I Just Bought A Hat

I am sure you are asking yourself “what the hell does Avi buying a hat have to do with this metals update?”

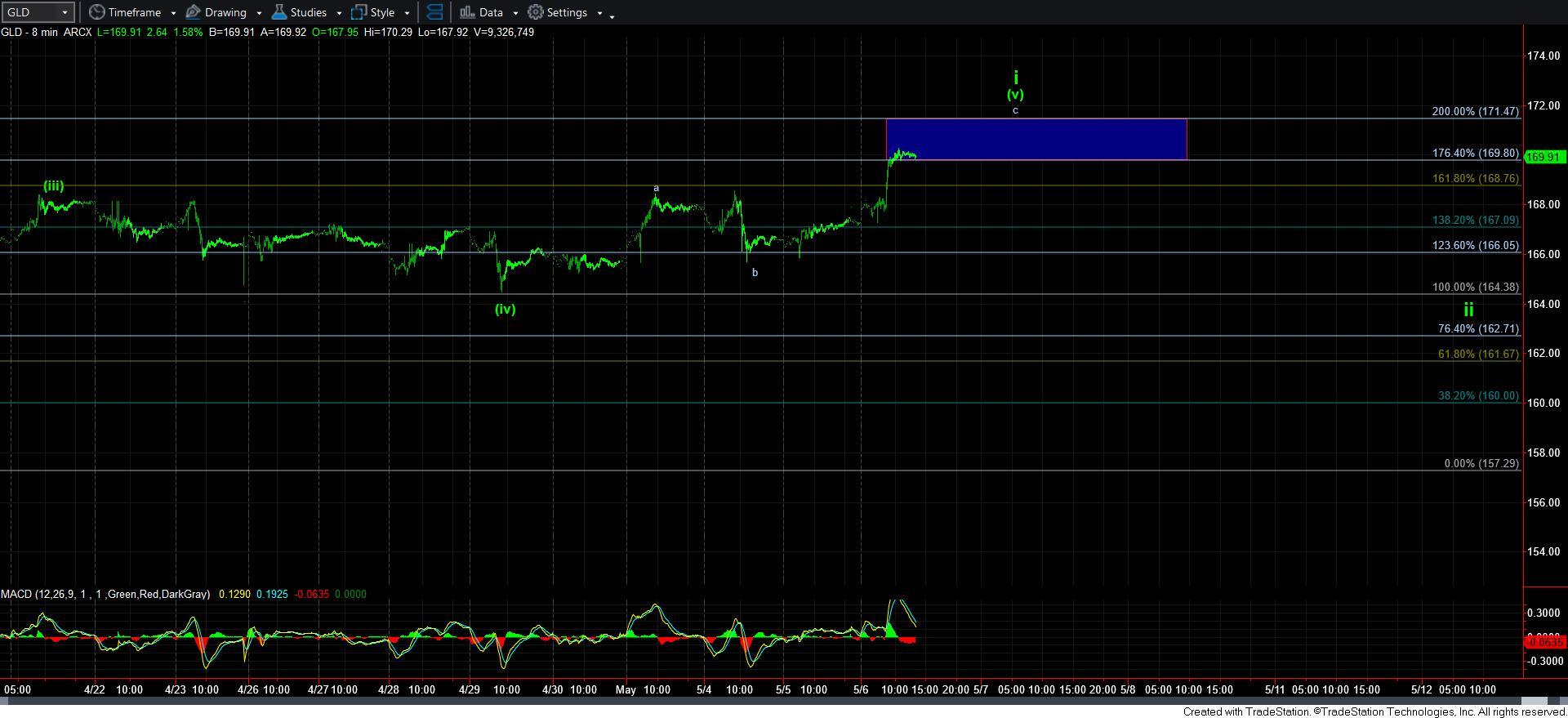

Well, now that we have the potential for all three charts I track to have 5-waves up off the recent lows, I now have something to hang a bullish hat upon. (smile)

As we can see from all three charts, we can now count the minimum number of waves in place for aa 5-wave rally off the recent lows. But, that does not mean we turn recklessly bullish. Rather, it means that the market has given a basis from which we can now look more bullishly at the complex. So, now we have to track the next break out set up for a 3rd wave rally.

In my primary counts, this rally we are seeing today should be coming to an end soon to complete 5-waves up off the recent lows. Therefore, we will need to see a corrective 2nd wave retracement. One the market provides us with evidence of a top being struck, I will put out the retracement targets on the smaller degree charts.

But, I want to warn you that we MAY not see a deep retracement. There are quite a few miner charts which may actually be one wave degree ahead of the GDX. It is for this reason that I am going to stay on my toes for what may be a shallow retracement in the respective 2nd waves. Ultimately, if we see GDX breaking out strongly through 40, then we are likely within the next melt-up phase in the complex, and likely in the heart of the 3rd wave I expected this year.

The question you should be asking yourself is what happens if the market does not provide us with an adequate entry for the heart of the 3rd wave? Well, remember that if you have been following me for any period of time, you would know that I maintain my core positions in stocks in the complex, which I entered back in the last half of 2015. Therefore, I have always maintained a core position in mining stocks, but hedged those positions at resistance/turning points.

The set up for which we are now stalking is for aggressive long positions. That means that if the market gives us the appropriate set up, then we can add those types of positions. However, if the market does not provide us with that appropriate entry, then one need not take any such aggressive positions, at least until the market can give us a low-risk entry point for such positions. So, PLEASE do not force any positions into your accounts, as that is often a good way to be hurt on a position. In the meantime, we will track the market in the coming weeks for such an appropriate low-risk entry for aggressive long positions.

In the meantime, I think it is reasonable to expect some weakness in the coming weeks for a wave ii retracement, which should set us up for the wave iii I still expect in 2021. Ultimately, it looks like the summer and into the fall of 2021 the metals can melt-up with the overall equity market if we can continue to develop the set up in the coming weeks.