Hopium Seems Contagious - Market Analysis for Sep 7th, 2019

As the market has ebbed and flowed over the last several months, the media has basically been focusing upon “fears” of trade deals or recession on the way down, with the supposed alleviation of those fears on the way up. Yet, these interpretations of the market gyrations are presented after the fact.

When we take a step back to understand investor psychology, we understand that markets move based upon emotions all the time, so it is quite logical to see the media attribute various fears to causing market declines, and optimism as causing market rallies.

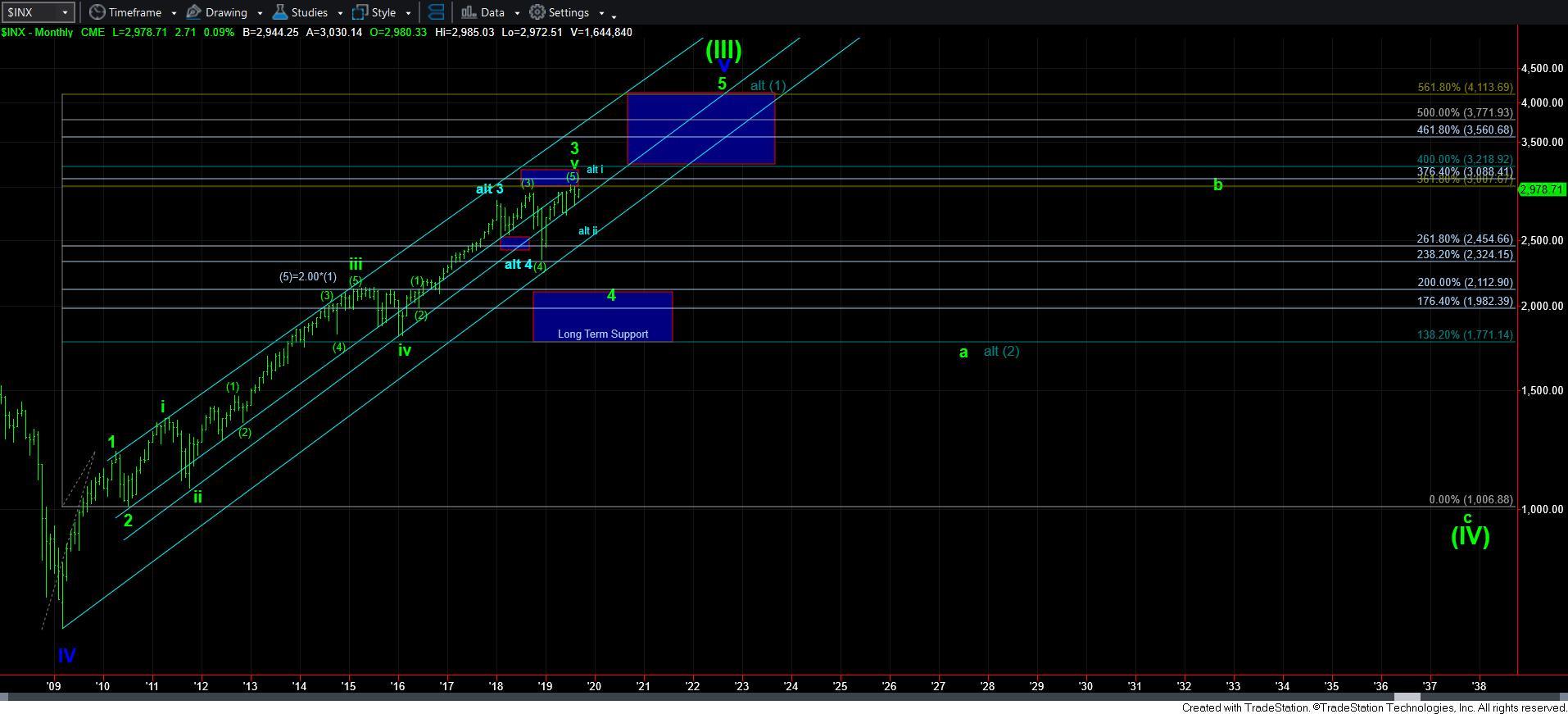

Understanding the larger context within which the market gyrates often puts these gyrations within a more understandable framework. In our case, I still think the market is moving to and fro within a larger corrective pattern. Moreover, Elliott identified that these corrective patterns are quite variable in nature. Whereas impulsive structures tend to be relatively predictable, these corrective structures morph quite often.

This past week, the IWM provided us with a “setup” for a c-wave decline. Yet, as we highlighted at the time, the SPX did not have the same setup, as it had potential to extend its [b] wave rally higher. So, while I highlighted the IWM setup through the week as it was developing, I cautioned about getting too aggressive on the downside before the setup actually triggered:

As I have been writing for the last few weeks, the IWM has been providing us with what could be a textbook downside set up. And, today, it took another step within that set up. So, let’s discuss what it would take to perfect that set up.

Thus far, I have been outlining that the initial decline off the late July high was a 3-wave decline, which was followed by a [b] wave flat. That means, we have been looking for an impulsive downside set up for the [c] wave decline. Last week, the market bottomed at what counts best as a 5-wave decline, which I counted as wave 1 down in the [c] wave. The bounce we experienced off that low counts best as a 3-wave corrective rally, which slightly exceeded our target for a wave 2 retracement.

Since the high of last week, we have what can also count as another 5-wave decline. While this last 5-wave decline off last week’s high is clearly not perfect, it does count rather well from an internal Fibonacci Pinball structure, and this decline also took us right towards the .618 extension of waves 1 and 2, which is the ideal target for wave i of 3.

Therefore, in order to perfect this set up, we will need to see a corrective rally for wave ii of 3, followed by a break down below the low of wave i. Moreover, as you can see from the attached 3-minute IWM chart, I have added a pivot box again. In order to be much more likely that we are in the 3rd wave down, the market will have to break down strongly below this pivot, and then hold below it as resistance. Should we follow these steps, the minimum target expectation would be the 136 region, but I would prefer us extending down to the 133/34 region.

Yet, I do have to point out that the SPX does not have as clear a decline structure in place. So, clearly, this makes me a bit more cautious. Yet, if we are able to break down below last week’s low in the SPX it would go a long way in making me a believer of an impending decline pointing us below 2700SPX.

With the break of the downside setup in the IWM, I have no immediate indication that the market is set up for a larger degree decline just yet. Rather, we seem to still be within a more extended and complex [b] wave rally. The question is of what degree.

I want to reiterate that all the main points I have noted in the past about the general wave degree for the market remains the same. I still believe that we will likely see much lower levels to come even though the market is not yet ripe to be immediately pointing us down just yet. That is what the broken downside set up on Thursday told us. But, the larger degree structure should remain well intact.

Therefore, I am going to be watching the IWM very intently in the coming week. As long as it does not complete a full 5-wave structure off the recent lows, I have to view this price action as further complex machinations within the [b] wave we have been tracking. Most specifically, the 148-149 support are going to be rather important early this week. As long as the IWM remains over 149, it can retain the potential to complete 5 waves up off this past week’s low. A break down below that support opens the door to this complex [b] wave finally having topped.

Yet, if the IWM is able to complete all 5 waves up in the coming week towards the 156+ region, then the nature of the decline off that high will tell us what we need to know over the coming months. Should that decline be clearly impulsive in nature, I will continue to look lower to those targets we have below the current price lows. However, should the decline be corrective in nature, and then we break back out over the high struck for that 5-wave rally, that will force me to viewing the market from the long side over the coming months, as presented in the yellow count on the 60-minute IWM chart.

The main issue that I have with the yellow count potential is that I have no reasonable relative perspective for this within the SPX wave structure. You see, the SPX completed a 5-wave topping pattern into the high struck in July. Therefore, my primary expectation must remain that we are now in a corrective decline phase after completing that 5-wave structure from December 2018 until July of 2019. And, I do not view it as highly probable that the decline we experienced in the one month of August is going to provide us all the “correction” we would expect after a 7-month rally, especially when there is no clear completion to that corrective structure.

Therefore, I have to maintain a larger bearish bias due to the larger degree structures being presented. But, until we see the next decline setup developing and triggering, I will simply remain quite skeptical of the “hopium” which seems quite pervasive during the rallies within a larger degree corrective structure, yet have no reason to aggressively trade for the downside.