It’s Time To Act – Not Hope

Ladies and Gentleman,

I got quite irritated today when I saw members posting about how they “hope” that the metals hold support and continue higher. It really made my blood boil and resulted in me posting this in the main trading rooms today:

“Folks, I am getting sick and tired of reading posts about "hoping." Enough already. You are adults and you need to approach the market like adults. You don't HOPE . . . you need to have a PLAN.

As long as the market abides by the plan, then you maintain your position. If it does not abide by the plan, then you stop out. PERIOD!!!=

Also, your plan has to be appropriate for the time frame you are trading. IF you have a short term option, then you apply a short term plan for it. If you have a long term hold, then you apply larger degree analysis. PERIOD!!!!

YOU MUST HAVE A PLAN. NO HOPING ALLOWED HERE!!!”

This is also why I stress that each of you must know what type of trader/investor you are. That will determine the focus of the analysis you require. If you are a short term options player, then you should not be trading off a daily chart. If you are a long-term investor in the metals complex holding ETF’s and mining stocks, then you should not be making your decisions based upon micro-counts. And, no one can make this determination other than you.

Now, on to the metals analysis. As was highlighting yesterday, silver rallied sufficiently into yesterday’s high to consider a minimum completion of the micro wave iii of [3] we were tracking on the 8 minute chart, which meant we could see a wave iv pullback at any time now. And, I moved our support up today, and that is how I am viewing today’s pullback. Now, as I also said today, as long as we hold over the 33.50 support, I am going to continue to view it as such.

But, based upon what I wrote above, should silver see a sustained break down below that support (more than a spike and reversal), then those that are more short term focused – especially with nearer term options holdings – would likely stop out until the market clarified into what pattern it was morphing, as there could be several. But, for now, we are still holding that support and I am looking up to the next box higher. We will need to see an impulsive move through 34.30 to begin the expectations for that move.

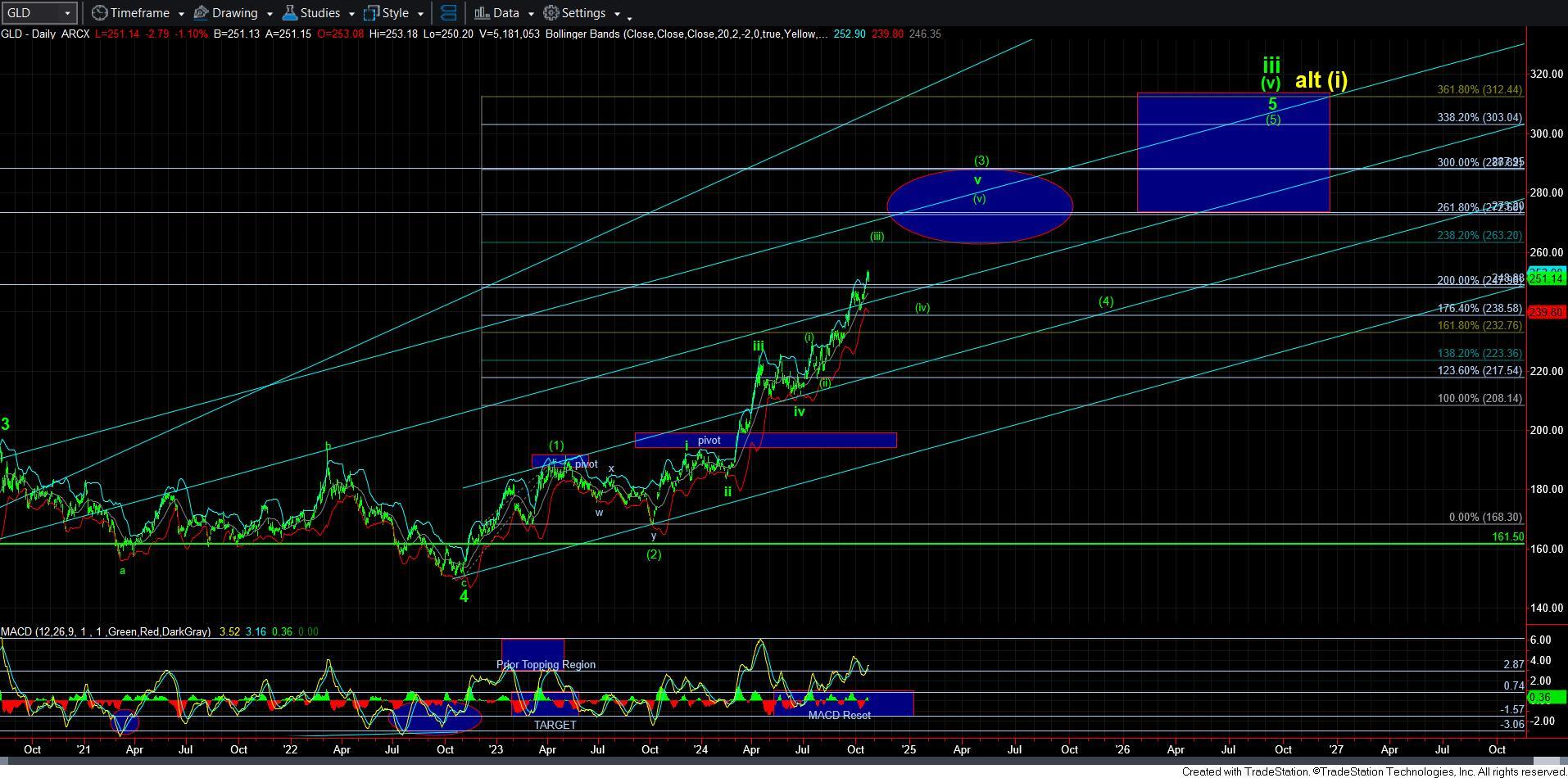

As far as GLD is concerned, I really have not clear way to consider that wave [iii] is done. Rather, I would need to see a move to at least the 261 region to consider it potentially completed. But, even so, my primary – as of now – would only view that as the completion of wave [3] in GLD. But, it would be wise for those holding shorter term options positions to cash in should we be able to get there. And, a break down below 246 would suggest that the pattern I am tracking as shown is likely breaking down (not the larger degree bullish pattern – just the expectation for much higher in wave [iii]).

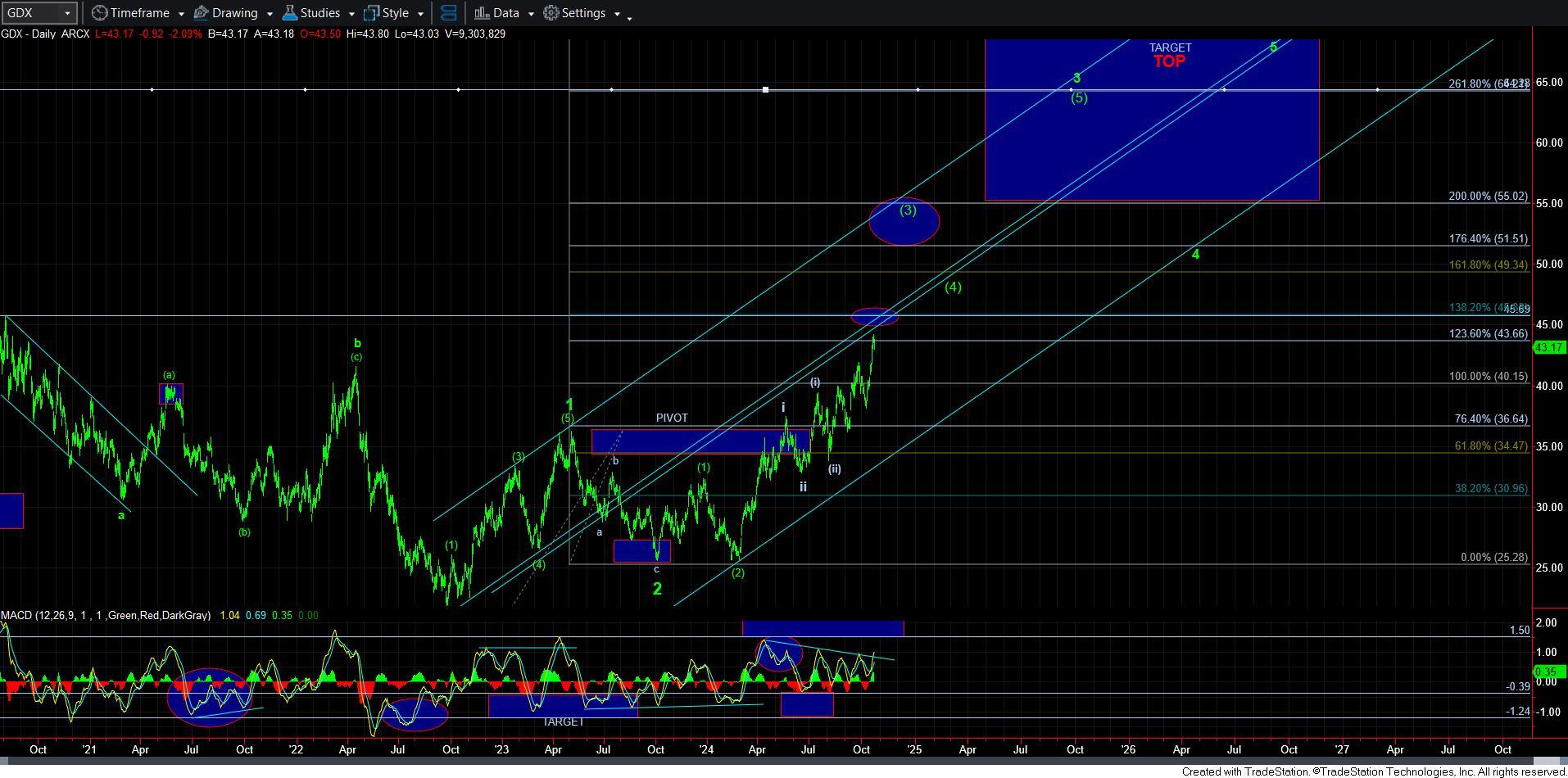

In GDX, as I noted over the weekend, we are now approaching the next big test in the chart. The question is still open as to whether the market can gap up over the 45/46 region and put us into the more accelerated channel, as is my current preference. A break down below 42.50 would give me some concern about that potential in the near term. But, do take note that the MACD on the daily chart is attempting a break out right now. Should price continue higher, then we have a set up to be able to gap above the next resistance and move into the accelerated trend channel to follow through on wave [3].

At the end of the day, the short term pattern is still holding, and the long term pattern is clearly still very much in place. But, should the short term pattern morph, you MUST have a plan in place so that your amazing short term returns garnered thus far are not withered away.