Gold Hitting It’s Target

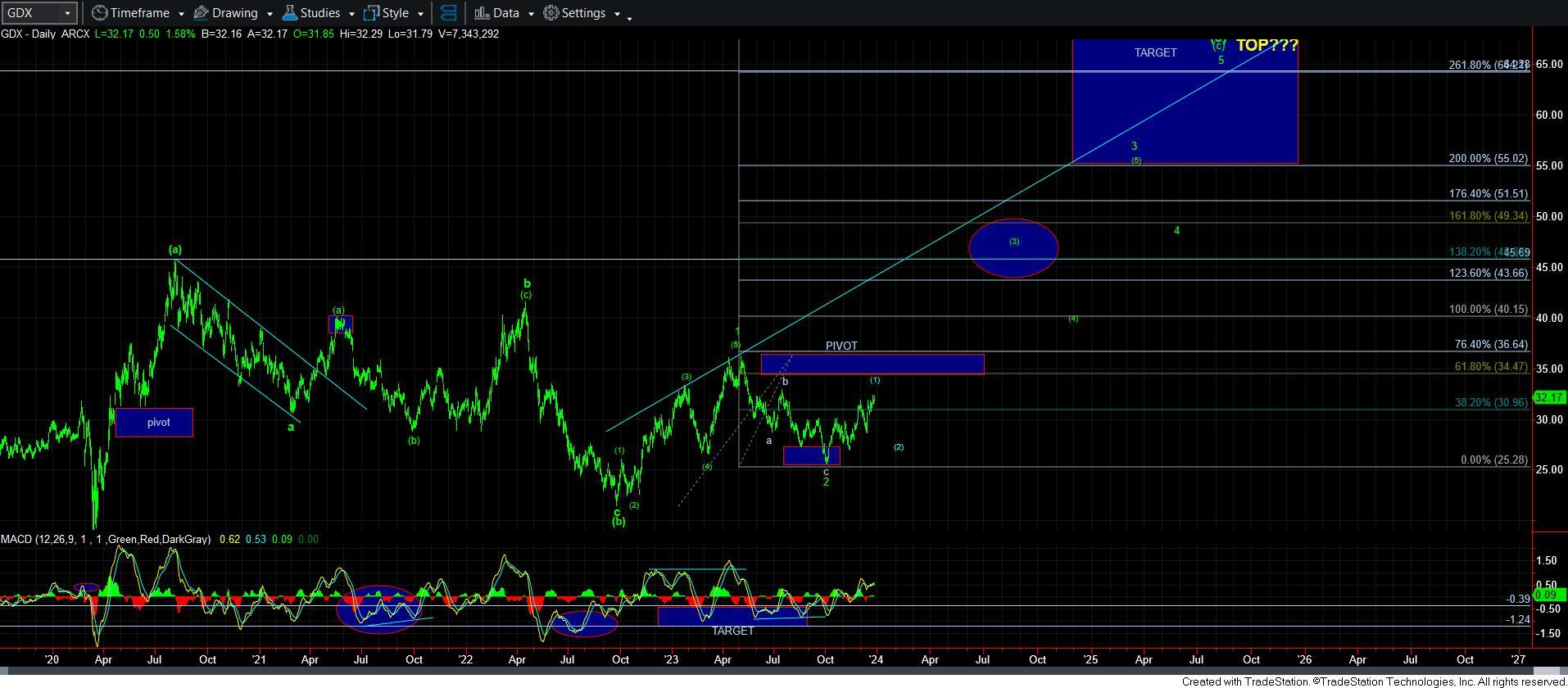

Over the last week, I have outlined my primary view that gold is rallying in a c-wave of a [b] wave in an ongoing wave ii consolidation. My view was that the c-wave was taking shape as an ending diagonal.

And, today, gold has now struck the minimum target I would expect for this ending diagonal. Therefore, an impulsive drop below 2060 in the GC chart will be our first indication that a [c] wave decline has begun. The target for that [c] wave is general the same region in which the [a] wave bottomed. For GC that is the 1986 region, whereas in GLD it is the 183 region.

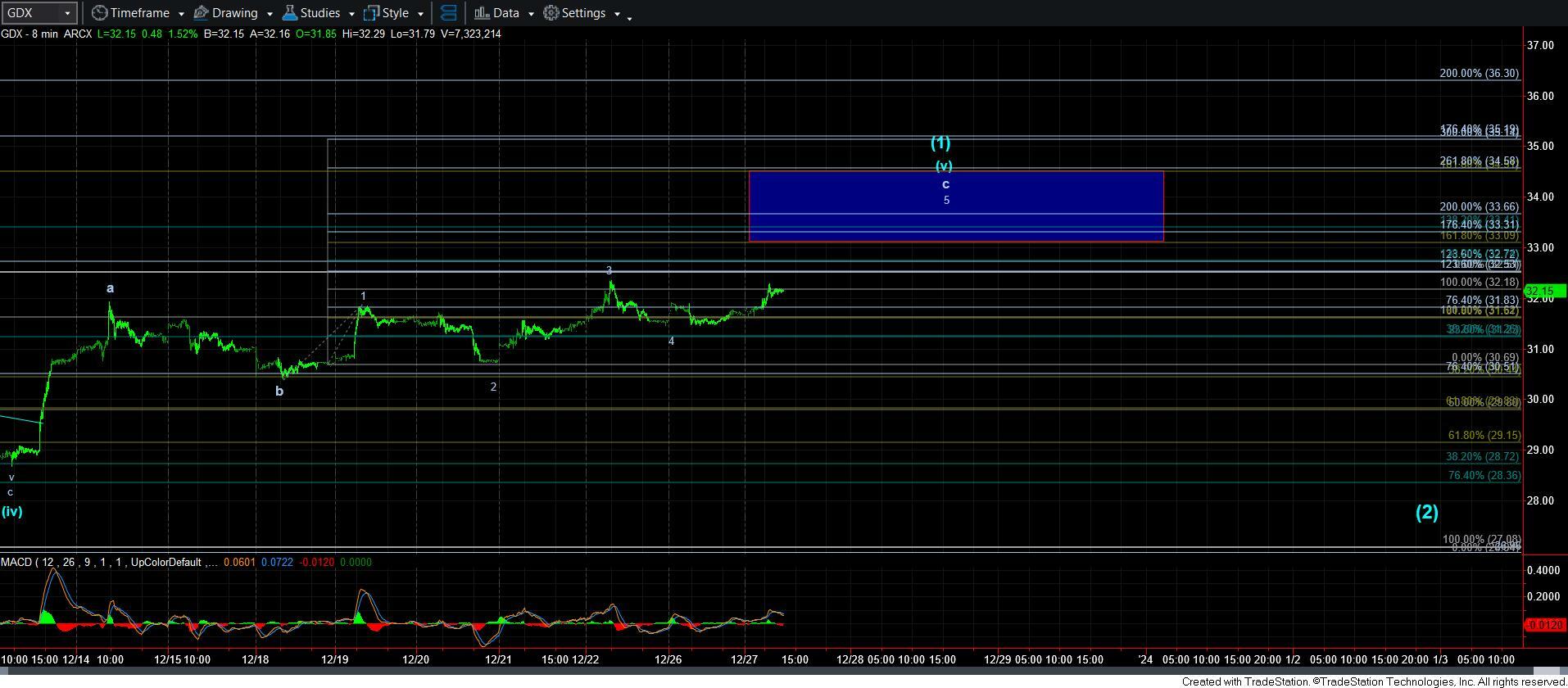

The problem is that GDX is a bit shy of its target, so I would like to see it make an attempt at pushing to at least the 33 region in the coming day or so. But, to be honest, it can present as a shortened c-wave in its 5th wave of wave [1].

Silver is still an issue. I am not really sure what it is doing in this region, as it is quite short for the c-wave rally, even in the purple count. But, if we turn back down below 23.95, then I have to begin to assume that the purple [c] wave is taking hold. And, it gets confirmed on a break down below 22.77.

The main takeaway at this time is that as long as all these charts respect their resistances, then we seem to be setting up for that one more bout of weakness before a 3rd wave can begin in earnest. And, should we see a 5-wave decline in either silver or gold in the coming week or so, that would be our initial indication of a c-wave decline.