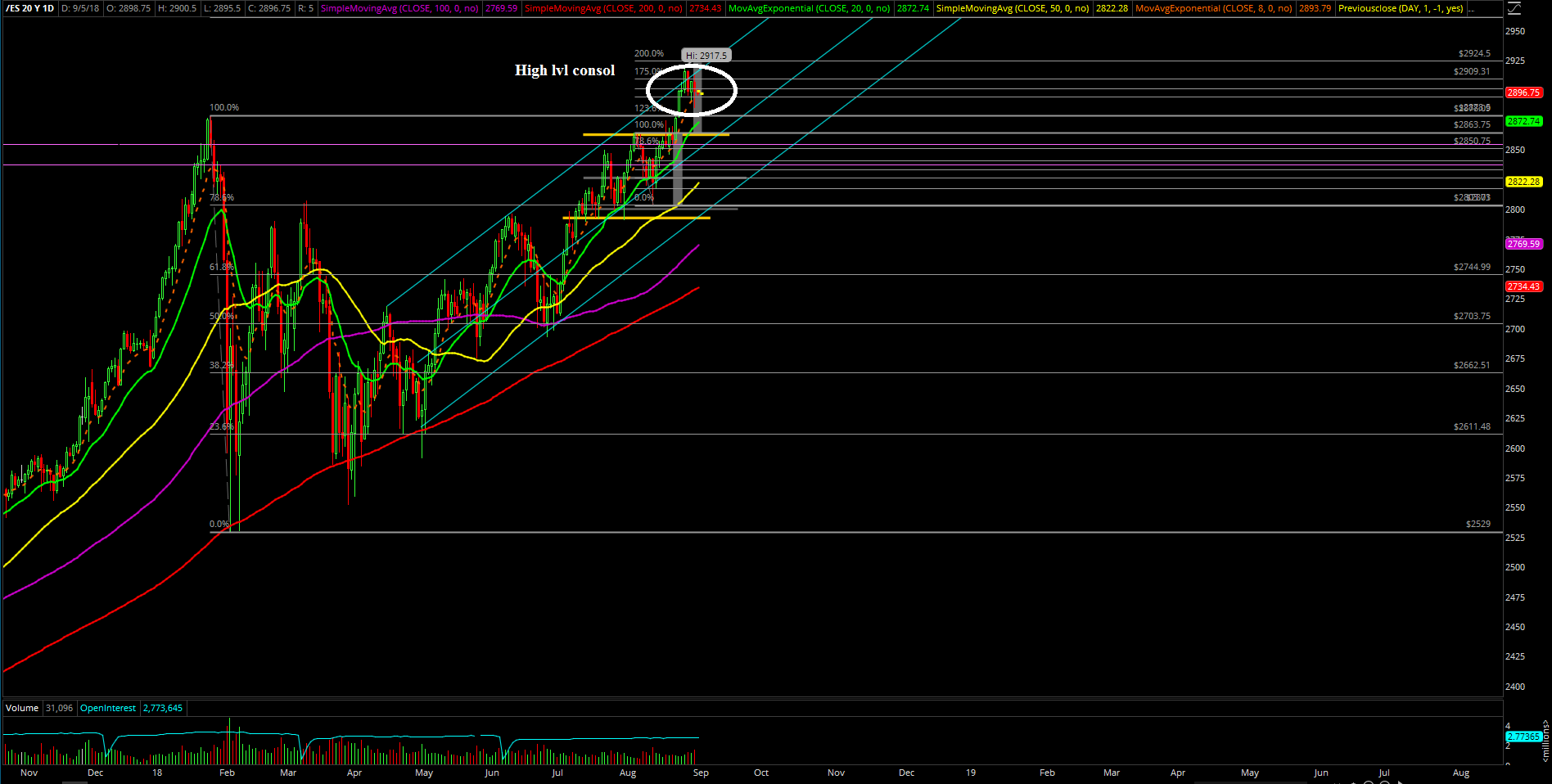

High Level Consolidation Again

Tuesday was one of those typical rangebound consolidation sessions. It really started with the overnight micro double-top pullback at 2912 in the ES (Emini S&P 500) at around the 3AM European open into the US RTH (regular trading hours) open that flopped around the key levels we had discussed.

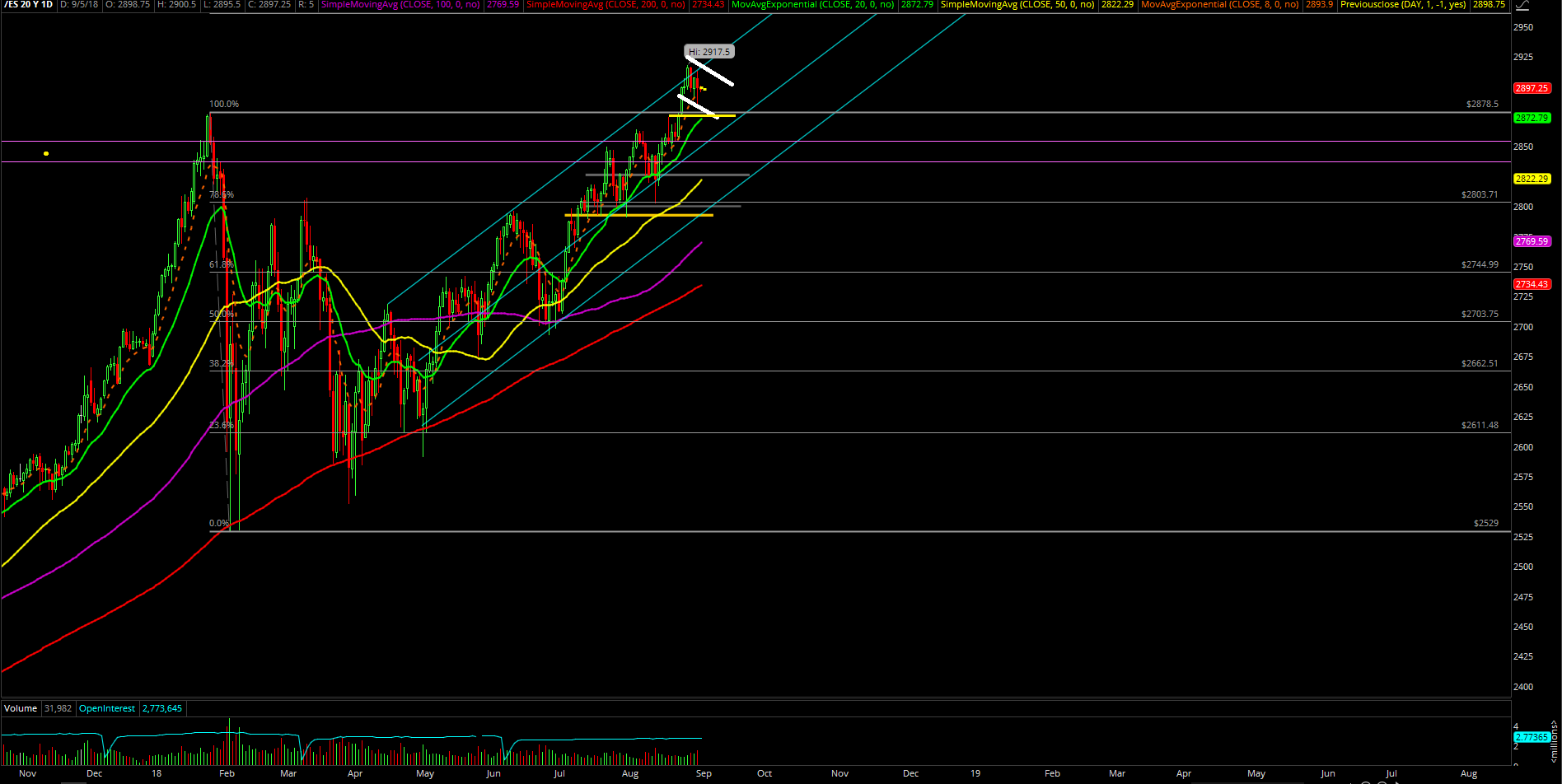

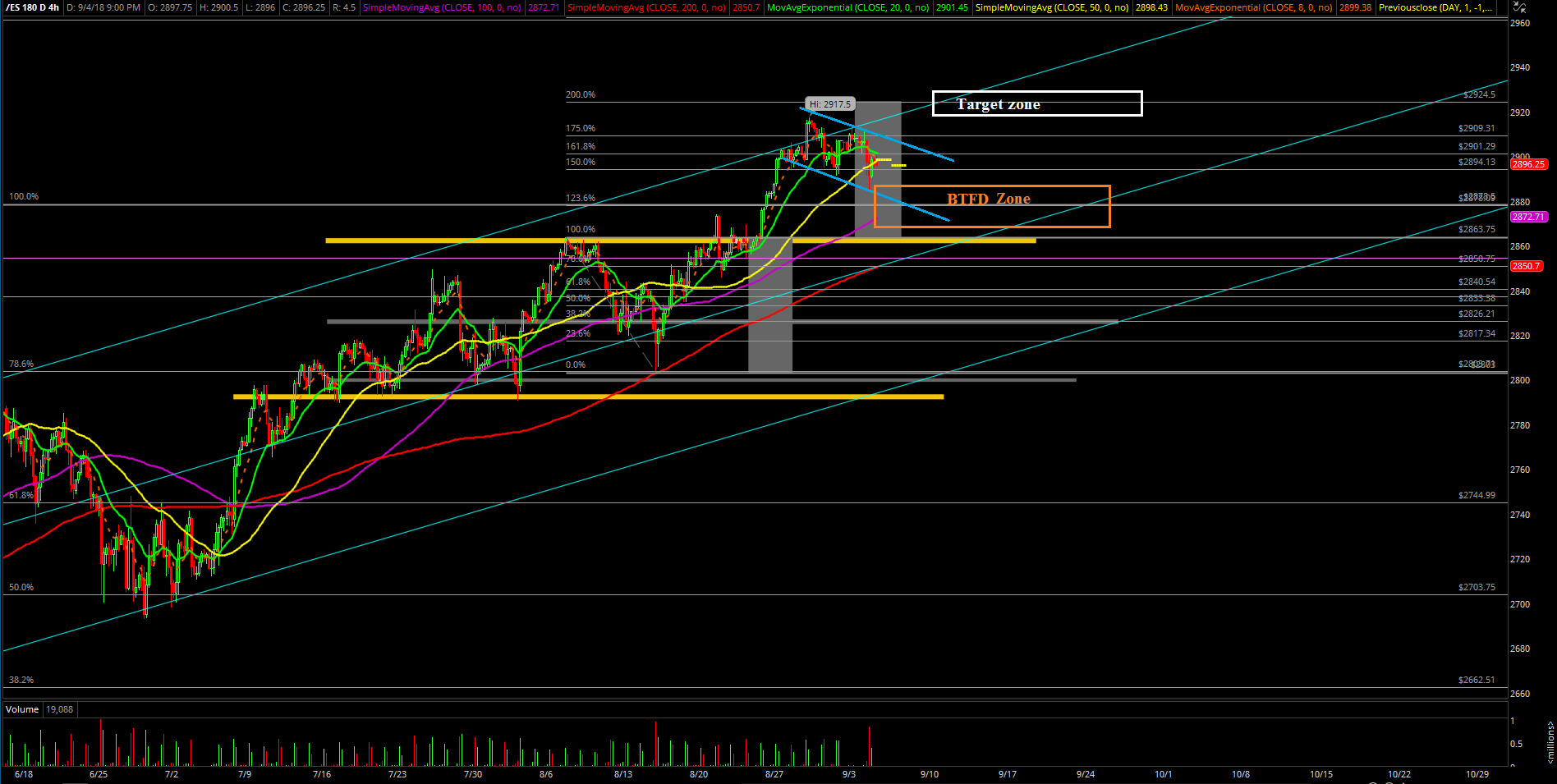

As we demonstrated earlier in our ES trading room, we managed to buy the morning dip at the lows and sold at the highs for a quick ride. In simplest terms, the overall market is back into a 1-hour/4-hour bull flag/high level consolidation pattern by taking a breather after the impressive 3-week upside acceleration run from 2803 to 2917.5 highs.

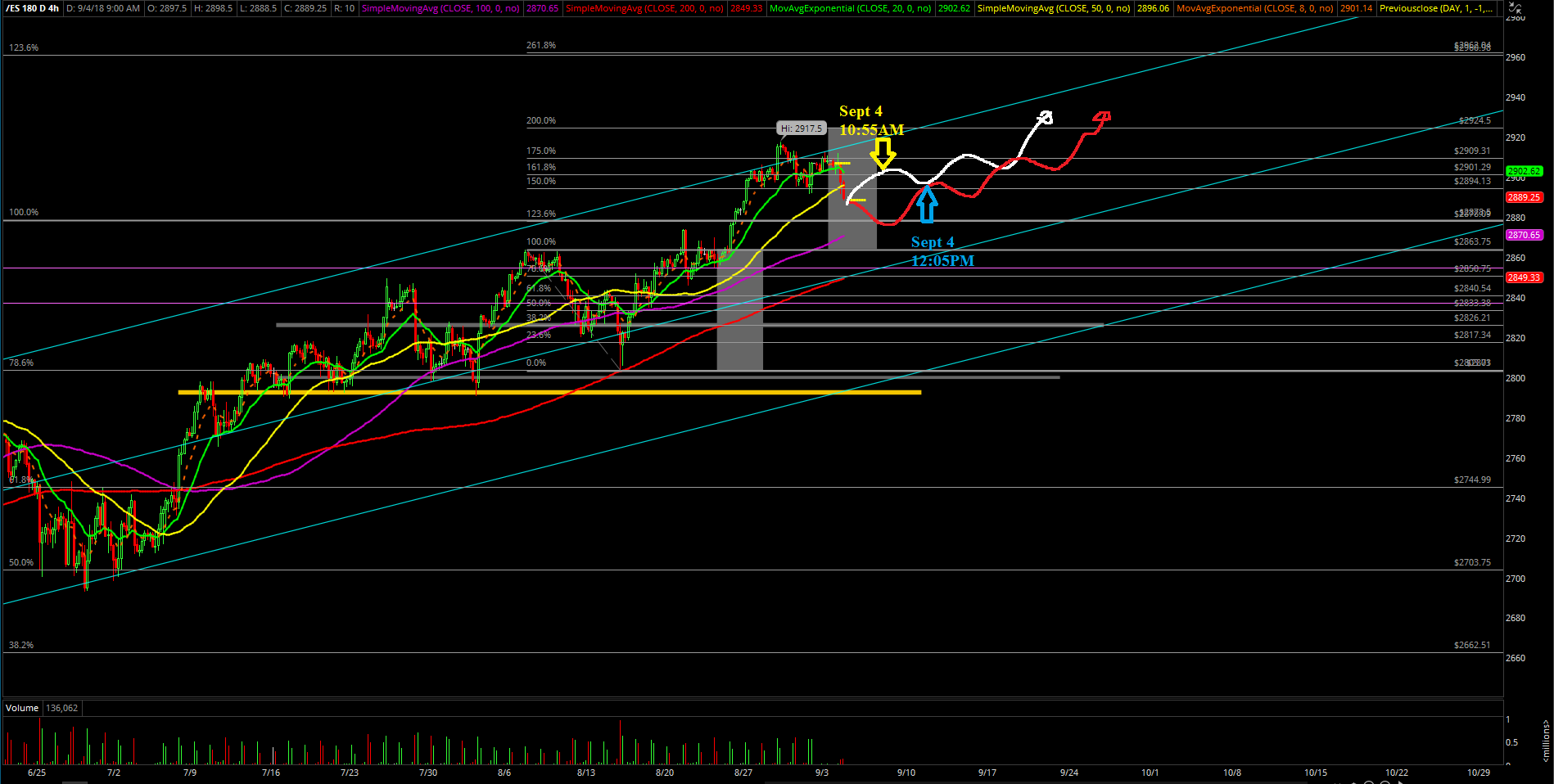

The main takeaway from this session remains the same: The pre-determined/corrective dips are considered an opportunity and not a risk when above the must hold swing from Friday from the trading room. Also, today’s newly updated 4-hour projection chart highlights the same end goal/result for the current bull train back towards the 2920s measured move target.

What’s next?

Daily closed at 2987.25 with top and bottom wicks indicating indecision and market doing the good old high-level consolidation in order to take a breather.

Heading into Wednesday, we expect the market to continue the same corrective pullback when below 2912 along with daily 20 EMA (exponential moving average) trending support around 2870. For reference, last week’s low was 2876.75 for immediate trending purposes and confluence. When above 2912, then obviously the bull train is trying to immediately breakout and follow the 4-hour white line route.

Currently, the micro market action is just flopping around with white versus red line projection morphing back and forth until it’s ready to ramp up again towards the 2920s (or beyond) as long as our key support holds obviously. As shown on the projections, there’s still a possible micro OML (one more low) for bears out there instead of getting obliterated from the past couple weeks.

Either way, traders should be aware of the inside/consolidation day potential Wednesday along with the bigger picture showcasing a clear risk vs. reward for the upside. We’re going to keep utilizing the same trading strategy and level-by-level approach as we’ve been doing for the past few months that is outperforming the market.