Just A Micro Mess

I wish I had some wonderful insight to provide you this evening. Alas, the market is not being terribly compliant with allowing me to do that.

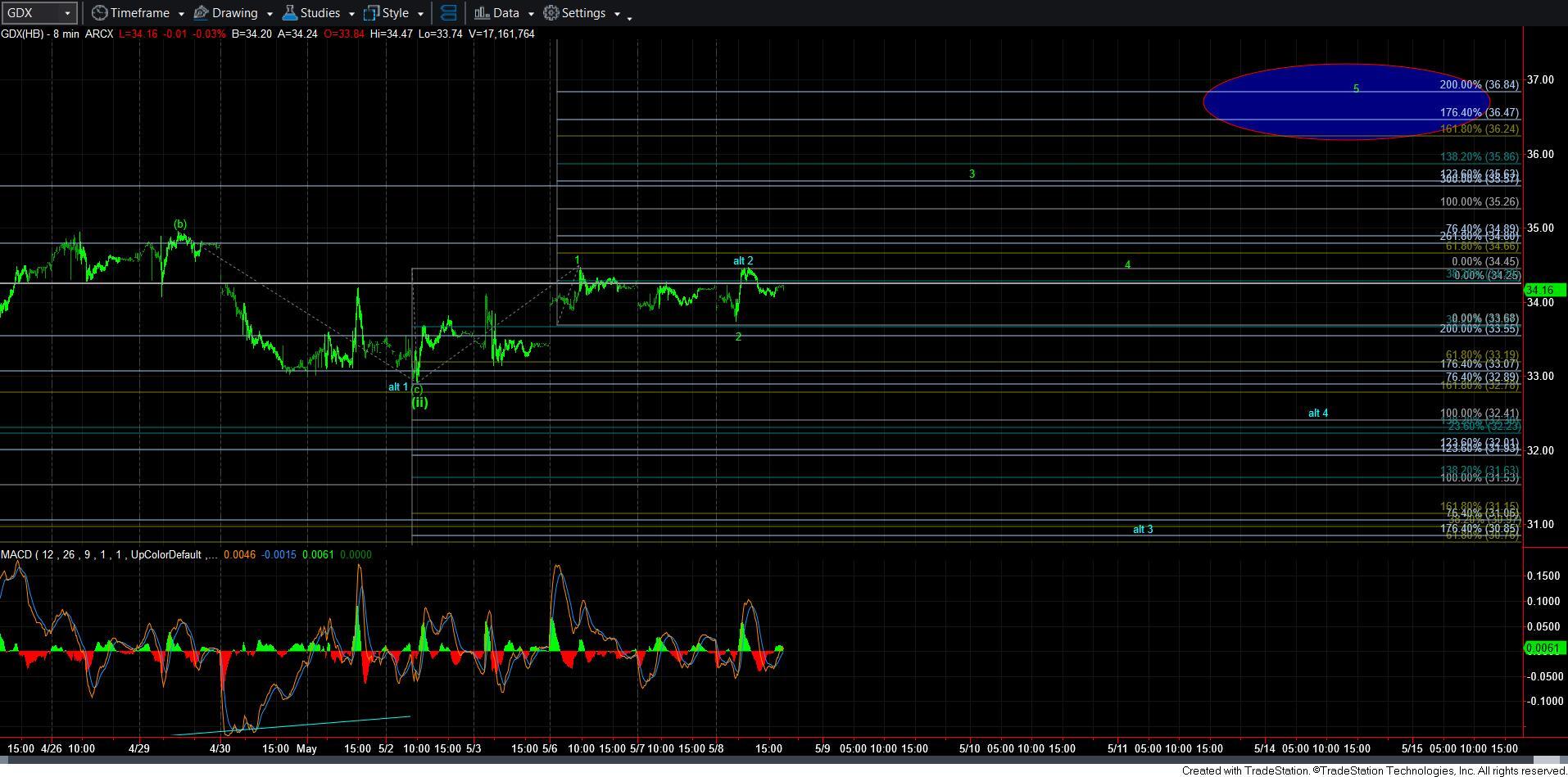

Starting with the GDX 8-minute chart, we are seeing a lot of overlap, which still leaves both potentials on the chart. Until we take out the 35 region, we still leave the door open for a deeper wave [ii], as presented by the blue count. And, the reason it is hard to distinguish it from the green count is because the green count is a leading diagonal, with its own issues of overlap. But, over 35, then I have to adopt the green count. And, breaking down below 33 would have to force me into the blue count, with us dropping down towards the 30 region for the deeper wave [ii].

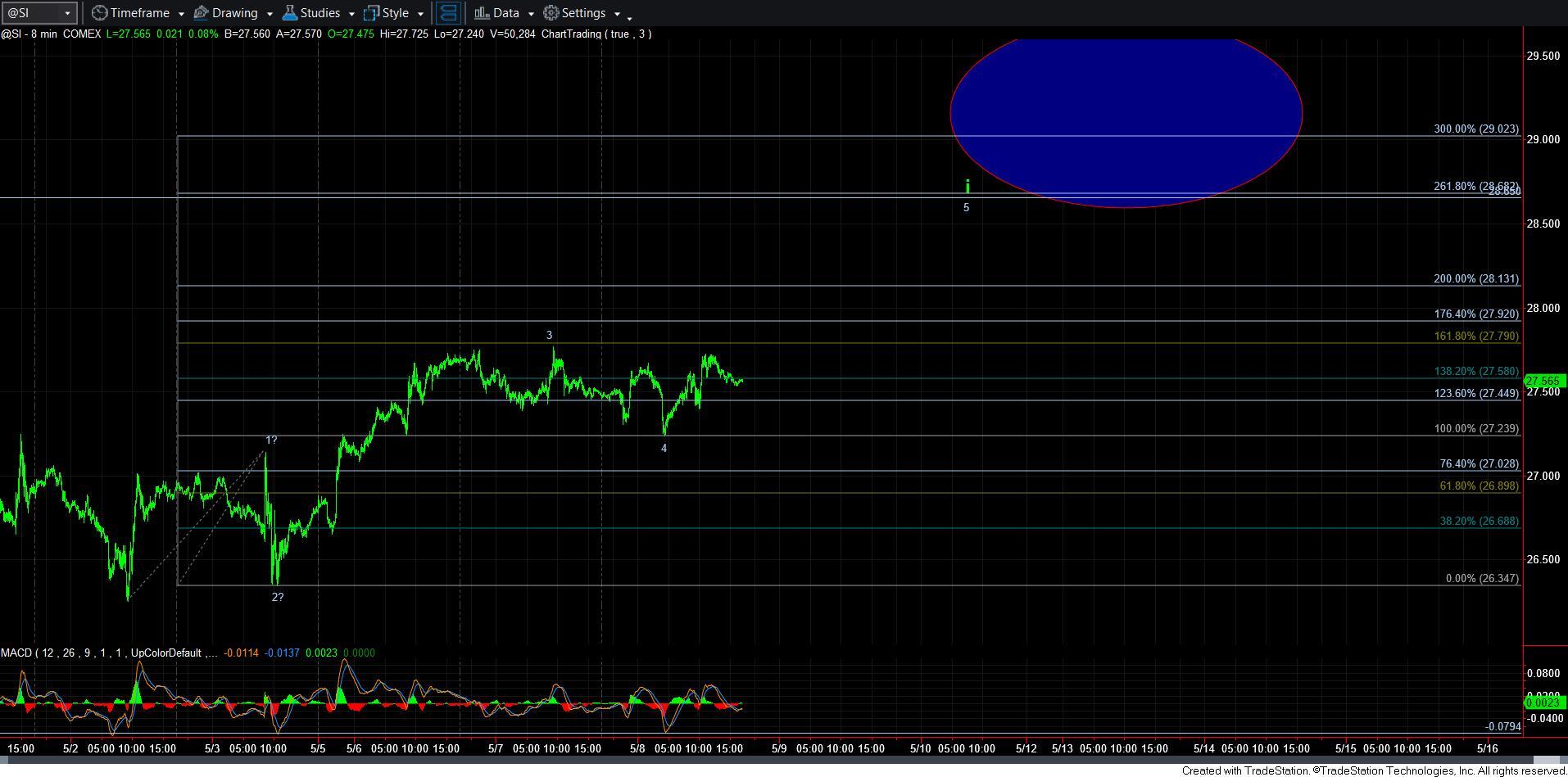

Silver 8-minute chart has a few issues as well. While I can clearly count a structure for waves 1-4 on the chart, I have to note that a 3rd wave in silver which only reaches a 1.618 extension is VERY unusual. Silver often provides massive extensions, so a 1.618 extension is a bit out of the ordinary. But, as I outlined earlier this week, as long as we hold the 27.24 level, I can still continue to look higher for a 5 wave structure to complete. And, early this morning, that is exactly where we bottomed.

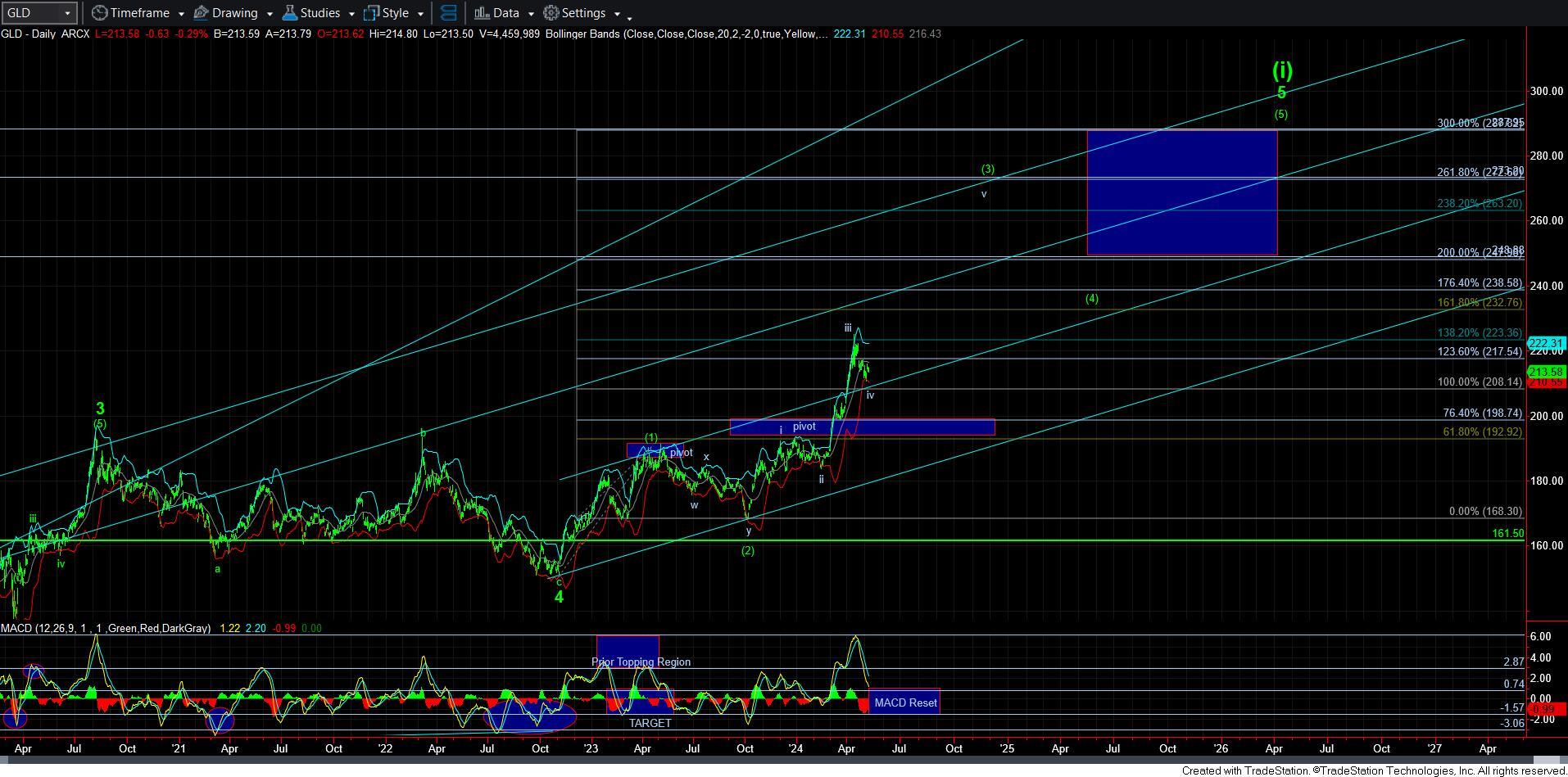

As far as GLD is concerned, as I explained in the live video to the full-time membership this morning, as long as we remain over 208, I do not want to give anyone an opportunity to make a mistake in the smaller degree, which is why I am only using the daily chart. As long as we are over 208, I am maintaining a primary count which is based upon a standard Fibonacci Pinball structure for wave 5, which suggests that we should begin wave v of [3] soon. In fact, take note that the MACD on the daily chart has now reset, which now leaves us plenty of room overhead for the wave v of [3]. But, I am looking for wave [i] of v to take us back towards the recent highs before I begin to get ready for the next major break out, which can carry us to the 248-274 region, depending upon the extensions we see. For now, I am strongly considering the higher end of the target due to the expectation of a large run to be seen in silver and GDX during that run in GLD.

Of course, should GLD see a sustained break of the 208 region, the I will adopt an ending diagonal structure for wave 5, which should still strike the lower half of the target box above. So, either way, I still see a lot of further upside for GLD in the coming year or two.

Overall, I still have no indications that we are ready for the next major rally phase in the metals market. T will likely still take some time before the next 1-2 set up develops. But, once it does, I will outline it for all our members, as it will likely be an opportunity to trade the next upside move aggressively.