GOOGL: Big Capex, Bigger Question — Will the Crowd Stay Onboard?

Alphabet has been one of the clearest beneficiaries of the AI capex cycle among the hyperscalers. For years, the company paired fortress-level fundamentals with a valuation that offered a meaningful margin of safety. That combination worked — and the market rewarded it.

But cycles evolve.

As Lyn Alden recently outlined, Alphabet now sits at a different point in its journey. The company continues to execute well across its core businesses: search remains resilient, YouTube continues to thrive, and Gemini maintains meaningful share in the LLM landscape. From an operational standpoint, little appears broken.

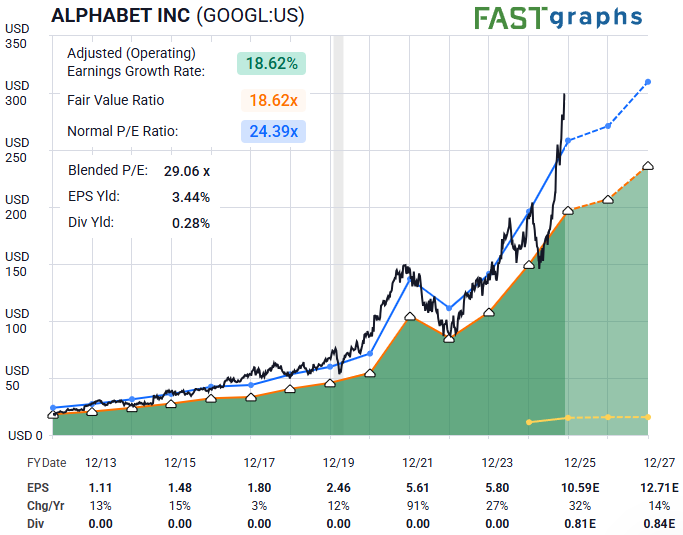

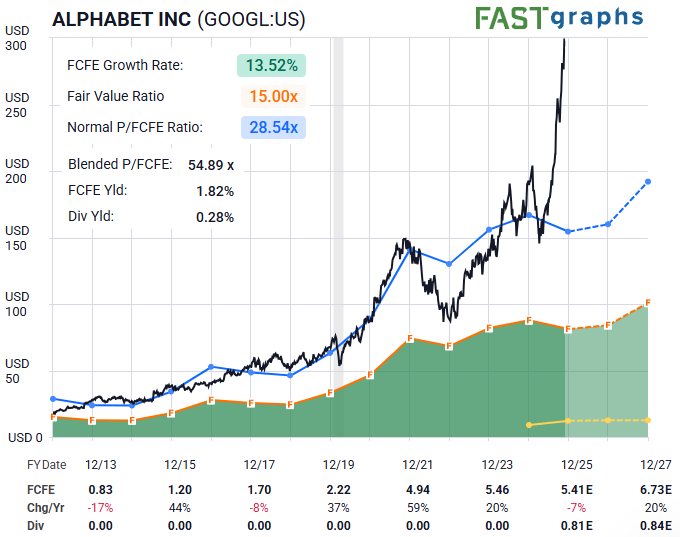

What has changed is the valuation backdrop and the capital intensity of the moment. Massive AI capex is pressuring free cash flow even as reported profits remain strong. The easy upside driven by multiple expansion and skepticism relief now appears largely played out. With sentiment broadly bullish and valuation no longer offering a clear margin of safety, Lyn has shifted her stance to neutral and views Alphabet as a reasonable name to take some profits in for now.

That doesn’t negate the quality of the business. It simply marks a transition.

And transitions are where fundamentals begin to lose their predictive edge.

From here, Alphabet’s stock becomes less about debating long-term AI narratives and more about how the crowd responds to them. When early bulls start trimming and new buyers must commit at higher prices, price action becomes the arbiter. This is where sentiment, structure, and risk definition matter more than conviction.

The fundamental thesis worked. Now the question is whether the crowd stays onboard — or needs a pause.

That’s what the chart will tell us next.

⸻

Sentiment Speaks

To begin this segment of the analysis, let’s step back and look at the bigger picture — the view that provides context no balance sheet can.

Here, Zac Mannes is illustrating the potential for a meaningful top to form. There is no definitive signal just yet, but as fundamentals and sentiment begin to further align, the probability of a larger transition increases.

Zooming in further clarifies the near-term message.

Garrett Patten is also identifying this same longer-term structure as it approaches completion. In the days and weeks ahead, the market may attempt some additional light corrective action followed by one more rally, as reflected on the chart above.

However, a decisive break below $230 would begin to confirm that an important high is already in place.

In the meantime, modest additional upside remains plausible for GOOGL. But the equation is shifting. It is becoming less about direction and more about how much risk is acceptable for how much reward.

The crowd has spoken early on this one. The question now is how long that vote of confidence can persist at current valuations.

Alphabet doesn’t need to fail for its stock to disappoint — it merely needs expectations to move ahead of what free cash flow can justify in the near term. That is the subtle risk at this stage of the cycle. Great businesses don’t always make great trades at every price, and markets have a way of resolving that tension through time, consolidation, or correction. For now, the story has shifted from discovery to digestion. Whether the crowd remains patient — or demands proof sooner rather than later — will determine the next meaningful move. Until then, price — not narrative — will have the final word.