Has VXX Diagonal Topped With Monday's High?

Overnight the iPath S&P 500 VIX ST Futures ETN (VXX) moved down a bit further off of the highs, but here at the open we are trading higher once again.

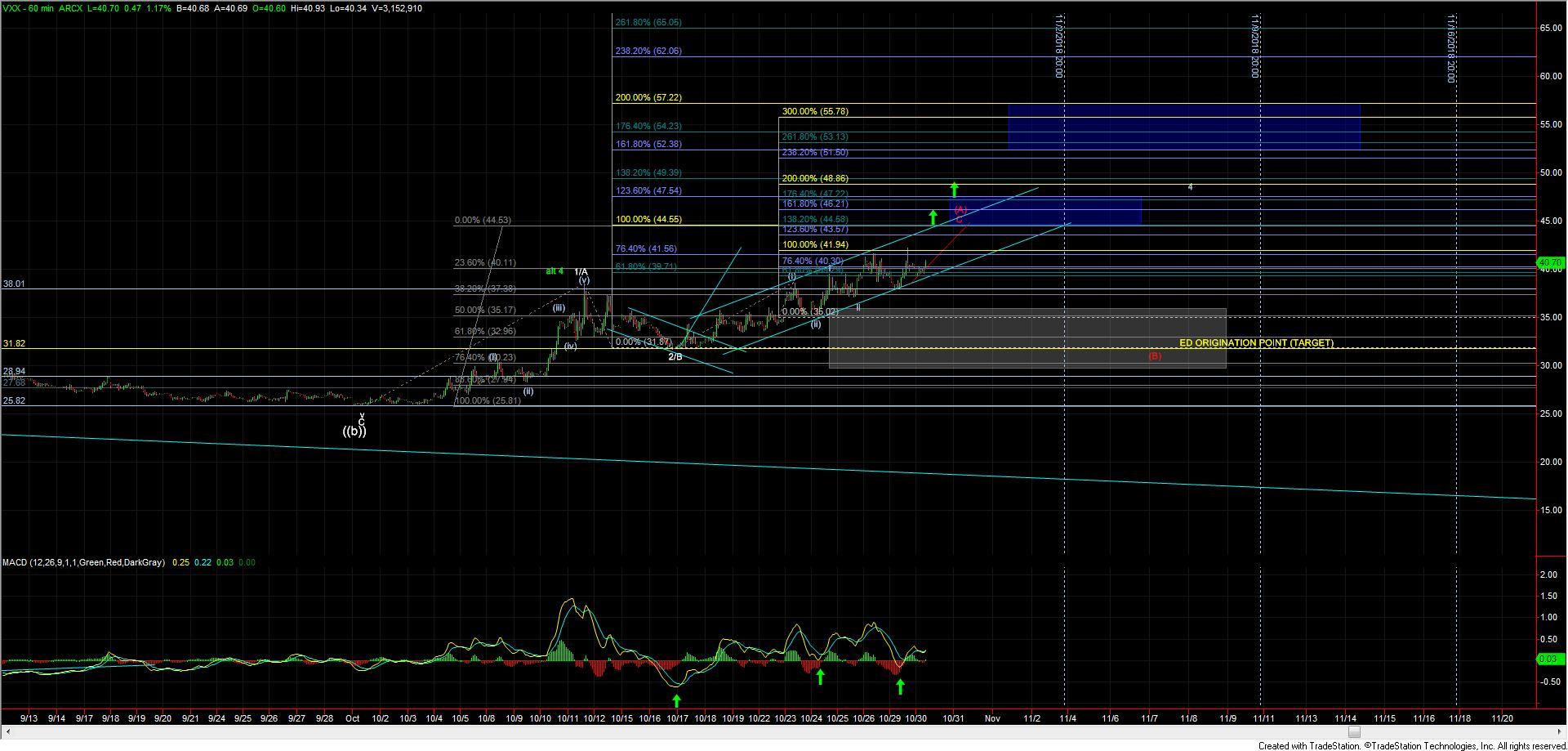

From a structural perspective really not too much has changed since yesterday and the count is fairly straightforward at this point in time. My base case is that we are in a diagonal up off of the 31.82 low. Whether that diagonal has already topped with yesterday's high is still a bit uncertain, and while I do think it still would look better to see one more high into the 44.50 area prior to topping, there certainly are enough waves in place to consider this already topped.

Once this does make a top we should see a sharp reversal back down towards the origination point of that ending diagonal at the 31.82 level.

Zooming into the very small time scale charts, initial confirmation of a top will come with a break of the 39.26 level followed by a move through the 37.97 low. Overhead resistance on the micro levels currently comes in at the 40.38-41.49 zone, and a move through those levels open the door to this seeing another high prior to topping.