How Will TSLA Earnings Affect Metals?

With TSLA’s earnings coming out this afternoon, I thought it would be a good time to discuss the ramifications for the metals complex.

As the demand for electric vehicles increases, so does the demand for silver. You see, silver’s high conductivity makes EV’s much more efficient by creating lightweight but strong electrical connections. In fact, it is used in many crucial applications in production.

As some examples, silver is used to coat electrical contacts for functions like power steering, automatic braking, and navigation systems. Silver is used in the anode and cathode of EV batteries, which are the electrodes that allow current to flow. Silver is also used in high-performance electrical switches, high-power connectors, and certain control systems.

Now, if you think you have entered the twilight zone with the start of my update, then you are 100% correct. Of course, the direction of silver is not going to be determined by the production of electrical vehicles or the myriad of other reasons fundamentalists have told us will cause silver to skyrocket for over a decade. I was just having a little fun. (smile)

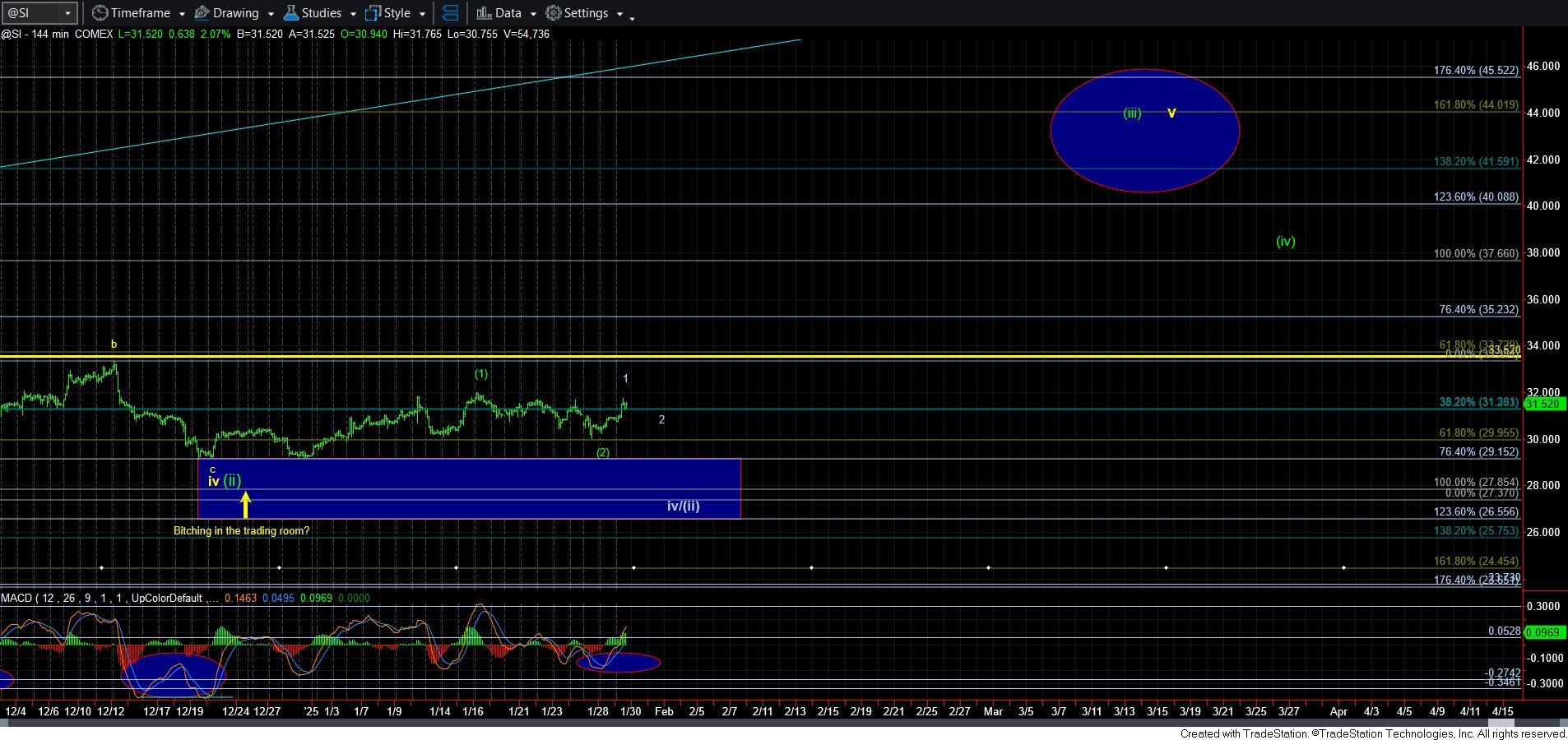

In the meantime, silver is certainly trying to provide us with a 5-wave rally off a potential wave [2] low. Ideally, I would prefer to see silver back to the 32 regio to give me a better 5-wave structure. But, even so, PLEASE remember that we are dealing off a potential leading diagonal for wave [1]. That means we have to be a bit more cautious about this action. So, for me to be adding more aggressive long positions, I will need to see that 5th wave complete, followed by a corrective pullback, and then rally back over the high of wave 1. That will likely trigger me into some aggressive long positions in silver.

As far as GLD is concerned, well, I still am trying to patiently await an appropriate wave 2 pullback. We really have not seen much of a pullback yet, as it has simply been a very high level consolidation. But, I am going to give it a bit more time and a bit more room to give us an appropriate wave 2 over the coming week or two.

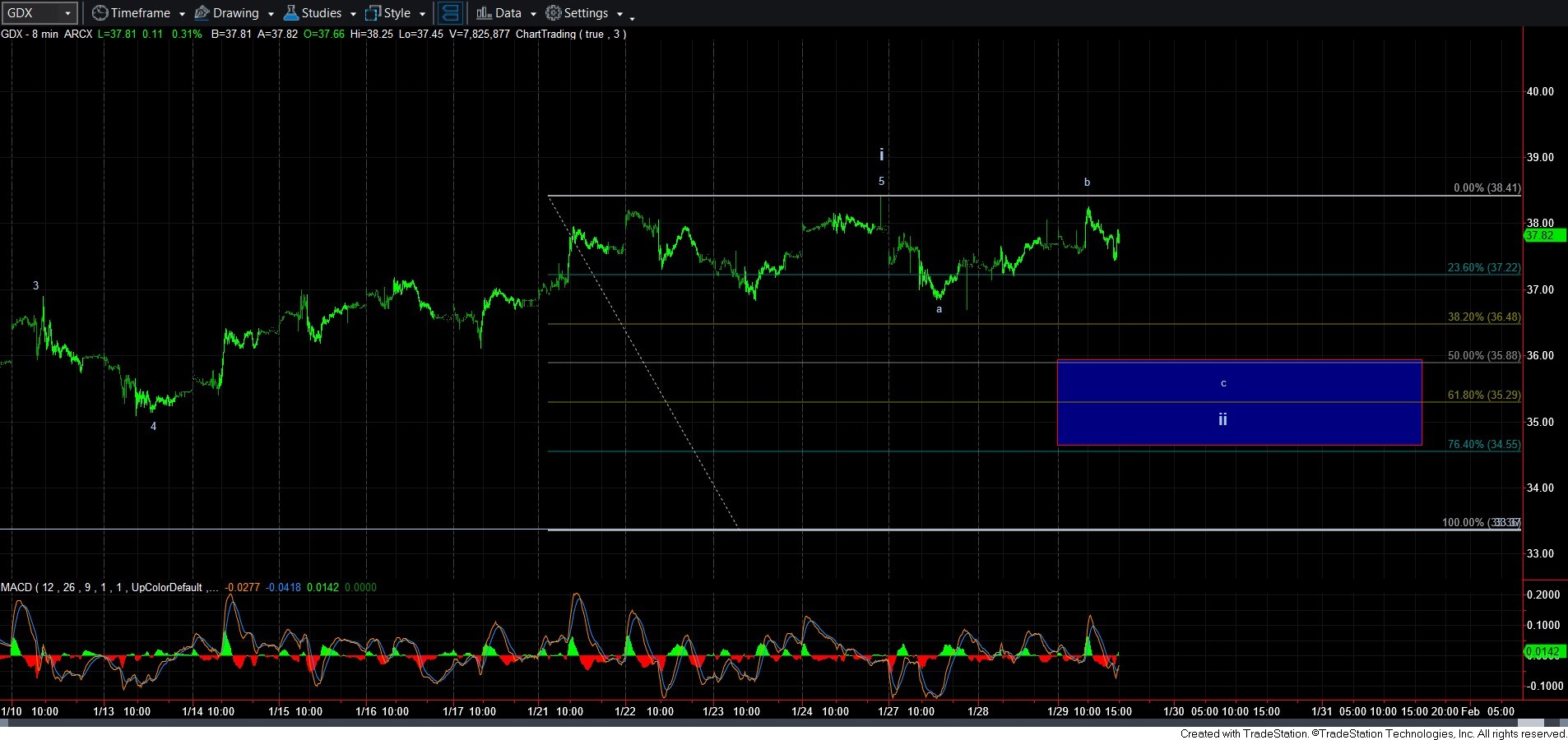

In GDX, I have the same issue as GLD. Ideally, I would like to see a c-wave down to our support/target box below presented on the 8-minute GDX chart.

So, I really do not have to make this more complicated than it has already been. For now, I am going to continue to reiterate that it is unlikely that the metals bull market is done. Rather, I see it as a very high probability that we will see AT LEAST one more major rally, and potentially two, before this bull market runs its course. We are now simply trying to identify the trigger for the 3rd wave of the next move higher.