Is This The Final Move?

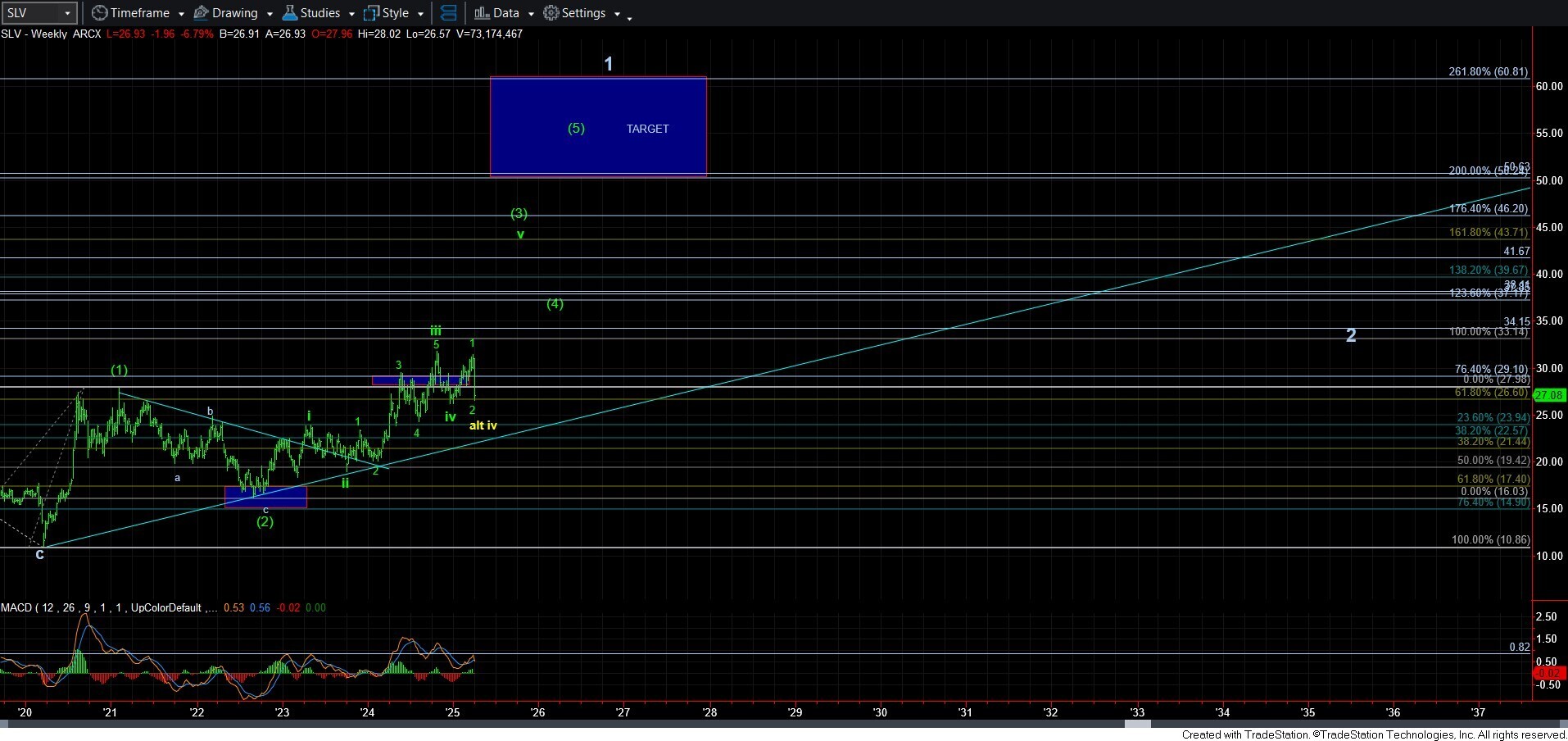

For those that remember early this year, I was strongly urging that we prepare for what will likely be a parabolic run and catch up move in silver. In fact, I attached the “conservative” chart path I laid out in the spring. I even noted at the time that I would not be surprised if the final 5th wave higher would provide us with many $2+ days of rally. And, that is what we are seeing of late.

So, of course, this is begging the question “is this the final move higher?”

I am still struggling with that answer, as I still think silver has a bigger pullback coming. The issue I have with this being the final move is that the rally off the late October low in silver into the mid-November high counts as a 3-wave structure. I have tried very hard to even see if I can force a 5-wave structure out of it to count it as a 1-2 structure off the October low, but I fail with each attempt. If that had been a 5-wave structure, then I would have potentially viewed this as the final move. But, since I simply cannot get 5 waves into that segment of the rally, I cannot view this as a final 5th wave.

The closest I can come to viewing us as being in a final rally is if we only see the yellow wave 4 pullback in the coming weeks. Then I would be forced to view the rally off that support as the final 5th wave of wave (5) within an ending diagonal. But, as I have said before, I have a hard time viewing silver completing this last segment as an ending diagonal. However, I will go with what the market tells me in the coming weeks and months.

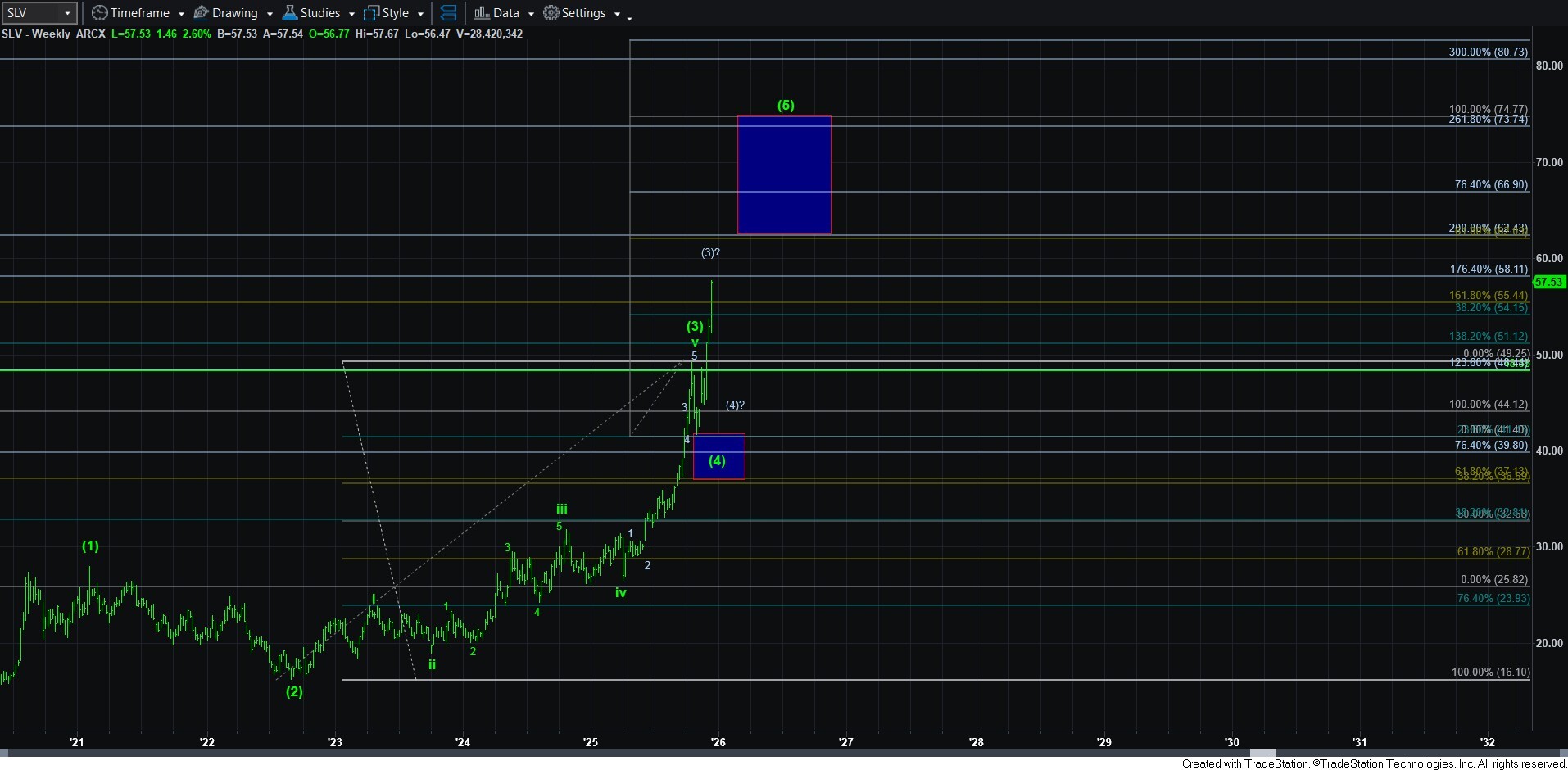

So, even though we have seen some sizeable extensions in silver, I have a hard time viewing this as a the final segment of the move. In fact, I may even consider this as only completing a very extended wave (3), as I am showing as an alternative on the SLV weekly chart.

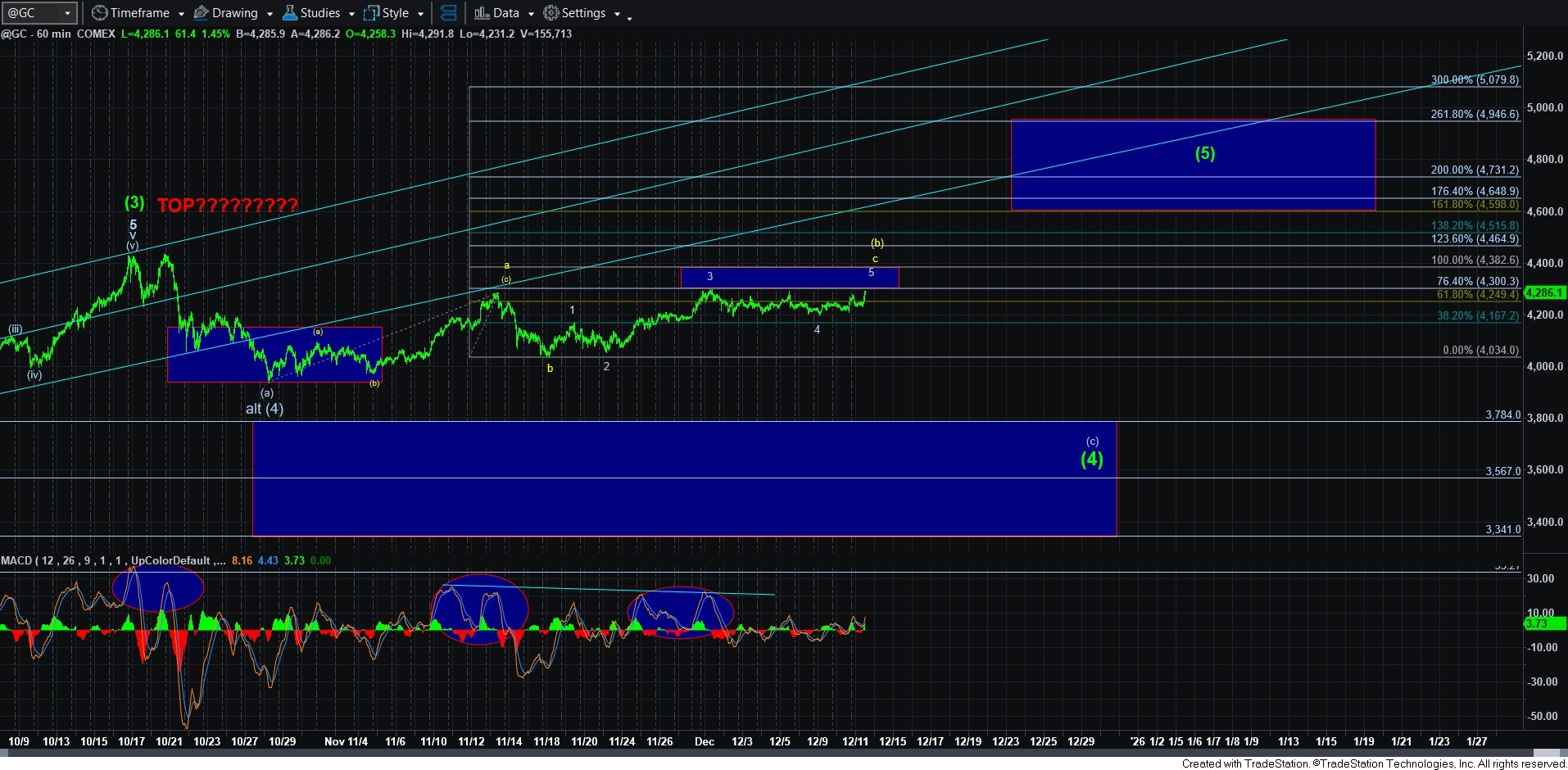

The other reason I have a hard time viewing this entire metals rally as complete is that I am still longing for a completed wave (4) in GDX. This rally still counts best as a (b) wave not only in GDX, but across many individual mining stocks as well. So, I really have no choice, but to allow this rally to run itself out and then seek a 5-wave decline to begin the (c) wave down.

Gold has now broken its immediate 1-2 downside structure for a (c) wave, but that is still the best interpretation of this larger degree 60-minute chart. The primary count still suggests this is a larger (b) wave within wave (4), at least as long as the resistance box holds. However, should we break out through the resistance box then I will have to assume wave (5) is taking shape as an ending diagonal in gold, and we will likely fall short of the hugely expected 5000 mark to complete this long term rally.

For now, there are still many reasons to expect more of a bigger pullback across the complex. It is very hard to view this as the final rally for all the reasons I have noted (along with a few others I have not). Therefore, I still have to side with the expectation for a larger pullback yet to come. Moreover, as we continue to move higher, I am even selling some of my September SLV calls into this rally with the intention of buying back in the next pullback.