Is This A Goldilocks Pullback In Metals?

We are starting to see more of a pullback in metals, but the question, of course, is how deep will it take us? And, to be honest, in both GLD and silver, we have the minimum number of waves in place to consider a correction is complete. Yet, GDX still seems as though there is still more potential pullback to come. So, let’s discuss these.

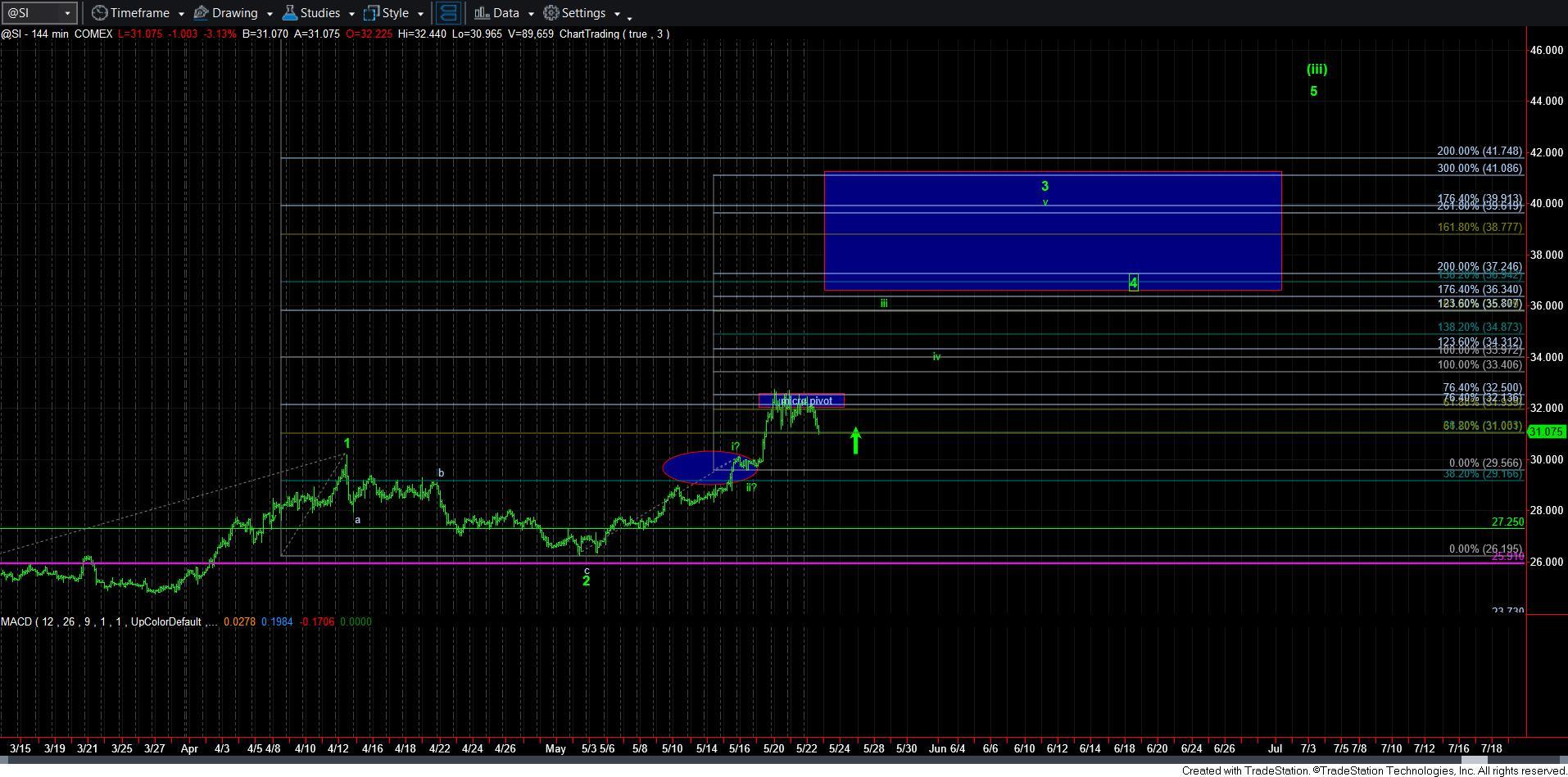

Clearly, the pivot we outlined earlier this week has held, thus far. And, while I had initially wanted a better i-ii in silver, we MAY have to accept the smaller degree wave ii as shown on the 144-minute chart as being already in place. That would mean that the current overlapping a-b-c corrective structure can be viewed as comprising a b-wave triangle, with a c-wave decline taking shape as an ending diagonal.

Therefore, I am slightly modifying the support for this high-end consolidation to the 30.85 region, wherein we have an a=c support for this consolidation. This would have me count this pullback as wave [4] within wave iii. And, should we see a 5-wave move back up to the high struck earlier this week, it would even make me consider a shorter term more aggressive option on the ensuing corrective pullback to trade the wave [5] of iii.

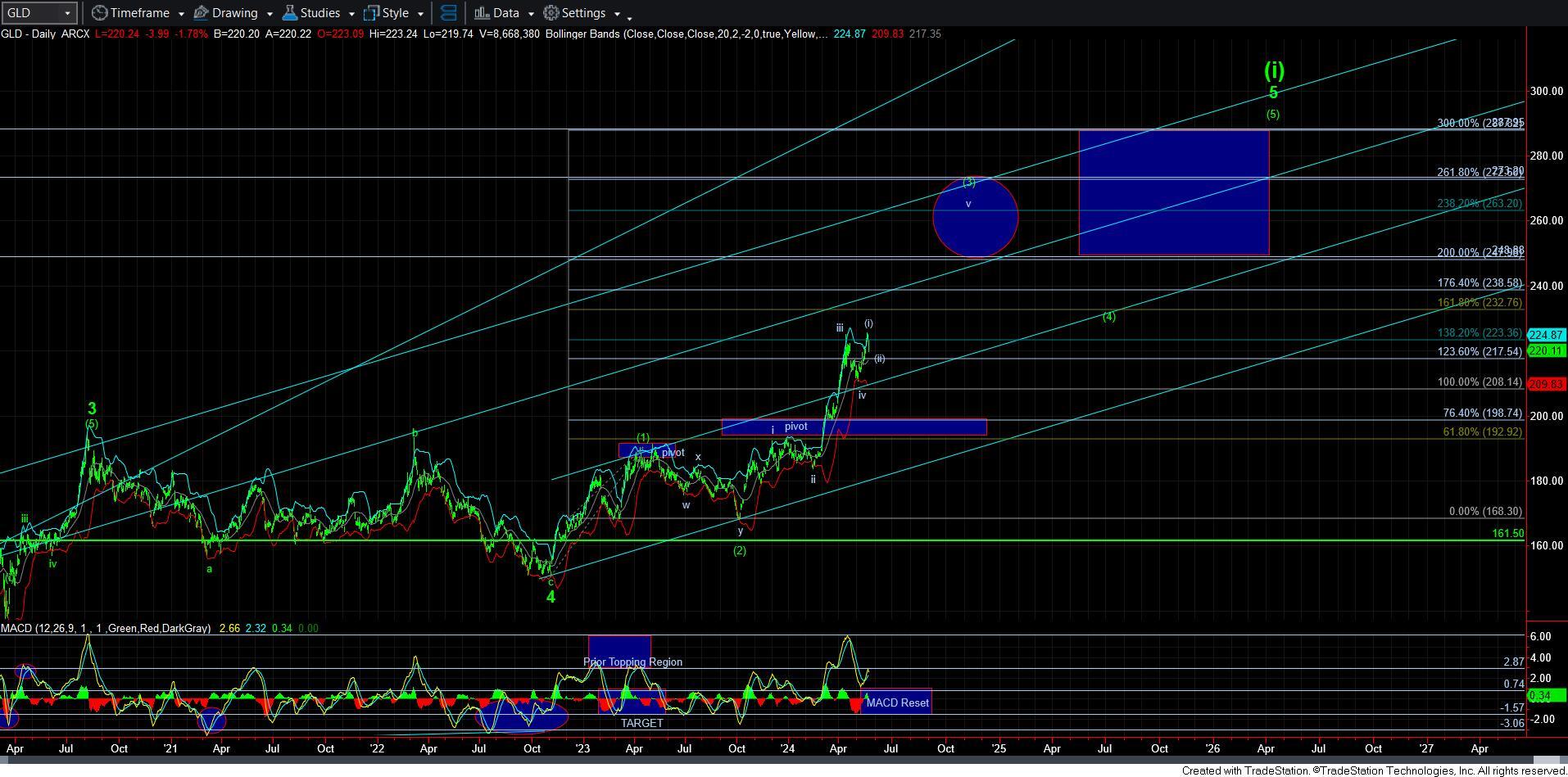

As far as GLD/GC is structure, I think it is best seen in the attached 8-minute GC chart. Earlier this morning, I posted this support zone for wave [ii] in GC/GLD, which provided a target between the .382-.618 retracement region of wave [i]. We have now moved into that support/target zone for wave [ii]. But, if I am going top expect a full c-wave, then I think we can still drop to the middle to lower end of the box.

And, just as with gold, the next time we get a 5-wave rally back towards the highs will likely begin the set up for the next break out rally.

GDX now also has enough of a pullback in place in the micro structure for us to be on alert for its next 1-2 break out set up as well. But, this one still concerns me a bit for more of a pullback to take us another week or two (maybe even a bit longer), at least based upon the bigger pullback potential in the NEM. So, it really is imperative to wait for that next 5-wave rally followed by a corrective pullback to make it more likely that the next major move higher in GDX is beginning. And, that next move will likely be akin to the recent silver action, as GDX has a lot of catching up to do.

So, as it stands right now, we have the minimum pullback across the chart to suggest that this pullback/consolidation may be done, or at least very nearly done. Therefore, I would suggest we all be a bit more patient for the next 5-wave rally before we are ready to trade the next upside break out more aggressively.