Highest-Probability Path (Higher) Winning Out Again

Signals went long last week, and I pounded the table for members to "buy it if it ain’t nailed down." On 4/8, I held hands for newer or timid members to get them full allocated…if you aren’t at least in one of these trades, then sigh.

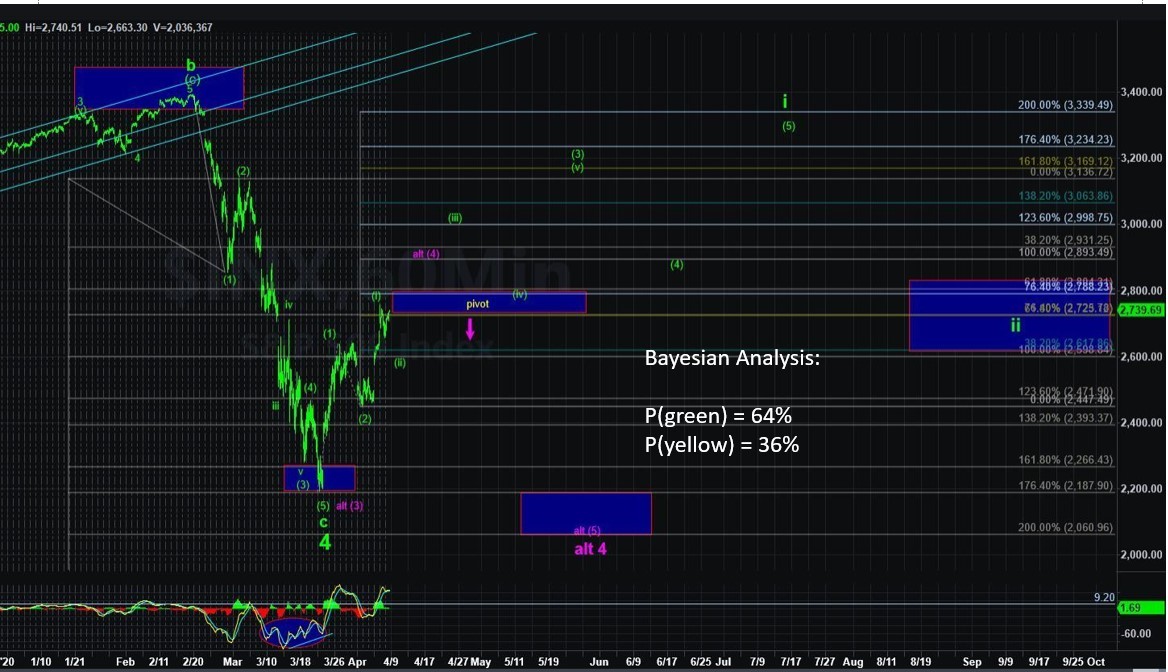

Let’s discuss aggregated probability paths: (1) [P=19%] SPDR S&P 500 ETF (SPY) stalls out in the 270s and tumbles back to the 210-220s more directly, (2) [P=54%] SPY grinds its way thru the 270s and finds its way to the 285-295 region before the next decision will be made, (3) [P=27%] SPY stalls in the 250-270s region in a choppy, nearly untradable range.

Bottom line: The highest probability path does appear to be winning out again, and has led to one of those perfect trading weeks = boring and very profitable.

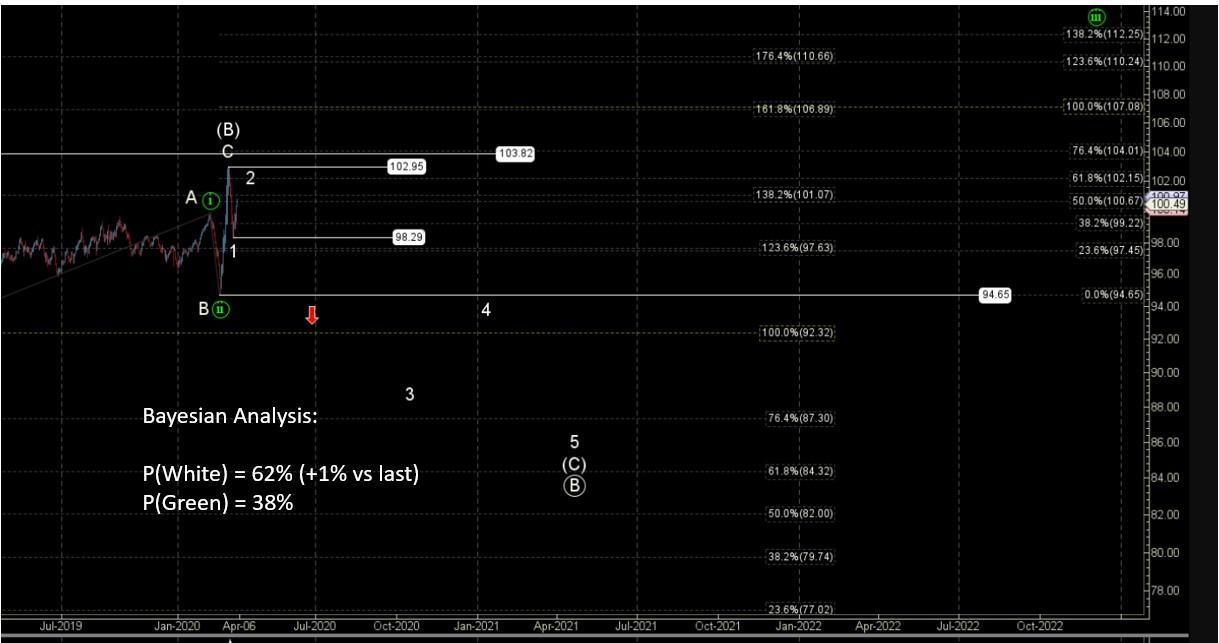

LONGER-TERM LONG POSITIONS UPDATE: I’ll leave this here another few days, but last week provided a potential pullback low with prices that may not be seen again anytime soon. As I wrote: “Today (4/1) I will begin scaling back into my longer-term long positions, because in probability terms, 'the bottom' is most likely in. Depending upon market action, it is my intention to get back into 100% of my longer-term positions on this current sell off that could see as low as 240 (and possibly even a quick reach into the 230s). When getting into longer-term long positions, I err on the side of 'getting in' versus 'getting the best tick penny price.' From before: As I’ve said before, below 200 is 'bad for longer-term bulls' and targets the 170s and possibly lower as we begin a multi-year bear market.”