Is It Finally Pullback Time?

Needless to say, we are overdue for pullback time. And, the best evidence I have of that is in silver.

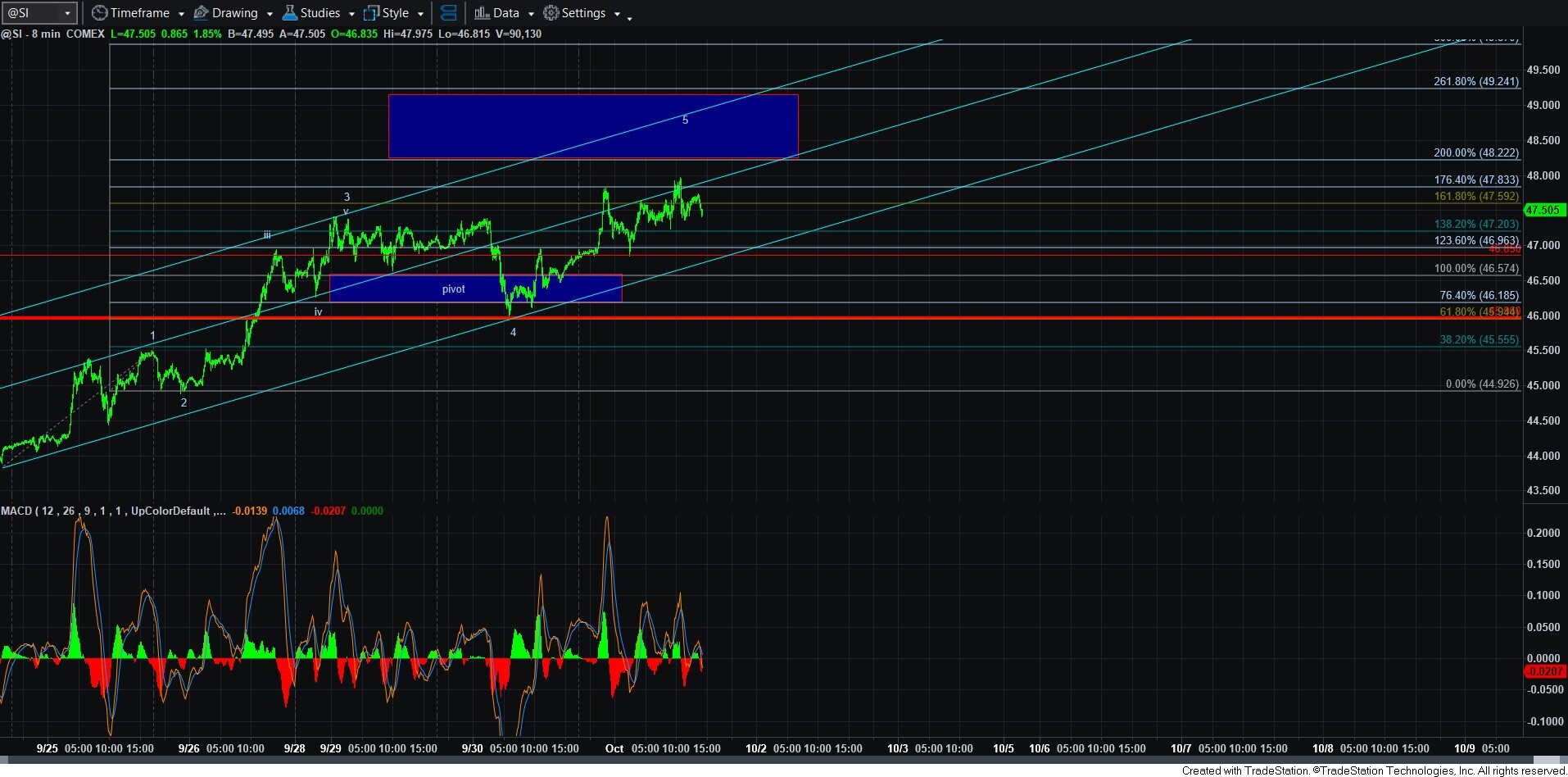

With the market making it clear that it is completing wave 3 of (3), the micro count in that move still suggested we had a bit higher to reach before wave 3 was complete. At this time, I can say that almost all the squiggles are now in place to consider that count as complete. But, as we know, the metals have ralied quite strongly, and we need some confirmatory evidence that we have indeed completed wave 3 and are in progress within wave 4.

So, I have added two signal levels on the 8-minute silver chart. And, as I explained in an alert earlier today:

“It seems that wave 5 in the smaller degree count is an ending diagonal. Therefore, a break down below 46.85 would be an initial signal that this rally has completed, and follow through below the wave 4 low of 45.96 will make it more likely that the larger degree wave 4 on the 144-minute chart is in progress.”

So, let’s allow support to break before we assume that wave is in progress.

The top of the support box for wave 4 is the .236 retracement of the wave 3 rally. And, when the MACD drops into the “BUY” zone, I will assume we have reset the technical situation enough to allow another run higher in wave 5 of (3). Now, that does not mean that the market will certainly bottom at that point in wave 4. But, that is the region at which the last segments of this rally bottomed, as we continued higher in wave 3. So, that is why I am making the assumption as noted. We will see how the structure looks at that time to further asses the situation.

But, based upon the larger degree count, I am expecting at least one more major rally in silver once the next pullback completes.

The same generally applies to both GDX and GLD/GC. But, the question still remains unanswered as to what wave degree the next pullback will be appropriate. I am still leaving the door open for the various options we have been tracking, so there really is not a lot more for me to add. But, I do want to point something out I noted in an alert for gold in the trading room today:

“To say that GC is full and in need of a pullback is an understatement. But, we will need to break down below 3820 to get that ball rolling. Follow through below 3750 makes it likely that the pullback is in progress, but then we will need to assess the nature of the pullback to determine which one is in progress.

The type of pullback we get will likely provide clues as to how much further this bull market has to run.”

For those of you that did not attend or listen to my live video this morning for the full-time members, or that did not see my update on this in the room, I will be discussing the blue count on GC in my weekend update. But, suffice it to say for now that it can lead to a top to this cycle a lot sooner than many currently expect. So, we will have to stay on our toes and see to where the next pullback takes us and the nature of that structure.

For now, it is reasonable to still expect higher to be seen in the complex. However, we are sorely overdue for a rest and/or a pullback. So, I am still patiently awaiting that opportunity.