Has Silver turned Bearish!?

As Helene Meisler's pinned Tweet says, "Nothing like price to change sentiment."

GC should get a (iv)-(v) of circle c. If the purple c after the triangle it can be a more muted (iv)-(v) toward 1820 region. If we are still in the blue ED for circle c the (iv) can get higher.

As posted last night on SI, the stretch lower got to the 123.6% ext of circle c there Ideally that is all of the 4 just under the 38.2% retrace of 3 and close to the 100MA. Either we have to squeeze in its (iv)-(v), or just count it as (a)-(b)-(c) of circle y instead of a c.

This can still sync nicely w/ GC. GC needs a bounce possibly as the higher blue (iv). SI could get 5up as i of 5 then. Remember, we discussed that SI is an impulse off March while GC is a Diagonal, thus the 5 in GC should be an abc move not 5up. If SI gets its i-ii of 5 out of the way while GC gets the (iv)-(v) of c then while GC goes up in a of 5 SI will get iii of 5, they would then fade in tandem for the respective b & iv of 5 and then finish off together with the v & c (likely into blow-off tops).

Remember what sentiment was like when we got some extension to 3 in Aug or when we were warning of a top to b of 4? It is pretty much opposite of that now... I know we stretched a bit under the more ideal 22.70 and SI could even still get a (iv)-(v) lower, but this is EXACTLY the move we were looking for and discussing for the last 2 months. Keep that in mind when the fear starts to creep into your otherwise stoic trading persona.

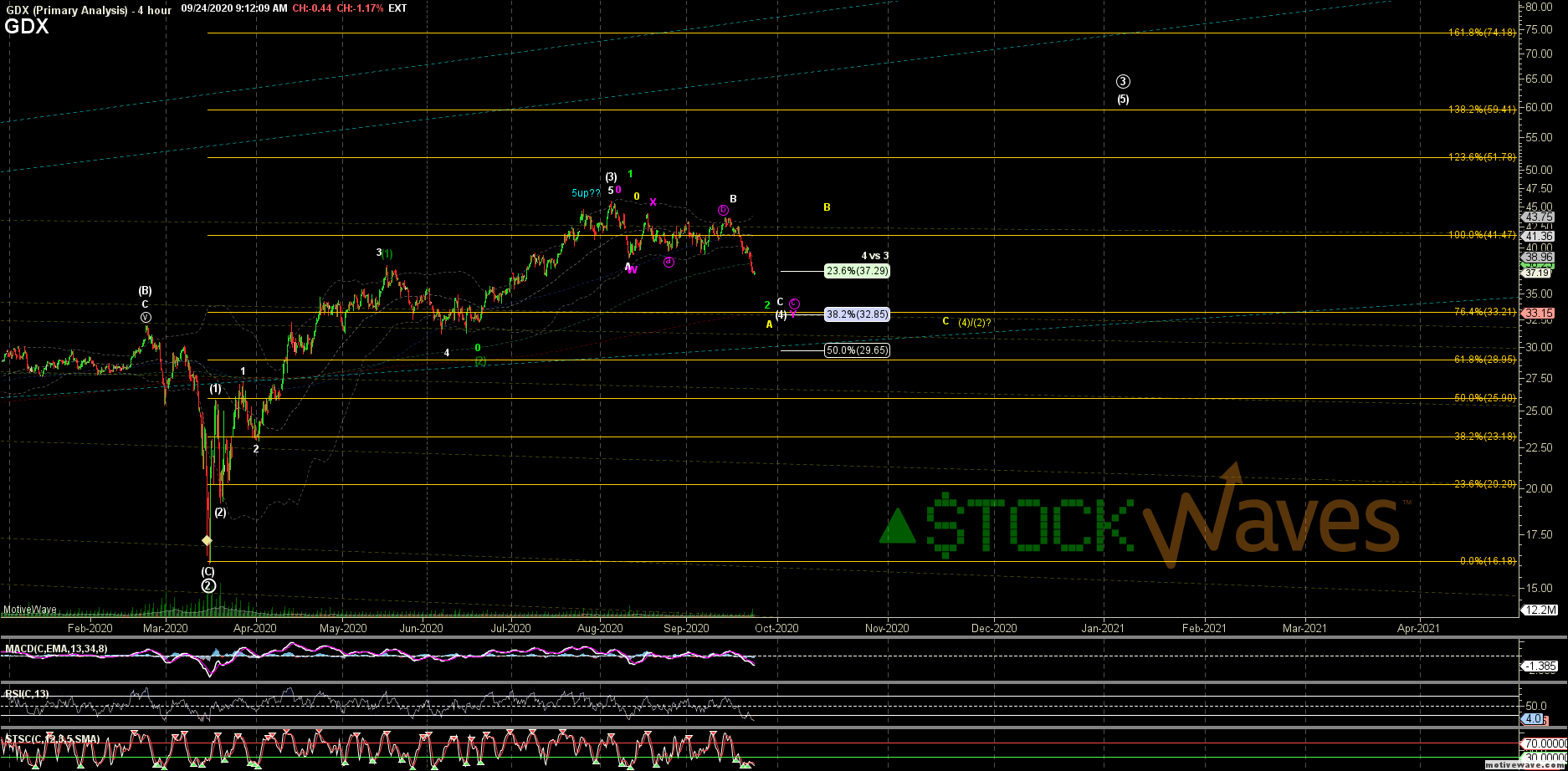

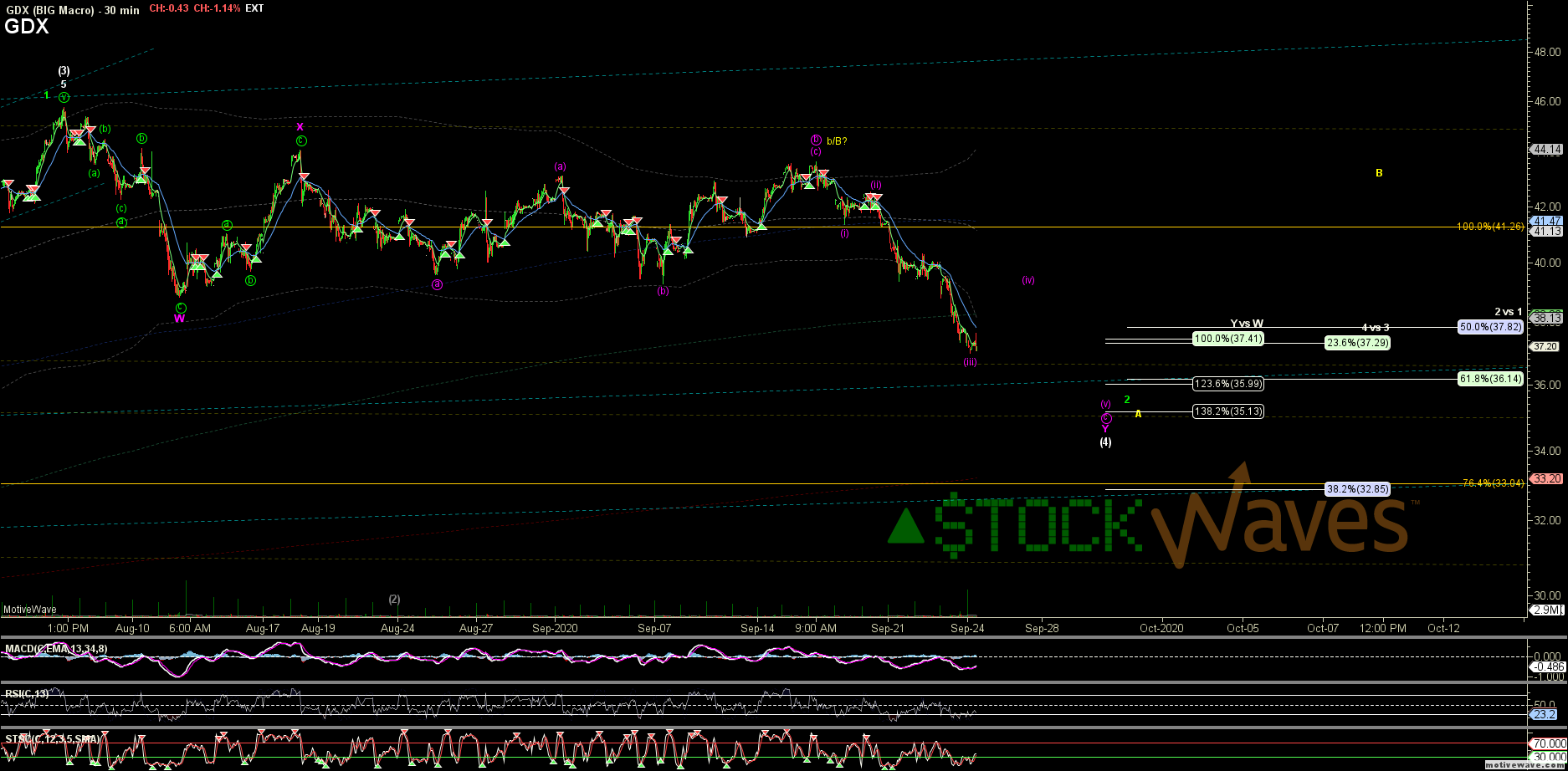

Whether counting the c of Y or just a C down from 9/16 on GDX we should get a four-five lower there as well towards the 35s.

Yesterday we trimmed half of our ZSL and DUST hedges and nibbled on a few new tranches of miners that were closer to their targets for all of this consolidation, but MOST support the look of needing a "four-five" lower.

Over then next week or so while we look for those "four-fives" were are going to juggle the remaining hedges, MAYBE adding some back on a very clear abc bounce for (iv), and adding more tranches of strong miners. We do expect some draw downs as we layer into a heavier exposure for the coming swing. But there is a tremendous amount of potential for the coming swing and our time horizon is longer term.

#Forest