Grinding Into New All-Time Highs

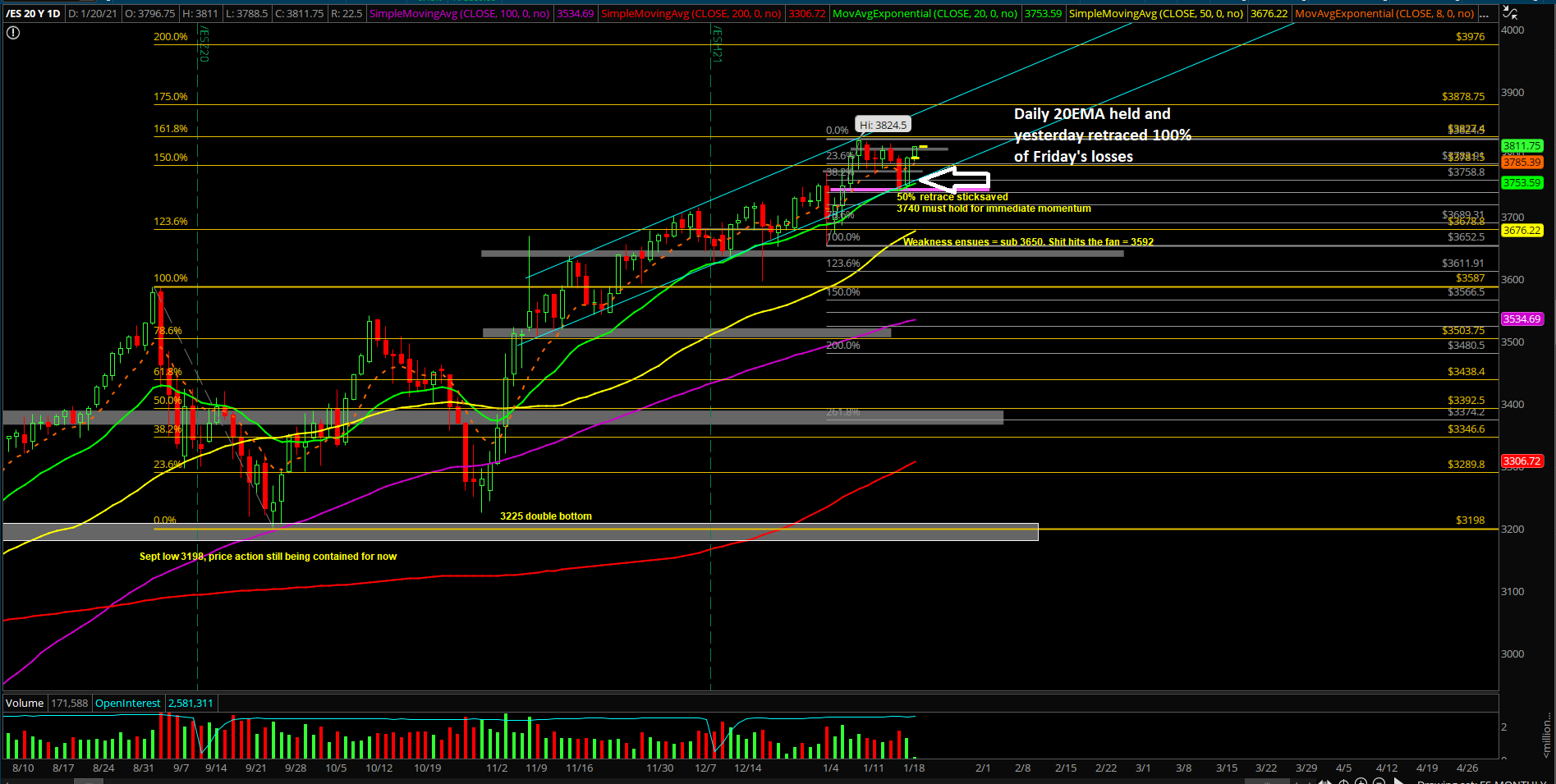

Tuesday’s session played out as a gap up and go continuation model as the bulls maintained their strength with the market retracing all the losses of last Friday. This is critical to note because it’s the same bullish consolidation into the daily 20EMA trending support and then eventually into a rotation higher.

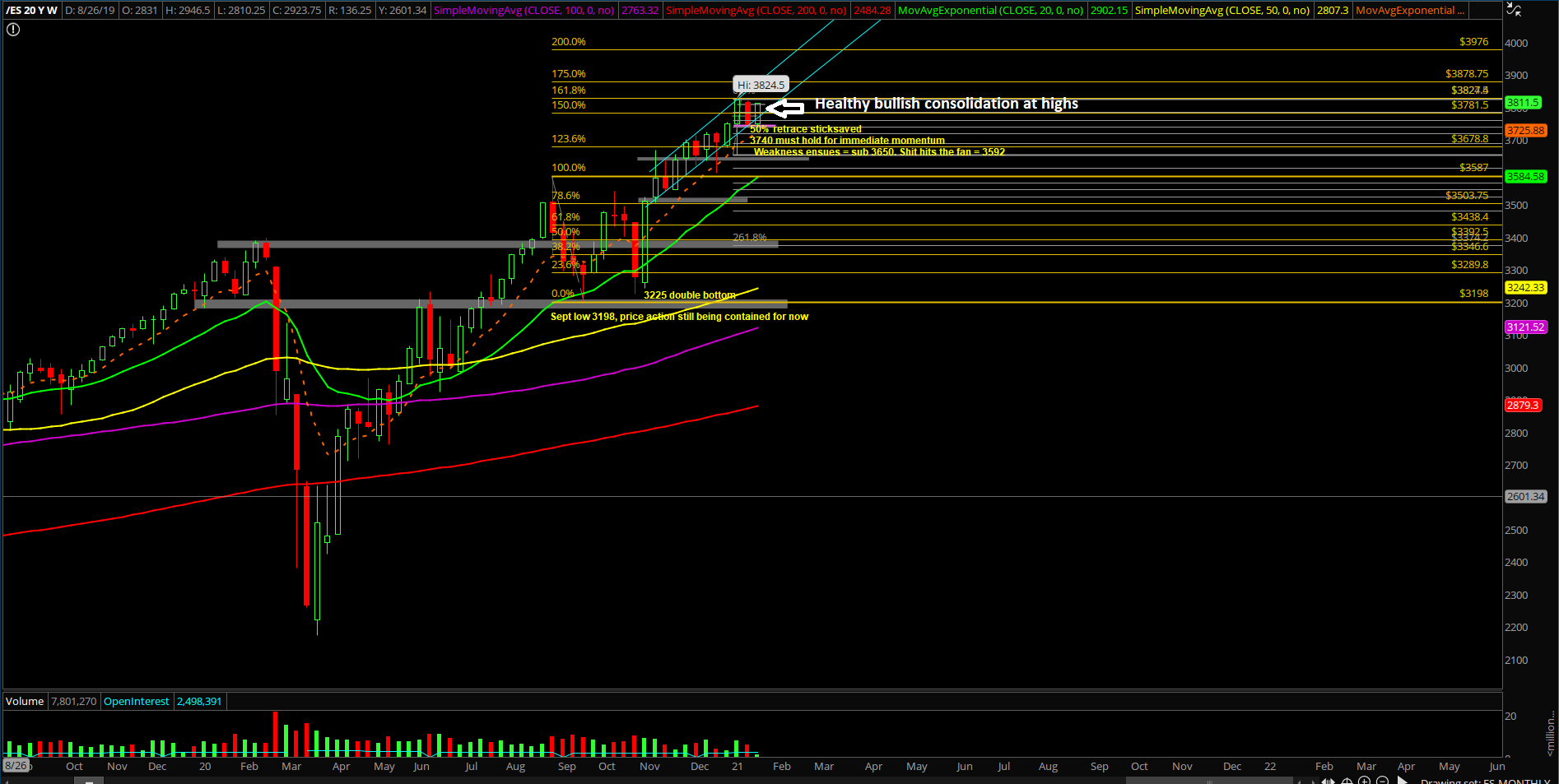

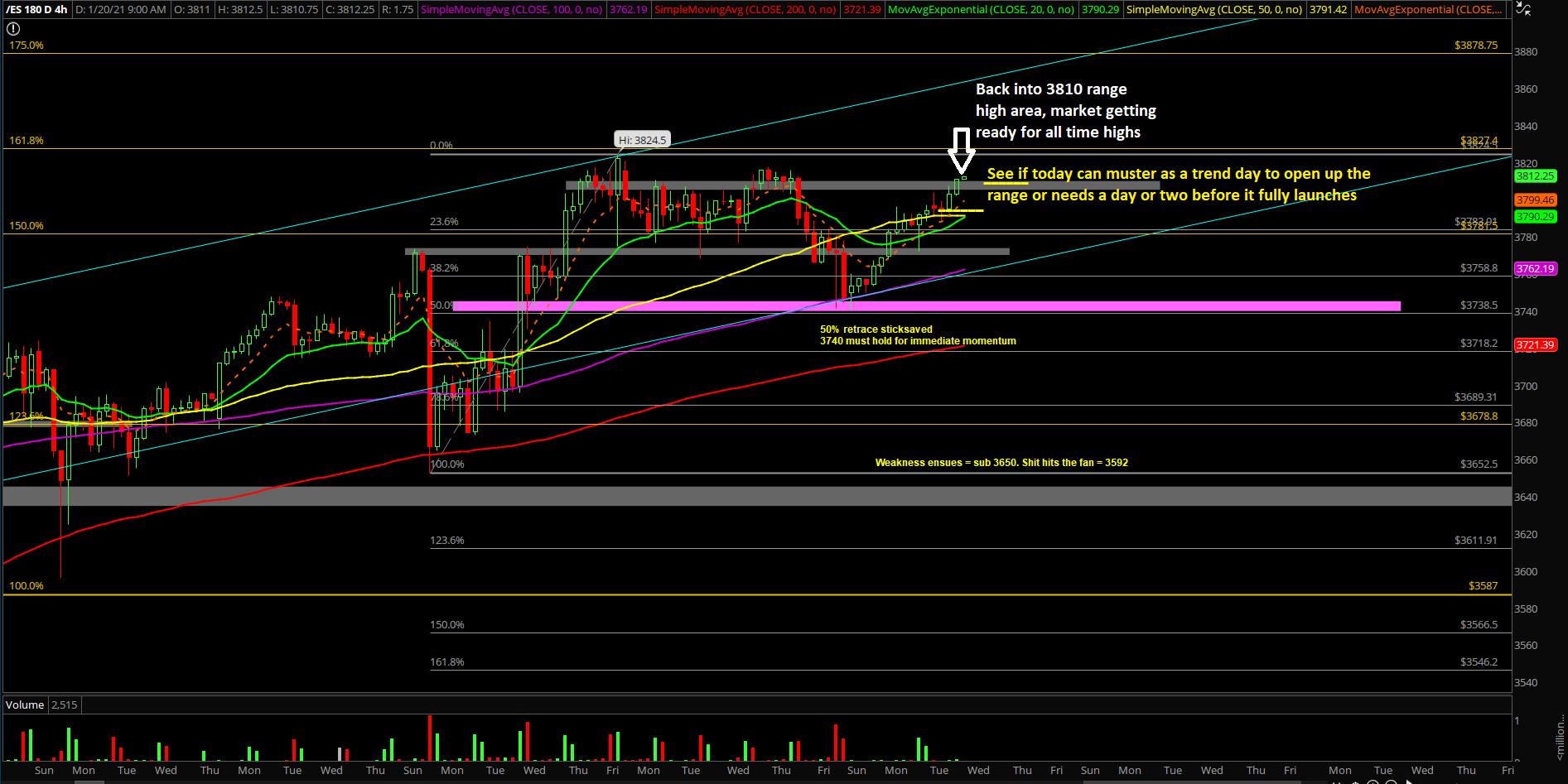

The main takeaway remains roughly the same: It’s been a healthy consolidation for the past few days and it looks more of the same going forward. Price action is doing its thing with stock rotations as the S&P 500 index hugs the daily 20EMA trending support combined with a confluence of key support area. The immediate V-shape recovery from ES 3740 is fairly telling that there’s an insatiable bid underneath the market so we’ll continue to monitor this for additional clues. Either way, it’s considered a bullish consolidation when above 3740 and weakness when below. As of writing, price action is revisiting the prior all time highs area and banging on the door for a breakout. No need to overcomplicate things here. Know your timeframes.

What’s next?

Tuesday closed at 3794 on the ES and the price action has confirmed a 100% retracement of last Friday’s losses indicating that bulls remain in full control. Rinse and repeat.

In sum:

- Last Friday, the market backtested into our 3740-3750 key support zone to shake out some weak hands, which represented the daily 20EMA trending support combined with the 50% fib retracement area of the entire rally from 3652.5-3824.50 (first week of Jan’s range).

- Heading into this week, it’s fairly simple to judge momentum as price action made a V-shape recovery vs the 3740 level. The main focus is whether price action could stay above 3740 for the rest of this week as the daily chart rebuilds another basing pattern vs the daily 20EMA /confluence area in order for the bull train to head higher eventually.

- Remember, it’s still an inside week trading range within the first week of Jan’s massive range 3824.5-3652.50. Be prepared to trade range bound for next few sessions until price is outside the boumdaries. Smaller range = 3810-3740.

- As of writing, price is hovering around 3810 (range high) which is banging on the door towards the prior all time highs of 3820s in order to open up much higher targets

- Micro wise, watch out for range day vs trend day clues as this morning/today is opening with a small +0.5% gap up.

- A break above 3810 would be the first indication that bulls are ready and finished with consolidation in order to re-attempt all time highs 3820s and our next levels at 3830/3850

- A break below 3785 would confirm that today is just another range day given the O/N range

- 3740 is now treated as the low of the week given yesterday’s price action confirming that bulls have done it once again vs the trending daily 20EMA + support confluence area

- At this point, a break below 3740 would open up immediate lower levels such as 3700/3695/3685…etc.