I Am Buying The Dip In REITs

Novice investors often make the mistake of thinking that it is a terrible decision to invest in an out-of-favor sector. However, unless you're trying to be a swing or momentum trader, this is most likely not the case.

Real estate investors have had a tough year in 2022; the Vanguard Real Estate ETF (VNQ) has seen negative single-digit returns. However, it's important to note that real estate values have not fallen to the same degree.

The decline in the value of publicly traded real estate investment trusts is largely due to their use of leverage. REITs that rely on high levels of leverage struggle to maintain strong dividends when the price of leverage increases. The key is to identify REITs with low leverage costs and healthy dividend coverage. Here are two such picks.

Pick #1: EPR - Yield 7.4%

Late last year, EPR Properties (EPR) saw its share price decline after a large tenant (Regal) filed for bankruptcy. However, EPR's management is highly competent and capable of dealing with the tenant's issues.

EPR's properties are essential to the business and are cash-flow positive at the property level. EPR has a master lease that covers multiple properties, ensuring that a tenant cannot just walk away from a single poor-performing property. While EPR was willing to renegotiate the lease with Regal, it went to the negotiation table from a position of strength.

Regal needed to rent EPR's properties more than EPR needed Regal's rent. The new agreement provides a clear outlook for EPR to maintain its current dividend and has upside potential for dividend growth in the future. Overall, this lease structure provides a reasonable base rent for EPR and some upside if the box office continues to recover to pre-COVID levels.

Pick #2: Realty Income - Yield 4.8%

Realty Income Corporation (O) is a great investment option for income investors. O is one of the oldest publicly-traded REITs and has declared 636 consecutive monthly dividends, earning it the nickname "The Monthly Dividend Company."

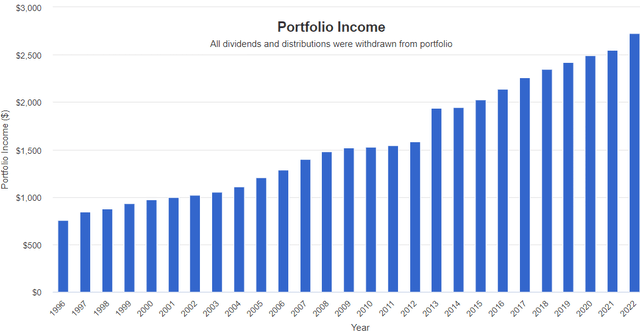

O's success as an income compounder is impressive. From 1996 through 2022, the income received by an investment in O increased 360%, without a single penny reinvested.

This was accomplished through two recessions and a few black swan events, making O a reliable income investment.

O operates a straightforward business model of owning a portfolio of nearly 12,500 properties in the U.S. and Europe, including gas stations, dollar stores, pharmacies, and grocery stores. O purchases the real estate and leases it to tenants, earning most of its money from rent over many years. By maintaining an average lease term of nearly 10 years, O has historically experienced very stable occupancy and rental income.

O has an A3 credit rating from Moody's and an A- rating from S&P, providing it with relatively cheap access to capital compared to its REIT peers. O has the expertise and financial muscle to raise capital and invest it for solid returns, even in challenging environments. With O, you can happily watch your income grow like a weed.

Conclusion

As an investor, it's important to consider the leverage or debt of your investments to ensure you receive great income from the market. Leverage can be useful when the economy is on the rise, but it can be harmful during a downturn. Therefore, we advise against using margin to leverage your portfolio heavily.

The objective for a professional income investor is to have a dividend-funded retirement, with the use of market tools. This way, you can enjoy financial security and independence without worrying about portfolio price swings. That's the beauty of income investing.