It’s Time To Hunker Down

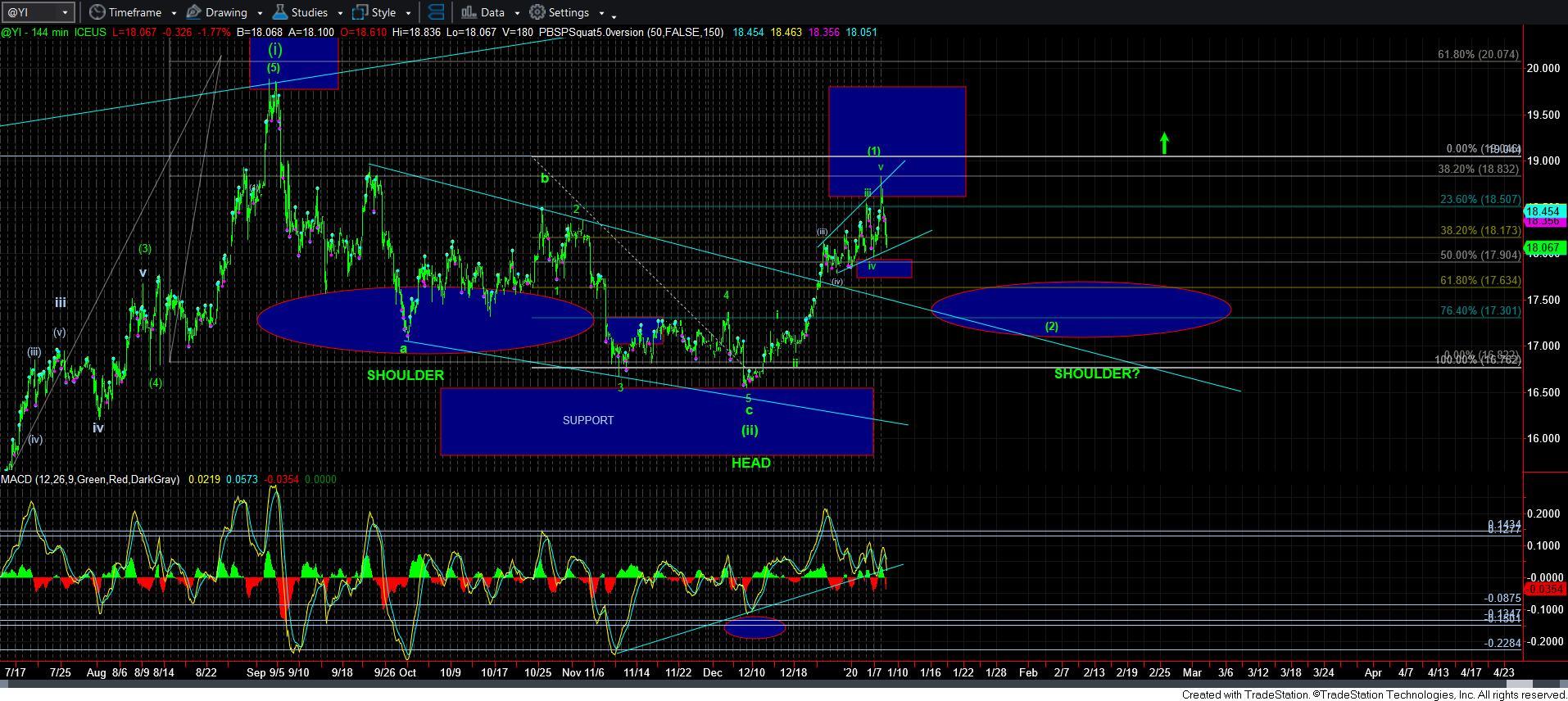

The metals charts have gotten quite full now that we have seen that last push higher in the complex. As I have been warning for the last week, we were close to completing this last rally phase begun over a month ago. And, with the last spike up and reversal, I think it is clear that the local top has been struck, and we are now LIKELY within a corrective decline.

But, with this decline, we are approaching one of the most important tests in the market we have had in quite some time. As I highlighted in my weekend update on GLD, this rally can complete the alternative c-wave as shown in red, and then point us down to levels below those struck in late 2015. While this is clearly not my primary count, I still have to recognize the potential risk.

Yet, as I have noted about GDX and silver, neither have that same set up. Yet, GDX’s rally over the last month has left a lot to be desired. It really did not complete a solid 5-wave structure as I would have expected. So, due to this lackluster structure, I have added an alternative to GDX in yellow. It would suggest the high we just struck in GDX was really only a 3-wave b-wave of wave ii. This would likely point us back just below the 26 region, and take us back down to our support box below to complete a wave ii flat. And, a break down below 27 would make this more probable.

In silver, I think we are playing out a standard wave (2) pullback, after we completed what is a nice 5-wave structure into our target region we set well before this rally even began. But, it may take us some time.

As far as the GLD is concerned, I am expecting it to take the shape of a standard wave 2 as well, especially as long as we remain over the 140 region. Below that level would be a warning to the long side.

Hopefully, you were able to follow my analysis over the last week, and prepare yourself for this pullback. And, please do not get overly aggressive on the long side just yet. I think this pullback will take us some time and may give us a few more up/down surprises along the way, as corrective structures are often quite variable in nature. And, again, I want to stress how important this correction is to the larger degree count. As long as this pullback remains overall corrective, then I will retain a very strong bullish bias for the rest of 2020. So, I am going to retain an open mind as to how we progress, and will inform you as we move through this decline. For now, its risk-off time in the metals complex.