How Things Change In Metals

It was just two months ago that many were attacking me for my overall bullish bias in the metals complex, as I was reinforcing my view that the bull market is not yet done, despite the decline we were seeing at the time. And, as gold is making higher highs now, I am still very much of the same opinion.

So, allow me to re-state what I said in my live video today.

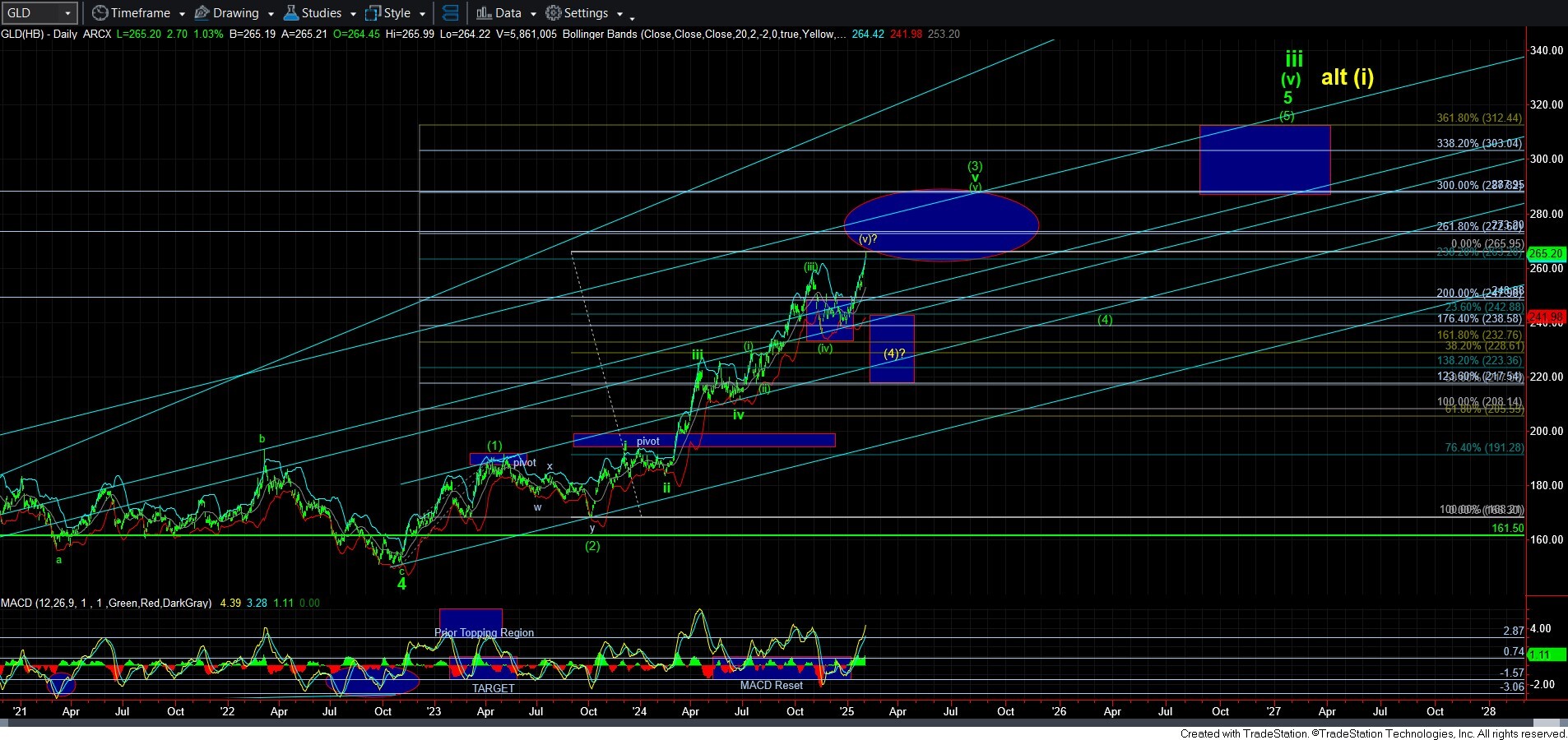

Two months ago, my primary count maintained an expectation in GLD that we would see 2 more higher highs before this bull market completed. Today, we are seeing the first of those higher highs. While the move was not clearly evident as we moved higher in a 3-wave rally, we now have the minimum number of waves in place to consider all of wave [v] done, which is why I have an alternative in yellow on the chart with that notation. But, the main reason I do not have that as my primary is because of GDX and silver. Allow me to explain.

GDX really would look best as only the initial move up in its wave [5] of 3, as shown on the daily chart. But, it means that all pullbacks now MUST be corrective in nature. And, as long as pullbacks maintain a corrective nature, I will maintain the green count in GDX. Moreover, this would likely align with the green count in GLD, wherein the next pullback is actually a b-wave in a very extended wave [v].

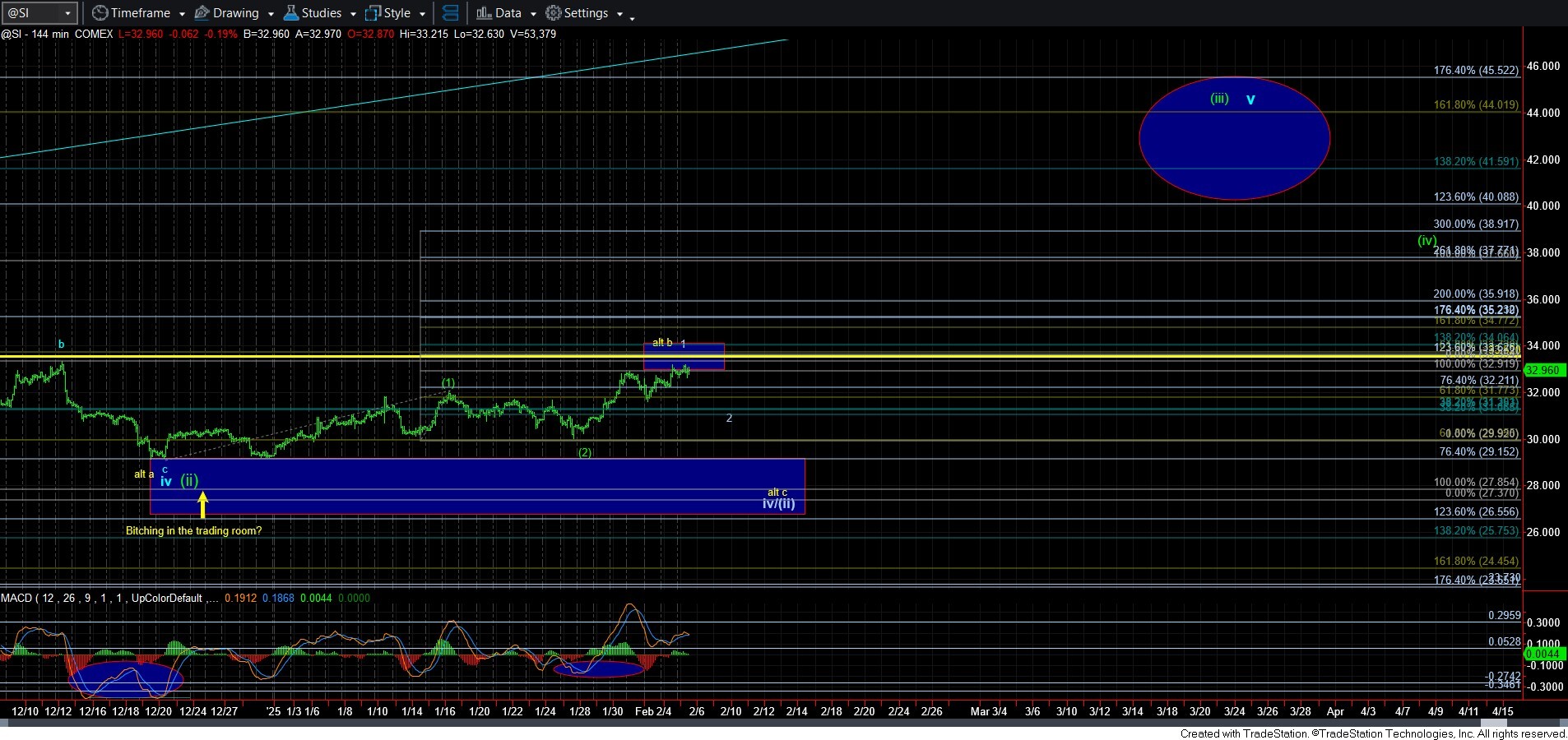

And, yes, I am viewing silver in the same manner. That would mean that as long as silver respects the resistance box we are now striking, the next pullback, if corrective, will be wave 2 of [3] of [iii], and can then set up a heart of 3rd wave, for which many have been patiently waiting (and for which others have not so patiently been waiting). But, as we have been trying to outline, we are coming to the end of this metals cycle which began a decade ago, and silver will likely outperform in this segment of the cycle, as it has historically. So, we really have to be prepared for a 3rd wave beginning at any time now.

While the market has certainly extended a bit further than I expected in this move right now, I still think it is reasonable to expect some kind of pullback imminently. Of course, if silver were to break out through its resistance box in a more direct manner, I would have to view us in the 3rd wave across the board, and expect the higher targets to be on our radar in the 3 charts sooner rather than later. But, for now, this has to be an alternative for me due to how extended the market is currently. Moreover, the manner in which I am personally playing this market right now is that I am still riding ALL my long positions, but had added some protective out-of-the-money puts based upon my general initial downside targets. In other words, I have added insurance for the pullback that I believe is a reasonable expectation at this time.

So, again, as long as the next pullback in silver and GDX are clearly corrective, then I will be looking higher in a more immediate sense, especially in GDX and silver. However, here is the kicker. If silver and GDX provide us with a clear 5-wave decline, then I am going to have to assume will see a much deeper pullback in yellow in silver and GDX (take note that I have changed the purple in silver to yellow to align with GLD and GDX), which likely will be accompanied by a wave [4] in GLD too.

Interestingly, this could mean that the wave [4] may not take quite as long as the multi-month correction I had initially expected, as I thought it could take at least 2-3 months long. So, I am just opening my mind that if the market takes this more immediate downside path, then GLD may complete its wave [4] sooner than I had initially expected.

But, such an immediate and deep downside path in yellow in the metals market would then suggest that the next rally in the complex will likely complete the entire cycle which began back at the end of 2015 and early 2016.

So, this really outlines how important the manner in which the next decline takes shape to the larger degree structure. And, I wanted to make sure you understood my bigger picture thinking, which will likely be determined based upon the manner in which the next decline takes shape.