Gratitude, Fear, Shiny Metals And GDX

Gratitude, Fear, Shiny Metals And GDX

Summary

- Looking back on 2023, metals and miners presented numerous opportunities.

- The intersection of fundamentals and sentiment is a good place to look at mining investments.

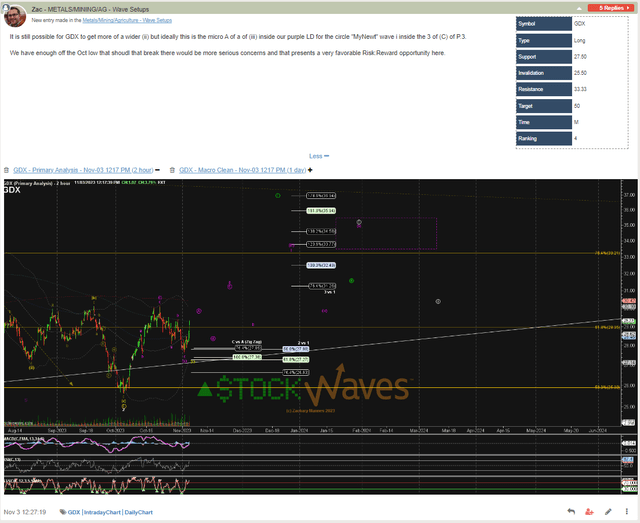

- GDX was a recent Wave Setup, with specific support, invalidation, resistance, and target parameters.

Contributed by Mark Malinowski, produced with Avi Gilburt

“To everything, turn turn turn. There is a season, turn turn turn. And a time to every purpose under heaven.” - The Byrds

Looking back

It's that time of year. Time for slowing down and looking back on the year that was and to begin to plan for the next round. A time when gratitude for all the gifts and people we have in our lives to be recognized. For some this is a season of harvesting and preparation for renewal, for others perhaps a season of regret based on lost opportunities or mistakes made. Common themes and emotions we often see expressed loudly in the trading room, usually sparking from people learning that it doesn’t have to be that way.

The last year for those trading metals and mining stocks might be best described as a year of anticipation, but also one of slow building opportunities both to the upside and the downside. Many of these have been identified with quantifiable risk reward scenarios, what we call Wave Setups. While others on the outside might have watched and wondered, when will we turn? Have we finally bottomed? Will we ever get a pullback? Why are some of the largest companies struggling so much? What does this merger or that acquisition mean? With these questions, many emotions come with quick changes in stock prices, never mind the even faster moving commodities. Metals are always a different animal than regular stocks, perhaps because they are shiny and a commodity. Fear and greed seem to be the strongest of emotions and in the world of shiny commodities, they always feel magnified.

In a previous life, I managed a 24/7 environment with many different people executing complex operations that required things to happen in the right order, at the right time, including coordination and communication within a room and to similar rooms across North America. Many times the people doing these jobs were criticized or brushed off as being people who "just pressed buttons." In other cases, I encountered people doing the job saying "they didn't need to follow the written procedures, because they knew what to do."

I wouldn’t dream to suggest that making investment or trading decisions is simply pressing buttons, but when things don't follow the plan, what do you do? How do you know what to do when adrenaline triggers your flight or fight response? What information do you rely on to cut your losses or back up the truck?

Those are a lot of questions. Let’s break them down into smaller chunks and then use GDX, the VanEck Gold Miners ETF (NYSEARCA:GDX), as an example.

Looking ahead

While many try to use fundamental analysis, sound reasoning, or technical analysis, we see the intersection of fundamentals and sentiment as a good place to put hard earned investing dollars to work. However, this doesn’t remove that critical component that very few articles address - emotion. Why use the emotional part of your brain and instead use the logical, mathematical part of your brain? Sounds good doesn’t? but it's easier said than done.

First The Shape

The work of Charles H. Dow observed two key things. Firstly, stock market advances occurred in 3 upward thrusts or waves. Secondly, at some point, in some point in every market swing (be it up or down) there would be a reverse movement canceling three eighths or more of such a swing. This work has been independently and collaboratively advanced by many individuals since then, including Ralph Nelson Elliott (Elliott Wave Theory), Robert Prechter and many others, to apply more rules and guidelines. This gives us the shape of what impulsive moves should look like.

Second Proportions

Over time, many have applied Fibonacci ratios to the principle of Elliott Wave Theory. The studies that ensued found answers to:

1. How big should each of these thrusts or waves be?

2. What are the characteristics or personalities of each of these waves?

Experience studying charts and this methodology lets senior analysts seem to predict what may happen and when it does, it looks like magic. However, more importantly, it allows people trading and investing to determine at what price they should consider buys, at what price is this unlikely to happen and stop out or when to consider taking profit. The true beauty is that this can be applied for day trading or long-term investing or anything in between, using the same principles.

In other words, in moments of calm, decisions can be made so that execution can occur when exuberance, adrenaline and the thrill of shiny metals glowing in our faces has many folks imagining dollar signs or screaming get out when the rally is only just beginning.

Fundamentally: Why Gold and Gold Miners?

Lyn Alden Schwartzer is the fundamental analyst in our group, and in summing up her October report on macroeconomics, “I have a long-term positive view on gold and bitcoin given the prospect for fiscal problems ahead.” In her November report on currency, Lyn noted that the number of local currencies that are struggling under ultra high rates of inflation has continued to grow. These environments also tend to have low interest rates, resulting in further discrepancy for people trying to grow anything they have saved. While some do not have access to US dollars, “The second most salable global bearer asset would likely be a sovereign gold coin. It could be a South African krugerrand or an American gold eagle.” The result of this being increased gold demand.

GDX was recently a Wave Setup

What do we look for in a setup?

Just like I described above, we look for shape and proportion. We also look back and zoom out, as the past can tell us many things about potential future paths. We also look at fundamentals and consider where companies operate and ongoing trends in that country with regard to mining. When these things align, we watch the chart to identify favorable risk reward opportunities. I would describe GDX as the de facto large-cap PM index of the industry. It's also quite diversified, so there's less concern about a mine strike or civil unrest or a government coup with promises of nationalization. These are real possibilities in some of the operating environments of individual miners.

What was the setup and how was it communicated?

The setup was based on structure of the last few months and was sent on Nov. 3 at 12:27 EST. Zachary Mannes stated:

"It is still possible for GDX to get more of a wider (ii) but ideally this is the micro A of a of (iii) inside our purple LD for the circle "MyNewt" wave i inside the 3 of (C) of P.3.

We have enough off the Oct low that should that break there would be more serious concerns and that presents a very favorable Risk:Reward opportunity here."

While some might be initially intimidated by the Elliott Wave jargon, Zac lays out the path clearly with specific support, invalidation, resistance and target parameters and one can play connect-the-dots.

What happened?

Well we did in fact get a slightly deeper wave (ii), but the support levels identified held. Both this and the slightly lower low were great opportunities that were flagged by analysts in the following days. Subsequently, support levels have been adjusted so that profits can be locked in and risk reduced.

GDX still needs to get more of a "four-five" to have five subwaves up from the October low as wave circle i of 3. We will then be watching for a corrective retrace as the wave two.

(GDX chart from 12/10)

Education

So while GDX was a great setup, how will you know when to take profits? If you didn’t catch this setup, how will know when the next great buying or adding opportunity will be? While I can’t tell you today exactly what those levels will be as patterns adapt, I can tell you I will use Fibonacci and Elliott Wave guidance to make decisions in a logical manner about entering and exiting positions. I won’t lie, there's a learning curve. However, gratefully there's a large component of education built into the style and information provided by our analysts in interactive videos and chat.

If you're looking at your own portfolio of miners or don’t have any, how would you assess the current state of this sector?

We continue to see opportunity, both near term and longer term in the precious metals and miners space for investors and traders alike. We identify these opportunities and monitor them as the market ebbs and flows.

We see the price of gold and silver significantly higher over the next two years. Avi Gilburt posted a public target for Gold on Jan. 17, 2023, and this aligns well with the increased profit potential for the sector of the market over the next few years.