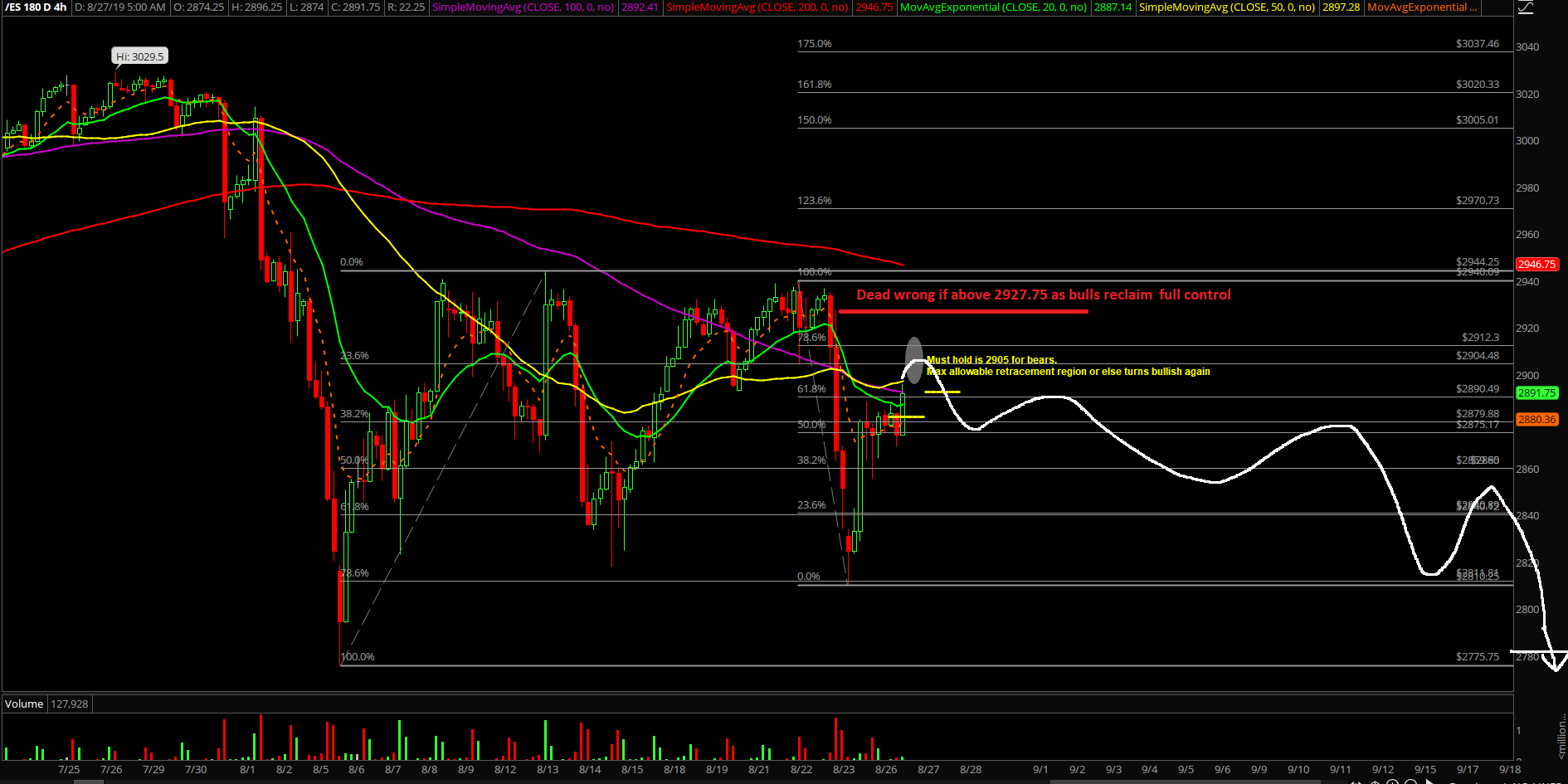

Monday’s session was a big range day as expected, as the market did a great job of trapping both sides with the pickpockets during regular trading hours. The main reason for this was that the meat of the move was accomplished through the Sunday night gap down open into the 2810 low on the Emini S&P 500 (ES) and then the subsequent bounce back into premarket 2888 highs. If you recall, the market held the 200-day MA once again by making a temporary double bottom/higher lows sticksave vs. the ongoing August 2775 lows. The bulls were able to wrap up the day around the highs as price action continues grinding into our STFR ("sell the f-in rally") zone from last Friday’s resistance.

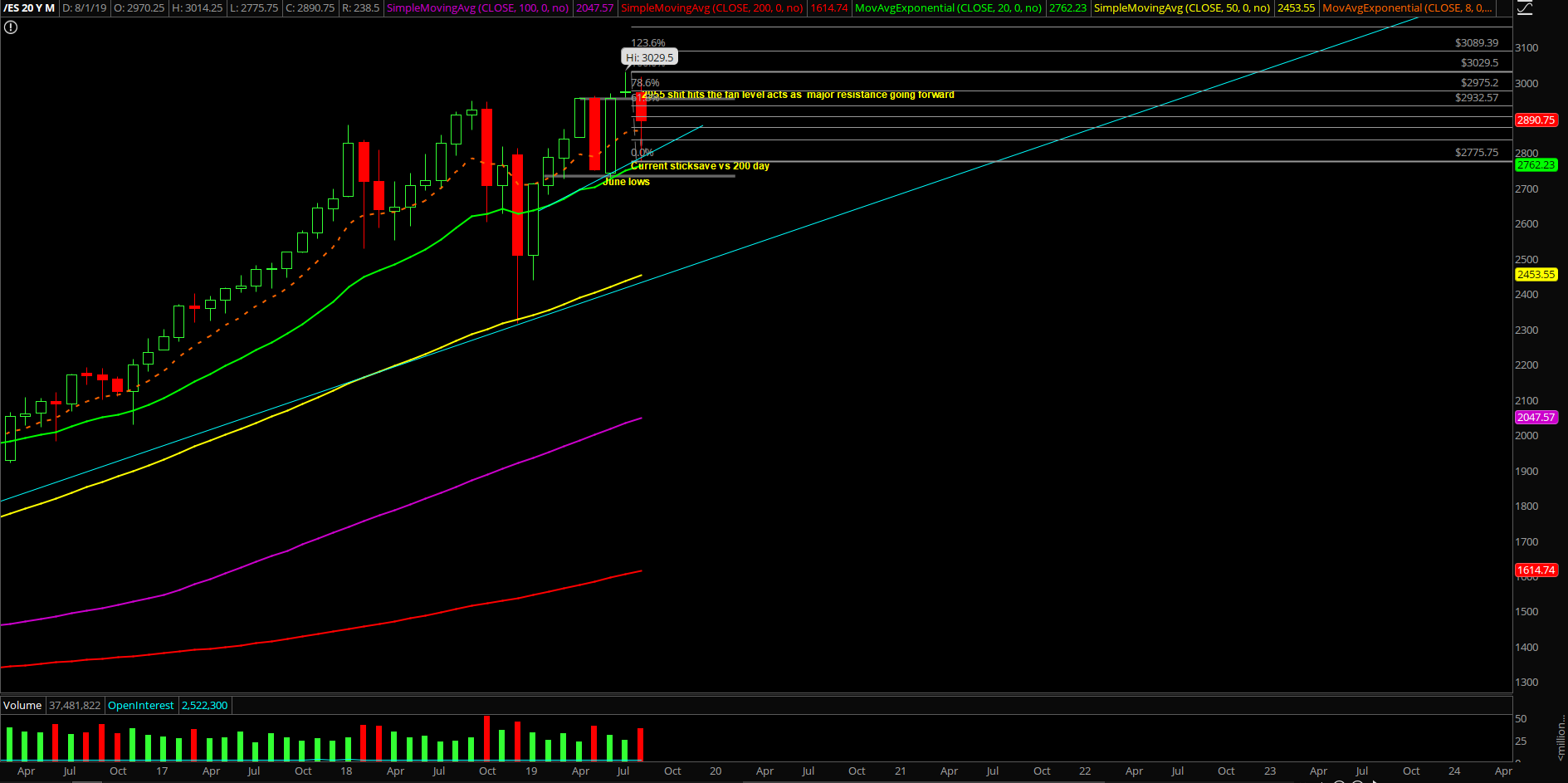

The main takeaway remains the same from the weekend report. It’s anybody’s game for this upcoming weekly/monthly closing print battle we have on Friday August 30. There are two ongoing massive setups, with the bulls obviously trying to confirm another double bottom/higher lows sticksave, while the bears are obviously trying to break open the August range by breaking below the 2775 low and opening up a liquidation event potential or just a normal flush into the 2720s-2730s March+June 2019 lows.

What’s next?

Monday closed at 2882 on the ES and nothing has changed in terms of perspective with the STFR strategy. The only concern is just this turning into yet another V-shape recovery as bears fumble, but that’s part of playing the odds of setup/pattern.

Current bias/parameters:

- Nothing has changed; we are executing our STFR strategy as discussed given the downside continuation setup from last Friday.

- Zooming out, the must hold support is 2775 and must hold resistance is 2905.

- Below 2775 opens up 2720-2730s immediately as follow through target, derived from the March and June 2019 lows.

- Above 2905 on a daily closing basis and we will likely confirm 2775 vs. 2810 as double bottom and bears losing due to the shift of odds. This would open back up 2940s and beyond.

- Preparing for the worst case scenario, if 2775 goes, it would be considered a liquidation event like 2955 (shit hits the fan level) from July where the market tanked so major downside extensions could open up.

- This is likely going to be a wild week because both sides are battling for the weekly/month end closing print on Friday. Understand the timeframes in battle here and adjust both mentality and trading system accordingly. Ongoing August range is 2775 – 2944 for now.