Holding Strong Into Month End

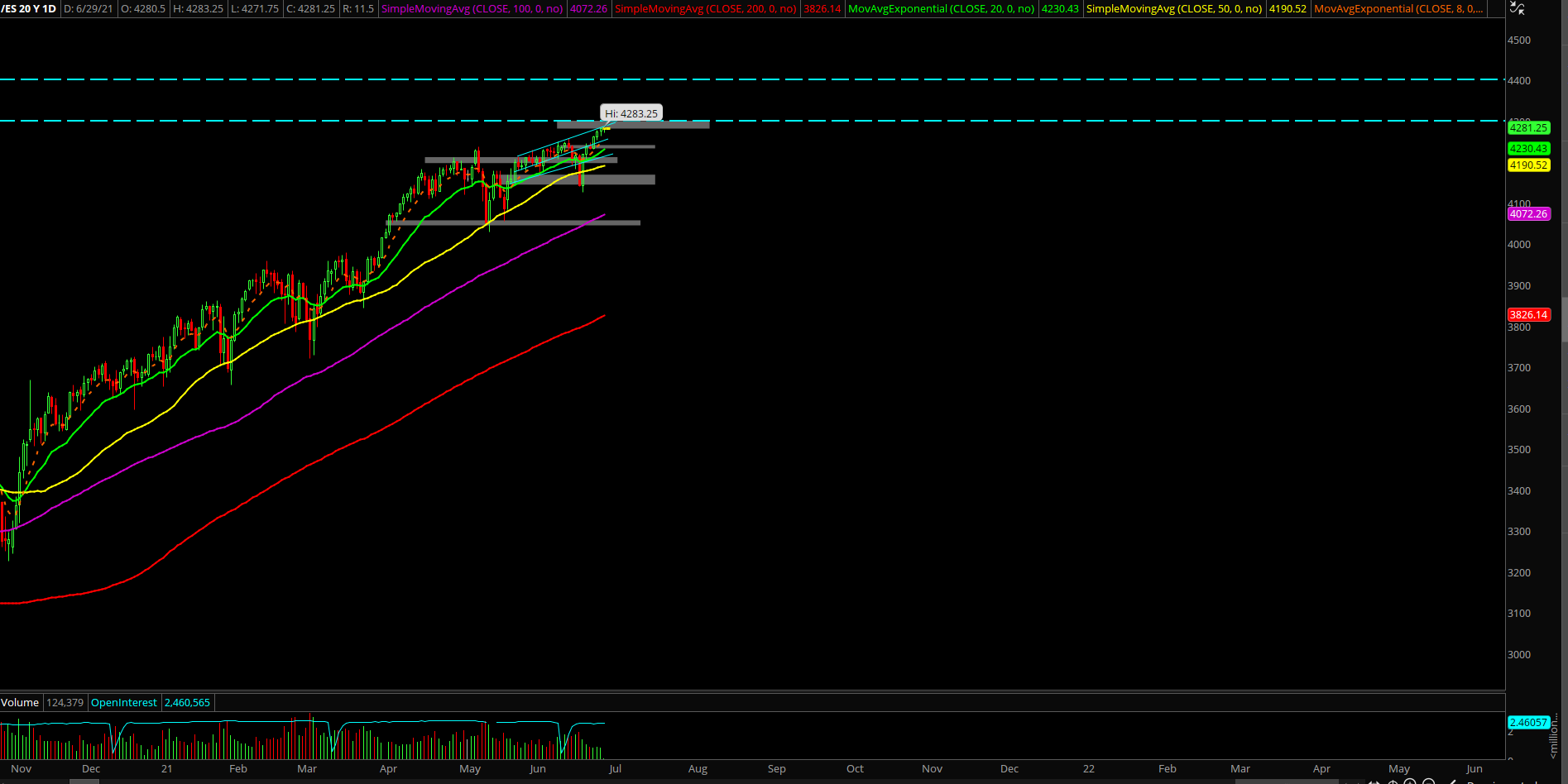

The Emini S&P 500 (ES) closed Monday at 4280.50 around the highs of the session as it was another slow grind.

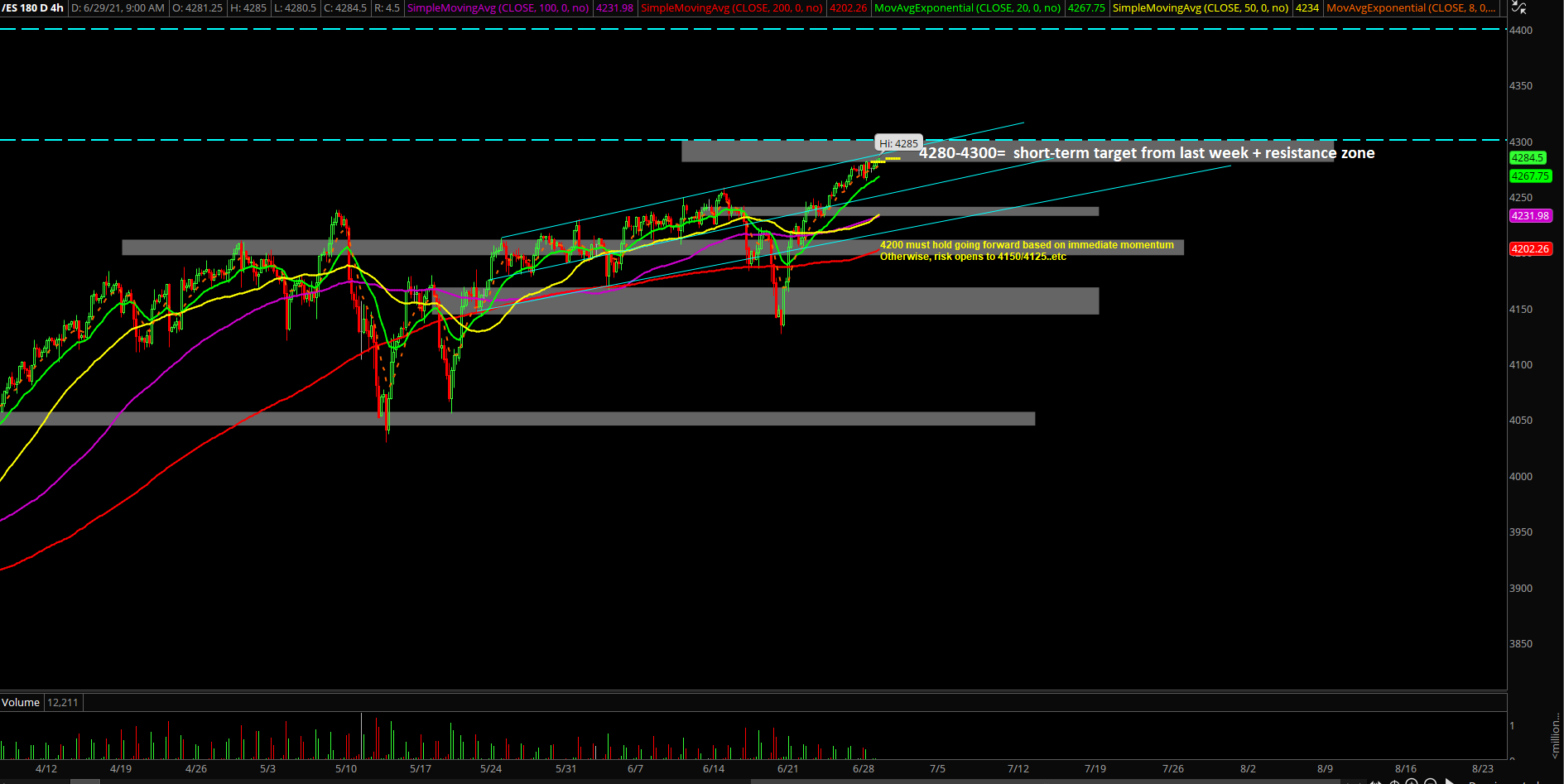

Expect 4280-4300 to provide immediate resistance to reset some of the short-term overbought condition, so look for applicable buyable dips here to play for the bigger picture.

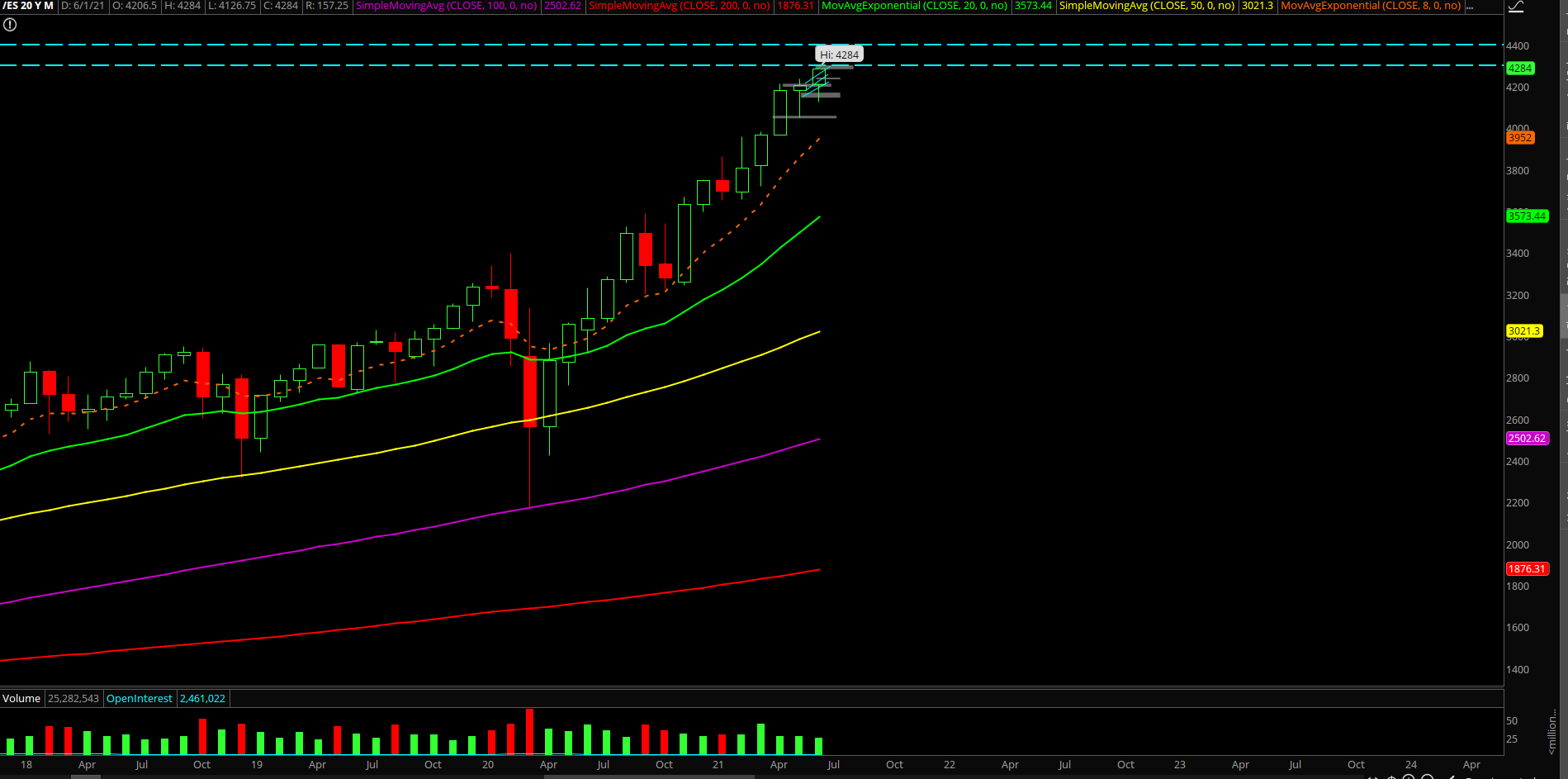

This week is mostly about holding strong for the month-end closing print at/near highs because it’s been an uptrend month once again(surprise surprise, bull market making higher lows+higher highs). Then, setting up for the strong July seasonality.

Keep in mind July is the 3rd strongest month based on returns via past 20 year S&P 500 data. We’re expecting more of the same grind up structure; market is a launch pad towards 4300 and 4400.

Immediate supports are located at 4265/4258. All dips above 4200 are buyable into 4300 and then 4400.

If the ES sustains above 4300, the market could accelerate even faster into 4400 (outside the current uptrend channel).

Know your timeframes and risk exposure here as we move into the holidays/July.

Bonus notes: NQ/tech remains the strongest and it has outperformed as we expected for the past few weeks/months now. It is holding everything together at the moment alongside most of our ‘best in breed’ picks’ (shared freebies in private room), which continue to outperform the market.

Manage risk properly if you are operating an uber bullish tech portfolio like us. Racket up stops dependent on your timeframes and enjoy the lazy river approach. Easy money for the time being, given nasdaq/tech riding above the daily 8+20EMA strong bull trends.

If and when tech turns south, it could get real ugly for ES+RTY…more volatility picks up/mood swings. Otherwise, expecting more of the same pattern, resilient grind up towards our 15k target. Level by level approach (as of June 29, NQ hovering at 14500).