Here Is A Shocker: Oil Is Going Lower

Oil is going to be heading lower, and everyone is now going to believe it is because of what is happening in Venezuela. But, anyone who has been following my analysis for the last year knows that this has been on our charts for quite some time.

Yet, everyone loves a story. And, the story today is that the current news in Venezuela is what is going to cause oil to head lower. Let’s put that to the test.

The current action in oil reminds me of the stock market around the time of 9/11 in 2001. Most investors believe that the 9/11 event caused a bear market in the stock market. But, the problem is that most of those investors are not burdened by the facts of history, especially when there is a good “story” for them to follow.

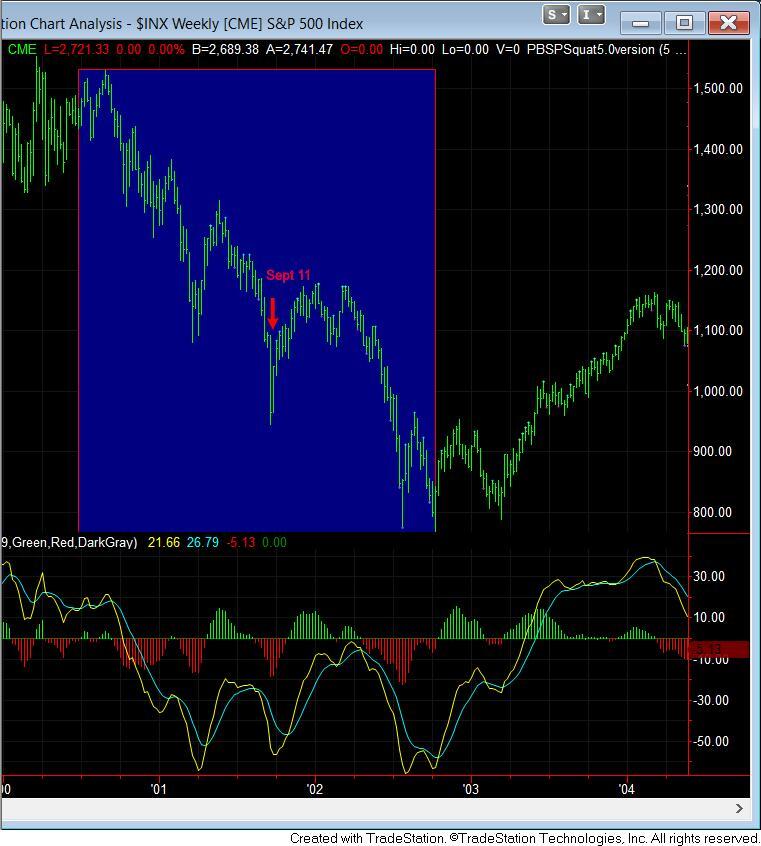

I have provided the following challenge to thousands of my members and clients over the last 15 years, and not a single one has been able to meet this challenge successfully. With the events of 9/11 being viewed as the most impactful event in the United States for the last 50+ years, you would think that it would be quite easy to identify this event on a chart. Well, here is a long-term chart of the SPX with the dates removed, and I challenge each and every reader to identify where 9/11 occurred on this chart:

If you are like the significant majority of investors, you assumed that 9/11 occurred as some high on this chart, leading to a very large decline. But, the truth is much different than the assumptions:

As you can see from the attached chart, the stock market was already within a multi-year bear market when 9/11 occurred. Moreover, and most shockingly, the market was approaching a near term low when 9/11 occurred, and the market was actually higher within two to three weeks after 9/11 than where it was on 9/11.

Clearly, this flies in the face of all expectations that investors have when they view how markets really work. Yet, history shows us that markets do not follow a mechanical paradigm as commonly believed. As Bob Prechter outlined in his seminal book The Socionomic Theory of Finance (a book I strongly recommend to each and every investor and trader):

“Observers’ job, as they see it, is simply to identify which external events caused whatever price changes occur. When news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn’t fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to “psychology,” which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren’t prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators’ mental bias towards mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist.”

Until the times of R.N. Elliott, the world applied the Newtonian laws of physics as the analysis tool for the stock markets. Basically, these laws provide that movement in the universe is caused by outside forces. Newton formulated these laws of external causality into his three laws of motion: 1 – a body at rest remains at rest unless acted upon by an external force; 2 – a body in motion remains in motion in a straight line unless acted upon by an external force; and 3 – for every action, there is an equal and opposite reaction.

However, as Einstein stated: “During the second half of the nineteenth century new and revolutionary ideas were introduced into physics; they opened the way to a new philosophical view, differing from the mechanical one.”

Yet, even though physics has moved away from the Newtonian mechanical viewpoint, financial market analysis has not.

“Many services and financial commentators in newspapers persist in discussing current events as causes of advances and declines. They have available the daily news and market behavior. It is therefore a simple matter to fit one to the other. When news is absent and the market fluctuates, they say its behavior is “technical.” . . In the dark ages, the world was supposed to be flat. We persist in perpetuating similar delusions.” - R. N. Elliott

But, the truth is that external events affect the markets only insofar as they are interpreted by the market participants. Yet, such interpretation has been guided by the prevalent social mood. Therefore, the important factor to understand is not the social event itself, but, rather, the underlying social mood which will provide the “spin” to an understanding of that external event.

This actually explains why we see markets often move higher after bad news is announced or lower after good news is announced. When the market sentiment is positive, negative news will be interpreted as positive. And, vice versa. This is a more intellectually honest and consistent lens through which we can view market actions as opposed to some mechanical paradigm which often leaves us scratching our heads.

And, many recent market studies have supported this conclusion.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

In a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, attempted to explain this phenomenon:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

Allow me to show you an example of this using our USO charts from the last year. And, you can then decide for yourself if the news really made a difference.

This was our expectation in the Spring of 2025.

As you can see, we were expecting a bottom in USO in the 60 region, with the expectation that we would rally towards the 88 region, followed by a decline to below the 60 region. And, this chart was laid out well in advance of all these moves, and we clearly did not have advance knowledge of any “news.”

As we now know, USO bottomed a little over the 60 level, and then rallied strongly to the 84 region. In truth, there was a spike in the overnight session to the comparable 88 region at the end of June which was not seen during the market hours tracked in the USO chart, which then reversed before the market opened the next day. And, the top occurred when the war with Iran and Israel concluded. Did I know that this war was going to occur when I published this chart analysis early in 2025? Did I know the war was going to end when the USO would reach the 84-88 region?

Now, if you think that I got lucky with this analysis, well, my 8000+ clients would explain to you that we have done this many, many times over the last 15 years, to the point where it has gone well beyond luck. As one of my members who has been with me for over a decade noted, “The number of different markets, i.e., TLT, Metals, Oil, IWM, SPX etc.., that you have absolutely nailed over the years is legend.”

In fact, I am still amazed at how the market provides us with this roadmap well before any news hits the market. And, it leads to the conclusion that many experienced traders and investors note as a popular refrain: “News follows the cycles.”

Clearly, news does not actually follow the cycles, but what they mean is that news fits into the cycles and does not cause the cycles, which is completely opposite of what most novice investors believe.

So, of course, I am sure many of you are now thinking to yourself, “but, Avi, what about all those times that I see the news cause a move in the direction that I expected based upon the news?” Well, have I said anything that would suggest this cannot and does not happen? In these situations, it simply means that the sentiment and the substance of the news event aligned at the time. But, it is the opposite scenario, where the substance of the news and the direction of the market are exactly opposite, which must lead you to the conclusion we are discussing above. Yet, when that occurs, most novice investors simply ignore these “outlier” situations so that they can retain their false mechanical paradigm expectations, as they then move on to the next news event.

So, why are novice investors convinced of their mechanical paradigm falsehood? Well, one reason is because the financial media bases their entire premise day in and day out on this mechanical paradigm. Every day you hear that “the market rallied because of XXX” or “the market dropped today because of YYY. As Daniel Kahneman noted in his book Thinking Fast and Slow, “[a] reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguishable from truth.” And, if you follow closely, you may even see those times when the XXX and YYY are the exact same reason, but with markets moving in opposite directions to those exact same reasons.

Another reason, as presented by Kahneman, is that our minds are always seeking reasoning for what is going on around us. As he said, “evidence is that we are born prepared to make intentional attributions.” In other words, our minds engage in an automatic search for causality. Moreover, we also engage in a deliberate search for confirming evidence of those propositions once we hold them dear. This is known as “positive test strategy.”

“Contrary to the rules of philosophers of science, who advise testing hypotheses by trying to refute them, people seek data that are likely to be compatible with the beliefs they currently hold. The confirmatory bias [of our minds] favors uncritical acceptance of suggestions and exaggerations of the likelihood of extreme and improbable events . . . [our minds are] not prone to doubt. It suppresses ambiguity and spontaneously constructs stories that are as coherent as possible.”

This also explains how Bob Prechter came to his conclusion above, when he noted that “[w]hen news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist.”

So, as the market continues to make its way down to our target for USO below 60, you will likely continue to see many up/down machinations, as the structure is likely taking shape as a very complex ending diagonal to our target. But, ultimately, the structure is pointing us lower in the coming months, which will likely lead to an amazing buying opportunity once this decline structure completes.