Immediate Acceleration Pattern - Market Analysis for Oct 21st, 2019

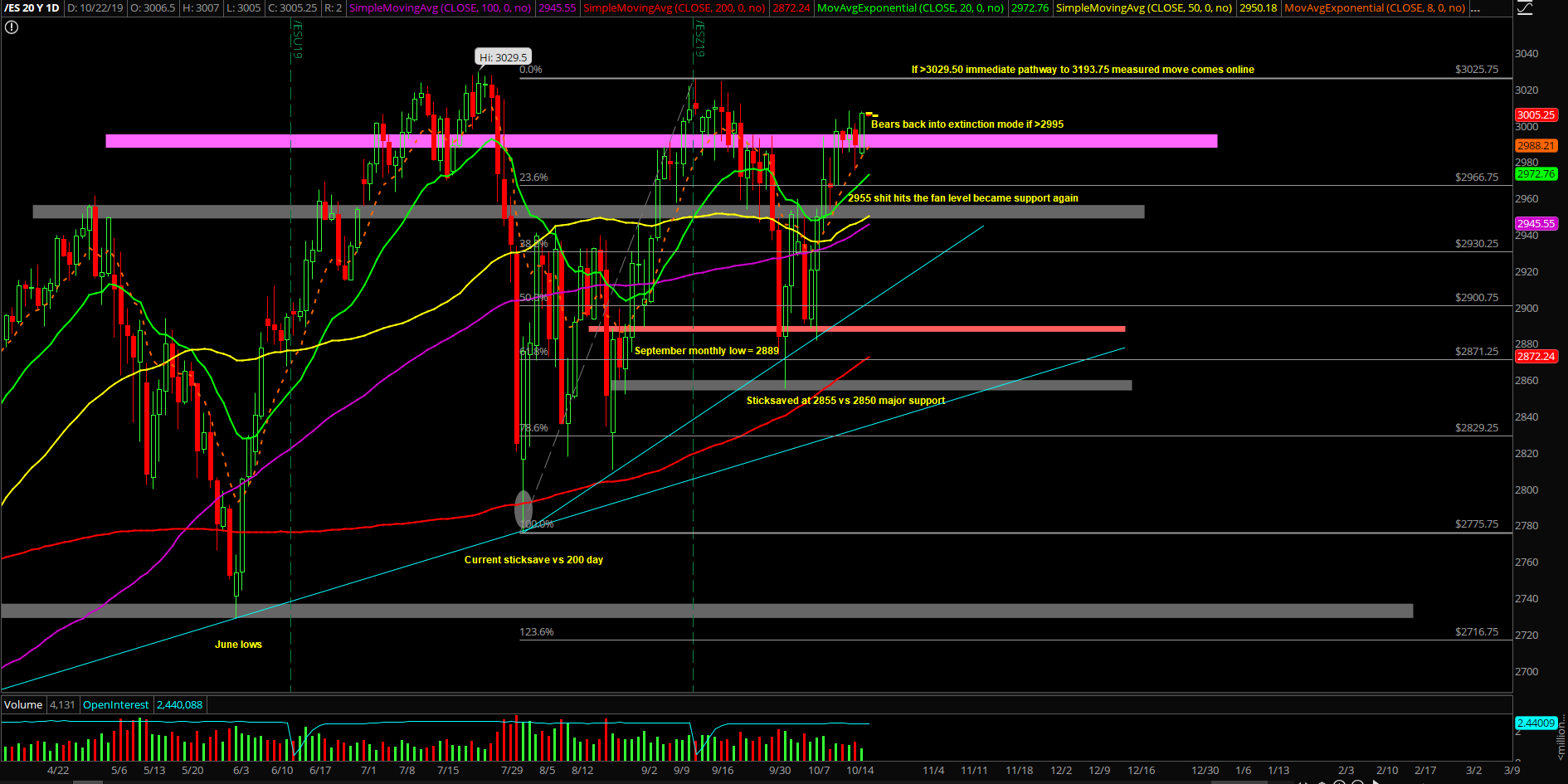

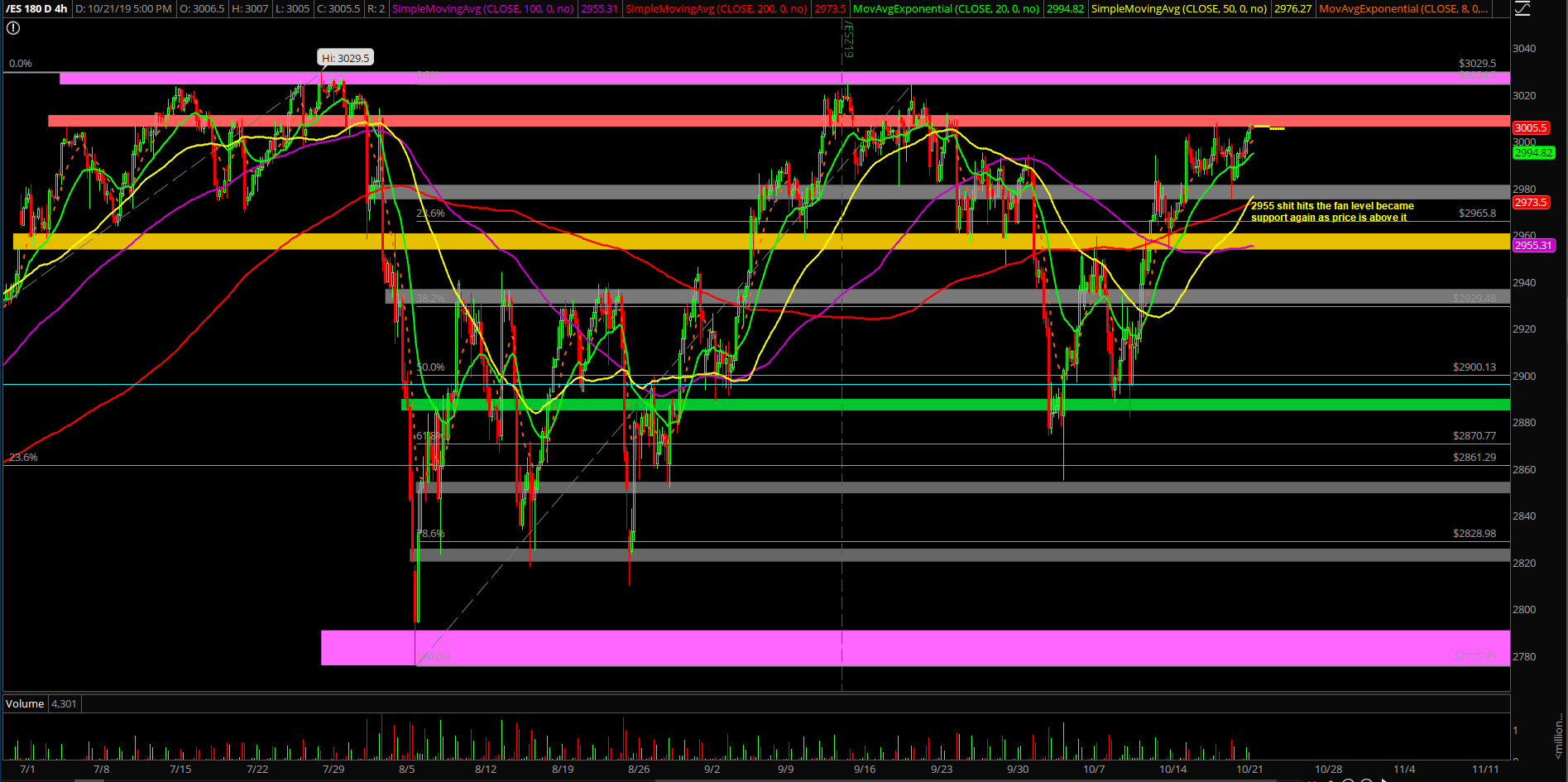

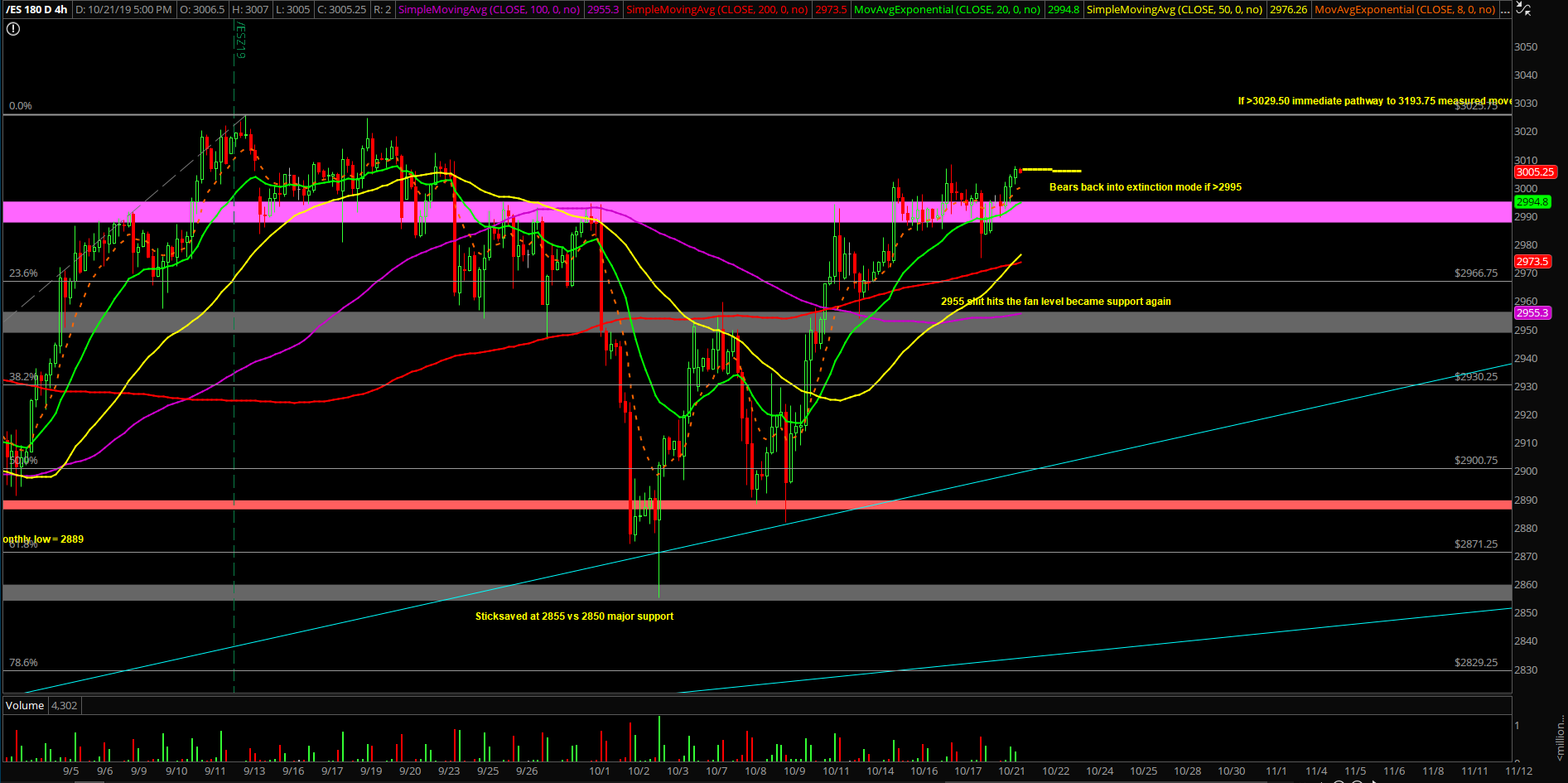

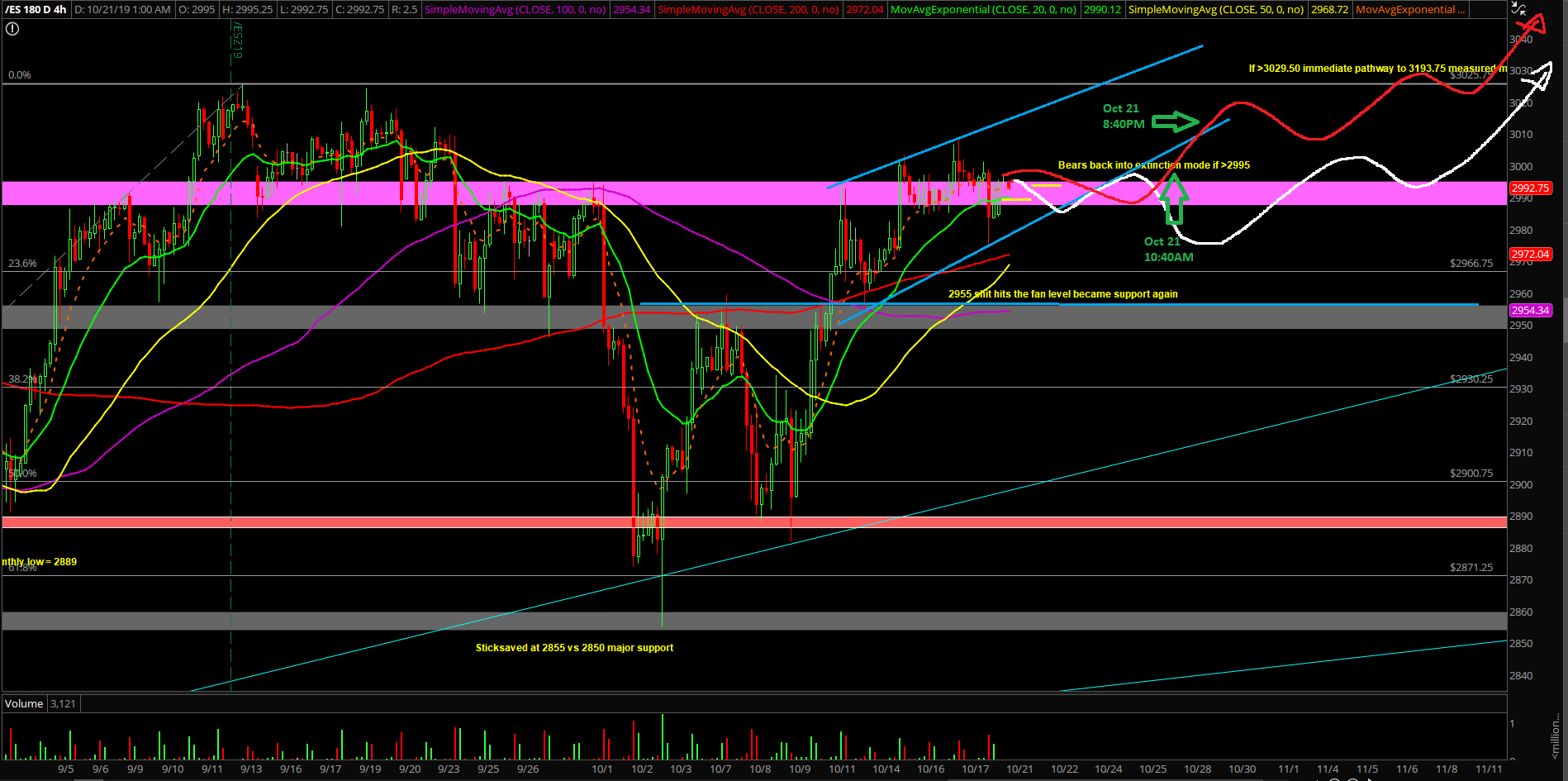

Monday’s session showcased a grind-up day bias with the market gearing towards all-time highs. Essentially, the market bottomed out during the Sunday night low at 2984.75 on the Emini S&P 500 (ES) and formulated as a higher lows vs. Friday’s 2975 low. This also created the massive feedback loop squeeze setup as the weak hands were shaken out on Friday. Overall, the market is still trending well above the daily 8EMA and it’s now entering an acceleration phase.

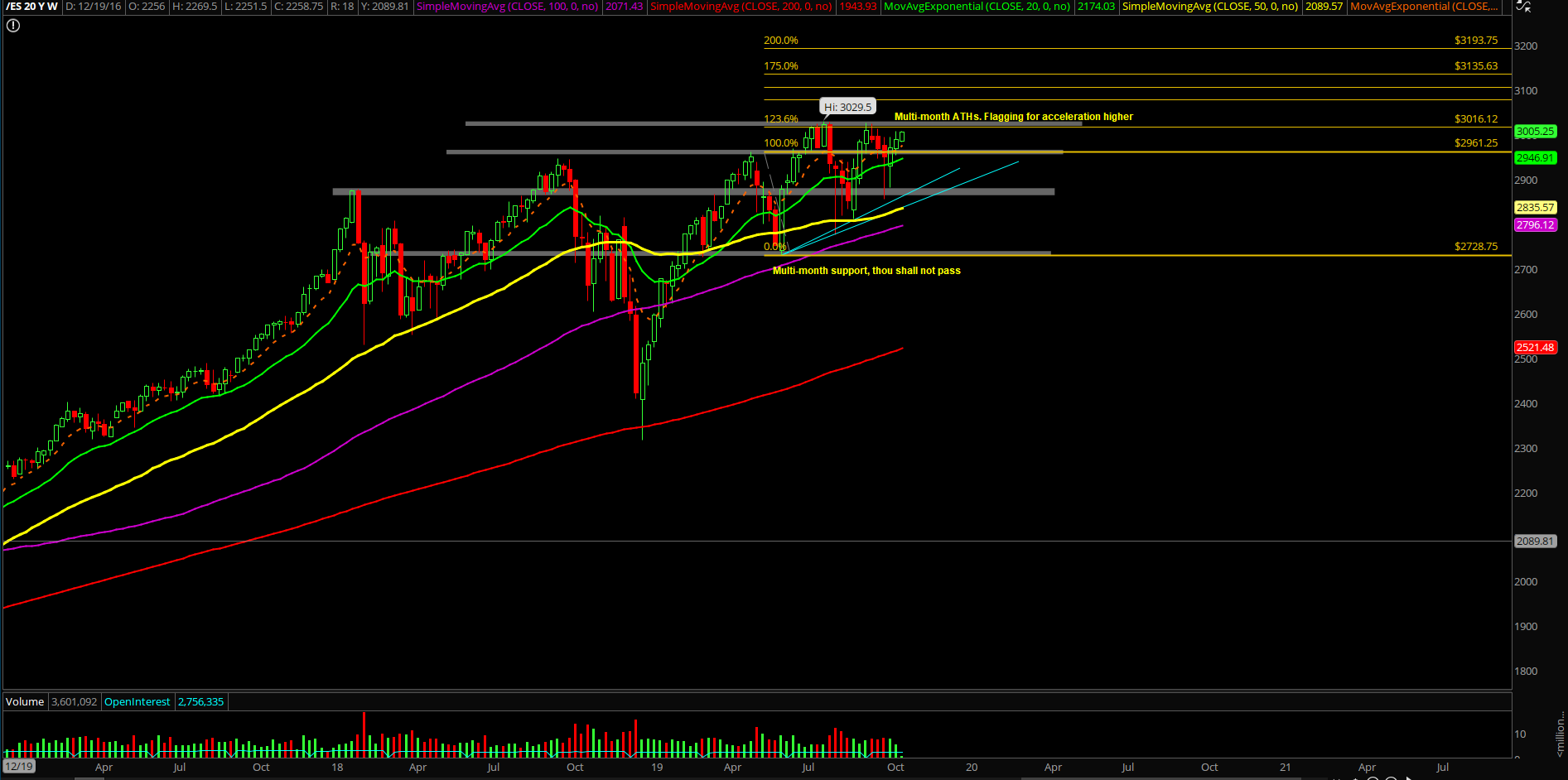

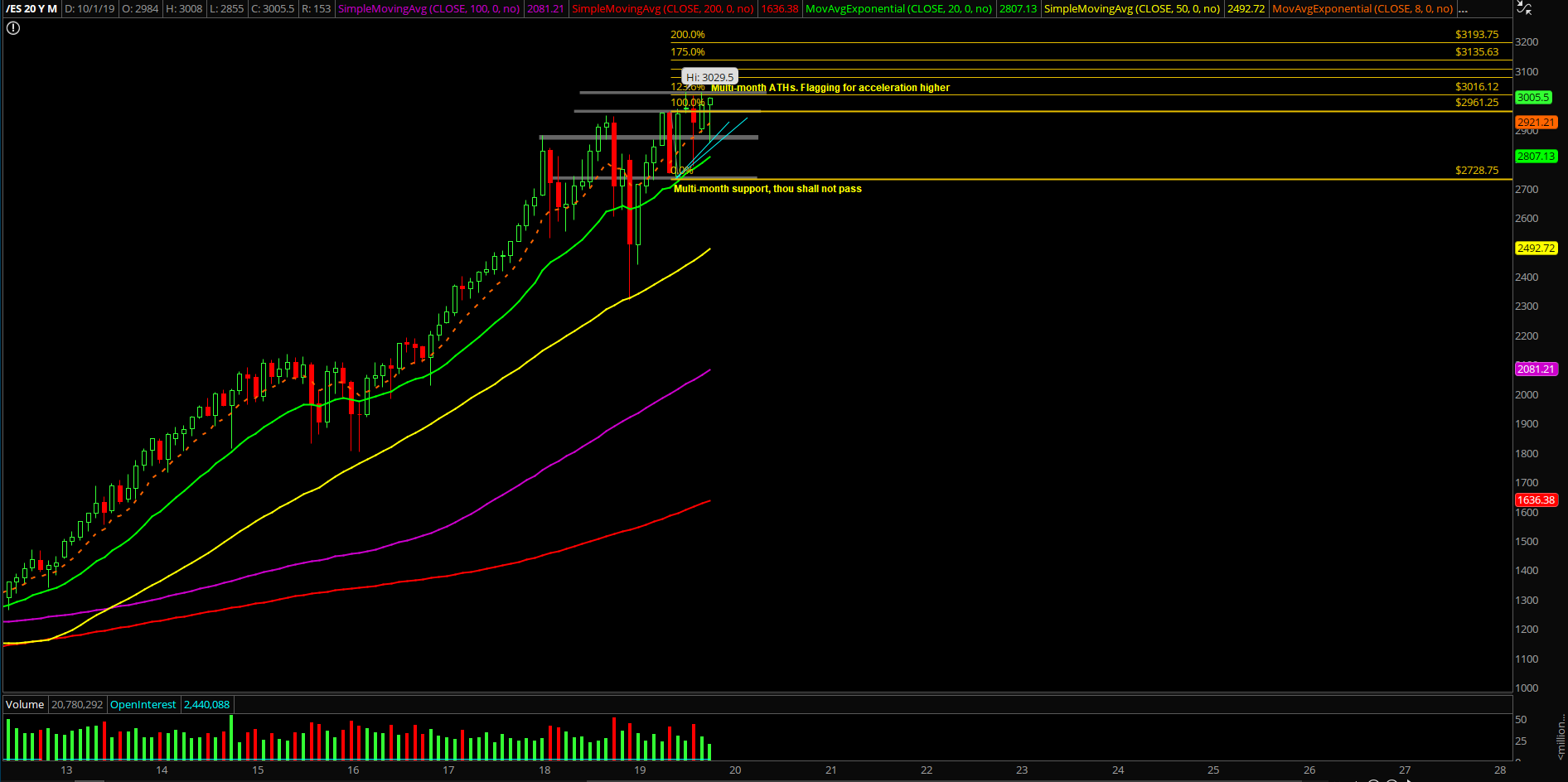

The main takeaway from this session is that the market is mimicking our 4-hour red line projection into new all-time highs and the trending supports have moved up due to today’s grind-up pattern. Nothing has changed from the weekend report: all this posturing with the flagging/digestion pattern plays well into bulls’ case as long as price action remains strong by holding against the trending supports.

What's next?

The odds still favor the prevailing trend due to the setup/pattern. The main concern going into this 4th week of October is that there are a bunch of negative/bearish divergences on the micro timeframes such as 1hr and 4hr. This means that if the price action does not immediately break out of last week’s range, then it is very possible to have an inside week to trap in more market participants before the real breakout/acceleration takes place at a later date. Obviously, this is all presuming that no trending supports or the 2955 major level gets reclaimed in a decisive manner on a daily closing print basis.

The ES closed at 3006.5 at the highs of the day and the immediate acceleration pattern looks ripe. The price action so far has broken above last week’s high and nothing has changed In our perspective.

Among our key summary points:

- The 4hr red line projection remains primary/king for now until price action proves otherwise

- Market is attempting the immediate breakout scenario from the weekend report to erase all doubts of an inside week or digestion first before the all time highs setup

- Trending supports have been upgraded to 2984.75 and 3000 given the acceleration

- Must hold major level is located at 2955 on a closing print basis

- Bears would resurrect themselves again if sub 2955 given the prevailing trend is breakout into all time highs. Must adapt back to STFR if price action proves it