Here We Are Again

Calls for sub $1,000 gold are being heard quite loudly. Many are “feeling” that the metals bear market has not ended. And, we have the usual suspects who have been terribly whipsawed in this market following trendline analysis highlighting the current trend line break down again. Isn’t this all too familiar to you already?

Each time this has happened over the last two years, the metals have staged a “surprising” rally to the upside. Yes, when the beachball gets pushed too far down, it is bound to rise to the surface, and often with strong force. And, with this market only going sideways for well over a year, there does not seem to be many left who are looking higher in this market. But, that is how major rallies begin – when most are looking lower or are completely disinterested. Major rallies often begin with the fewest passengers aboard the train.

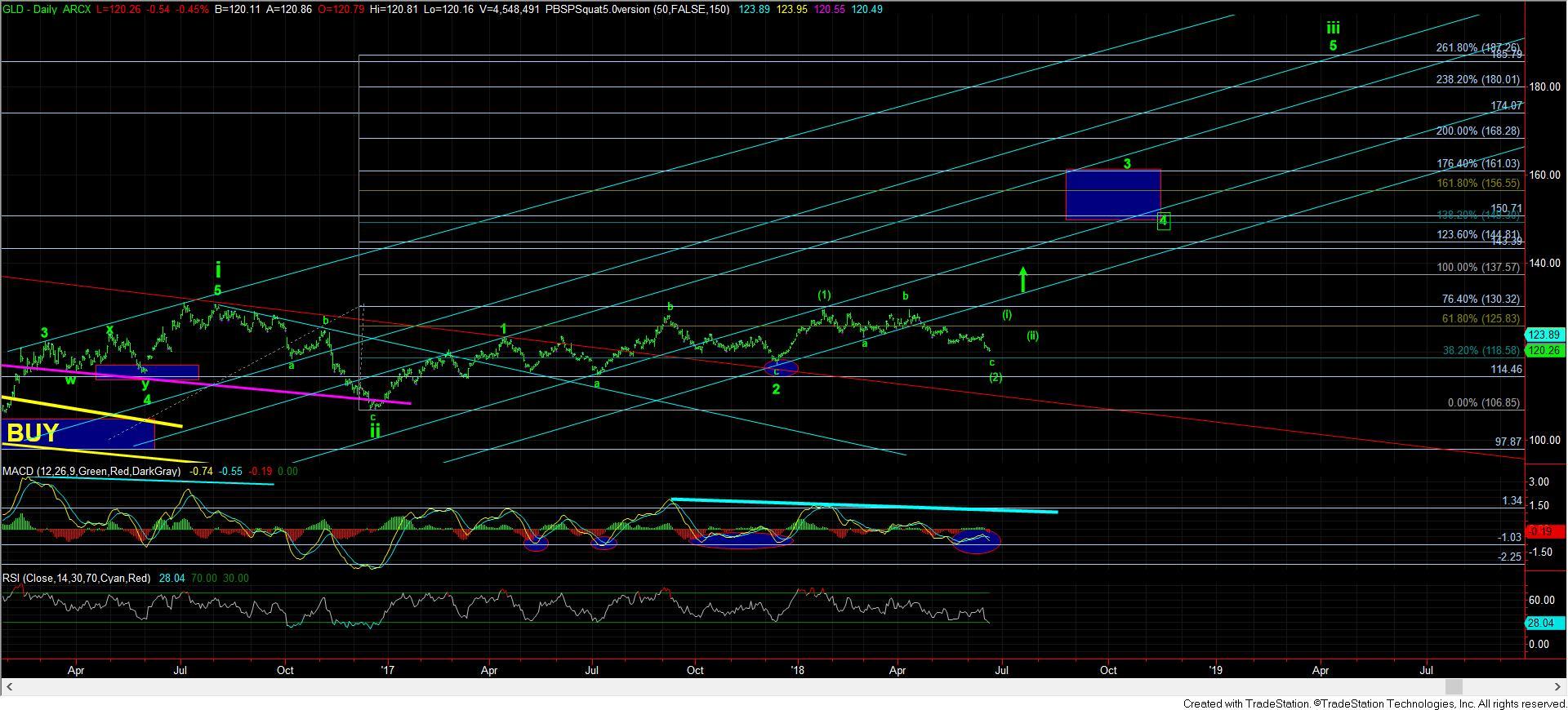

While the market seems to be in the final stages of this micro 5th wave lower, there is not too much more room underneath us until I would be concerned about this bullish set up. In fact, it would seem we are micro squiggles away from this last drop to complete in GLD, as shown on the 8-minute chart. Moreover, silver has a target of 15.95 wherein this c-wave would be equal to the a-wave in this segment of this consolidation. So, as long as 15.95 is held in silver, I view this as the market nearing another bottoming, with a rally likely to follow.

Also, if you look at the 144-minute silver chart, you will notice that I have highlighted the positively divergent MACD, which has signaled an impending bottom for each and every bottom struck in silver for years. And, as I always have asked in the past, will this time be different? I don’t know. All I can tell you is that every time we have had this set up on the MACD, coupled with a completing wave structure on silver for the last several years we have seen silver bottom in the near term.

Also, as I noted in the weekend update, we would need to see an impulsive structure through 122 (lowered from 122.50) to begin getting more bullishly inclined.

In summary, based upon the current micro structures, negative market sentiment, and positive divergences on multiple time frames, it would seem we are completing this downside segment which commenced last week. We will need an impulsive structure off these lows to begin to assume a major bottom has been struck. This set up has been in place for the last year and half, and has not gone away. Is it finally time for the market to take advantage of this set up, especially as most seem to be disinterested or looking much lower? Only the market can answer that question, but, as noted, the setup is certainly in place.