Healthcare Costs Are Out Of Control, Make The Doctor Pay You Rent

Healthcare Costs Are Out Of Control, Make The Doctor Pay You Rent

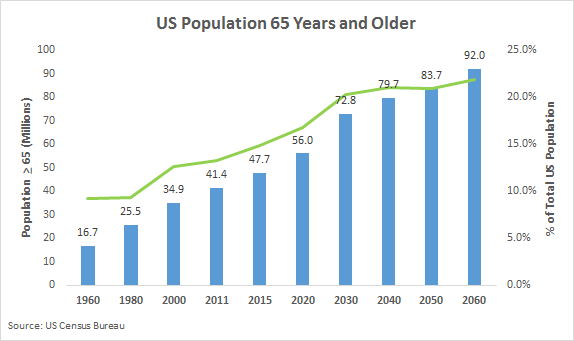

American's are getting older as more of the Baby Boomer generation will be passing the 65 years-old milestone over the rest of the decade. By 2030, 20% of the U.S. population will be over 65 years old.

Source: PRWeb

Source: PRWeb

As investors, we must recognize trends that will impact the businesses we invest in, and the growing 65+ population is a material trend. One sector that will experience substantial tailwinds is healthcare. There is a very strong correlation between age and the number of doctors you know on a first-name basis.

The aging population is creating a secular tailwind for the healthcare sector. Demand is increasing and will continue to grow at a rate that supply will have difficulty keeping up with. For everything from bifocals, elective surgeries like knee replacements to life-saving surgeries like heart surgery, medical demand increases with age.

One way to take advantage of this trend is in medical real estate. Owning real estate avoids issues like insurance payments and changes in government regulations in a highly contentious field in the political arena. Landlords benefit from medical operators needing space.

Today, we look at two Real Estate Investment Trusts (REITs) that operate in the healthcare niche.

Healthcare Trust of America, Inc. (HTA) yields 4.4% and owns "medical office buildings" or MOBs. These are buildings you might go to to see a doctor, specialist or have outpatient procedures done.

Medical Properties Trust, Inc. (MPW) yields 5.3% and owns hospitals, primarily "general acute care" hospitals – the type of facility you would go to the emergency room or have more complex procedures done.

Both types of properties are essential to the overall healthcare system, and both will see growth in demand.

Healthcare Trust of America - Yield 4.4%

HTA is the largest owner of MOBs in the United States. They buy and develop buildings specifically designed to serve medical needs. Then they lease these properties to a diverse group of tenants. 74% of their tenants are large health systems or regional providers.

Source: HTA June Presentation

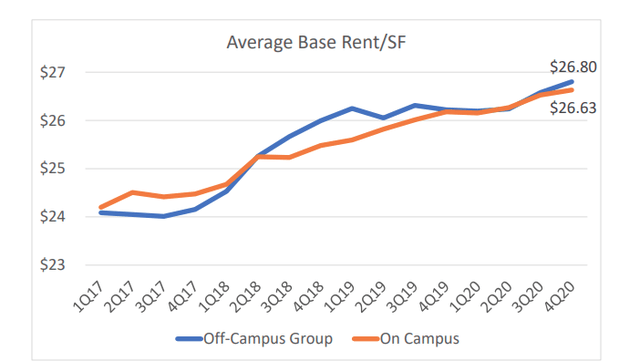

Thanks to strong fundamentals, HTA has seen rent increasing in both their "on-campus" and "off-campus" properties.

Source: HTA June Presentation

"On-campus" properties are MOBs that are associated with a hospital and are nearby. "Off-campus" properties are buildings that are off on their own and are usually more convenient to a larger population.

The benefit of on-campus is that many specialists want space close to the hospital, so there is a ready base of potential tenants. Off-campus properties are more flexible in that HTA is not restricted to leasing to doctors belonging to only a single health system.

Reliable Dividend

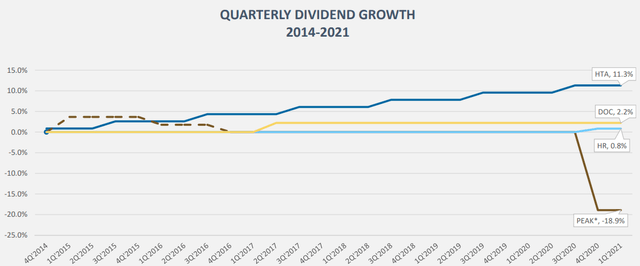

HTA has had a reliable dividend – being able to raise its dividends consistently every year.

Source: HTA June Presentation

HTA has been able to do this by consistently increasing its funds from operations (or FFO) per share. With a current payout of only 72% of FFO last quarter, we expect that HTA will be announcing its next dividend raise in the upcoming quarter.

Growth Ahead

HTA fuels its growth through acquiring new MOBs, leasing up existing properties, and new developments. In 2021, HTA expects to acquire $300-$600 million in new MOBS and to complete development on $130 million in properties.

Investors can expect HTA to maintain its steady growth and consistent dividend raises. As demand for MOB properties increases, we could see the rate of growth increase in the future. In the near term, we put fair value for HTA at $32 (4% yield) which is about 17% upside from current prices. HTA is a very conservative investment to take advantage of the aging population.

Medical Properties Trust - Yield 5.3%

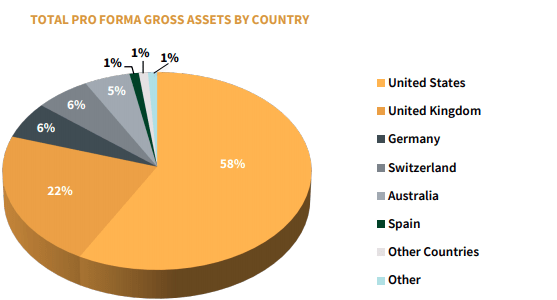

Where HTA is a mature company growing at a steady rate, MPW is off to the races. MPW invests in hospitals around the world. Only 58% of MPW's assets are in the U.S., 22% in the UK, and the remaining spread across other countries. MPW's properties span North America, Europe, and Australia.

Source: MPW Q1 Supplement

MPW recently announced another significant acquisition. $950 million for a portfolio of inpatient behavioral health hospitals. Plus another $900 million for hospitals in Florida. It is only halfway through the year, and MPW has closed or announced over $3.4 billion in acquisitions.

MPW is expanding rapidly, taking advantage of low property prices combined with low interest rates for borrowing. This will lead to MPW's results exceeding guidance and the potential for another dividend increase by year-end.

MPW's Strategy

The reason hospitals are attractive is that they are very long-term leases. The Florida properties that MPW acquired will be under a lease through 2041. These leases have regular "escalators" that increase the rent regularly based on CPI or a similar index or flat rate. This ensures that MPW has extremely stable revenue while providing some protection from inflation as well.

Hospitals are needed everywhere, and MPW has demonstrated that their model works in various countries with very diverse healthcare policies. Whether the government is very involved or more "hands-off", hospitals are needed, and there is an opportunity for MPW to profit.

Steward

MPW has significant exposure to a single tenant. Steward Health Care makes up 21.5% of its assets. MPW owns numerous hospitals operated by Steward and also holds nearly 10% of the equity in Steward. Steward was recently acquired from the private equity firm Cerberus in 2020 and is now the largest physician-owned hospital system in the U.S. The physicians own 90%, and MPW owns 10%.

MPW released Steward's financials publicly for the first time as an amendment to their 10-K. We have reviewed these financials and concur with MPW that Steward is, in fact, in sound financial shape. Steward's only debt is a $279.5 million revolving line of credit with an additional $254 million in unused capacity. A relatively small amount of debt for a company with $3.2 billion in assets and did over $5 billion in revenue in 2020. Steward's largest liabilities are their lease agreements with MPW.

This review confirmed what we already suspected, that the claims that Steward was on the brink and was financially struggling are not true. This is further supported by Moody's, which recently increased MPW's credit outlook to "positive" and for considering an upgrade is comfortable with MPW's exposure to Steward as a percentage of gross assets being "closer to 20%". Currently, Steward hospitals make up 21.5% of MPWs gross assets.

MPW is currently rated Ba1, so an upgrade to Baa3 would put them across the line to "investment grade". A rating upgrade would be very bullish for MPW's share price.

More Growth Ahead

MPW has doubled its asset base from $9.4 billion in 2018 to over $20 billion today. Cash flow is growing, FFO is growing, and MPW's dividend is growing. They are showing no signs of slowing down, and there is no reason they should. MPW has found a niche where there is little institutional money. Hospital operators are looking to raise capital for their expansions as demand for medical services increases. Doing a sale-leaseback to MPW is a great way to free up capital for them.

With MPW's price having pulled back, we can take advantage and add some more shares. With substantial growth already on the way from announced acquisitions, MPW should have a clear path to $26, a 28% upside from current prices. You can get a healthy 5.5% yield today and enjoy dividend growth later this year or early next year.

Conclusion

There are numerous ways for investors to take advantage of the growing demand for health care. As income investors, we are often partial to investing through real estate. With real estate, we can achieve significant cash flow and collect a significant income while avoiding much of the execution risk.

These REITs offer retail investors two options to hold a healthcare portfolio. HTA owns MOBs and has a very reliable and stable growth profile. Investors can collect their 4.7% yield and expect modest but consistent 3-5% growth year in and year out.

MPW is putting the pedal to the metal and expanding by buying properties hand over fist. MPW has managed to do this expansion while maintaining its capital structure and keeping its debt profile in line with what the rating agencies want. An increase to an "investment-grade" credit rating is a potential catalyst to boost MPW's share price in the next year or two. Additionally, MPW's acquisitions will be paying rent, increasing their earnings considerably.

We love holding the combination of both. HTA for the conservative and reliable income, and MPW for the substantial upside potential. Both companies will capitalize on the growing demand for health care, and both tickers will see their valuations increase as Wall Street looks to cash in on the opportunity.