'High Dividends Investing' And StockWaves Work Together To Boost Your Income

Summary

- "High Dividend Investing" lays the foundation for long-term recurring income through its income method.

- Elliott Wave Trader is one of the best platforms for capital gains.

- You can mix them together for outstanding all-around returns.

I've been asked a lot lately, by both income investors and those who trade more frequently how exactly High Dividend Investing and Elliott Wave Trader can be used effectively in tandem. I am an income investor with a bend towards value investing. Find those companies whose perceived risk greatly outweighs real fundamental risks and who can pay me for holding them.

In the long run, dividend investing is extremely defensive. Each dividend received is a form of real-world cash returns that cannot ever be taken away. Dividends can and do provide a massive boost in returns as the years and months roll on. This is why The Income Method is so effective, you find a great security, buy it and stop fretting about its short-term movements.

So how can you mix the long-term wealth-generating powers of The Income Method with the higher frequency of trading that proponents of Elliott Wave Theory enjoy? In fact, they are made to work together. Most of us have 2 portfolios, one earmarked for trading, and one we use for our savings and retirement. High Dividend Stocks are the kind of investments you want own in your retirement account!

The Short-Term: Generate Positive Returns For A Foundation

We all know that EWT is fantastic at locating quick and hefty profits from market movements. We know this since EWT has been proven to generate returns from recognized market movements. Ralph Nelson, in 1920, formulated the foundations of EWT to capitalize on these movements.

Considering that the average American has only $65,900 in their total savings according to a 2020 Planning & Progress Study by Northwest Mutual. So most investors could benefit in the immediate term by using EWT to identify opportunities to invest at the best prices. Being careful and making sound decisions is always a must. Never bet your entire savings on any single call.

The best part about dividend investing is- the dividends! When you have an income portfolio, you will have consistent cash coming into your brokerage account. When you use your dividends to buy more shares, your income stream will grow without any external investment.

Yet the stock that just paid you the dividend is not necessarily the best option right now. This is why we do not recommend "DRIPing" your dividends. DRIPing automatically reinvests in the same stock regardless of its current price. This is better than not reinvesting at all, but you can achieve better results by reinvesting your dividend stream in stocks that are trading at the best prices right now.

We recommend sitting down at least once a month and manually reinvesting your dividends in the best opportunities, whether that is adding to investments you already hold or something entirely new. Personally, I go through all of my holdings once a week and make a list of picks that are trading at attractive prices.

This is where techniques like EWT can help you identify which picks you want to reinvest in right now, and which you might want to wait a little bit longer. The better price you get when investing, the higher your yield! StockWaves is providing a weekly report specifically available to members of both services to identify the best time to add to HDI picks.

A Brief Aside on Historical Wealth Generation

What do we mean when we mention historical wealth generation? We are harkening back to the foundation of riches vs wealth.

We need to take a trip down history lane for a second, leaving our city and sedentary lifestyles behind, take a turn past the beginning on agriculture societies, and land firmly in the hunter-gather stage.

During that time, wealth was not determined by the size of your rock horde or the ability to storehouse goods. Food rots quickly, so they were forced to constantly be looking for more. The ability to hunt and gather effectively wasn't a one-off skill, you had to be able to repeatedly do so. Like a recurring income stream, wealth was determined by those able to continuously use their assets or skills to generate the needed results.

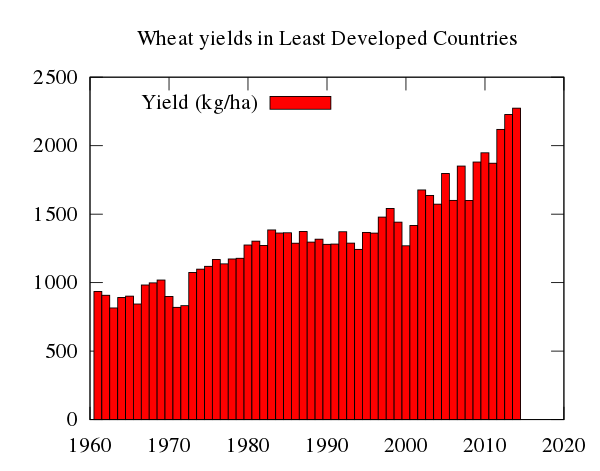

As cultures moved into farming and agrarian societies, the ability to hunt and gather diminished, but the ability to create crops and raise animals rose. Here again, storehousing vast amounts of grain or meat was not the principal determiner of wealth. Nor was owning vast swaths of land, it was the productivity of your land, crops, and animals that separated a subsistence farmer from a wealthy one. The functional ability of those assets. Now the asset-producing wealth is not just your ability, but the ability of your assets – your land and animals. As time and technology improved, so did the output of those farms and lands.

Over time, the focus has shifted from generating recurring products to storehousing "riches." This largely occurred as towns developed and trade became important. We attributed a value upon coins, bills, and precious metals. Then we viewed those people with an excess of those items as "rich." Over time, riches were accumulated by those who had an excess in the functional production of their assets. The farmer with productive crops was able to have the excess income stored in those items attributed with value. As time went on that successful farmer saw his idle assets grow and his functional assets grow as he bought more land and farms.

Jumping years into the future, we saw the concentration of those riches more and more. Thus the way we measure wealth changed its meaning. It's not defined as owning assets that accumulate wealth, but it's simply having an excess amount of them.

With this I disagree, so High Dividend Investing moves investors and retirees back to a historical form of wealth generation. Assets that produce income or assets for you to live off of.

The Long Term: Recurrent Income For Generations

With any plan that will produce strong recurrent income, the foundation is essential. You plan carefully, craft diligently, and produce stellar results. Your income stream must flow from a foundation that is stable and solid. Most founders of generational wealth became wealthy from their own skills or talents.

Over time, the goal will be that your income stream from your portfolio does the heavy lifting, becoming large enough to fill your needs while still reinvesting and growing even larger. Most heirs do not have the same level of talent or interest as their progenitor. So having a family wealth based on the need to master effective trading techniques is riskier than expecting them to not sell anything and enjoy dividends as they roll in.

What I suggest is buying outstanding picks from HDI which can complement your capital gains from EWT. Together with EWT, we will also help you identify the best opportunities in your portfolio to reinvest dividends into as they come in. You will be amazed at how quickly your portfolio's income stream grows!

The end goal? Being able to kick up your feet, relax, and not have to care what the market is doing. Your portfolio is stable, strong, and reliable. Your income stream flows into your account and covers your expenses and enough to reinvest. That's financial independence. That's financial freedom. That's exactly how you can use both The Income Method and EWT to maximum benefit for your life.