I Don’t Think Silver Is Signaling A Bottom - YET

While I would absolutely love to consider silver as having bottomed now that we have moved through resistance, I have several issues with it, which I will now explain, and then outline how I intend on approaching the market in the coming weeks.

First, I want to reiterate again that I have been stressing this to be a bottoming structure. And, if you are interested in a long-term play in the metals complex, this is yet another buying opportunity in the bigger picture.

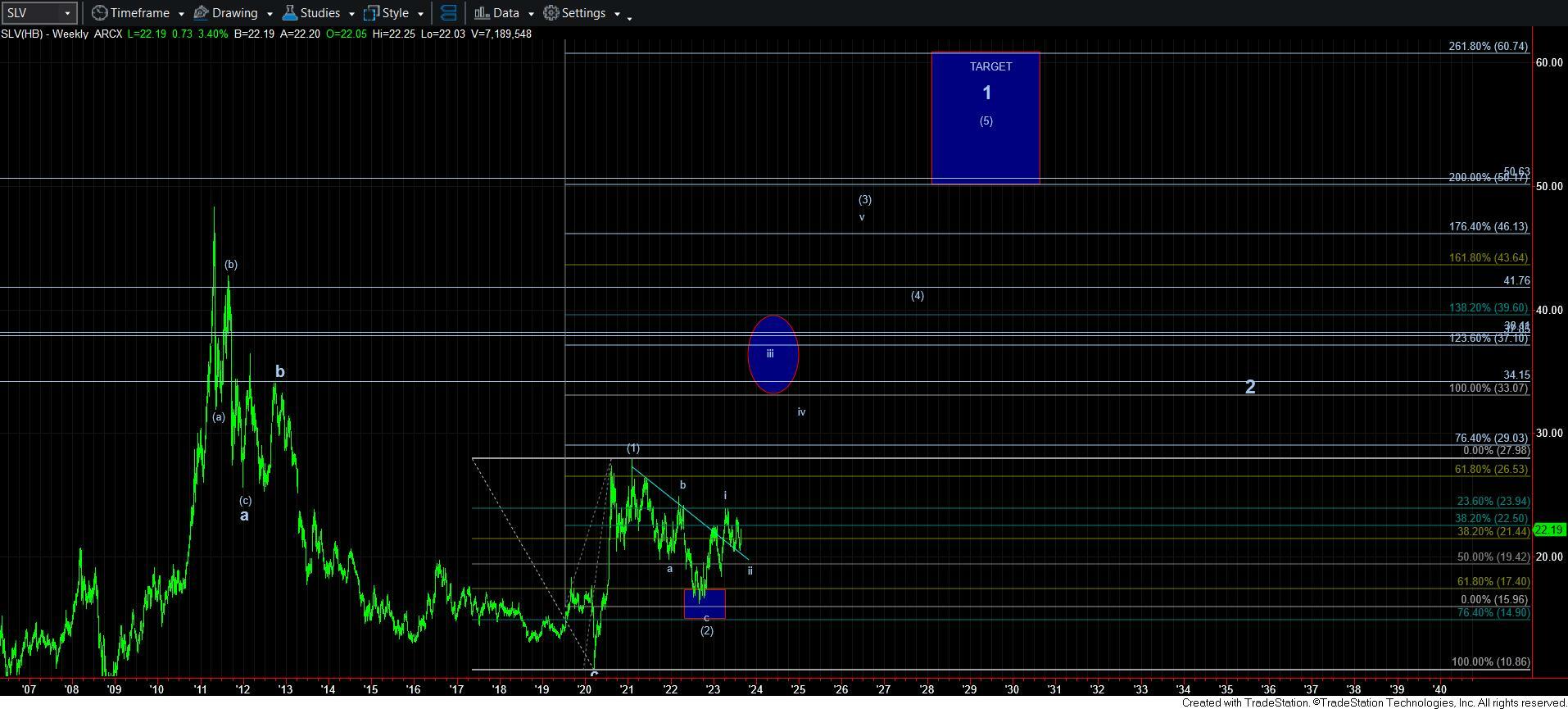

Second, I want to note that we have been attempting to track a more protracted 2nd wave pullback across the board in the various charts I outlined. That being said, I have been seeking a 5-wave decline in a c-wave to complete that 2nd wave. And, this is where we seem to have come up short thus far.

Let me discuss silver. As we have been tracking, the decline from the 25 region really counts best as a 3-wave structure. Moreover, I would expect silver to at least have seen a marginally lower low in the [c] wave of its 2nd wave. Yet, we have stopped short and have begun to rally again.

This leads me to two conclusions. The first is that the bottom is in place in a most unusual fashion. The second is that we have an ongoing [b] wave within this 2nd wave. And, truth be told, the second answer seems to satisfy the Occam’s Razor principle which usually guides my analysis.

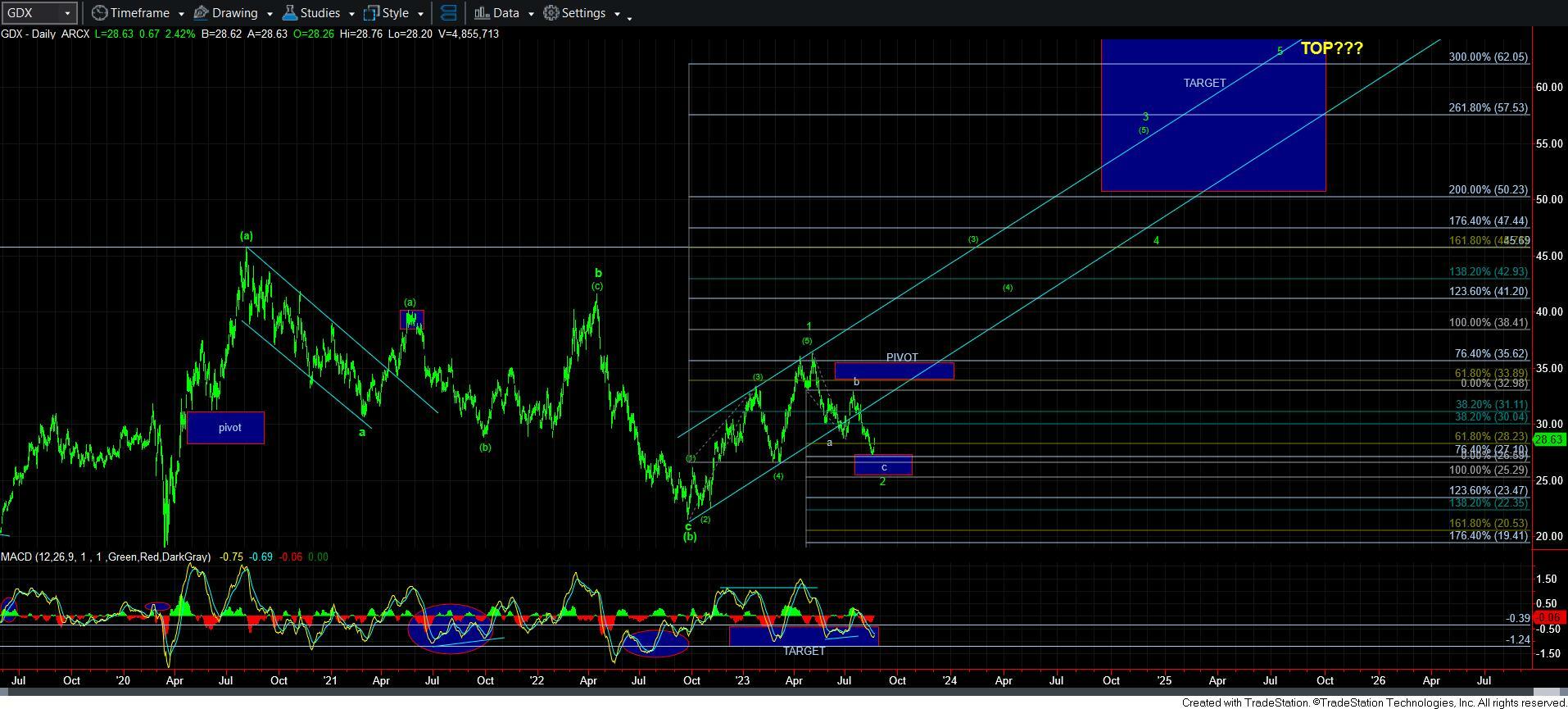

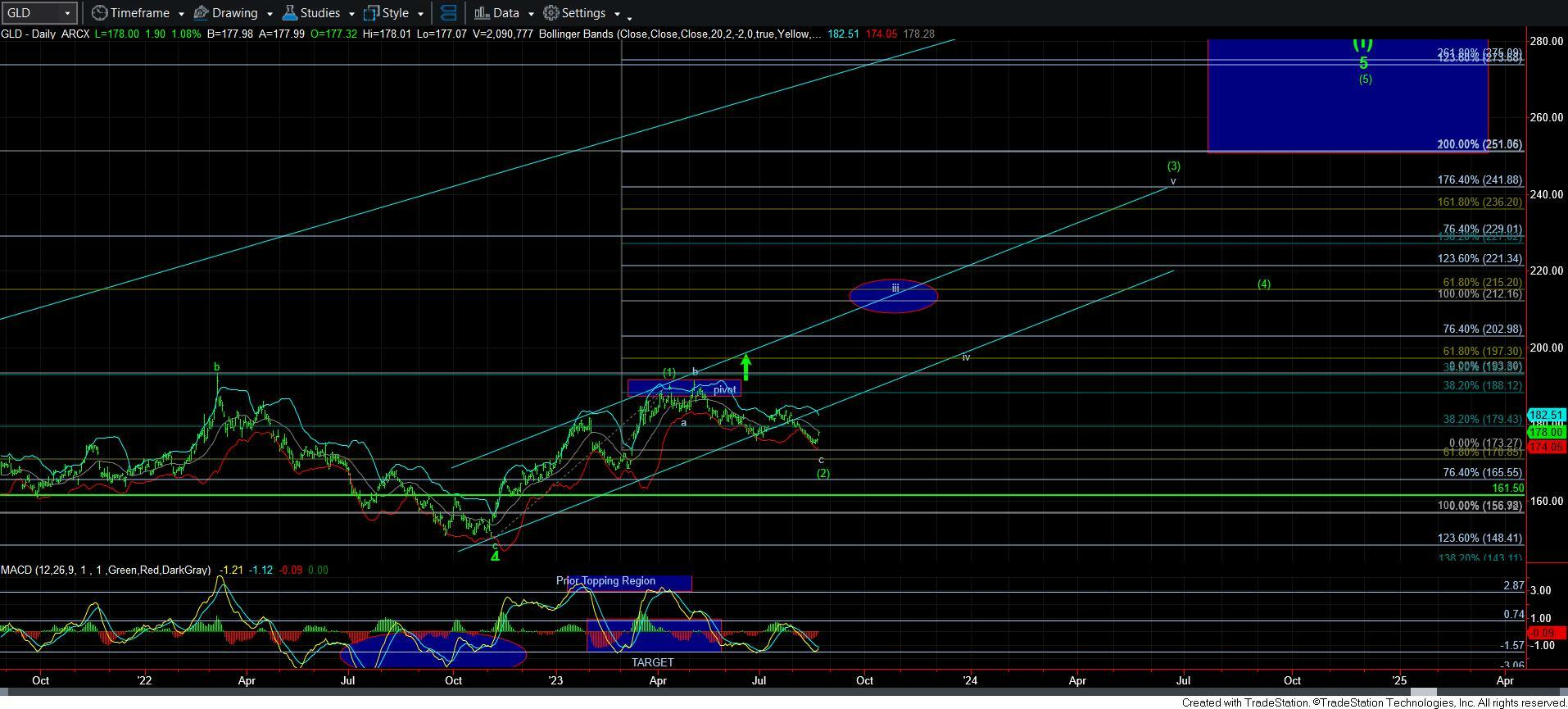

There are other reasons I am siding with this being the continuation in the corrective structure. As I have been saying of late, gold and GDX both look like they are missing 4th wave bounces in what I am counting as a last leg down. So, it does align with silver’s rally to complete its [b] wave, thus suggesting that all charts will likely see one more 5-wave decline before this correction is finally complete. While I know that we read all charts on their own, this does align quite well across the board.

Next, when I take a step back and look at the weekly SLV chart, it does not look like a completed 2nd wave. In fact, the more expanded [b] wave followed by a [c] wave down to complete its wave ii is also the cleanest and most likely count I would view if I was simply looking at that chart alone in an objective fashion.

So, the weight of the evidence suggests that this rally is not likely starting the next big rally we wanted to see. Now, of course, I can be wrong in that assessment. And, should the market continue to rally to the 25 region in silver, and then pullback CORRECTIVELY, I will place you on a break out alert warning, as that would portend the potential for the [i][ii] noted in green. Should the market pullback correctively, and then break back out over the high of wave [i] in green, then I move into the melt-up phase, and I add the final aggressive positions on the long side.

As far as GDX, if we see an impulsive rally through 30, then I will consider the bottom as being in place.

Those that have followed my work in metals through the years know that I will most often side with the more immediate bullish count as my primary so that we are not left out in the cold when the metals entire a 3rd wave. Moreover, if the market proves that the more immediate bullish case is not warranted, we were almost always able to exit the market before the downside took shape in a meaningful way, often taking positions off the table in profit, as we did back at the 25 region at the end of July.

Yet, I have also noted that I will not make the more immediate bullish count my primary count if I have good reason. And, I think I have outlined a number of good reasons above. Moreover, I have also made it VERY clear where I will abandon the expectation for a lower low as well.

I think the market is providing us wonderful parameters at this time. And, for now, my expectation is for a lower low in the coming weeks based upon the weight of evidence. Yet, if silver provides us with the [i][ii] break out before that occurs, I will adjust immediately and move into the melt-up mode of the heart of a 3rd wave at that time. So, until that occurs, I think the weight of evidence suggests a lower low in the coming weeks.

As far as positioning, I am still holding LEAPS in GDX and silver. And, I am looking for an opportunity to add the final tranches in those positions. Ideally, I will want to add if we get a 5-wave [c] wave decline, and then a final tranche after a [i][ii] structure thereafter. However, if the market proves to be more bullish sooner than later, than I will add the final tranches on a break out over the high of wave [i] in green, after a wave [ii] corrective pullback.

But, please take a step back and recognize the main point I have been trying to make for months - - this is a bottoming structure in the overall complex. The divergences we are again developing are quite stark, and NEM is truly a picture for this potential (despite my expectation that it may lag a number of other mining stocks in the next rally). Please do not try to be penny foolish when your goal should be to position yourself for what is likely going to be a major rally in the coming year or two.