Gold Still Pointing Lower

It has been relatively clear that gold has been within a consolidation of late. And, that consolidation seems like a triangle. The only question today was whether the e-wave of that [b] wave triangle would be able to rally one more time towards just below the c-wave or not. Initially, I expected it to try one more time to push just a bit higher since the initial move down off the intra-day high looked like a 3-wave decline. But, if we begin to break down below the 3270 region in gold then I have to assume the [c] wave down is in progress.

Silver still has not provided us with anything resembling a clear 5-wave structure, not even as a leading diagonal. Remember, in order for me to even begin to accept the leading diagonal potential as a reasonable probability, I need to see a 5th wave taking us to at least the 1.618 extension of waves [i][ii]. Of course, I can force a count wherein the leading diagonal is already completed. But, I cannot say it is anywhere near a reasonable probability for that count. Therefore, for now, I remain learning towards the yellow count.

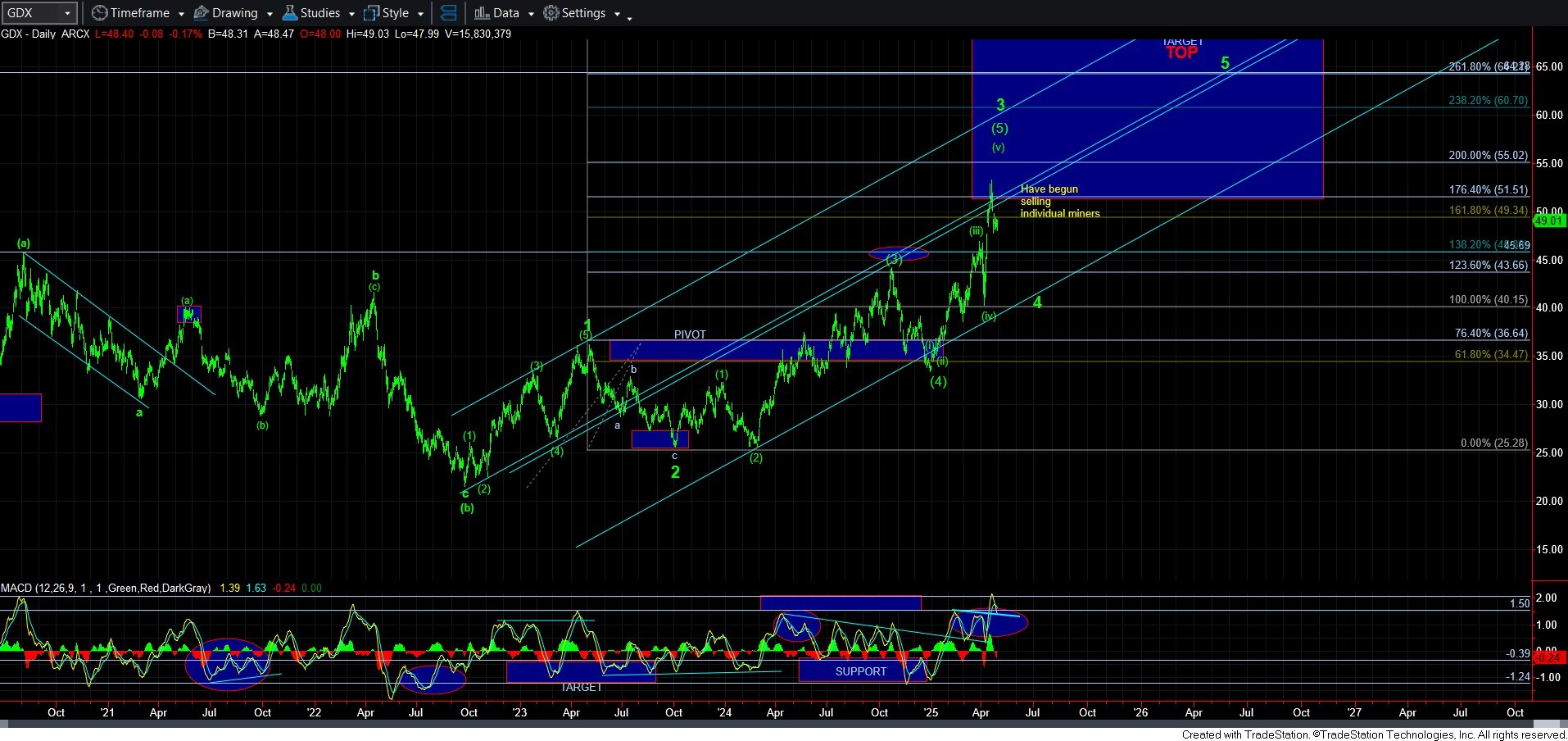

As far as GDX is concerned, I am really not sure if wave 4 is in progress just yet. But, we are clearly running out of room for it to potentially push higher. I will need to see a 5-wave move off a low VERY soon in order to expect one more extension. The same applies to NEM. So, I am reserving my analysis on this chart for now.