Good Dilution vs. Bad Dilution

Good Dilution Vs. Bad Dilution

One reason that dilution has a bad name is that not all equity raises are done from a position of strength. Sometimes, companies will issue equity as a last-ditch effort to avoid bankruptcy.

How do you tell the difference?

Is The Company Making A Profit?

Beware of companies that are issuing equity to fund losses. If a business model is broken, adding more capital rarely solves the problem.

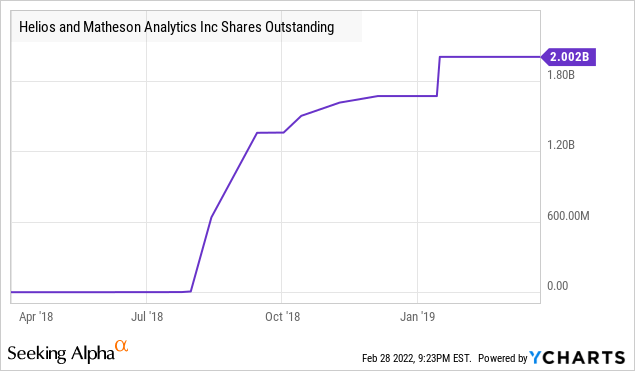

One extreme example I can think of is Helios and Matheson Analytics Inc. (OTCPK:HMNY), a company that became extremely popular with the product "Movie Pass". The problem? Movie pass never turned a profit and as it grew, the size of its losses grew. The company turned to issuing equity in order to fund its operations, but since the operations weren't turning a profit they had to issue even more at a lower price just to fund operations. The need for more equity caused a vicious cycle as shareholders were diluted and profits never improved.

HMNY went from under 100,000 shares outstanding to over 2 billion in a little over a year. Shareholders saw their shares fall 100%. HMNY's operating losses continued to build and raising new capital was like putting a bandaid on a broken leg.

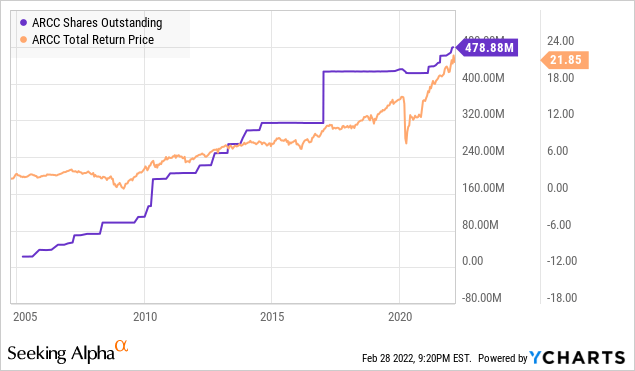

Now compare that extreme example to Ares Capital (ARCC), a company we hold that has frequently raised capital.

Even as ARCC issued new shares, ARCC's total return per share continued to climb. This is because ARCC has a profitable business and by raising capital, it is able to grow in a profitable manner.

ARCC's most recent capital raise occurred in January at a premium to NAV. Being able to consistently raise capital at a premium to NAV is a huge positive for a company and will drive future earnings.

What Are The Funds Being Used For?

While companies will often use the generic "general corporate purposes" in SEC filings to allow them to use funds for anything, an equity raise will usually come with a statement about the use of funds. Common uses are:

- To pay down debt.

- To fund a specific acquisition.

- To fund undisclosed future acquisitions.

- To fund losses.

You definitely want to avoid any equity raise that is being used to fund losses. If being used to fund acquisitions, it is usually a positive as long as the equity is being issued near or above NAV. In some cases, even issuing equity below NAV for a specific acquisition will be positive if the acquisition is expected to be particularly profitable.

If being used to pay down debt, the situation is less clear. You want to dig into the details a bit. A company using equity to pay down debt because it can't refinance is a huge warning sign. However, it is sometimes a very positive move when a company uses an equity raise to deleverage.

For example, VICI Properties (VICI) is a REIT that owns casinos and recently used an equity issuance to pay off a $2.1 billion term loan. To determine if this might be a sign of distress, a good place to look is the credit rating agencies. If you look to Moody's, you will find that this move is a strong credit positive. Moody's wrote:

VICI's repayment today of the $2.1 billion Term Loan B due in 2024 with its proceeds from the equity issuance and forward sale agreement is a credit positive. The debt repayment signals that VICI is making progress towards unencumbering its assets, one of Moody's focuses during the review period for a potential upgrade of up to two notches of VICI's CFR and its senior unsecured rating.

A two-notch upgrade is a huge deal for a REIT like VICI, resulting in access to substantially cheaper debt and saving millions on interest payments. Current shareholders will benefit from higher returns and from a higher valuation multiple if VICI is successful in obtaining an investment-grade credit rating. Well worth a little dilution in the near term.