It’s All About The MACD For Me

When TLT was ripping higher weeks ago, many thought that we are going directly to my next target of 121-125 without a pullback. Yet, I continually noted that the greater likelihood is for a pullback to be seen to reset the daily MACD to support a rally to 121-125.

And, when the SPX was rallying strongly through 4100 in the futures after the CPI report, I maintained my primary count for a pullback, as we were not likely going to head to 4300 without a reset in the daily MACD.

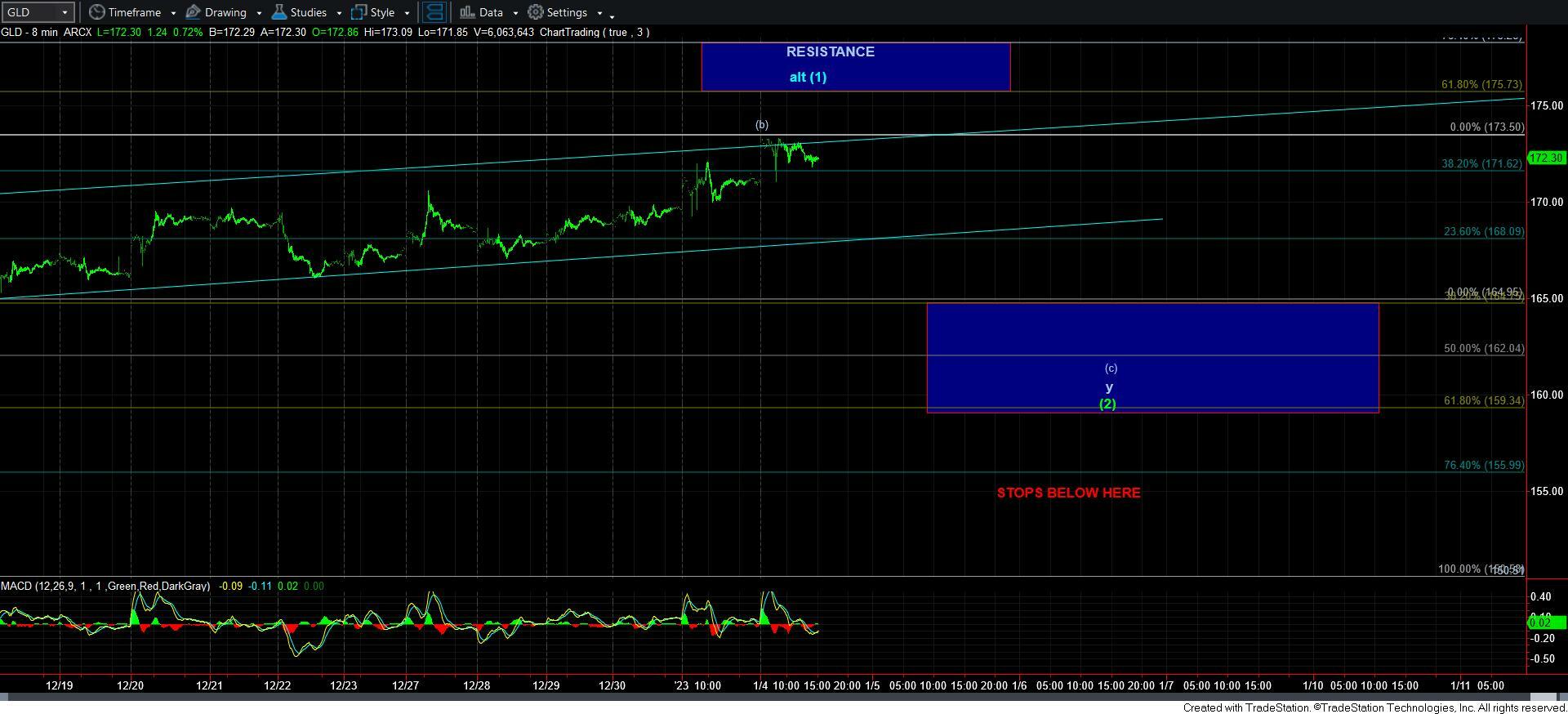

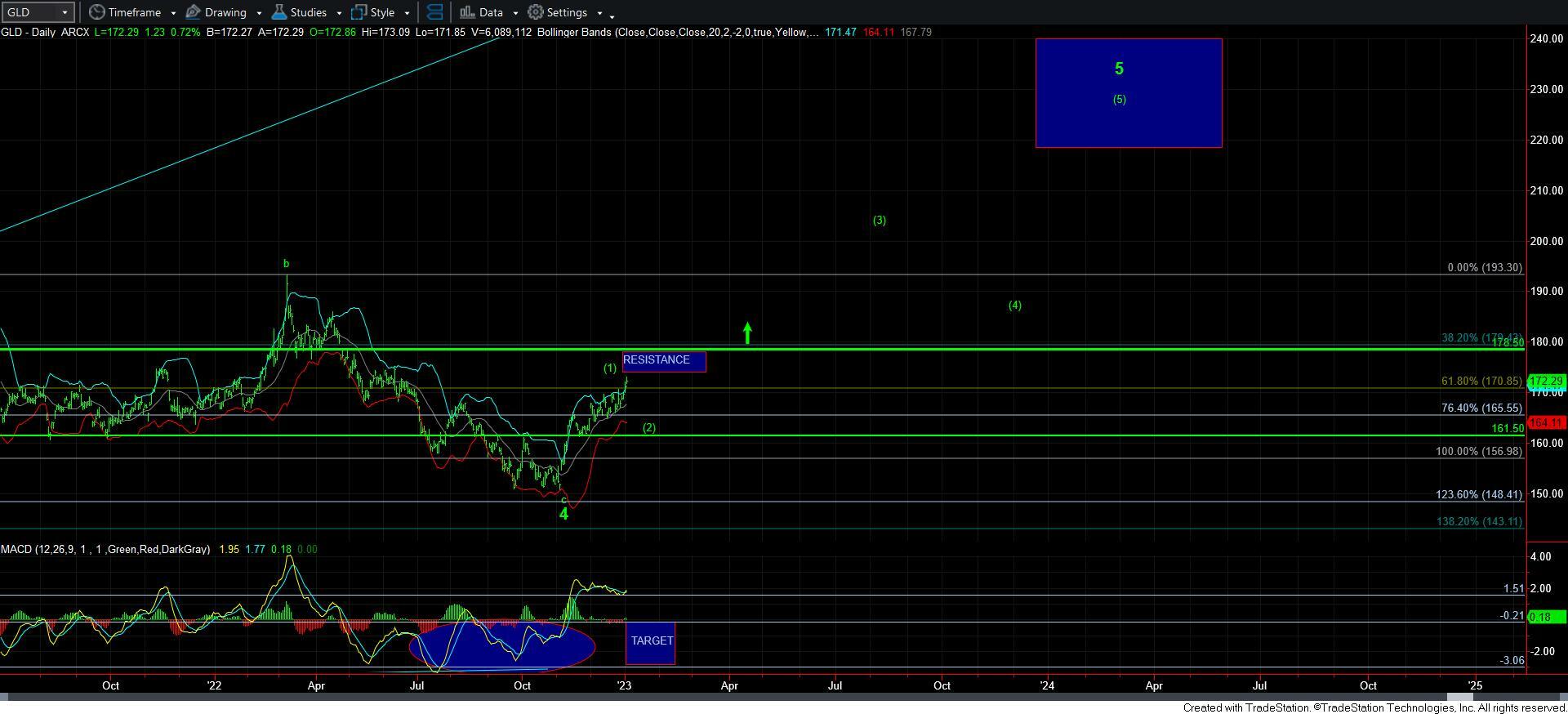

So, now that GLD is pushing its resistance, I am going to say the same thing – I don’t think we begin the heart of a 3rd wave rally before the technicals reset.

Now, of course, the market can do whatever it wants, and price is going to be our guide. But, the greater probabilities point to seeing a pullback first. Whether that pullback is just going to be a [c] wave, with this rally being an expanded [b] wave, or whether we are just stretching out our wave [1] is still unclear. For now, I am siding with the expanding [b] wave.

As far as silver is concerned, we saw some weakness today with silver poking below its uptrend channel. But, as with GLD, I do need to see at least a [c] wave down to consider this a 2nd wave.

GDX has the same issue as GLD. Are we seeing an expanded [b] wave or are we stretching our legs in a bigger wave [1]? Again, I am unsure. But, for now, I am relying upon the [b] wave count.

So, in effect, we are exactly where we have been these last few weeks and seeking a reset to the daily MACD on the GLD chart. But, I will also note again that if the market is able to break out through the resistance boxes noted on the 3 charts, then I have to go with price and consider us in the 3rd wave already. But, again, I see this as the lower probability right now.