HDO Market Outlook: The 4 Phases Of The Bull Market

First: A Market Update

I will start with a quick market update: The equity markets continue to look extraordinarily bullish. Each pullback is being met by investors "buying the dip". As stated previously, this is a market that is driven mainly by liquidity. Strong economic fundamentals do help, but they are not required in such an environment. All we have to do is look at the market rally in mid-2020. We were in the midst of a full recession, and the market had its largest rally ever. All that is required is printing money and pumping it into the system to create a bull market. Yet more money is being printed, and consumers have more savings than ever to invest.

Biden Offers to Scrap 28% Corporate Tax

The big news this week is that President Biden offered to scrap his proposed corporate tax hike of 28%, and instead settle for a minimum tax rate of 15%. This is very bullish for equities in general, and this is the main reason why we saw the Nasdaq index rally on Friday. The Nasdaq has been the main drag on the general markets, and finally, we can expect that all the markets move higher at a synchronized pace.

This 15% minimum tax will mostly hurt those companies that pay much less than 10% tax, that have subsidiaries in "tax haven" or "low tax" countries, or through tax loopholes. Basically, this will impact stocks such as Amazon, Facebook, and Netflix. However, this removes a lot of uncertainty for equities.

Volatility during the Summer

I would like to warn members that the summer season is likely to be a volatile one, but I see no reason to worry. With many traders and large investors on holidays, we are likely to see many market swings. However, the technicals are solid and unlikely to change.

Medium-Term Outlook and Best Course of Action

We remain in an extraordinarily strong market. The main trend remains up. The S&P 500 is likely to head to the 4400 level soon, and I expect it to reach the 4600 level (or 8.7% higher from here) by end of summer or early autumn. Our "model portfolio" is set to outperform the S&P 500 index by a big margin. The best course of action would be to keep holding your dividend stocks and collect your recurrent income. I would not try to trade this market because dips can quickly recover and you will miss the opportunity to buy at lower prices.

I am very excited about the prospects of our portfolio. As you have been noticing, our dividend stocks keep strongly outperforming the markets, even during some down days, our portfolio was up. Our performance year-to-date has been stellar, and I expect it to be the same throughout 2021.

When Will the Bull Market End?

In last week's market outlook I have explained:

- That this bull market is liquidity-driven and not only based on economic fundamentals. Even if economic growth slows down, it would not impact this secular bull market.

- Equities are not expensive, using two valuation metrics (P/E ratios and Earnings Yields). We can even argue that they are cheap.

- I tackled one of the major risks that is worrying investors today, which is future rate hikes by the Fed. I explained that the next rate hike is likely to be next year, and it will only result in a knee-jerk reaction. It should not impact the bull market.

- I also explained that the Fed's hands are tied and that the possibility of aggressive future rate hikes is unlikely. This is good news for equities.

If you did not have a chance to read last week's market outlook, I would strongly encourage you to do so. This is the link:

Market Outlook, May 30, 2021, The Markets Beyond 2021

Why This Bull Market Looks Very Similar to the 2000 Bull Market

The current bull market is mostly "liquidity-driven" and is very similar to the bull market that we saw back in the early 2000s. Both have little to do with economic growth and this is why a slowing economic growth will not derail today's bull market.

While currently the liquidity is being pumped by the Federal Reserve and the Government, back in the year 2000, it was done by the banking system through irresponsible banking practices. The end impact? Wealth brings more wealth. More wealth brings more speculation. More speculation leads to higher asset prices. And eventually, an "asset bubble". And finally.... a bubble burst.

The bull market can be broken down into 4 phases which I will explain now. The bubble burst happens in the 4th and last phase. As explained in my last market update, the last phase of the bull market is when stocks see their biggest and fastest gains in the shortest period of time. This will be one of the most interesting and fascinating times to be invested and experience the markets, yet it is one of the most dangerous of all phases. We need to be extra careful in order to pull the trigger on time to take defensive positions to maximize our gains. But we are not in this last stage yet. I project that this phase will start sometime in the middle of 2022 or the beginning of 2023, and will end in the year 2023. By mid-2022, we will slowly start taking a more defensive approach while riding some of our gains to the maximum extent.

The 4 Phases of the Bull Market

Phase 1: The Pessimism Phase:

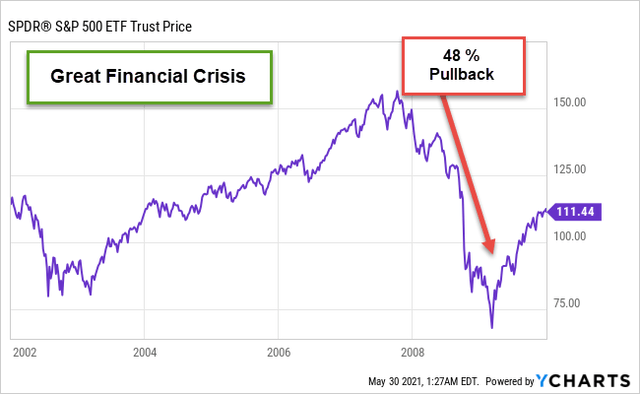

This phase starts right after a "bear market" or following a big downtrend when investor losses are large and pessimism is at its worst. There is a lot of gloom out there, and few investors are willing to put new money to work. However, one good indicator that we are entering the first phase of a bull phase is that the markets stop reacting to bad news. In such cases, we can see either a consolidation phase before the markets start moving up, or we can see a "V-shaped" recovery similar to what we saw following the Great Financial crisis of 2009 when most investors remained very bearish, and following the COVID crash of February 2020.

In our case today, Phase 1 started in April 2020.

Phase 2: The Skepticism Phase

This is the period when the markets start to climb but the vast majority of investors are skeptical and still not willing to invest. The pain of the losses they incurred from the previous market crash is still vivid. The media during this time is not helping. Bad news sells better than good news, and you probably keep reading about analysts projecting another market crash. This is typical. Doom and gloom analysts tend to get more attention on TV and elsewhere than those who are projecting a market recovery. During this phase, technicals are starting to improve. There are many signs that an analyst should be looking for to ensure we are in a 2nd phase of a bull market, rather than just a market bounce. These include improving economic fundamentals, higher liquidity, corporate earnings, the state of interest rates, valuations, the Federal Reserve stance (its readiness to support the economy and markets), among other things. During this phase, market volatility tends to be high.

In our case today, Phase 2 started around September 2020.

Phase 3: The Optimism Phase

During this phase, negative sentiment among investors is reduced. At the same time, the economic outlook starts to improve as we are seeing today as the economy re-opens and more people are vaccinated. The media which had been projecting negative news is now finally broadcasting a positive one. Typically, this phase can be a long-lasting one. The technical charts tend to be strong which causes volatility to remain very low, which is the situation today. This is when investors who were on the sideline during Phase 1 and Phase 2 start slowly investing money into equities which help drive prices higher. We have evidence that this is happening now as I have been pointing out over the past two months. There is a mountain of cash still sitting on the sidelines (on bank deposits, CDs, and money markets) now slowly moving into equities.

Valuations during this phase tend to be at acceptable levels as I have shown in last week's report. This phase tends to be very profitable for investors.

In our case today, Phase 3 started around January 2021 as the economy started to re-open and GDP growth accelerates.

Phase 4: The Euphoria Phase

This is when the markets start shooting up and making money becomes very easy. Investors become Euphoric. Market prices are going up because of speculation rather than anything else. Valuations become extremely high, and we feel some type of "irrational exuberance". These are some obvious signs of the Euphoric Phase:

- Most people are gathering their savings to invest in the markets.

- You hear your friends, relatives, neighbors, and colleagues at work continuously discussing which stock to invest next.

- People that you know who never invested in the markets before, start opening brokerage accounts.

- The taxi driver or your plumber may ask you about which stock you are investing in today.

- You may start getting unsolicited calls from brokers about stocks that can double or triple to convince you to open an account with them.

- Friends who know that you are an investors call you "out of the blue" just to ask you which stock they should buy.

As stated above, this last phase is when stocks see their biggest and fastest gains in the shortest period of time. This will be one of the most interesting and fascinating times to be invested in and experience the markets. However, I project that this phase will end with an asset bubble, similar to what we have seen during the Great Financial Crisis, but the extent of the pullback is likely to be less.

We have to be extra vigilant to maximize our gains during this period and be ready to pull the trigger at the right time to more defensive high dividend positions and maximize our gains.

Note that the "bubble burst" will be triggered by some event. For example, the "housing bubble" burst during the great financial crisis of 2008 was triggered when the homebuilders finally caught up with housing demand. Housing prices started to fall. Investors were speculating for years, buying up houses based on cheap loans, and driving up prices without "real demand". Prices fell, and their housing investments were not enough to cover their housing mortgages.

We are currently in phase 3 of this bull market and we will probably not see phase 4 begin until the year 2022 or beginning 2023.

My Next Market Update

In today's market outlook:

- I explained the four phases of the Bull Market, and which phase we are in today.

- I gave my estimates on when the last phase of the bull market will start, and when it will end, which would most likely be during the year 2023.

In my next market update, I will expand further and explain:

- Why the Federal Reserve has virtually no tools to prevent an "asset bubble".

- What will be the "trigger" that will end this bull market? It will be a combination of several factors that will converge.

- What are the signs that I will be looking for?

- What type of high-yield "defensive" dividend stocks are best to hold during a bear market.

- Other tools we may use to hedge during a "bear market".

Note: During next week, we will be posting a report on soaring commodity prices, and why we could be heading for a "commodity supercycle". This report is an important read because inflation and higher commodity prices will be one contributor to the end of this bull market... And the Fed has virtually no tools to fight inflation either as I will explain in more detail next weekend.

Have a great Sunday!

Rida MORWA