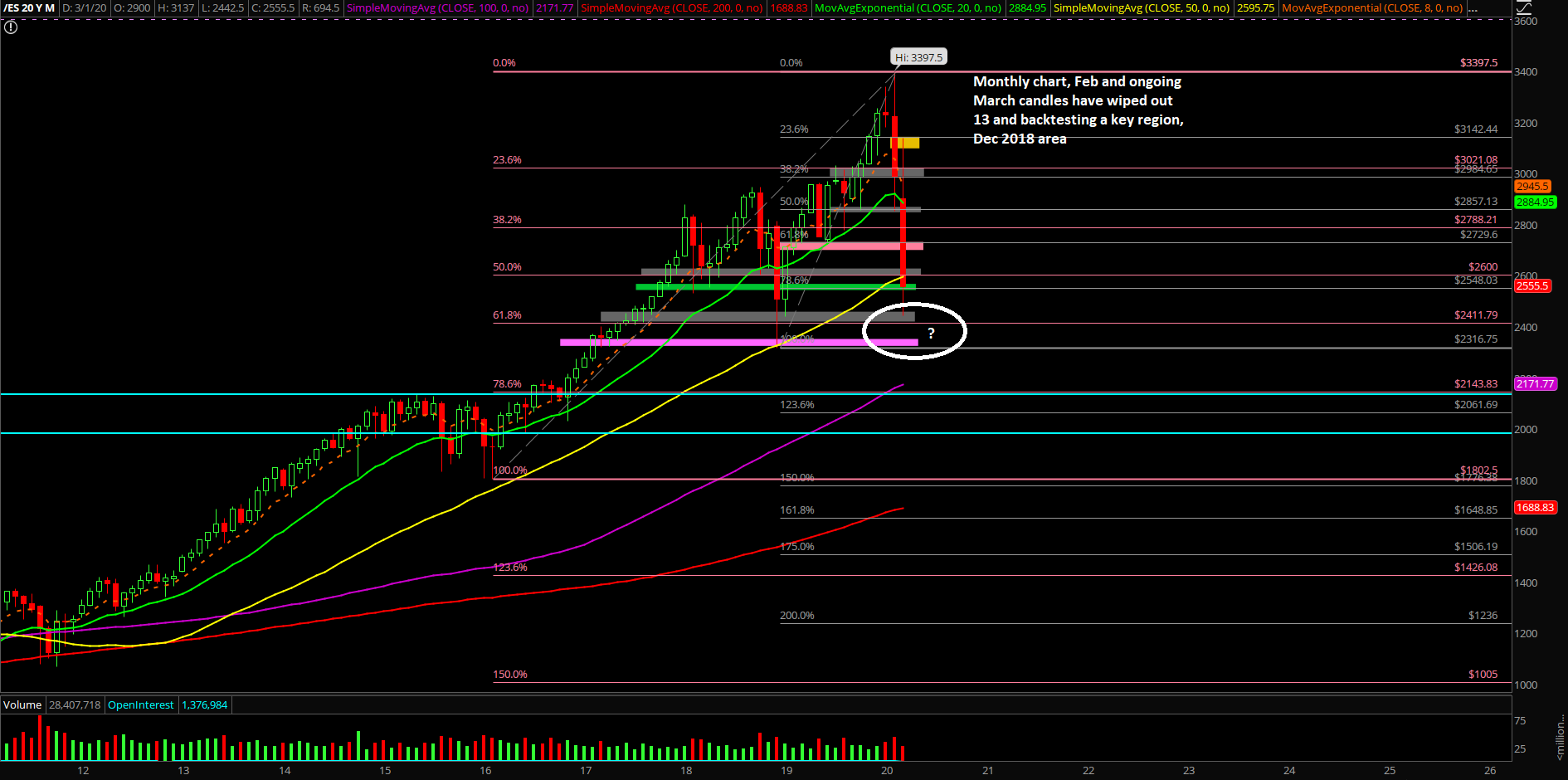

Key Backtest Against Dec 2018 Area

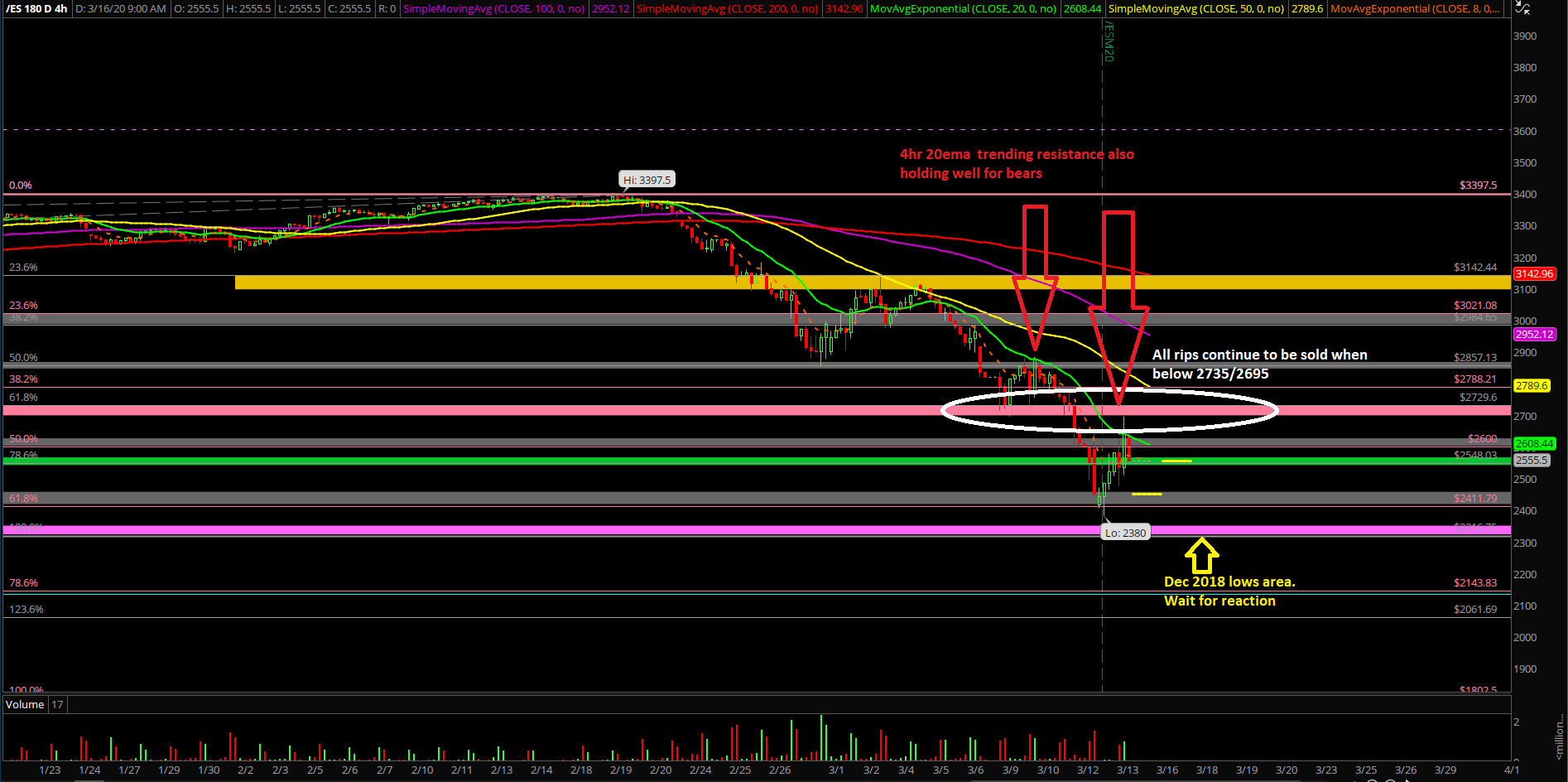

The futures Sunday were limit down again and backtesting against the key levels one by one. When below 2735 and especially 2695 on the Emini S&P 500 (ES), all rips are currently being sold for short-term purposes given the risks. If you recall, those are the key levels derived from March 9-12’s breakdown.

Currently, we do not have a solid edge on the micro timeframe, so we’ve just been utilizing our key levels for mainly entries on our long-term investment accounts and generally sitting on hands for the short-term accounts until things stabilize a bit and we see a better edge.

The market’s volatility is extremely high, so it would not be fair to post setups, as prices could be moved by 20-40 points easily by the next minute or two. Just remember, cash is a legitimate position when the odds are not in your favor and we’re perfectly fine in accepting that given it’s been a pretty wild week with limit downs and limit ups.

For those trading setups, utilize the key levels with converge strongly near a single point of reference is vital, otherwise it’s more akin to gambling in this environment and you DO NOT want to gamble in a high vol environment.

Traders should consider sizing down an extra notch from 1.5% max risk per trade to something in the region of 0.50-1% to account for the extra volatility of the past few days

What is the bias/game plan going into today? Do you see a feedback loop setup?

- Watching closely on how the market reacts on first try basis on backtesting the Dec 2018 lows for short-term momentum gauge and see if there's any applicable scalp setups or remain in heavy cash positions for now.

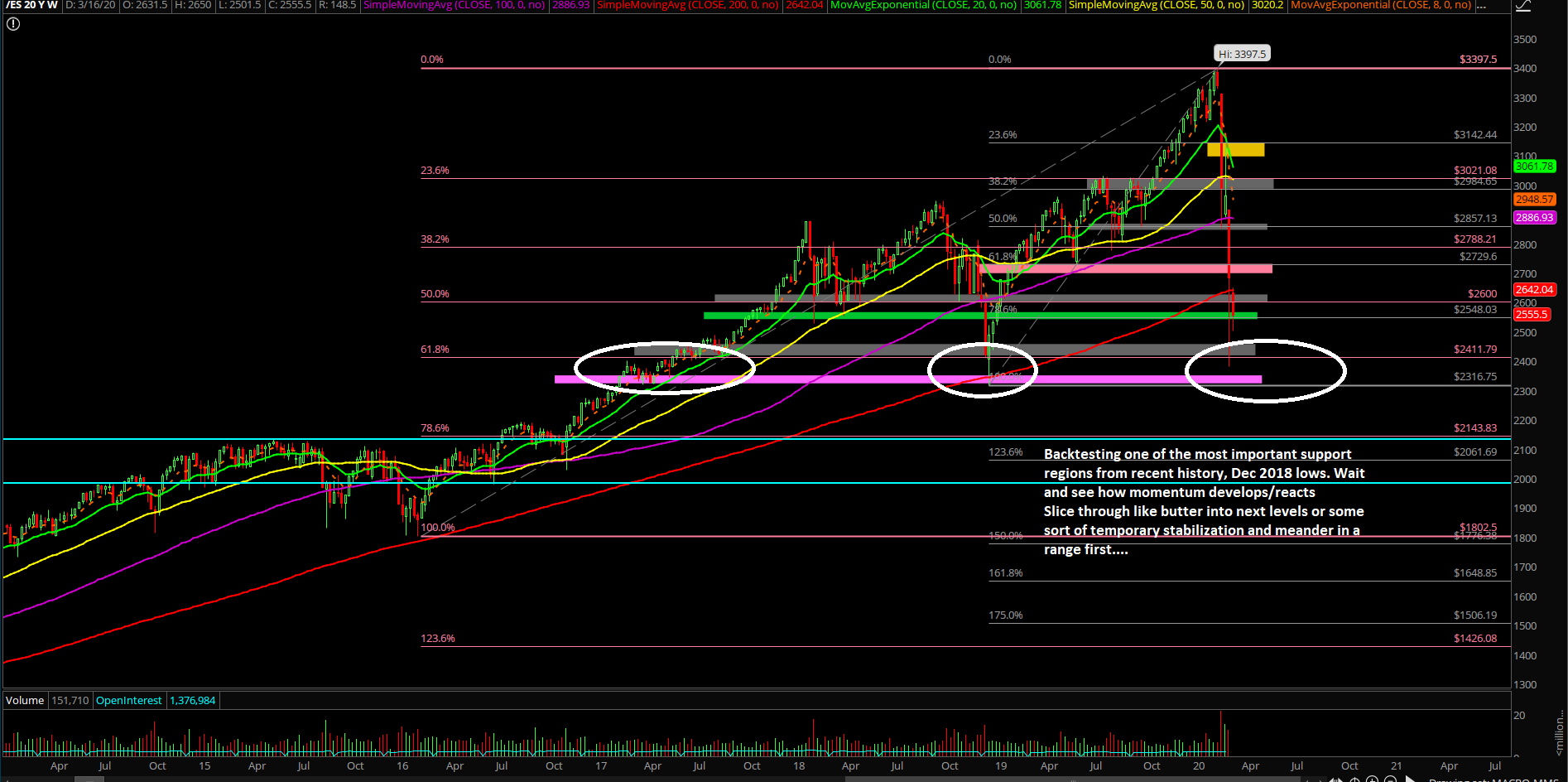

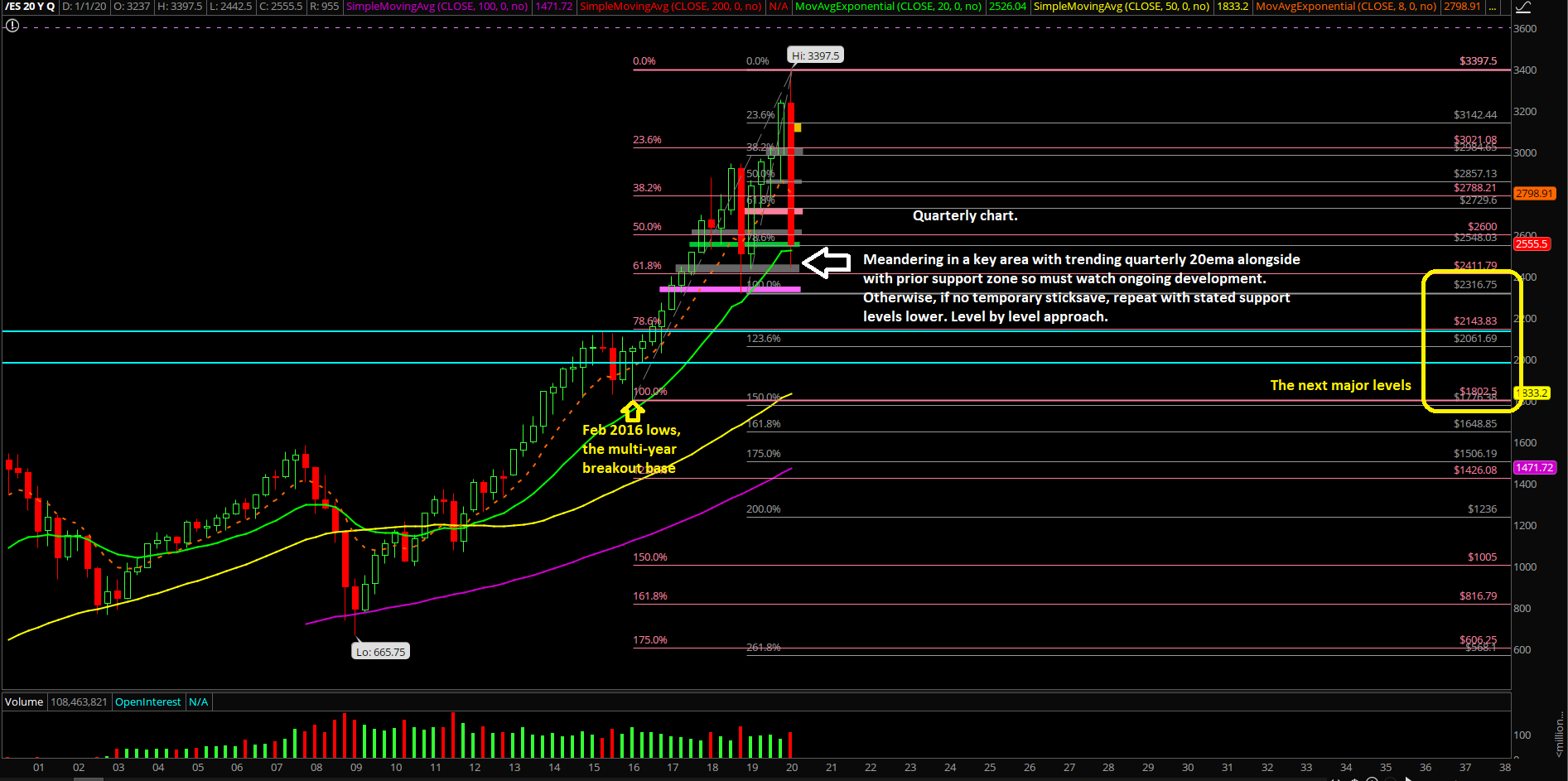

- Dec 2018 lows to Feb 2020 highs range: 61.8% fib = 2729, 78.6% = 2548, 100% = 2316.75

- Feb 2016 lows to Feb 2020 highs range: 50% fib = 2600, 61.8% = 2411, 78.6% fib = 2143, 100% = 1802.50.

- There’s some real panic in the global markets and it is greatly appreciated because we’ve been lacking that extra juice in the first week of March as it was relatively easy or a bit too calm like we demonstrated in real-time

- We’ve been fully prepared with lots of cash on hand to re-deploy into long term investment accounts in case the shit hits the fan and It looks like we may get our wish for fire sales across the globe

- If you are in the same age bracket as us in like 20s, then, you have the next 30-50 years for dollar cost average for these plan B long term investment accounts, when the shit hits the fan you get a better long term average that will be worth millions

- (We are down to about 72.5% cash leftover and looking to deploy more as market hits near our support levels, the bigger the drop…the better for our long term average cost as the market has been giving us a great discount since the breakage of the daily 20EMA trend that occurred in late February.)