July High Even More Divergent For Financials

Summary

-Financials got nominally higher than May but still failed to exceed 2018.

-Some financials have markedly more bearish setups.

-Weakness here can be the Canary for the rest of the market.

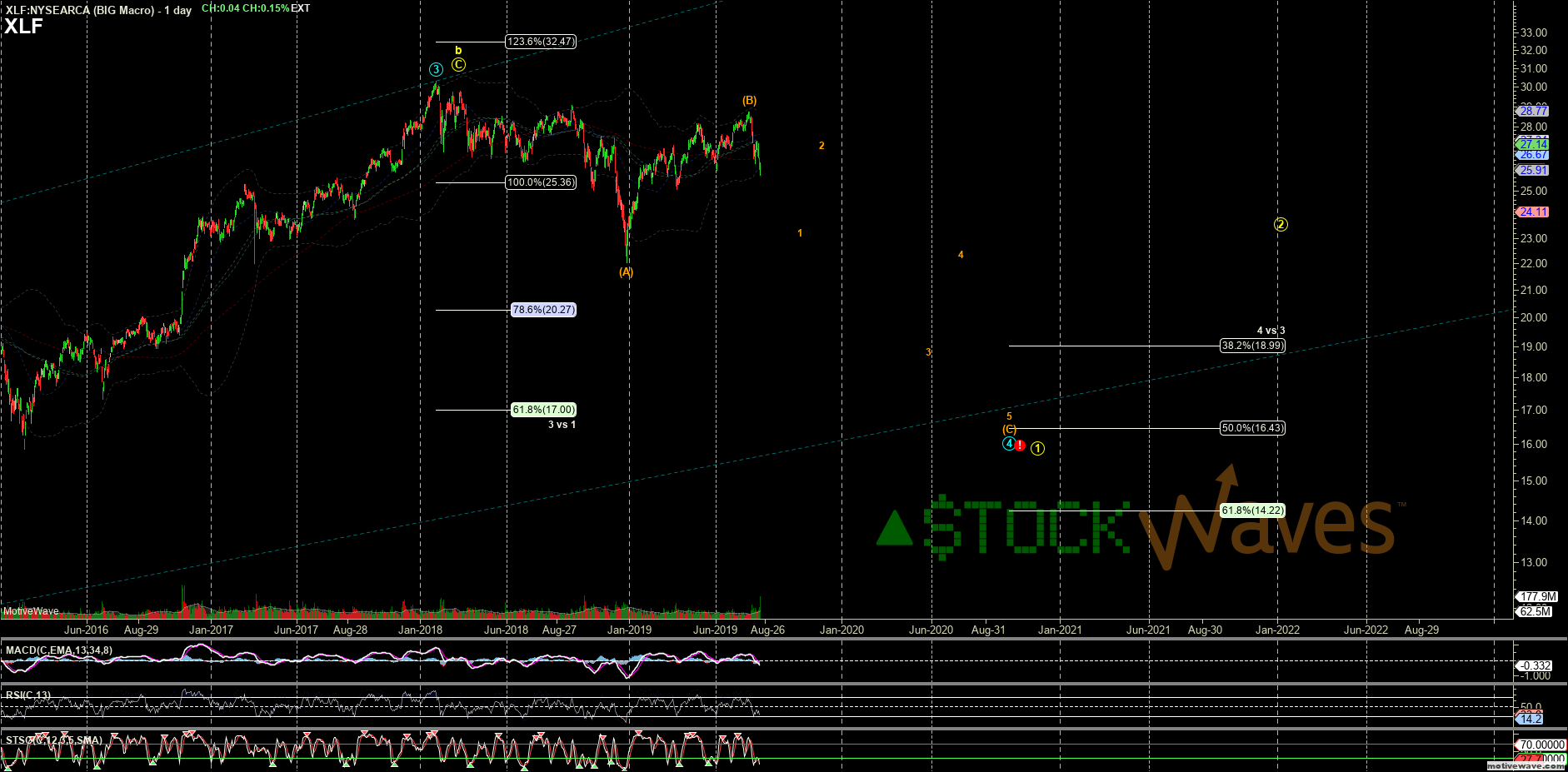

In May we raised concerned about the lack of participation to new market highs from the financial sector. Despite getting nominally higher than May in July, the SPDRs Select Sector Financial ETF (XLF) as well as many of the individual components failed to exceed either top made in 2018. This divergence can be very telling as to underlying market weakness.

As we often do we like to start our analysis with top down view of the overall sector. For this we use the XLF. XLF is mostly likely underway in a similar Primary degree wave 4 correction like most equities. Its three largest components JPMorgan Chase (JPM), Berkshire Hathaway (BRK.B), and Bank of America (BAC) as we discuss look like the projected declines will hold support as Primary 4ths and allow for 5th waves higher in the years following a 2020 low. XLF's divergent July high counts best as an Intermediate degree (B.) wave inside this Primary 4. The move off that high fits within parameters for expected price action in the start of a larger (C.) wave down that targets the 19-17 region into 2020.

(XLF chart)

But the relative weakness in financials is not actually new. The entire "third" waves for many of the XLF names were more muted, more typical of "C-waves". As measured in logarithmic scale off the 2011 low, XLF did not even touch the 123.6% Fibonacci extension. The S&P 500 by comparison slightly exceeded the 176.4%. If this is a 4th wave correction in XLF it is likely inside a larger Ending Diagonal off the 2009 low rather than in a strong impulse like the broad equity markets. But there is a more sinister potential.

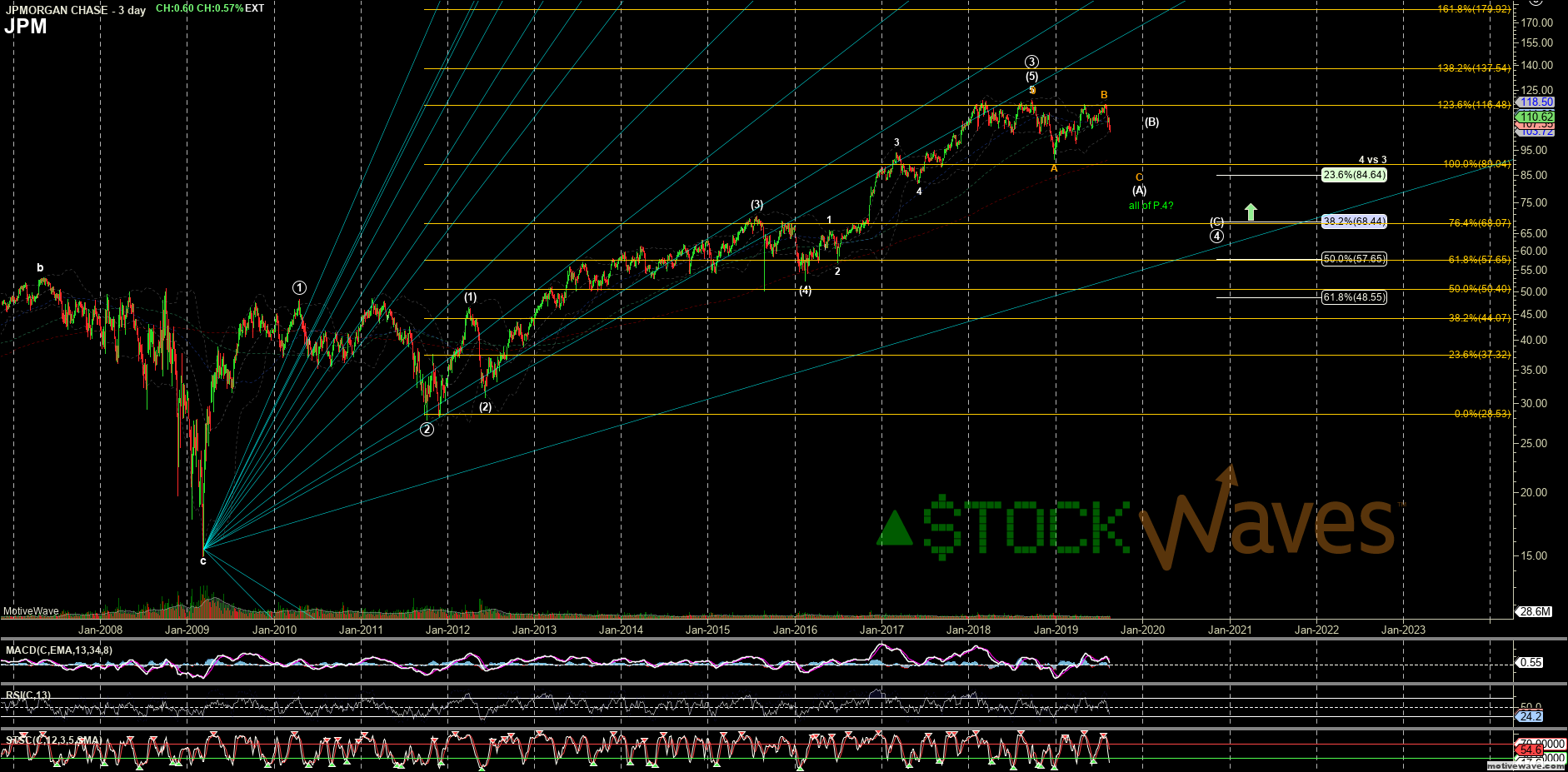

As discussed the charts for JPM, BRK.B, and BAC currently align with the Primary wave 4 count. As the 3 biggest market caps this should not be ignored. JPM and BRK.B count the best as impulsive moves and have both moved significantly past the pre-2008 Financial Crisis highs. Although JPM did only reach its 123.6% of P.3 BRK.B slightly exceeded the 176.4% like the S&P.

(JPM chart)

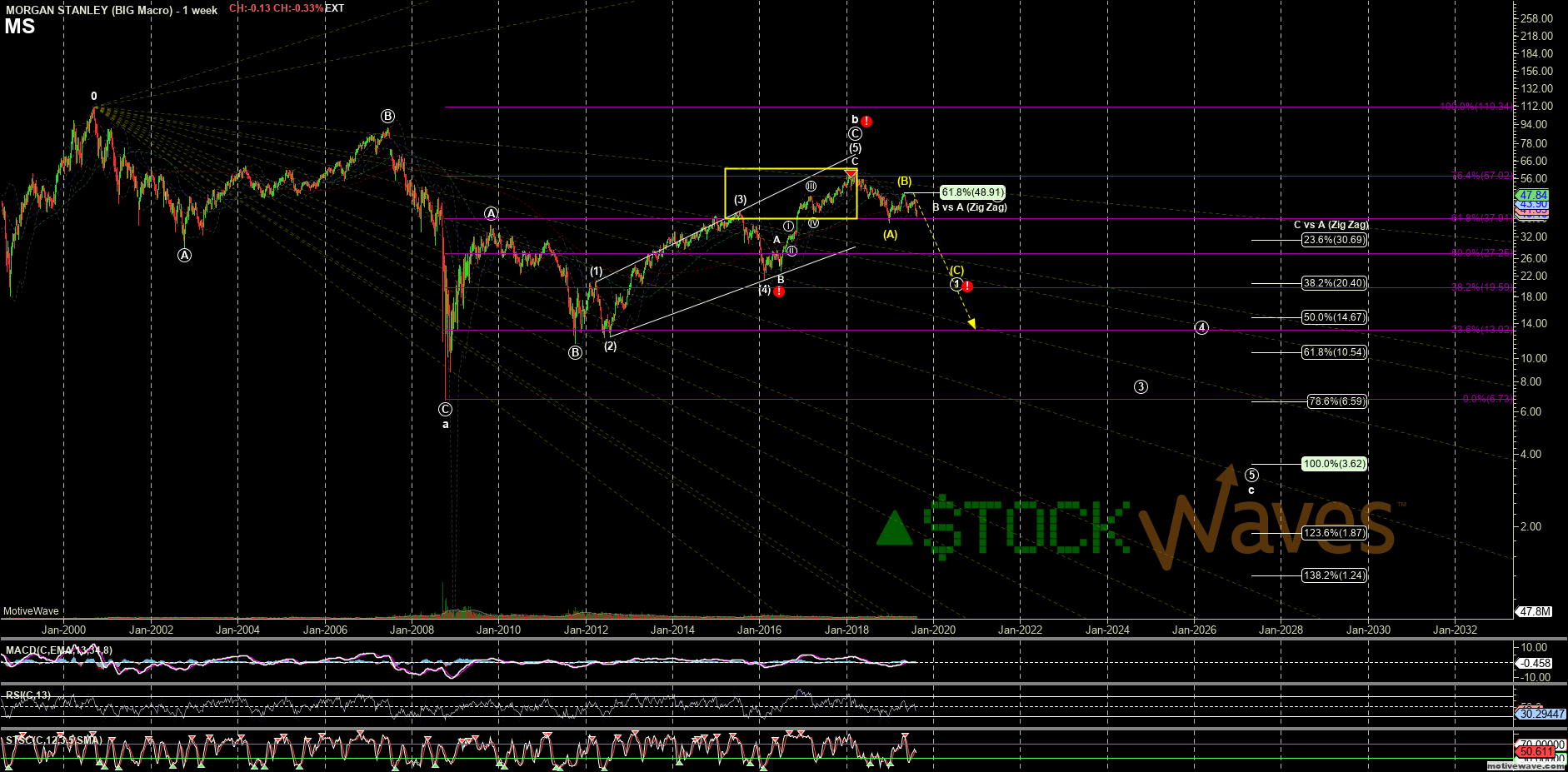

For many financial stocks though, the moves off the 2009 (or 2008) lows count as a completed ABC moves up. These clearly corrective moves not only failed to make higher highs over those in 2018, but failed to even exceed the tops marked in 2007. In fact XLF itself only came close to that high in early 2018 but failed to breach it, but many of the components fared much worse.

Morgan Stanley (MS) for example hit an exact 76.4% retrace of the move down into Oct 2008, highly typical of a large degree Cycle "b" wave. The same path projected for a correction into 2020 here can be just the Primary wave 1 of a much larger Cycle "c" starting. We have pointed on the same concerns for Goldman Sachs (GS). This list also includes MetLife (MET), Prudential (PRU), ING Group (ING), and American International Group (AIG), I could speculate about possible "Black Swans" involving certain types of annuities or insurance, but I should probably save that for another article.

(MS chart)

I did not include Deutsche Bank (DB), Genworth Financial (GNW), or General Electric (GE) in the video but as we saw in 2008 contagion in our markets spreads rapidly in general but even more so in the Financial sectors where everything is intertwined. The timing of the recent news on GE is interesting seeing that like DB they are already much further along in large Cycle c waves down. While DB can count complete and GE can attempt a decent bounce the c waves can continue to extend much lower. That said it looks like most of the damage to these has been done but perhaps these are the "Bear Stearns", and our "Lehman Bros" is still out there.

(DB & GE charts)