I Got Issues - Market Analysis for Jun 10th, 2020

For those that follow me, you know that I am generally a metals bull when I have a good reason to be so. Yet, I am also a realist and do not like to lose money or to place someone else in a posture that can lose them money.

So, right now, I have issues.

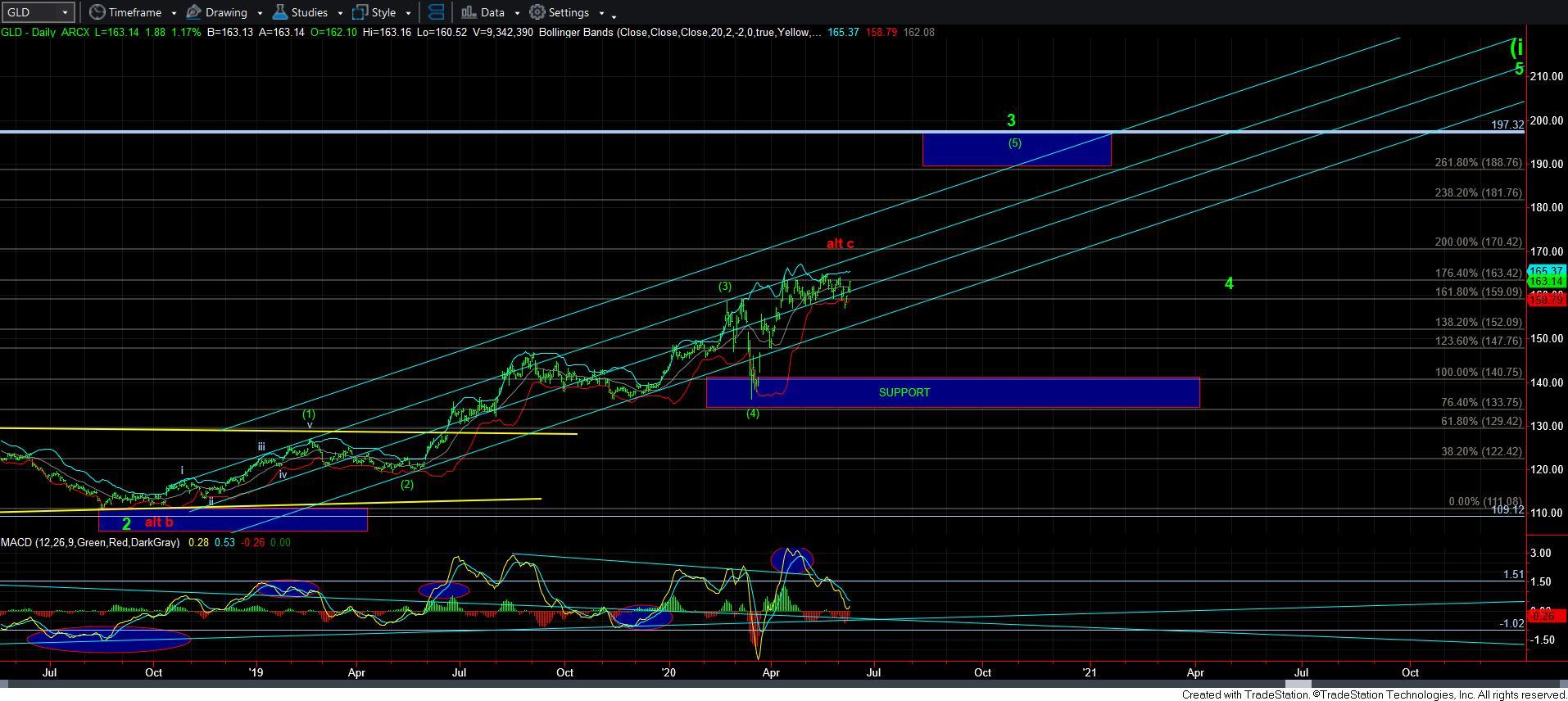

When I look at GLD, I now have two smaller 5-wave structures that have developed off last week’s low. That would suggest that the pullback was indeed a more complex w-x-y structure within wave [ii]. That begins to strongly weight the evidence in favor of GLD having bottomed and having begun its next rally phase. It also means that if we can see a strong move through the 164 region, it opens the door for GLD to head to the next target in the 170 region, but more likely towards the 174-178 region.

But, when we move over to GDX, I have to be honest in that I struggle for a few reasons with regard to the micro count. The only way to have the wave iv as competed below is with a truncated structure, as we did not complete a 5-wave c-wave structure. Moreover, the rally off that low was overlapping and did not look like a strong rally structure off that low. So, over the weekend, it really lead me to believe that a lower low would likely be struck.

But, with today’s rally, I have to begin to consider the likelihood that we have begun wave v to 40+. Yet, I am going to remain cautious during this initial move up off the lows for the reasons cited above. Therefore, I am going to need to see a bigger 5-wave structure take us towards the 37 region to be more confident that we are heading to 40+ sooner rather than later. In the micro structure, the 35 region is the next micro resistance, being the 1.00 extension off the recent lows. So, please stay on your toes until we are through that resistance.

If we can now exceed that 35 region, it does get my bullish juices flowing. But, I did buy some more out-of-the-money puts in GDX as further protection if we do turn down here. My hope again is that hedges I buy go valueless, but I have not had such luck when I hedge.

As far as silver is concerned, as I noted this morning, if you have not set your stops for your short-term positions at 17.20 before, then you REALLY should now. Silver is going to now move through the prior high in the 18.90 region, and then follow through the 19.40 region to set our sites on the 21 region next. So, again, the 17.20 region of support is VERY important for the smaller degree structure. Should we break that support, then 16-16.40 will likely be struck below.

In conclusion, I have good reason to be bullish when viewing the larger degree structures, as most of the miners I am tracking support this concluding a wave iv within a 3rd wave, as they have all held support where they needed to do so. Moreover, GLD is looking rather bullish off its recent lows, and also has me viewing that chart bullishly for now, especially as long as we remain over TODAY’S pullback low of 160.62.

But, I still have some questions regarding GDX in the micro structure, which I have outlined above.