KO Holds the Crown — But PEP and KDP May Hold the Plot Twists

The Cola Wars of the ’70s and ’80s crowned Coca-Cola (KO) the undisputed king. But the battlefield has changed. What we have now are the Beverage Wars — an arena spanning energy drinks, coffee systems, sports hydration, flavored waters, and wellness brands. And while KO still wears the crown, PepsiCo (PEP) and Keurig Dr Pepper (KDP) may be the ones holding the plot twists.

Let’s begin with the fundamental snapshots forming the current landscape — then we’ll turn to the only force that decides price direction: the crowd. Lyn Alden recently shared her take on all three beverage giants. We’ll hear her view first, and then mesh that with what sentiment and structure are telling us.

The Fundamental Snapshot With Lyn Alden

“KO, PEP, and KDP basically represent three points on the quality spectrum.

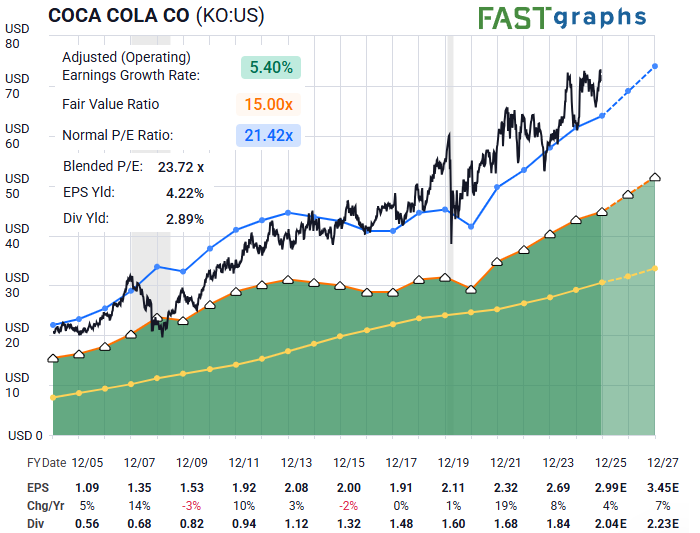

KO has the strongest balance sheet and moderate growth, but comes with the highest valuation.

KO has the strongest balance sheet and moderate growth, but comes with the highest valuation.

PEP has the second-strongest balance sheet and currently weak growth, and—unsurprisingly—a discounted valuation relative to KO.

PEP has the second-strongest balance sheet and currently weak growth, and—unsurprisingly—a discounted valuation relative to KO.

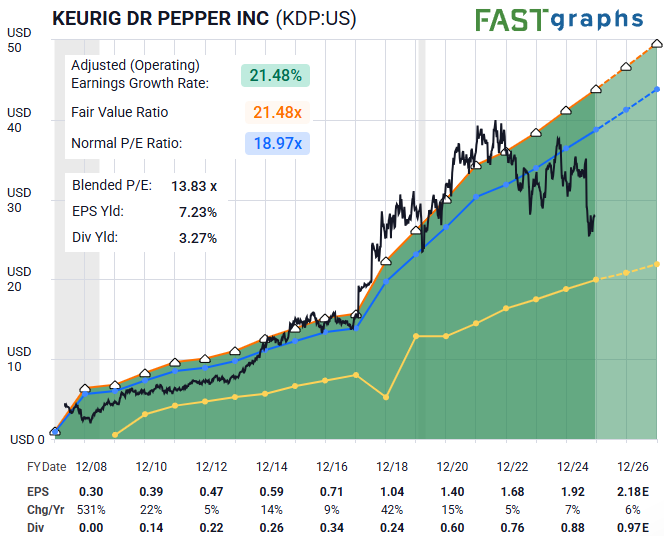

KDP has the weakest balance sheet and the market assigns a severe valuation discount. Yet its growth is the best of the three. If execution continues, it may carry the most upside potential in exchange for the most risk.” — Lyn Alden

KDP has the weakest balance sheet and the market assigns a severe valuation discount. Yet its growth is the best of the three. If execution continues, it may carry the most upside potential in exchange for the most risk.” — Lyn Alden

A Mix of Three?

I wouldn’t personally recommend mixing Coke with Pepsi with Dr Pepper — that sounds like a recipe for gastrointestinal regret. But we can clearly delineate risk-versus-reward across the three charts and structure a coherent investment thesis.

The King, of course, goes first.

KO: The Crown Still Fits

Our working view is that KO found a key low back in January. Zac’s chart shows a likely circle ‘i’–‘ii’ already in place, and potentially a nested (i)–(ii), i–ii setup forming. That allows us to define risk tightly at the wave (ii) low near $65.

If the structure continues to unfold in standard fashion, the next major advance — circle ‘iii’ — targets $84–$87.

The crown may be aged, but it still commands respect.

PEP: The Reliable Prince

PEP’s price structure mirrors Lyn’s assessment almost perfectly. For as long as price holds the $141 low (or higher), the chart supports a rally into the $165–$168 region.

It’s a steadier chart, with less drama than KDP — but also less embedded growth optionality.

KDP: The Wildcard With a Twist

KDP may become the plot twist in this beverage saga. It has the highest growth rate, the lowest valuation, and a balance sheet that the market continues to penalize. That mix creates asymmetry — the kind that can ignite strong upside if sentiment turns.

Charles Carnevale (creator of FAST Graphs) recently noted here that:

“Keurig Dr Pepper offers a compelling blend of growth, income, and stability.”

Zac Mannes agrees — but adds an important caveat:

KDP would present a better bullish setup with one more dip into the $24 region.

If that move completes, KDP could be setting the stage for a far more dynamic advance than either KO or PEP.

Plot twist incoming? Quite possibly.

Final Sip

- KO: Still the king; strong structure, defined risk, clear upside path.

- PEP: Lower-growth but stable; a solid second with measurable upside.

- KDP: Volatile, discounted, potentially explosive — but requires nimbleness.

The Beverage Wars are no longer about cola — they’re about crowd behavior, valuation normalization, and the evolving structure of price.

For now the crown stays with KO . . .

but the next chapter may belong to the upstart.