Going To Need More Information

Unfortunately, where the metals currently reside, we will need more information based upon the upcoming wave action over the coming weeks before we can make any determinations. Moreover, the structures have turned quite complex, but I am going to attempt to simplify the analysis. And, I hope I am successful.

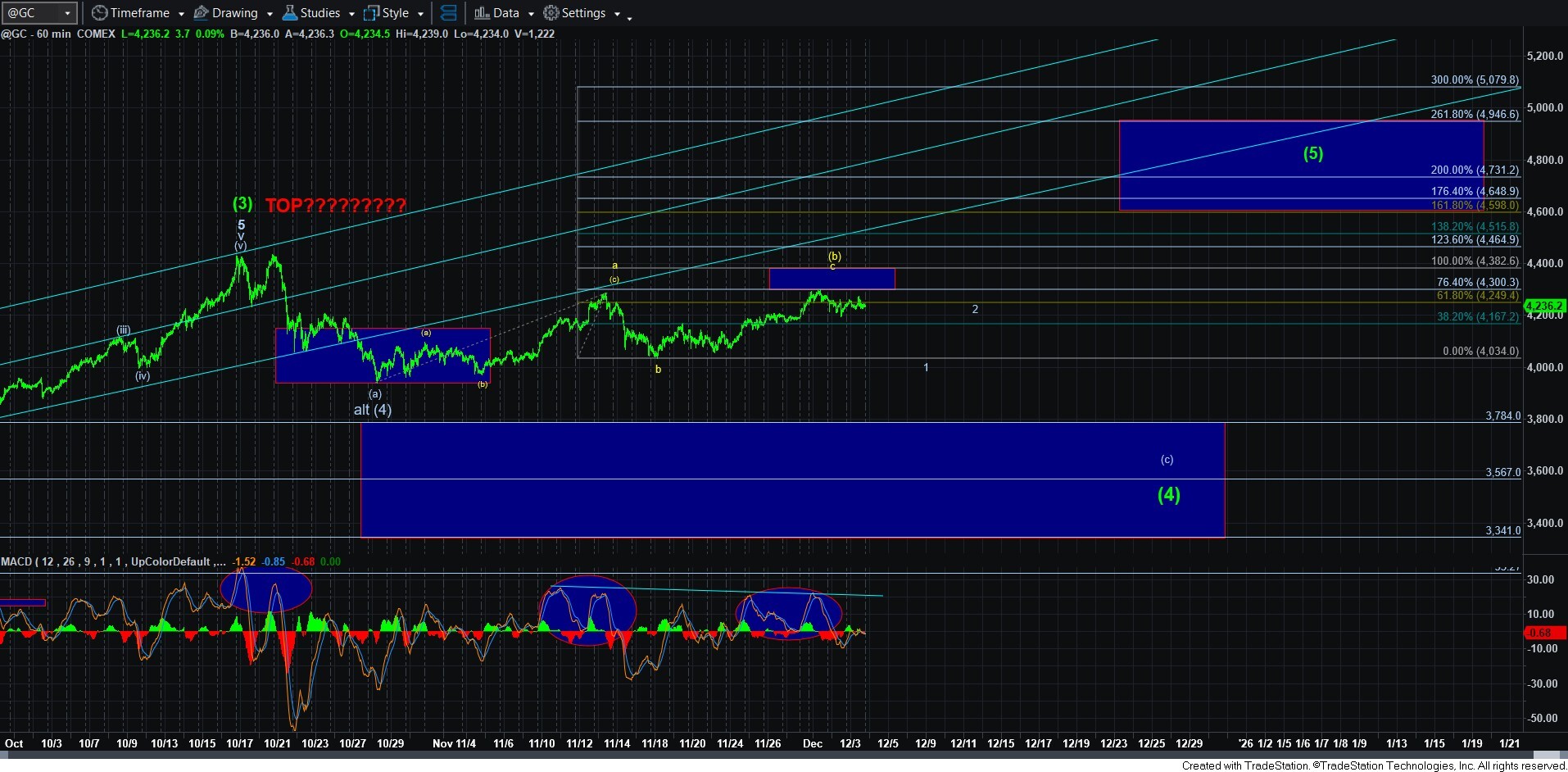

Let’s start with gold. The structure of the rally off the end of October low is clearly a 3-wave structure. And, as long as the resistance box on the 60-minute chart is respected, then we are well within a text-book a-b-c structure for the yellow (b) wave. But, in order to strongly indicate that a (c) wave down is in progress, we are going to need a clear 5-wave decline structure.

What we have currently is only a leading diagonal for a potential wave i of 1 in a larger (c) wave decline. Moreover, the action we experienced today is not really conducive to a clearly impulsive wave (i) of iii of wave 1. And, if we break out over today’s high, it places the alternative 5th wave of the c-wave of the (b) wave as our primary wave count.

Moreover, should the market be able to exceed the resistance box on the 60-minute chart, then we would have to accept wave (4) as having completed, and the current rally – which began with a clear 3-wave structure – is an ending diagonal for wave (5), which will likely come short of the 5000 mark. But, to be honest, it is hard to accept that a final 5th wave in a metals chart will complete as an ending diagonal. That is not terribly likely, so I am still very much in the (b) wave camp, with a (c) wave decline as my most likely expectation.

Silver is even more complex than gold. The rally off its support box has taken shape as a clearly corrective structure. This leaves many options on the table as to how this can resolve in the coming weeks. The blue count presents us with a 5-wave leading diagonal for wave 1 of (5), which would indicate that a deep wave 2 (ideally taking us back to the low region of wave (4) of wave 1) would be in order.

But, the other path to consider is that all of wave (5) is taking shape as an ending diagonal, as shown in yellow. Yet again, to accept that a metals chart is going to complete as an ending diagonal is not terribly likely, so I am leaving this as the least likely path for now. However, the market is going to have to break down below the yellow alt 4 support box to take this completely off the table.

Furthermore, there is potential that the high we are creating now is an expanded (b) wave or even an (x) wave in a complex (w)(x)(y) structure, both of which would project us back down to the support box below on the 144-minute chart. However, we will need to also break down below the yellow 4 support box to increase the probabilities of these paths. Moreover, if the break down below the 57 support region is a clearly impulsive structure, then it makes the expanded (b) wave structure much more likely, with the expectation that this decline is indeed a (c) wave. But, as I started this update, we do not have enough information yet to make any determinations between these various paths.

As far as the micro structure is concerned, we seem to be in an overlapping ending diagonal structure over the 57 support region. And, there is still potential for another push higher in this structure. But, remember, the hallmark of an ending diagonal is that, once it completes, it reverses quite rapidly back to the region from which it began, which in our case, is the 57 region. We will need to see how the market ultimately breaks down below the 57 region to begin making assessments regarding the various paths, as noted above.

GDX is rather clearly in a (b) wave rally, at least based upon my humble opinion, as it seems the most likely wave count. We still can see one more push higher towards the 86 region (the after-hours high struck in GDX in the middle of October) as the downside thus far is not looking clearly impulsive.

So, needless to say, the structure with which we are dealing have become much more complex than I would have preferred. But, I assume that the next week or two will provide us with a much more clear picture as to how this long-term cycle will terminate. In the meantime, a larger pullback is still well within reasonable probabilities and within my strong expectations. Yet, due to the complexity in the smaller and larger degree structures, I cannot yet say it is a strong primary count at this time.